Category Archive: 5.) Emerging Markets

Drivers for the Week Ahead

We remain dollar bulls; this is an important data week for the US. Final August eurozone manufacturing PMIs will be reported Monday; UK reports August PMIs this week. RBA meets Tuesday and is expected to keep rates steady at 1.0%; BOC meets Wednesday and is expected to keep rates steady at 1.75%.

Read More »

Read More »

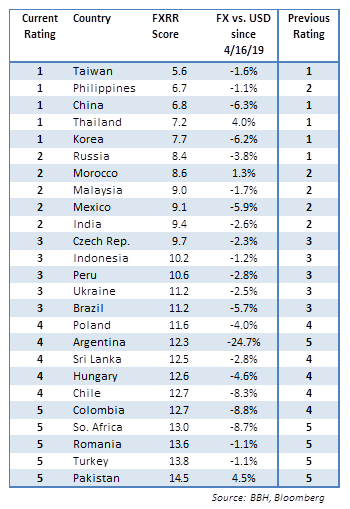

Emerging Markets: FX Model for Q3 2019

The broad-based dollar rally remains intact despite the market’s overly dovish take on the Fed. We still believe markets are vastly overestimating the Fed’s capacity to ease in 2019 and 2020. What’s clear is that the liquidity story is not enough to sustain EM. MSCI EM FX is on track to test the September 2018 low near 1575 and then the April 2017 low near 1568.

Read More »

Read More »

Dollar Firm as Markets Calm

Market sentiment has improved after President Trump said China has asked to restart trade talks. PBOC fixed the yuan basically flat and firmer than what models suggested. The G-7 summit wraps up today with little to show for it. We believe the Chicago Fed National Activity Index remains the best indicator to gauge US recession risks. Germany July IFO business climate came in weaker than expected

Read More »

Read More »

