We see the ECB remaining on hold throughout next year although we believe it could tweak some of the technical parameters of its toolkit.

The first press conference of any new ECB President is an event in itself, and this time will be no different. Christine Lagarde’s debut this week will understandably attract a lot of attention as the media and market participants scrutinise both form and substance. Indeed, the ECB’s ‘transition’ goes beyond the change in leadership as the central bank is facing a deluge of challenges, from risks to the economic outlook to the side-effects of its policies and from internal dissensions to external political pressure.

The timing could not be better for President Christine Lagarde to launch a comprehensive review of the central bank’s strategy and to seize the opportunity to restore cohesion within the Governing Council. In short, we expect Lagarde’s presidential style to look like a combination of Jean-Claude Trichet’s (in form) and Mario Draghi’s (in substance) as she is likely to spend more time forging consensus than forcing decisions on a (small but growing) minority of Governing Council members.

In her first interventions, Lagarde said that the ECB’s strategic review next year will be guided by two principles – “thorough analysis and an open mind” – suggesting that the whole process will keep the ECB busy for the bulk of 2020. The strategy review will provide the opportunity to reflect on the past decade of unconventional crisis measures. Rather than allowing Lagarde to ‘reset’ monetary policy , it may provide her with a clean(er) starting point for the next eight years.

| The scope of the strategic review may not be finalised before early 2020, but it should be centred on four main issues: 1) the definition of price stability and inflation measures; 2) the side-effects of unconventional policy measures; 3) internal and external communication strategy; and 4) climate risks.

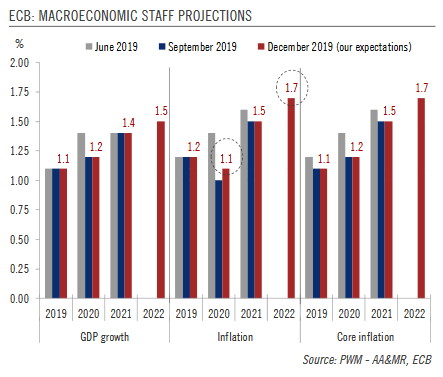

Continuity should prevail when it comes to setting monetary policy ahead of the review. Our baseline scenario remains that the ECB will stay put in 2020 but finetune some technical parameters of its policy tools. An increase in the multiplier of bank reserves in the tiering system is possible in order to further mitigate the side effects of negative rates. Still, the ECB should keep an easing bias. If downside risks were to materialise, a rate cut would come as the path of least resistance. An increase in the pace of asset purchases, from EUR20bn per month to EUR 40-50bn (along with an increase in issuer limits for its bond purchase programme), would only be decided in the event of a material deterioration in the inflation outlook. |

Source: perspectives.group.pictet - Click to enlarge |

Tags: newsletter,Pictet