In recent months, Ray Dalio seems to be undergoing a deep midlife and identity crisis, which has not only led to dramatic recent management changes at the world's largest hedge fund, Bridgewater, but also resulted in some fairly spectacular cognitive dissonance, as Dalio first praised, then slammed, president Trump.

Read More »

Category Archive: 8b.) Economic History

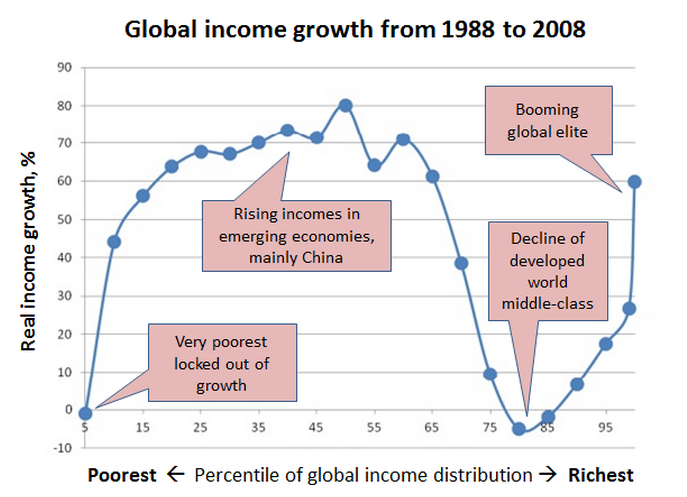

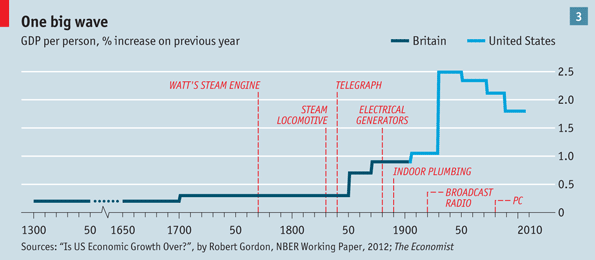

The All In One Economic History Chart

It was tweeted out and annotated by James Plunkett and it's based on a chart from inequality economist Branko Milanovic.

Read More »

Read More »

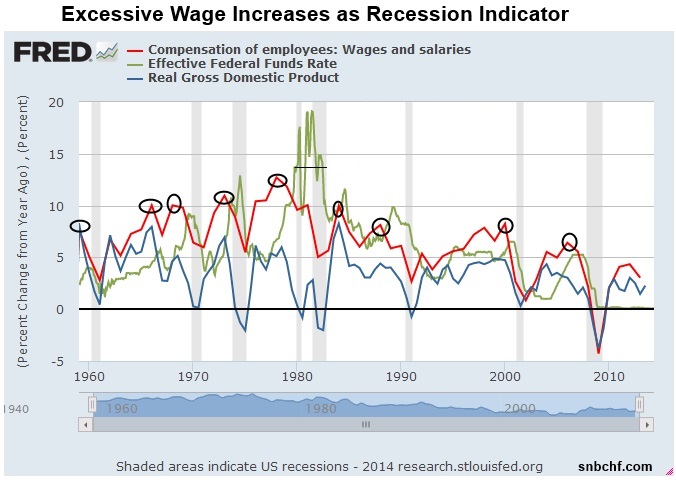

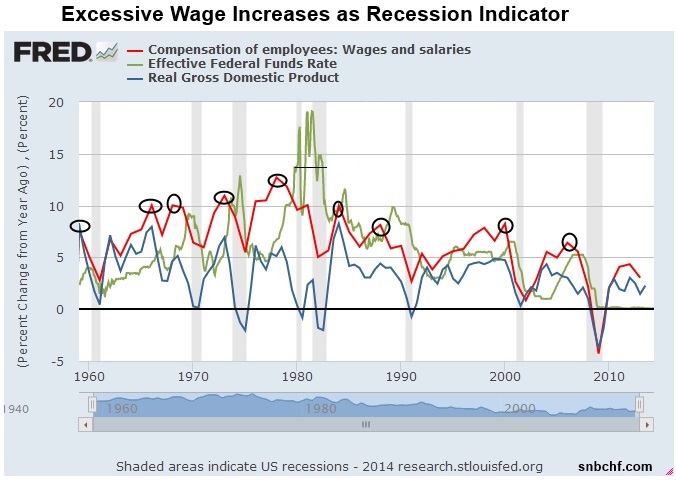

A Little History of Wages, Inflation, Treasuries and the Fed – And What We Learn from it

On this page we show that

Inflation expectations and wages drive the behaviour of the Fed and Treasury bond yields.