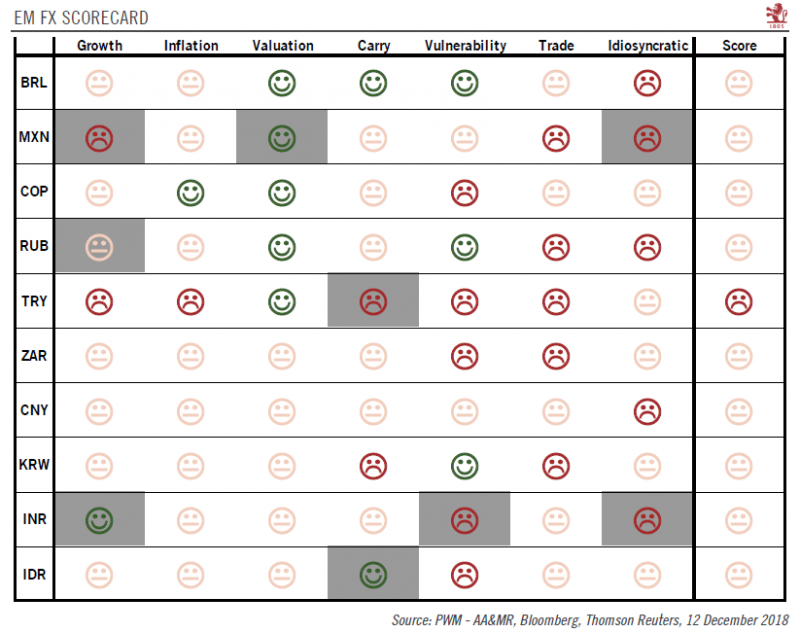

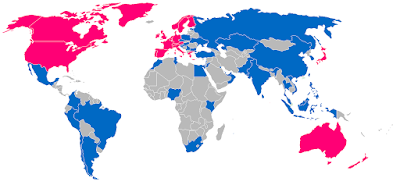

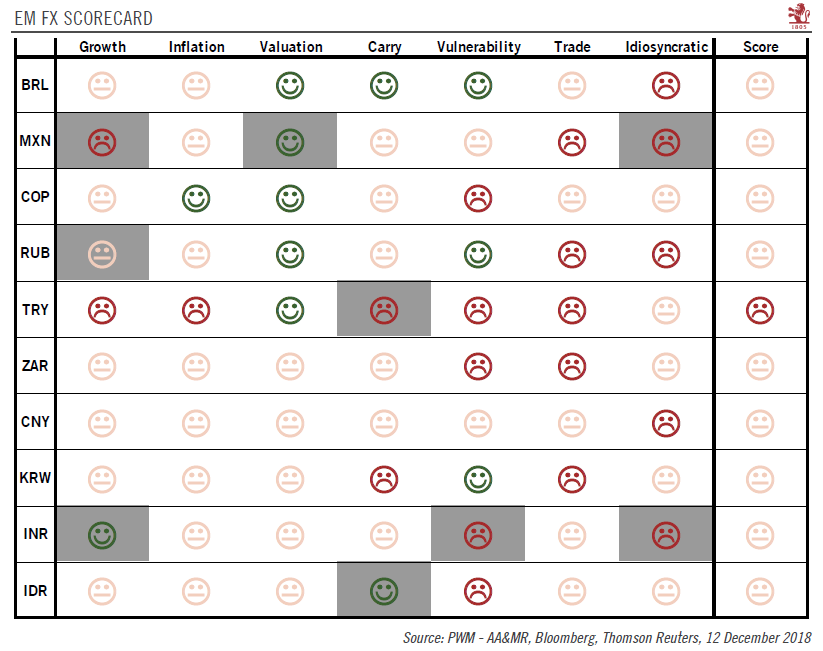

Emerging market currencies: idiosyncratic risks strike back

The environment will remain challenging for EM currencies next year.Despite a dovish shift by the Fed and the temporary truce in the US-Chinese trade dispute, the global environment remains challenging for emerging market (EM) currencies. In fact, our latestEM FX scorecard, which ranks 10 EM currencies according to key criteria such as growth and vulnerability to external shocks, is still unable to identify a single attractive EM currency among the...

Read More »

Read More »

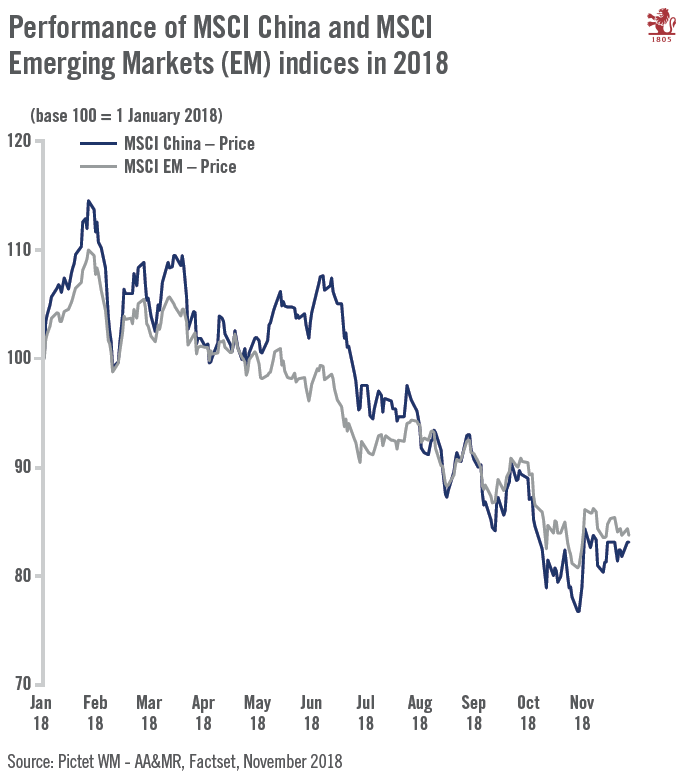

House View, December 2018

We remain neutral on global equities overall, seeing relatively limited potential for developed market stocks in particular as earnings growth declines. We favour companies with pricing power as well as measurable growth drivers and low leverage.

Read More »

Read More »

Emerging Markets: Preview of the Week Ahead

EM FX ended mixed in Friday, capping off an up and down week. RUB and TRY initially firmed on their respective rate hikes but gave back some of those gains heading into the weekend. Trade tensions are likely to remain high, as press reports suggest President Trump is pushing ahead with tariffs on $200 bln of Chinese imports even as high-level talks are planned.

Read More »

Read More »

Emerging Markets: What has Changed

Philippine central bank signaled another big hike. Poland central bank appears to be moving its forward guidance out further. Russia officials are sending confusing signals regarding monetary policy. Russia officials stand ready to support the ruble debt market if new US sanctions negatively impact it. South Africa’s African National Congress pledged to undertake land reform responsibly.

Read More »

Read More »

Emerging Market Week Ahead Preview

EM FX ended last week on a firm note, but weakness resumed Monday. Higher than expected Turkish inflation hurt the lira, which in turn dragged down BRL, ARS, ZAR, and RUB. We expect EM to remain under pressure this week when the US returns from holiday Tuesday.

Read More »

Read More »

Emerging Markets: What Changed

China stepped up efforts to attract more foreign inflows to the onshore bond market. Russia has softened its unpopular pension reform proposal. The African National Congress withdrew an existing land expropriation bill. Moody’s downgraded twenty Turkish financial institutions. Turkey central bank Deputy Governor Erkan Kilimci has reportedly resigned.

