Category Archive: 1) SNB and CHF

The strong Swiss franc – truth or myth?

The Swiss franc has hit an all-time high against the euro. Even though it trades at an unprecedented CHF0.95 to the euro, the strong franc no longer poses a threat to the Swiss economy. What has changed in the last ten years?

Read More »

Read More »

SNB-Jordan: «Nationalbank hat ihre Geldpolitik nicht zu spät angepasst»

Nach Beendigung der Negativzinsen sieht die Schweizerische Nationalbank (SNB) die Möglichkeit, dass die Zinsdifferenz zwischen der Schweiz und dem Ausland wieder steigen könnte, sagt Notenbankchef Thomas Jordan..

Read More »

Read More »

Publication on the centenary of the Swiss National Bank’s main building in Zurich: The Pfister Building 1922-2022

To mark the centenary of the Swiss National Bank’s main building at Börsenstrasse 15, the SNB is publishing ‘The Swiss National Bank in Zurich: The Pfister Building 1922-2022’ (Verlag Scheidegger & Spiess).

Read More »

Read More »

Monetary policy report Quarterly Bulletin 3/2022

Report for the attention of the Governing Board of the Swiss National Bank for its quarterly assessment of September 2022. The report describes economic and monetary developments in Switzerland and explains the inflation forecast. It shows how the SNB views the economic situation and the implications for monetary policy it draws from this assessment. The first section (‘Monetary policy decision of 22 September 2022’) is an excerpt from the press...

Read More »

Read More »

Business cycle signals: SNB regional network – Q3/2022

Report submitted to the Governing Board of the Swiss National Bank for its quarterly monetary policy assessment. The appraisals presented here are based on discussions between the SNB’s delegates for regional economic relations and company managers throughout Switzerland. In its evaluation, the SNB aggregates and interprets the information received. A total of 209 company talks were conducted between 19 July and 6 September.

Read More »

Read More »

Prof. Dr. Thomas Jordan – Die Geldpolitik der SNB in Zeiten der Inflation

Für die Schweizerische Nationalbank (SNB) sind zwei ordnungspolitische Prinzipien von grosser Bedeutung: Die Unabhängigkeit von der Politik und ein Mandat, das sich auf die Gewährleistung der Preisstabilität konzentriert.

Read More »

Read More »

Swiss Balance of Payments and International Investment Position: Q2 2022

In the second quarter of 2022, the current account surplus was CHF 11 billion, almost CHF 1 billion lower than in the same quarter of 2021. The receipts surplus in goods trade, especially merchanting and traditional goods trade (foreign trade total 1), declined. The expenses surpluses in services trade, primary income and secondary income were each lower than in the same quarter of 2021.

Read More »

Read More »

Thomas Jordan: Sixth Karl Brunner Distinguished Lecture – Introduction of Benjamin M. Friedman

I am very pleased to welcome you all to the sixth Karl Brunner Distinguished Lecture. The Swiss National Bank established this annual lecture series in honour of the Swiss economist Karl Brunner, one of the leading monetary economists of the last century. Our aim with these lectures is to reach a broad audience, and to contribute to the public debate on issues related to central banking and economics more broadly.

Read More »

Read More »

+++Märkte+++ – Börsen-Ticker: Schweizer Aktienmarkt sinkt – 13 anstehende Zinsentscheide machen Anleger nervös – Bitcoin auf Drei-Monate-Tief

Der SMI notiert um 0,53 Prozent tiefer bei 10'554,85 Punkten. Laut Ansicht von BNP Paribas hat sich das Chartbild weiter eingetrübt. Bis zum Korrekturtief vom Juni bei 10'350 Punkten stelle sich nur noch das Zwischentief vom März 2021 bei 10'513 Punkten in den Weg.

Read More »

Read More »