Excessive wage increases lead to recessions, more or less voluntarily caused by central bank tightening

Central banks pin down the short end of the yield curve, while financial-market participants price longer-dated yields

Some Emerging Markets seem to copy strong wage increases and inflation that we lived in the 1970s

Quickly...

Read More »

Read More »

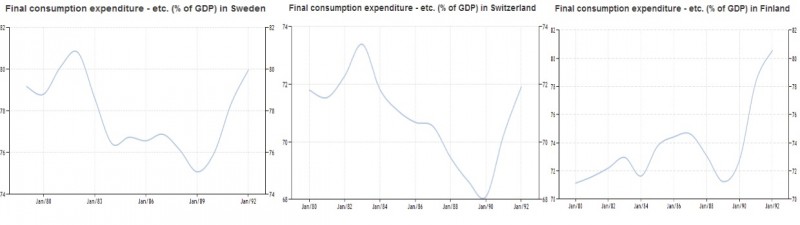

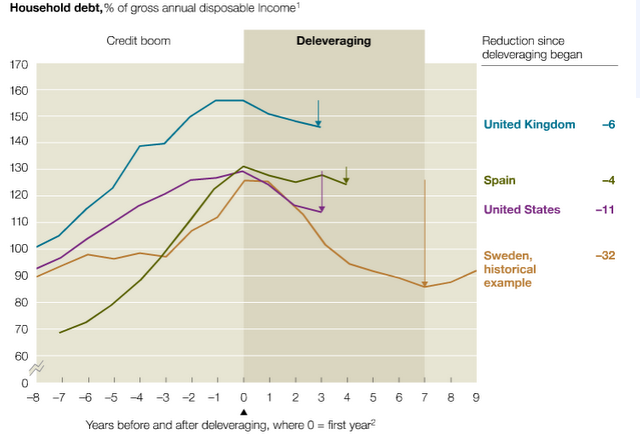

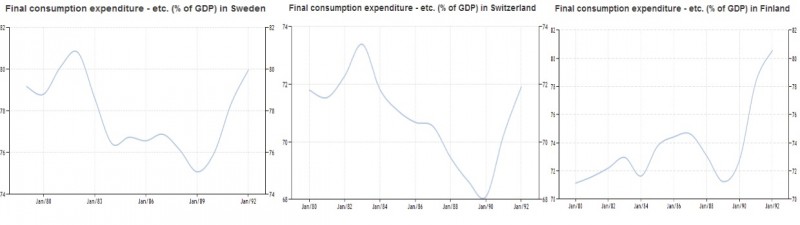

Financial Cycles History, 1991-1998: Overspending in Germany, Asia and former communist countries, Housing Busts in Japan and Northern Europe

In this post we present financial and credit cycles in the history: Due a weak credit cycle, Germany was a weak economy under many other weak ones.

Read More »

Read More »

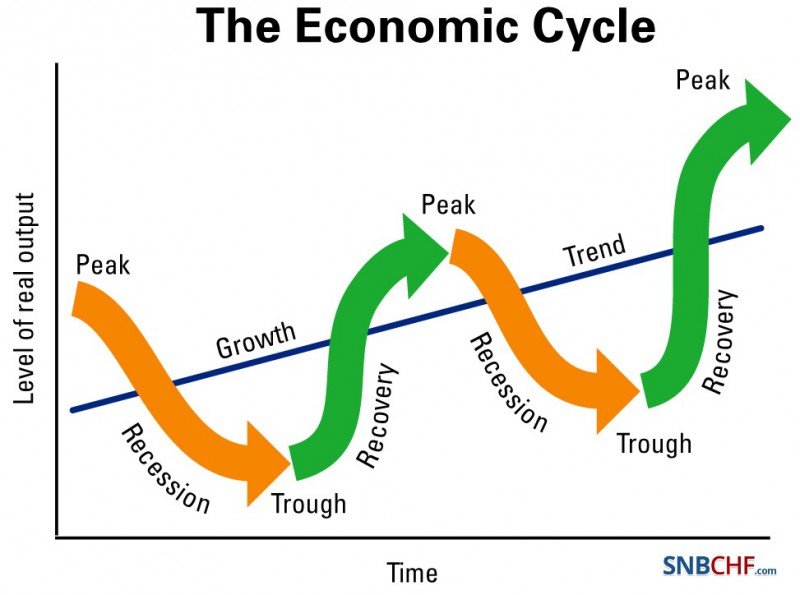

Business Cycles

The typical backstops of all improvements in business cycles are high oil prices and inflation. Inflation is mostly caused by local effects.

