Category Archive: 2.) Italy

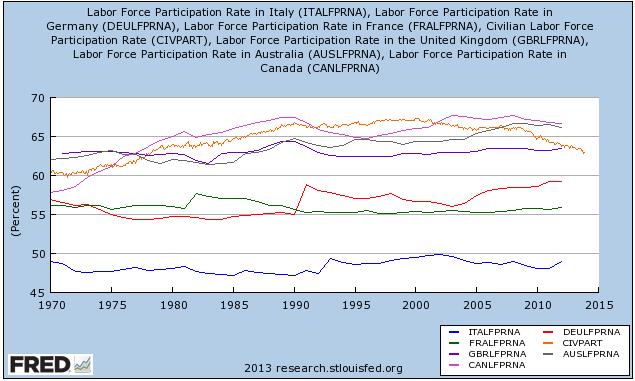

Italian Euro Exit: Why it Might Come in some Years and Why it Will Help the Euro Zone and Italy

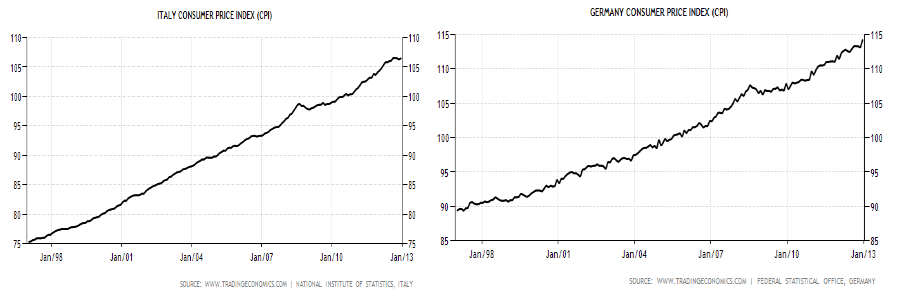

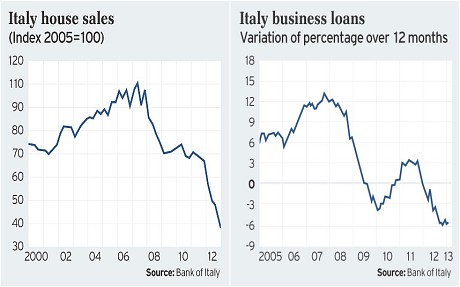

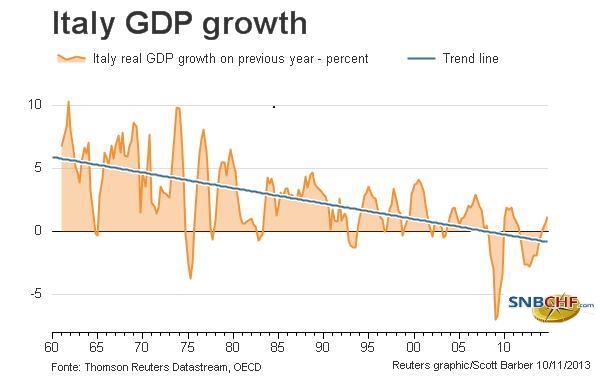

Italy has three options: 1. exit the euro zone and devalue the currency; 2. remain in the euro zone and devalue salaries. 3. go for Japan-like decades-long slow growth with stagnating wages, but also with falling inflation and (positive news!) falling bond yields.

Read More »

Read More »

Great Graphic: Italian Banks and a German Bank

DB and Italian bank stocks have been moving in tandem. They suffer from fundamentally different problems. The euro has been selling off as the bank shares rebound.

Read More »

Read More »

The Italian Dilemma

The sudden panic about a potentially imminent Italian banking sector collapse back in July has somewhat subsided for now, but sooner or later the issue will inevitably rear its ugly head again.

Read More »

Read More »

Renzi and the Italian Referendum: Disruption Potential Minimized

Italian Prime Minister has set the date for the constitutional referendum as late as practically possibly. It will be held on December 4. The issue is the perfect bicameralism that gives as much power to the Senate as the Chamber of Deputies. Renzi's argument is that the political reform is necessary to make Italy governable. Italy has had 63 governments since the end of WWII. In order to address the economic challenges the country faces, political...

Read More »

Read More »

European Court of Justice Ruling Weighs on Italian Banks

ECJ uphold principle of bailing in junior creditors before the use of public funds. Italian banks shares snap a three-day advance. The EBA/ECB stress test results at the end of next week are the next big event.

