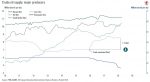

Last week’s 50 bps Fed rate hike was not a surprise. Indeed, Fed chairman Jerome Powell’s assertion that a 75 bps hike had not been actively considered was enough to spark a stock rally. But it proved short-lived, with markets quickly returning to their fears about inflation.

Read More »2022-05-10