Read More »

Read More »

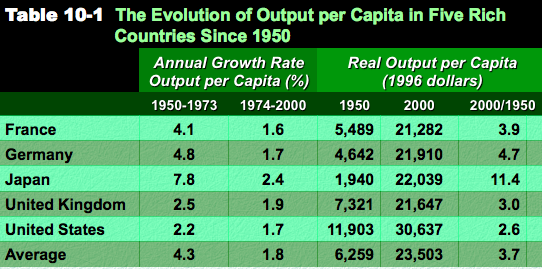

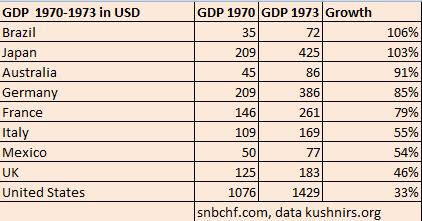

Financial Cycles History: 1945-1966: Bretton Woods, strong growth in Europe

The Bretton Woods time from 1945 to 1966 was a period of strong growth, especially in country like Germany, France, Italy and Japan.

Read More »

Read More »

Financial Cycles History, 1978-1985: Oil Glut, Strong Dollar and the Lost Decade in Latin America

The next financial cycle takes from 1981 to 1990: The dollar was strong, Latin America lost a decade and the Japanese created their bubble.

Read More »

Read More »

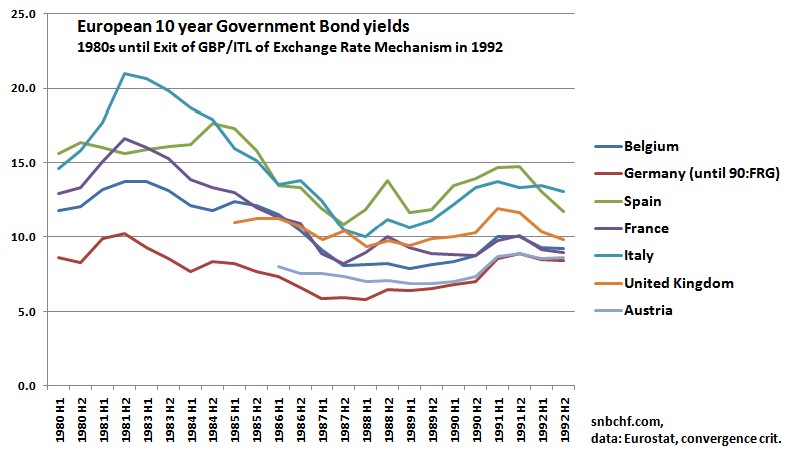

Financial Cycles History, 1990-1996: Breakdown of Communism, German Reunification, Housing Busts in Europe and Japan

A history of financial cycles: 1990-1996 the breakdown of communism leads to a boom in Germany and - due to high interest rates and inflation - to a breakdown of the European monetary system.

Read More »

Read More »

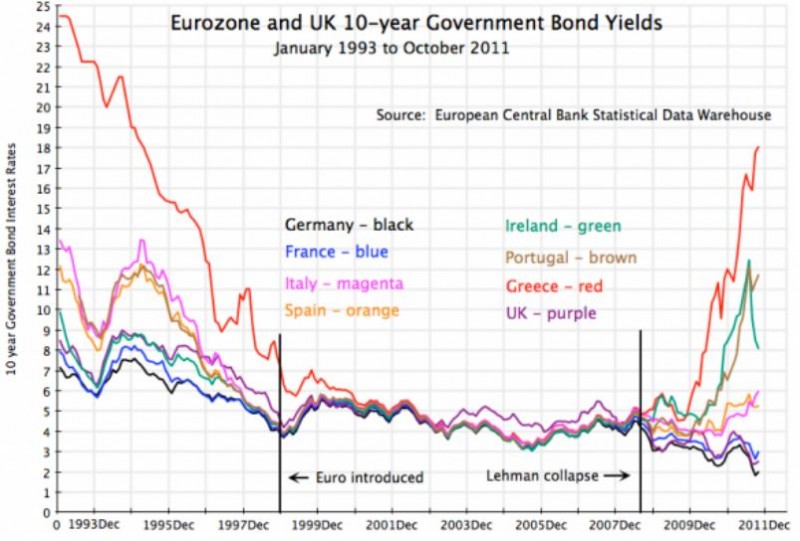

Financial Cycles History, 1998-2002: The Dotcom Bubble and Bust and European and Asian Austerity as its Enabler

In this post we present financial and credit cycles in the history: Due a weak credit cycle, Germany was a weak economy under many other weak ones.