Read More »

Read More »

Great Graphic: More Thoughts on Banks

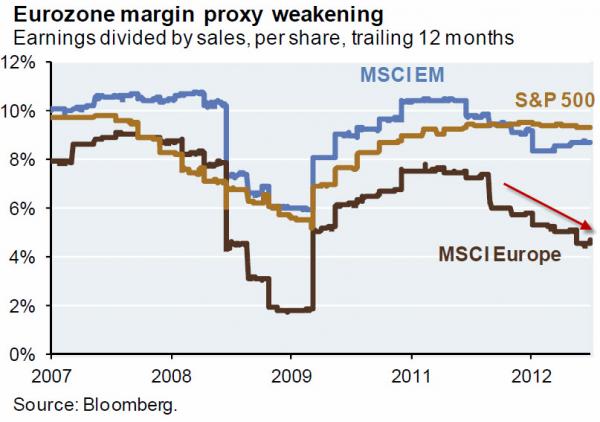

Italian banks have done worse that European banks. Italian banks outperformed Germany banks from end of H1 12 through H1 15. US banks and financials more broadly have outperformed Europe.

Read More »

Read More »

Return of the Repressed: Europe’s Unresolved Banking Crisis

The IMF identified three banks that posted the most significant systemic risks. It has been overshadowed by new pressure on Italy's banks, and Three UK commercial real estate funds have been frozen to prevent redemptions.

Read More »

Read More »

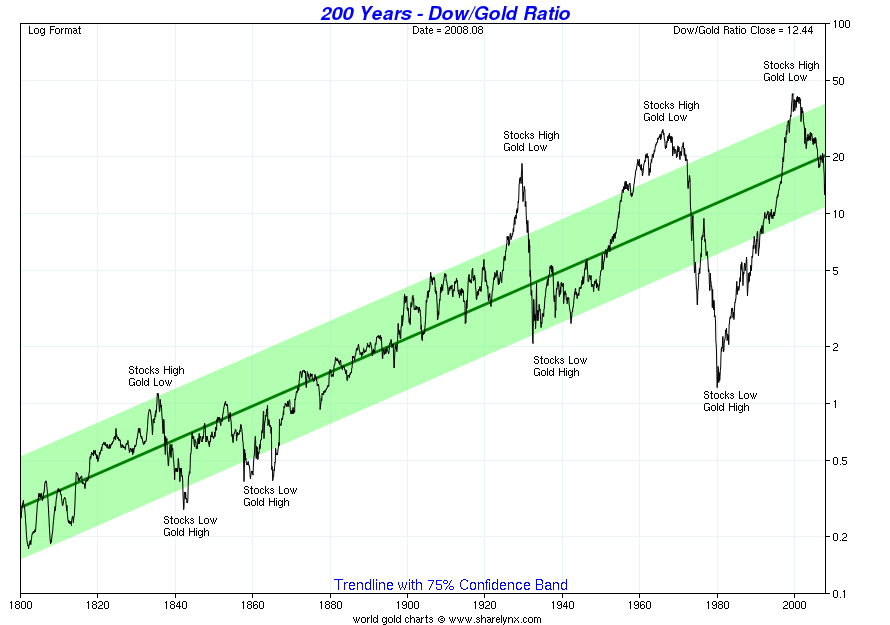

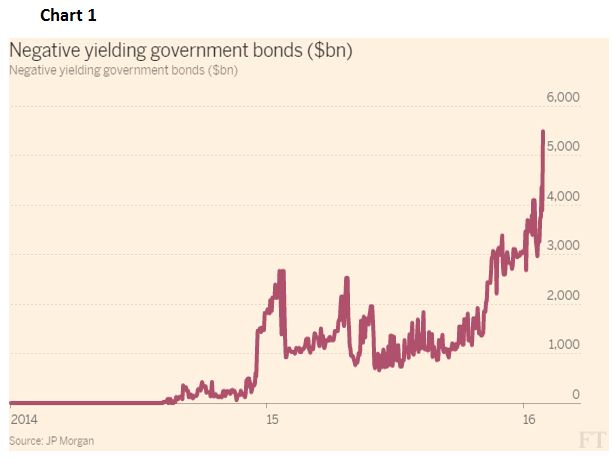

The New Widow-Maker Trade: Short Italian Government Bonds

We think that, similarly as Japanese JGBs, Spanish and Italian Government Bond Yields will continue its race to the bottom, Short Italian Bonds is the new Widow-Maker Trade.

