Tag Archive: newsletter

USDJPY remains above 100/200 hour MA & below a solid ceiling as buyers and sellers battle

The ceiling at 30+ highs comes between 151.91 to 151.97. Support at the 100/200 hour MA at 151.51 to 151.447. Traders looking for a break and a run outside one of the extremes.

Read More »

Read More »

Elektroautobauer erleben BIutbad! 1 Billion Dollar vernichtet!

Tesla und andere Elektroautobauer erleben einen gigantischen Börsenschock!

Depotempfehlung 3,9 % Tagesgeld-Zinsen und 5,3% für Einlagen in USD

Zur Osteraktion https://link.aktienmitkopf.de/Ostern *

📊 Tracke deine Dividenden mit dieser App http://myfinances24.de/mydividends24

📒 Mein Buch! Der Rationale Kapitalist ►►http://amzn.to/2kludNT

🎧JETZT auch als Hörbuch bei Audible ►► https://goo.gl/iWvTRR

Haftungsausschluss: Anlagen in Wertpapieren und...

Read More »

Read More »

Depot ≠ Einlagensicherung: Sind Deine ETFs und Aktien sicher?

Das Geld auf Deinem Depot ist durch die Einlagensicherung geschützt? Vorsicht: Abgesichert ist immer nur Geld. Ein Depot besteht aber aus Wertpapieren - und für die gibt es keine Einlagensicherung. Wie sind Deine ETFs, Aktien und Co. dann vor einer Bankenpleite geschützt? Saidi zeigt es Dir.

Read More »

Read More »

Morgan Stanley: „Diese Aktien muss man kaufen!“

► Sichere Dir jetzt meinen Report „Diese Gefahr wird unterschätzt!“ – 100% gratis → https://www.lars-erichsen.de

Das hier wird, auch wenn es natürlich spannend wäre, kein Crash-Video. Ich bin und bleibe bullisch für den Aktien-Markt auf Sicht der nächsten 12-18 Monate. Das was wir jetzt allerdings sehen ist nah dran an einem Goldilock-Szenario.

D.h. also der Markt blendet die Risiken fast alle aus, auf der anderen Seite konzentriert er sich...

Read More »

Read More »

Artificially Low Interest Rates Are Creating Economic Chaos

If you asked him, Edward Chancellor wouldn’t say he’s particularly Austrian. Yet The Price of Time: The Real Story of Interest, the dense book he most timely published during the height of the inflation summer of 2022, is as obsessed with centrally planned interest rates as your average Misesian. Like many before him, and many in the Austrian camp, Chancellor identifies the many ills that trouble the world and locates their cause in a dysfunctional...

Read More »

Read More »

What Are You Going to Do About It? (The National Debt)

The national debt has spiraled to nearly $34.6 trillion. It's easy to point out that this is the problem. But what are we going to do about it? Answering that question isn't so simple.

But as host Mike Maharrey explains in this episode of the Money Metals' Midweek Memo, there is a blueprint we could follow to address the spending and the debt. Thomas Jefferson gave it to us. The question is whether anybody in Washington D.C. has the courage to...

Read More »

Read More »

EURUSD rallies toward key moving average amid weak ISM data

EURUSD tests 38.2% retracement level after ISM nonmanufacturing data; 200-day MA looms ahead

Read More »

Read More »

Machst Du diesen Geld-Fehler? | Geld ganz einfach

Depot-Vergleich 2024: Die besten Broker & Aktiendepots

ING* ► https://www.finanztip.de/link/ing-depot-yt/yt_B070kK808lc

Finanzen.net Zero* ► https://www.finanztip.de/link/finanzennetzero-depot-yt/yt_B070kK808lc

Trade Republic* ► https://www.finanztip.de/link/traderepublic-depot-yt/yt_B070kK808lc

Scalable Capital* ► https://www.finanztip.de/link/scalablecapital-depot-yt/yt_B070kK808lc

Justtrade

Traders Place* ►...

Read More »

Read More »

Unterhalt bei der Scheidung: Wie berechnet man das?

Bei einer Scheidung kommen mehrere Kosten auf Euch zu. Dazu gehören in vielen Fällen auch die Unterhaltskosten für Eure Kinder. In diesem Video zeigt Euch Saidi, worum es dabei geht und wie der Unterhalt berechnet wird.

