The Czech National Bank (CNB) ended the EUR/CZK floor today. Timing was a little earlier than expected, but rising inflation and a robust economy warranted it. We think it’s too soon to talk about a rate hike, as we expect the koruna to overshoot to the strong side.

POLICY OUTLOOK

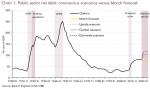

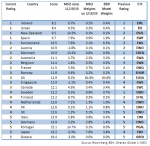

Price pressures are rising, with CPI accelerating to 2.5% y/y in February. March data will be reported April 10, with consensus at 2.6% y/y. If so, this would be the highest rate since November 2012 and is creeping closer to the top of the 1-3% target range. Given low base effects from 2016, we see risks that inflation moves above the target range this year. Core CPI and PPI measures are also accelerating.

The worsening inflation outlook

Read More »