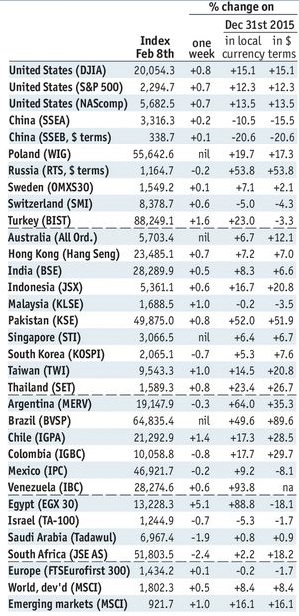

Stock MarketsEM FX ended last week on a firm note. Falling US rates allowed many foreign currencies to gain some traction. This week, a heavy US data slate is likely to test the market’s convictions on the Fed, with January PPI, CPI, IP, and retail sales all being reported. Yellen also testifies before Congress on Tuesday and Wednesday. |

Stock Markets Emerging Markets February 08 Source: economist.com - Click to enlarge |

IndiaIndia reports January CPI Monday, which is expected to rise 3.24% y/y vs. 3.41% in December. It then reports January WPI Tuesday, which is expected to rise 4.35% y/y vs. 3.39% in December. The RBI left rates steady last week and moved to a neutral stance. Price pressures are likely to pick up this year, as the acceleration in WPI inflation suggests.

PolandPoland reports January CPI Monday, which is expected to rise 1.7% y/y vs. 0.8% in December. If so, this would be the highest since January 2013 and back within the 1.5-3.5% target range. It then reports Q4 GDP Tuesday, with growth expected to remain steady at 2.5% y/y. January industrial and construction output, retail sales, and PPI will be reported Friday. The central bank will find it hard to wait until 2018 to start tightening.

MexicoMexico reports January ANTAD retail sales Monday. Despite tighter monetary policy and rising inflation, retail sales have remained fairly robust, rising 5.3% y/y in December. With another 50 bp hike last week, we think it unlikely that consumption can remain firm in 2017. The next policy meeting is March 30 and it’s too early to say what’s likely to happen then.

ChinaChina reports January CPI Tuesday, which is expected to rise 2.4% y/y vs. 2.1% in December. Price pressures are likely to keep rising, as PPI (6.6% y/y rise expected) points to significant pipeline price pressures. Money and loan data may be reported this week, but no date has been scheduled. Another big jump in new loans is expected.

TurkeyTurkey reports December current account data Tuesday, which is expected at -$4.5 bln. If so, the 12-month total would fall slightly to -$30.1 bln. With oil and energy prices rising, we expect the external accounts to worsen this year. Taken in conjunction with rising inflation, the fundamentals will remain poor.

HungaryHungary reports January CPI Tuesday, which is expected to rise 2.2% y/y vs. 1.8% in December. If so, it would be the highest since March 2013 and back within the 2-4% target range. It also reports Q4 GDPTuesday, which is expected to grow 2.0% y/y vs. 2.2% in Q3. Growth remains sluggish, but we think it will be hard for the central bank to ease further if inflation continues to rise. Next policy meeting is February 28, no change expected then.

Czech Republic

|

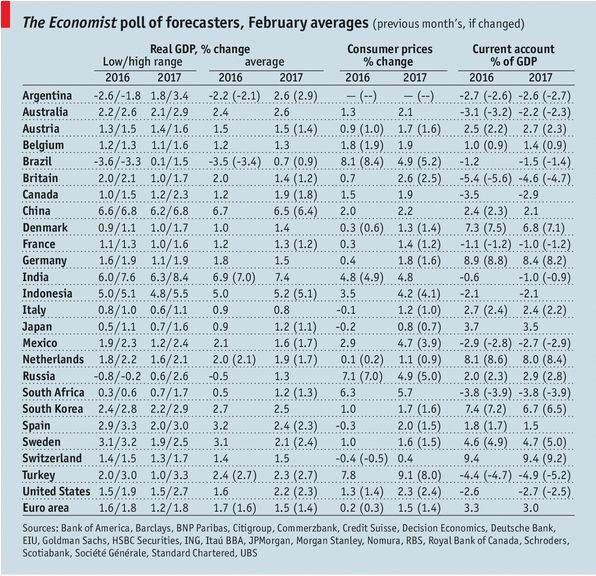

GDP, Consumer Inflation and Current Accounts The Economist poll of forecasters, February 2017 Source: Economist.com - Click to enlarge |

Tags: Emerging Markets,newslettersent,win-thin