#Finanztip

Read More »

Read More »

Real Estate Investing Tips for 2024 – Ken McElroy, Jaren Sustar

In this episode of the Rich Dad Radio Show, guest host Ken McElroy fills in for Robert Kiyosaki, discussing the transformative financial journey of Jaron Sustar, also known as the Finance Cowboy. Starting with a significant amount of debt due to student loans and consumer choices, Jaron and his wife decided to break the cycle of living paycheck to paycheck. By focusing on real estate investment, they managed to become millionaires by the age of 29....

Read More »

Read More »

New York Times: Massive Klatsche für Scholz!

Ich kaufe Katrin Göring Eckardt nicht einen einzigen Meter die Bemühung um eine ehrliche und echte Aufarbeitung ab!

Depotempfehlung 3,9 % Tagesgeld-Zinsen und 5,3% für Einlagen in USD

https://link.aktienmitkopf.de/Depot*

BIldrechte: By Michael Lucan - Own work, CC BY-SA 3.0 de, https://commons.wikimedia.org/w/index.php?curid=110456044

📊 Tracke deine Dividenden mit dieser App http://myfinances24.de/mydividends24

📒 Mein Buch! Der Rationale...

Read More »

Read More »

USDCAD muddles along today but remains above key moving average support.Can that continue?

The USDCAD 100 bar moving average on the four hour chart comes in at 1.35468. That is close support for traders today.

Read More »

Read More »

Connecticut’s Housing Shortage Is Rooted in Government Policies

Tu ne cede malis, sed contra audentior ito

Website powered by Mises Institute donors

Mises Institute is a tax-exempt 501(c)(3) nonprofit organization. Contributions are tax-deductible to the full extent the law allows. Tax ID# 52-1263436

Read More »

Read More »

Marx, Class Conflict, and the Ideological Fallacy

Tu ne cede malis, sed contra audentior ito

Website powered by Mises Institute donors

Mises Institute is a tax-exempt 501(c)(3) nonprofit organization. Contributions are tax-deductible to the full extent the law allows. Tax ID# 52-1263436

Read More »

Read More »

USDCHF moves to new highs for the year and pushes away from 38.2% retracement

The 38.2% retracement of the USDCHFs move down from the 2022 high comes in at 0.90252. Staying above that is more bullish in the short and long term now.

Read More »

Read More »

Kickstart your FX trading for April 3 w/ a technical look at the EURUSD, USDJPY and GBPUSD

The USDJPY is pushing against the highs from 2022, 2023 and 2024 to start the US trading day.

Read More »

Read More »

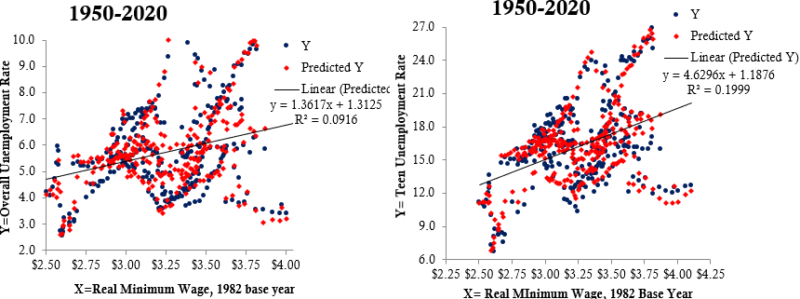

California’s Minimum Wage Increase is Inefficient and Unfair

California raised its minimum wage rate for the fast food industry to 20$ today. US Politicians haven't targeted specific industries with minimum wage increases since the Great Depression. There are already signs that some fast food places in California are cutting back on employment. The specific effects of this fast food minimum wage will become clear during the rest of this year. For the time being, we should recall the general effects of...

Read More »

Read More »

Could Powell Eclipse Market Expectations?

The JOLTS survey rate continues to slow, coincident with a slowing economy; interestingly, retail hiring has dropped sharply, despite increased retail demand (another example of divergent indicators). The data might not be as strong as we think. The difference between Fed promises and predictions can be vast. Markets remain in a "perfect" trend channel; what happens when the 20-DMA is broken? Commentary on the coming solar eclipse, and...

Read More »

Read More »