Read More »

Read More »

Emerging Markets: Week Ahead Preview

EM FX was whipsawed last week but ended on a firm note. We look past the noise and believe that the true signals for EM remain higher US interest rates and continued trade tensions, both of which are negative. Turkish markets reopen after a week off. Nothing fundamentally has changed there, and so it still poses some spillover risk to wider EM.

Read More »

Read More »

Emerging Markets: Preview of the Week Ahead

EM FX stabilized last week as the situation in Turkey calmed somewhat. Reports Friday that the US and China are hoping to resolve the trade dispute also helped EM FX ahead of the weekend. However, TRY remains vulnerable as the US threatens more sanctions due to the pastor. Both S&P and Moody’s downgraded it ahead of the weekend and our own ratings model points to further downgrades ahead. Turkish markets are closed this week for holiday.

Read More »

Read More »

Emerging Markets: Preview of the Week Ahead

EM FX has come under pressure again due to ongoing trade tensions and rising US rates but saw some modest relief Friday after the PBOC announcement on FX forwards. This helped EM FX stabilize, but we do not think the negative fundamental backdrop has changed. Best performers last week were MXN, PHP, and PEN while the worst were TRY, ZAR, and KRW.

Read More »

Read More »

Emerging Markets: Week Ahead Preview

EM FX enjoyed a respite from the ongoing selling pressures, with most currencies up on the week vs. the dollar. Best performers were CLP, MXN, and ZAR while the worst were TRY, CNY, and COP. BOJ, Fed, and BOE meetings this week may pose some risks to EM FX.

Read More »

Read More »

Emerging Markets: Week Ahead Preview

EM FX saw some violent swings last week, due in large part to some unhelpful official comments Friday. BRL and TRY were the best performers last week, while RUB and CLP were the worst. When all is said and done, however, we think Fed policy remains unaffected and so we remain negative on EM FX. Also, global trade tensions remain high after Trump threatened tariffs on all Chinese imports entering the US.

Read More »

Read More »

Emerging Market Preview: Week Ahead

EM FX ended Friday mixed, capping off a mostly softer week. TRY, MXN, and RUB were the top performers and the only ones up against USD, while ARS, CLP, and BRL were the worst. Looking ahead, US jobs data on Friday pose some risks to EM, coming on the heels of a higher than expected 2% y/y rise in PCE. China will also remain on the market’s radar screen, with the first snapshots of June economic activity just starting to emerge. We remain...

Read More »

Read More »

Emerging Markets: What Changed

PBOC fixed USD/CNY at the highest level since December 14. Bank Indonesia delivered a larger than expected 50 bp to 5.25%. Bulgarian Prime Minister Boyko Borissov survived a second no-confidence vote this year. Turkish President Recep Tayyip Erdogan was re-elected but with sweeping new powers. Saudi Arabia, Kuwait, and UAE are reportedly in talks to help stabilize Bahrain.

Read More »

Read More »

Emerging Markets: Preview of the Week Ahead

EM FX ended Friday mixed, and capped off a mixed week overall as the dollar’s broad-based rally was sidetracked. EM may start the week on an upbeat after PBOC cut reserve requirements over the weekend. Best EM performers last week were ARS, MXN, and TRY while the worst were THB, IDR, and BRL.

Read More »

Read More »

Emerging Markets: What Changed

Nor Shamsiah Mohd Yunus was named the new Governor of Malaysia’s central bank. Moody's cut the outlook on Pakistan's B3 rating to negative from stable. National Bank of Hungary tiled more hawkish. Israeli Prime Minister Benjamin Netanyahu’s wife was charged with misusing public funds. MSCI added Saudi Arabia and Argentina to its Emerging Markets index.

Read More »

Read More »

Emerging Markets: Week Ahead Preview

EM FX was mixed on Friday but capped off a largely losing week. MYR, CLP, and CNY were the best performers over the last week, while ARS, TRY, and ZAR were the worst. We expect EM FX to continue weakening, but note that with very few fundamental drivers this week, we may see some consolidation near-term.

Read More »

Read More »

Emerging Markets: What Changed

US-China trade tensions are rising. Pakistan devalued the rupee for a third time since December. Bulgaria will seek to join the eurozone banking union and ERM-2 simultaneously. The National Bank of Hungary appears to have tilted more hawkish. Newly elected Egyptian President El-Sisi shuffled his cabinet. Argentina has a new central bank chief after Federico Sturzenegger resigned.

Read More »

Read More »