Read More »

Read More »

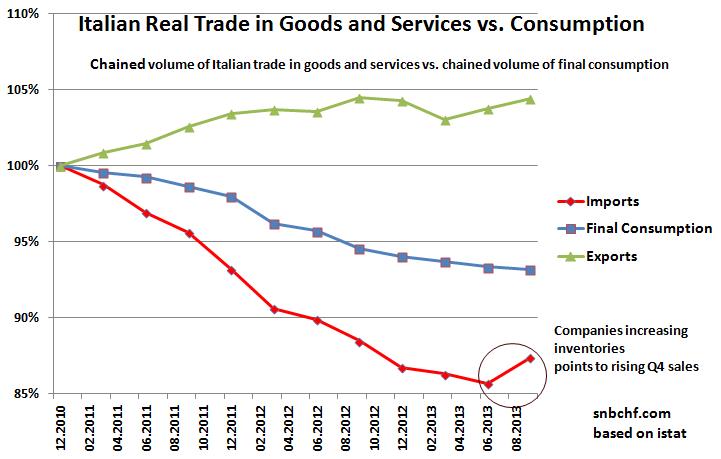

An Upcoming Italian Success Story?

While the mainstream is still talking about potential riots in Italian streets, we rather see positive adjustments in the Italian economy.

Read More »

Read More »

An Upcoming Italian Success Story?

Higher exports show that Italy's economy is trying to become a new German Companies seem to hide their competitiveness. A question remains: Will Italian companies really invest in Italy and create jobs?

Read More »

Read More »

8a) Italy and the Euro Exit

Italy, other peripheral economies and later France will follow Japan for a decade or more of balance sheet recession: stagnant wages, falling real estate prices and a reduction of private debt.

Read More »

Read More »

Italian Retail Prices Remain close to Switzerland, Germany Far Cheaper

Disinflation Finally Starting in Italy The Swiss site preisbarometer.ch is run by the Swiss Consumer Association. Their price data shows that a food basket is 46% more expensive when compared between the German “Kaufland” shop and the Swiss “Coop”. Going to France into “Leclerc” gives you an advantage of 38% against Coop. However, for a …

Read More »

Read More »

Why it Makes Sense to Exit the Euro Zone in Times of Balance Sheet Recessions

Italy will follow Japan for decade(s) of balance sheet recession. There is one mean to avoid it. The periphery should use current positive market sentiments and low inflation to exit the euro zone.

Read More »

Read More »

The Transfer Union from South to North since 2008: Wolfgang Schäuble, the Evil Genius of the Euro Crisis

Wolfgang Schäuble has become the evil genius of the euro crisis. He has understood that the Cyprus crisis won't lead to a bank-run and collapse of capital markets. We all know that the US is now recovering.

Read More »

Read More »

European Wealth Reports: Why “Median” Italians are Far Richer than Germans

We explain why according to the European wealth reports "median" Italians are more wealthy than Germans. The main reasons are high savings and accumulation of wealth for the average family until the 1990s, often invested in homes and real estate. Low ECB interest rates finally let the value of the home rise strongly.

Read More »

Read More »

A Century Of French And Italian Economic Decline

Italy overtook Japan with the worst real GDP growth of all advanced economies since 1991 (0.79% per year, an amazing and sad distinction). Italians and French are clearly getting tired of austerity.

Read More »

Read More »

Das beeindruckende Comeback Berlusconis.

Wir sind beeindruckt von dem Leitartikel der Weltwoche, der doch ganz unserem Gedankengut entsprochen hat. Der deutsche Kanzlerkandidat Steinbrück hat der deutschen Demokratieverachtung und EU-treuen Überheblichkeit dann noch das i-Tüpfelchen hinzugefügt. “Zwei Clowns haben gewonnen.“ Von Roger Köppel, Die Weltwoche Demokratie ist, wenn es anders herauskommt, als Meinungsführer, Journalisten und tonangebende Politiker gedacht...

Read More »

Read More »

Über die Arroganz und Demokratiefeindlichkeit der deutschen und Schweizer Medien

Deutsche und Schweizer Medien sind oft vereint mit den Europäischen Leadern, Deutschen Exporteuren und den Finanzmärkten im Kampf gegen den gemeinsamen Feind, Silvio Berlusconi, das Enfant Terrible, das Gegenteil der Schweizer Bescheidenheit- und “Bloss nicht zu laut”-Etikette. Berlusconi soll Schuld sein am Abstieg Italiens seit den 90igern, obwohl auch die Linke mit Romani Prodi zweimal …

Read More »

Read More »

Italy: A Sustained US Recovery Will Make a Eurozone Split Up Possible

We reckon that a sustained US recovery will make it possible that the eurozone splits up. Today's Italian elections are maybe the start of an upcoming Italian euro exit.

Read More »

Read More »

Who Says No to Austerity and Global Imbalances, Must Say Yes to the Northern Euro

Eventually the euro will be abolished, a Northern Euro introduced: politicians and their economic advisors might just be waiting for a calm moment, especially with upcoming German inflation.

Read More »

Read More »