Tag Archive: newsletter

Deine BU muss mitwachsen #shorts

Die BU ist eine der wichtigsten Grundlagen Deiner Finanzen. Aber auch wenn Du bereits eine BU abgeschlossen hast, solltest Du Deine BU im Auge behalten, damit Du auch im Alter bestens abgesichert bist. Saidi erklärt Dir in diesem Video warum und wie oft Du Deine BU anpassen solltest.

#Finanztip

Read More »

Read More »

Silver Prices Have Pulled Back Sharply! #shorts

🔔 SUBSCRIBE TO MONEY METALS EXCHANGE ON YOUTUBE

➤ http://bit.ly/mmx-youtube

📉 Silver Alert: Prices have dropped over $3 in the past week, with another dollar decline today, now below $28 per ounce. Gold is also seeing a reduction. Lower premiums and precious metals prices are creating a prime entry point for investors. 💼

▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬

★★FOLLOW MONEY METALS EXCHANGE ★★

FACEBOOK ➤ https://www.facebook.com/MoneyMetals

TWITTER...

Read More »

Read More »

RKI Files: Jetzt läuft es komplett aus dem Ruder!

Lauterbach redet sich um Kopf und Krafen!

Meine Depot-Empfehlung:

https://link.aktienmitkopf.de/Depot *

Auf der Freedom 24-Plattform findest Du:

- Langfristige Sparpläne mit Zinssätzen bis zu 8,76 %!

- Rendite von 3,86 % in Euro und 5,31 % in Dollar bei täglicher Gutschrift der Zinsen!

- Bis zu 1.000.000 Aktien, ETFs, Aktienoptionen und andere Finanzinstrumente!

Bildrechte: By Steffen Prößdorf, CC BY-SA 4.0,...

Read More »

Read More »

How The Economic Machine Works: Part 2

This simple animated video series answers the question, "How does the #economy really work?" Based on my practical template for understanding the economy.

This series breaks down economic concepts like #credit, #deficits and #interest rates, allowing viewers to learn the basic driving forces behind the economy, how economic policies work and why economic cycles occur.

This is Part 2, I hope you find these helpful.

If you enjoy this,...

Read More »

Read More »

Time to reject ‘social justice’ and replace it with real justice

One of the most familiar terms heard or read today is “social justice.” Ironically, “social justice” is anything but justice. It basically represents double standards, inequality, partiality, prejudice, racism, selectivity, and subjectivity. It has to be one of modernity’s cleverest and most subtle paradoxes.Perhaps the best way to expose it as a paradox is by revealing what genuine and true justice demands when applied evenly and honestly to all...

Read More »

Read More »

How Inflation Impacts Demand for Loans and Interest Rates

Understanding the correlation between inflation, loan demand, and interest rates is key. Learn more about longer duration bonds and their impact! 🔍💰 #Finance101 #InterestRates #Bonds

Want to learn more? Subscribe to our YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

750€ mehr für Krankenkasse. Privat versichern? | Geld ganz einfach

Krankenkassenvergleich 2024: Die besten Krankenkassen

HKK* ► https://www.finanztip.de/link/hkk-gkv-yt/yt_wlWvokxIIq4

TK

Audi BKK* ► https://www.finanztip.de/link/audibkk-gkv-yt/yt_wlWvokxIIq4

HEK

Energie-BKK* ► https://www.finanztip.de/link/energiebkk-gkv-yt/yt_wlWvokxIIq4

Big direkt gesund* ► https://www.finanztip.de/link/bigdirekt-gkv-yt/yt_wlWvokxIIq4

(Stand: 18.01.24)

Private Krankenversicherung (PKV)

von Buddenbrock Concepts* ►...

Read More »

Read More »

Eil: Obama schäumt vor Wut!

Teil 1 von Obamas Plan ging auf, aber Teil 2 ging in die Hose!

Meine Depot-Empfehlung:

https://link.aktienmitkopf.de/Depot *

Auf der Freedom 24-Plattform findest Du:

- Langfristige Sparpläne mit Zinssätzen bis zu 8,76 %!

- Rendite von 3,86 % in Euro und 5,31 % in Dollar bei täglicher Gutschrift der Zinsen!

- Bis zu 1.000.000 Aktien, ETFs, Aktienoptionen und andere Finanzinstrumente!

Bildrechte: By Sandro Halank, Wikimedia Commons, CC BY-SA 4.0, CC...

Read More »

Read More »

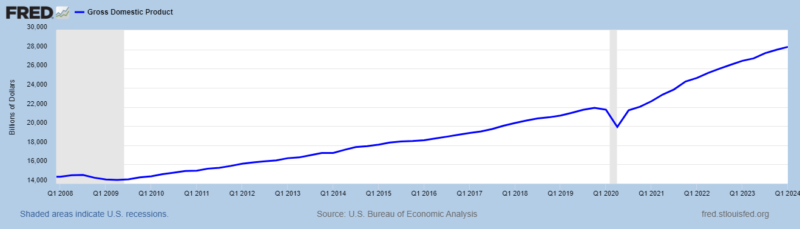

7-25-24 How Your Confidence Can Boost or Break the Economy

The S&P Global Services Index is "great," in contradiction to other eocnomic metrics; the first estimate of Q2 GDP is released today (up 2.8%); this will be revised. Important to note the behavior of GDP prior to past recessions, which are always back-dated. 350-days without a 2% correction, until Wednesday. Bill Dudley is calling for lower interest rates now; Lance Roberts & Michael Lebowitz explain the crucial link between...

