Category Archive: 1) SNB and CHF

SNB Sight Deposits: increased by 2.4 billion francs compared to the previous week

The sight deposits at the SNB increased by 2.4 billion francs compared to the previous week.

Read More »

Read More »

USD/CHF gains ground near 0.8850, potential upside seems limited

USD/CHF holds positive ground near 0.8840 in Thursday’s early European session. Fed’s Waller said that central bank is nearing rate cuts if there are no major surprises in inflation, employment data. Тhe rate cuts expectation by the SNB might drag the US Dollar lower.

Read More »

Read More »

USD/CHF holds below 0.8950 amid Middle East geopolitical risks

USD/CHF trades on a weaker note near 0.8925 in Tuesday’s early Asian session. Fed policymakers retain a cautious approach to rate cuts, emphasizing that their decisions would be data-dependent. The Swiss Franc is supported by the escalating geopolitical tensions in the Middle East and Ukraine.

Read More »

Read More »

SNB Surprises the Market (Again)

The US dollar is trading higher against all the G10 currencies today but the Norwegian krone. Norway's central bank left policy on hold and warned that if the economy performs as expected, it does not anticipate a rate cut until next year.

Read More »

Read More »

USD/CHF appreciates to near 0.8950 due to hawkish Fed, SNB Financial Stability Report eyed

USD/CHF gained ground as FOMC left its benchmark lending rate in the range of 5.25%–5.50% on Wednesday. Powell stated, “We don't see ourselves as having the confidence that would warrant policy loosening at this time.” Swiss Franc may see limited downside as SNB is unlikely to implement a rate cut in June.

Read More »

Read More »

Gold continues bearish tone on outlook for US interest rates

Gold rolls over after retesting key resistance as the outlook for US interest rates remains elevated. This keeps the opportunity cost of holding non-yielding Gold high, making it less attractive to investors. Gold (XAU/USD) trades a quarter of a percent lower on Tuesday after being rejected by key support-turned-resistance at $2,315 late Monday.

Read More »

Read More »

USD/CHF gains amid US labor market strength

In Friday's session, the USD/CHF recovered surging above the 0.8965 mark. Strong Nonfarm Payroll data from the US propelled the USD across the board. US Treasury yields increased while the odds of a cut in September by the Fed slightly declined.

Read More »

Read More »

Gold extends decline after US Nonfarm Payrolls beats expectations

Gold price declines after the release of US Nonfarm Payrolls data for May, shows a higher-than-expected change in employment and wages.

Read More »

Read More »

USD/CHF declined as the Greenback remains weak, defends the 20-day SMA

USD/CHF took a dip in Tuesday’s session and fell to 0.9110. Despite the Consumer Confidence index in the US and Housing prices exceeding expectations, the USD remains weak. The Federal Reserve maintains a cautious stance, asking the market for patience, which keeps the odds for rate cuts in June or July low.

Read More »

Read More »

USD/CHF stays above 0.9100 nearing the highs since October

USD/CHF hovers below 0.9152, the highest since October reached on Monday. US Dollar strengthened as higher Retail Sales amplified expectations of the Fed prolonging higher policy rates. Swiss Franc faces challenges due to the likelihood of SNB implementing another rate cut in the June meeting.

Read More »

Read More »

Canadian Dollar remains vulnerable after strong US Retail Sales

Canadian Dollar gives away gains as USD bounces up following strong Retail Sales data. Investors’ concern that Middle East conflict might escalate provides additional support to the safe-haven US Dollar. Oil prices have depreciated nearly 3.5% from early April highs, adding negative pressure to CAD.

Read More »

Read More »

Pound Sterling falls back as upbeat US Retail Sales strengthen US Dollar

The Pound Sterling faces pressure as geopolitical tensions improve the appeal for safe-haven assets. UK’s employment and inflation data will influence speculation over BoE rate cuts.

Read More »

Read More »

2024-04-09 – Martin Schlegel: Interest rates and foreign exchange interventions: Achieving price stability in challenging times

For decades, the exchange rate has played a key role for the Swiss economy and for the Swiss National Bank's monetary policy.

Read More »

Read More »

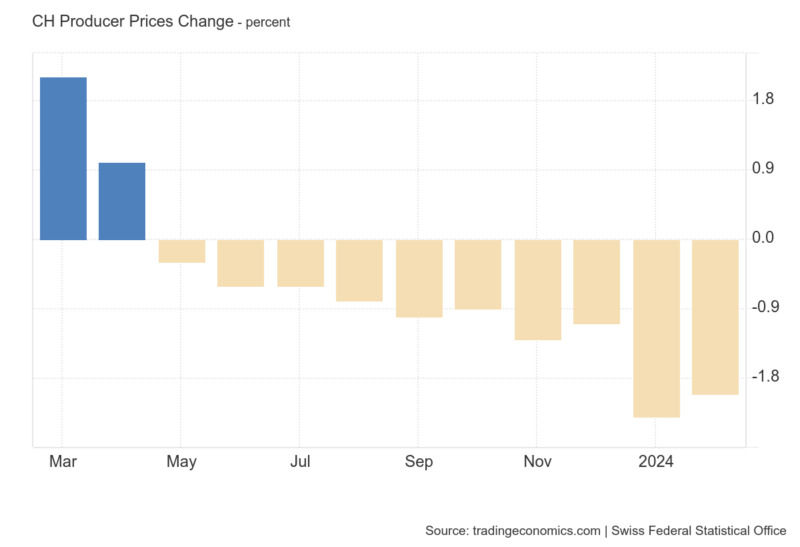

Swiss Franc at risk as inflation diverges from SNB forecasts

Swiss Franc is vulnerable as inflation data continues to undershoot official forecasts. The SNB expected inflation to average 1.9% in 2024 in its December forecast, but it currently sits at 1.2%.

Read More »

Read More »

EUR/CHF Price Analysis: Pullback possible amid mixed signals

EUR/CHF has rebounded from the 0.9254 December 2023 lows and rallied up to resistance from a key barrier in the form of the 50-week Simple Moving Average (SMA). The pair is probably still in a long-term downtrend despite recent strength.

Read More »

Read More »

The Swiss National Bank vs. the Federal Reserve: The Fed’s Capital Losses in Perspective

Switzerland’s central bank, the Swiss National Bank (SNB), lost $3.6 billion in 2023,

after a gigantic loss of $150 billion in 2022. But after booking these losses, and properly subtracting them from its capital, the SNB still had positive capital of over $70 billion.

Read More »

Read More »

US Dollar enters fourth day of consecutive losses ahead of Powell testimony

The US Dollar trades softer across the board on Wednesday. US Federal Reserve Chairman Jerome Powell is heading to Capitol Hill for his semi-annual testimony. The US Dollar Index snaps an important support, looking bleak ahead of the ECB decision and NFP data.

Read More »

Read More »

Swiss Franc extends losses on Swiss interest rate outlook

The Swiss Franc (CHF) edges lower against the US Dollar (USD) on Wednesday as traders continue to bet on a less-inflationary outlook for Switzerland, supporting a relatively low interest rate policy and dampening foreign capital inflows.

Read More »

Read More »

Vorwort des Buches « L’Humanité vampirisée ». Philippe Bourcier de Carbon (version Allemande)

Philippe Bourcier de CarbonIngenieur der Hochschule Polytechnique, DemographGründungsvorsitzender von AIRAMA, « Internationale Allianz für die Anerkennung der Beiträge des Nobelpreisträgers Maurice Allais »

Read More »

Read More »

-638453232816314704-800x305.png)