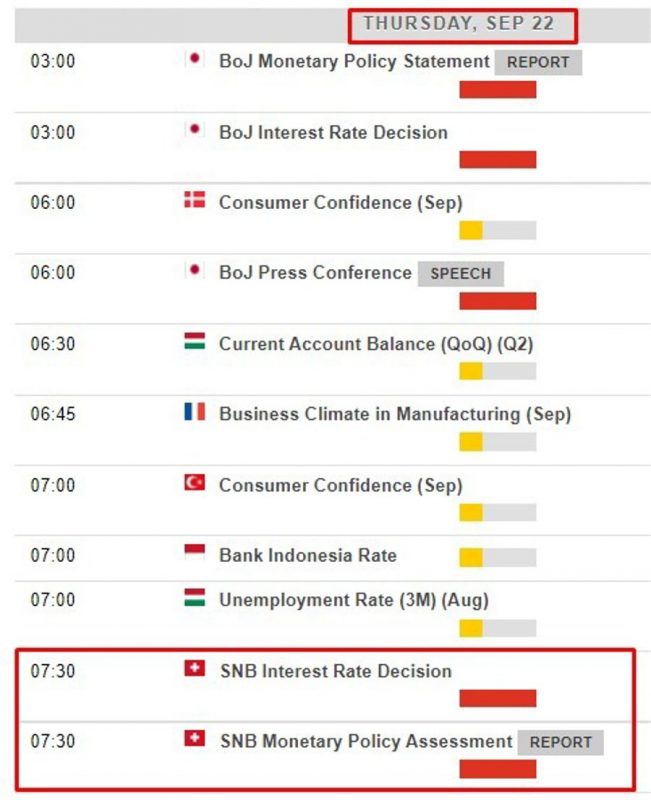

Swiss National Bank meet this week, a 100bp rate hike on the table – CHF impact

The SNB policy decision is due on Thursday. Via MUFG Bank:CHF has been the top performing G10 currency so far this month as it has strengthened sharply against both the EUR (+2.2%) and USD (+1.5%). It has regained upward momentum against our equally-weighted basket of other G10 currencies after a period of consolidation at higher levels between July and August.

Read More »

Read More »

Week Ahead Preview: FOMC is the highlight

MON: Japanese Respect for the Aged Day; EZ Construction Prices (Jul), Canadian Producer Prices (Aug), German Producer Prices (Aug). TUE: Chinese LPR, Riksbank Policy Announcement, RBA Minutes (Sep); Japanese CPI (Aug), EZ Current Account (Jul), US Building Permits/Housing Starts (Aug), Canadian CPI (Aug).

Read More »

Read More »

Thomas Jordan: Carl Menger Award Ceremony 2022: Introductory remarks on Ricardo Reis

I welcome you all to the ceremony of the Carl Menger Award, given by the Verein für Socialpolitik. I do so in the name of the sponsors of the award, namely the Deutsche Bundesbank, the Oesterreichische Nationalbank and the Swiss National Bank, as well as on behalf of the selection committee.

Read More »

Read More »

BOC’s Rogers: We are not where we were in July, but a long way from where we need to be

Bank of Canada's Senior Deputy Gov. Carolyn Rogers: We are not where we were in July, but we are a long way from where we need to be.

Read More »

Read More »

SNB-Chef Jordan begrüsst Zinsschritt der EZB

SNB-Präsident Thomas Jordan: Der Schritt der EZB war wichtig. (Bild: PD)Die Forward Guidance – die Leitlinien für die zukünftige Geldpolitik, auf welche die US-Notenbank und die Europäische Zentralbank achten, um die Finanzmärkte auf ihre Entscheide vorzubereiten und dem ihnen einen Schock zu ersparen – ist für die Schweizerische Nationalbank unbedeutend.

Read More »

Read More »

More from SNB’s Jordan: No comment on currency invention. We don’t rule anything out

Looks at series of models to gauge Swiss francs value; market has to live with some volatility, no comment on currency intervention.

Read More »

Read More »

SNB’s Jordan: We must ensure price stability over medium-term

SNB's Jordan is on the wires after the ECB hike rates by 75 basis points today:

ECB 75 basis point rate hike not fully surprising.

Read More »

Read More »

FX intervention watch – Swiss National Bank edition – too early for the CHF

This via the folks at eFX.

Credit Agricole CIB Research argues that it would be premature for the SNB to resume its intervention against CHF strength around current levels.

Read More »

Read More »

Börse – Zinsen, Dividenden, Wachstum: Diese Schweizer Bank-Aktien ziehen starkes Interesse auf sich

Die Chefs von Schweizer Banken dürften am 16. Juni aufgeatmet haben. Was auch immer über die Pros und Cons von Zinserhöhungen gesagt wird, der Zinsschritt der Schweizerischen Nationalbank (SNB) hilft der Branche. Wie eine Auswertung von cash.ch zeigt, liegen in der Jahres-Performance 12 der 16 besonders zinssensitiven Kantonal- und Regionalbanken in der Schweiz und Liechtenstein im Puls (siehe Tabelle).

Read More »

Read More »

Swiss National Bank President Jordan warned of persistently higher inflationary pressure

Swiss National Bank President Thomas Jordan spoke at the Federal Reserve’s annual Jackson Hole symposium on Saturday.“Structural factors such as the transition to a greener economy, rising sovereign debt worldwide, the demographic transition and ultimately also the fact that globalization appears to have peaked -- at least temporarily -- could lead to persistently higher inflationary pressure in the coming years”

Read More »

Read More »

-638453232816314704.png)