Read More »

Read More »

Wall Street’s latest poison: Leveraged EFTs

The market always seems to teach retail investors a lesson. Bloomberg reported leveraged EFTs such as The Direxion Daily Semiconductors Bull 3x Shares (ticker SOXL), which delivers triple the daily move of the NYSE Semiconductor Index, took in a record 1.5 billion last week, only to drop “15% Wednesday to extend a 37% loss in the past 14 days.”“The $23 billion ProShares UltraPro QQQ (TQQQ) and the $4 billion ProShares UltraPro S&P 500 (UPRO)...

Read More »

Read More »

A ‘smart city’ is a city plagued by high taxes and central planning

The term “smart city” conjures images of futuristic utopias where technology seamlessly enhances our daily lives. Traffic flows like a symphony, garbage trucks only show up when needed, and potholes fill themselves while apologizing for the inconvenience. But peel back the glossy veneer, and you’ll find that these so-called smart initiatives are often just a new way to nickel-and-dime residents. Let’s take a tour through the cityscape of this...

Read More »

Read More »

Reich vs Reality: Free Markets Work Best

Robert Reich recently asserted that “free markets” aren’t neutral or free, are actually shaped by those who wield power. Reich believes that government powers have been subverted by private interests- this part of his analysis is actually true in many cases. Reich hopes for some sort of miracle whereby countervailing government powers will work in the public interest to suppress greedy monopolists- this part of his analysis is delusional and...

Read More »

Read More »

UBS questioned by US Senator over $350 million tax evasion case

UBS Group AG was asked by a powerful US lawmaker about whether the bank it acquired, Credit Suisse Group AG, failed to report an American accused of evading taxes on $350 million (CHF307 million) in income.

Read More »

Read More »

Größter Raub der Geschichte – 25 Milliarden sind weg!

Kostenfreies Video-Training (Durch Trading in 2024 absichern) 👉 https://oliverklemmtrading.com/casestudy-1?utm_source=youtube&utm_medium=social&utm_campaign=tradingcoacholi&utm_term=morning-news&utm_content=1

Klicke hier, um dich direkt gemeinsam mit Oli unabhängig zu machen 👉...

Read More »

Read More »

Biden’s parting deluge of deceit deserves damning

In a mere 11 minutes on Wednesday night, President Biden settled any doubts about whether he was fit for another four years of the presidency. Uncle Joe wrestled with the teleprompter like a slacker high school boy blindsided by trigonometry questions on the math SAT test. By the end of the Bidens brief spiel, most judges declared that the teleprompter had won by technical knockout.A few weeks ago, Biden declared that it would take “the Lord...

Read More »

Read More »

Baerbocks VISA Affäre MASSIV ausgeweitet!

Die VISA Affäre weitet sich immer weiter aus!

Meine Depot-Empfehlung:

https://link.aktienmitkopf.de/Depot *

Auf der Freedom 24-Plattform findest Du:

- Langfristige Sparpläne mit Zinssätzen bis zu 8,76 %!

- Rendite von 3,86 % in Euro und 5,31 % in Dollar bei täglicher Gutschrift der Zinsen!

- Bis zu 1.000.000 Aktien, ETFs, Aktienoptionen und andere Finanzinstrumente!

Bildrechte: By Sandro Halank, Wikimedia Commons, CC BY-SA 4.0, CC BY-SA 4.0,...

Read More »

Read More »

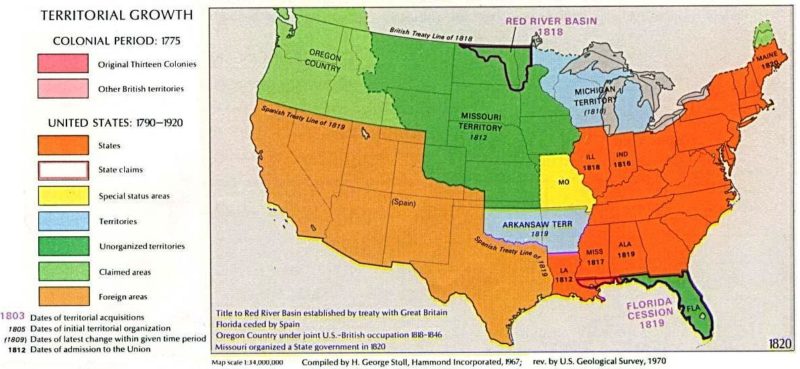

How westward expansion sowed the seeds of the Civil War

[Editor’s note: The article below is adapted from a lengthy 1954 memo by Rothbard which is written largely as a review of George B. DeHuszar and Thomas Hulbert Stevenson’s A History of the American Republic. The memo was republished in 2010 by the Mises Institute as part of Strictly Confidential: The Private Volker Fund Memos of Murray N. Rothbard, edited by David Gordon. Rothbard here provides a concise and razor-sharp analysis of how the...

Read More »

Read More »

Wichtige Morning News mit Oliver Klemm #329

► Kostenfreies Video-Training (Durch Trading in 2024 absichern) 👉 https://oliverklemmtrading.com/casestudy-1?utm_source=youtube&utm_medium=social&utm_campaign=tradingcoacholi&utm_term=morning-news&utm_content=1

Klicke hier, um dich direkt gemeinsam mit Oli unabhängig zu machen 👉...

Read More »

Read More »

Darfst Du IKEA Stifte einfach mitnehmen?

Hast Du auch schon mal einen IKEA-Stift mitgehen lassen? Dann erfährst Du hier ob das eigentlich überhaupt erlaubt ist.

#Finanztip

Read More »

Read More »

Have we been living in an MMT world since 2008?

I recently viewed Finding the Money, a video aimed at persuading a popular audience of the putative merits of Modern Monetary Theory (MMT). The video debuted this past May on several streaming platforms and theaters throughout the U.S. Whether it succeeded or not in its purpose, I will leave it for others to judge. What I found most noteworthy in the 95-minute video was a brief clip of an interview with George Selgin, an economist of some...

Read More »

Read More »