Read More »

Read More »

Official Eurostat Trade Balance Massively Distorted by UK Sales Of 1464 Tonnes of Gold To Switzerland

Somebody who follows regularly the trade balance figures from Eurostat, may have noticed a sentence that was repeated in each monthly release from the Eurostat trade statistics in 2013: “The EU28 trade surplus increased significantly with Switzerland”. The reason was massive gold sales from the UK to Switzerland.

Read More »

Read More »

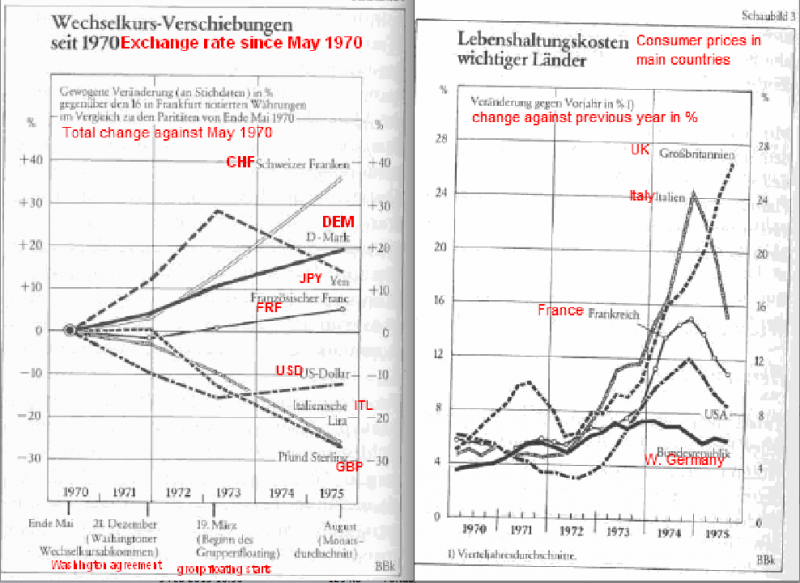

The “Cost-Push Inflation” Myth and the 1970s Stagflation

Economists commonly explain rising oil price between 1998 and 2008 with the growth of emerging markets. We argue that the cost-push inflation of the 1970s was also a reflection of rising global demand.

Read More »

Read More »

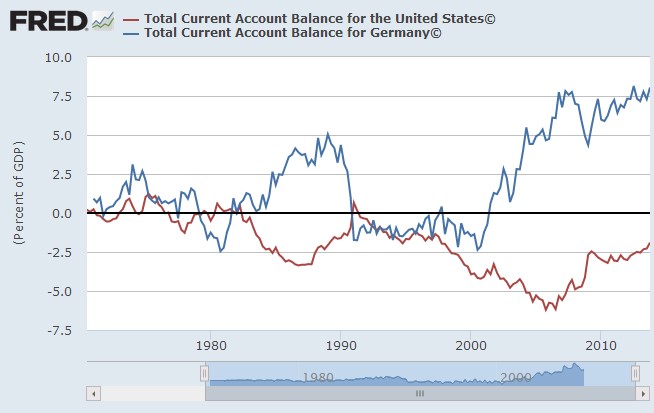

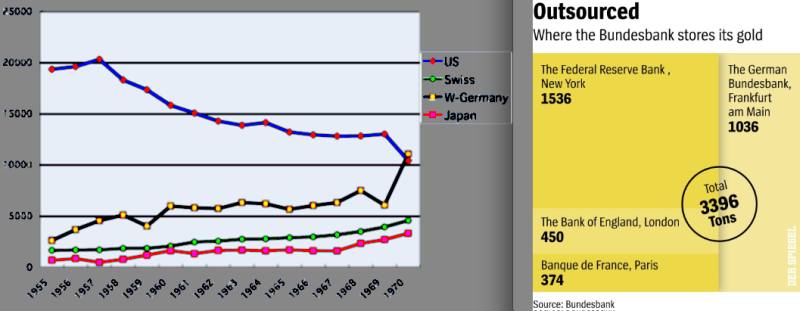

The Collapse of the Bretton Woods System, the German Current Account and Gold Reserves

German, Swiss and Japanese gold reserves rose continously in the Bretton Woods system, whereas American and British reserves fell.

Read More »

Read More »

History of Wrong Forecasts by Swiss and Fed Economists: Update September 2013

Or how to talk down and how to talk up an economy with wrong forecasts American and Swiss mentalities are very different, the Americans have the tendency not to care about the future a lot, the Swiss, however, do things only after careful consideration of potential risks. This tendency can be proven economically with … Continue reading...

Read More »

Read More »