Tag Archive: newsletter

Is “Havana Syndrome” Russian Aggression or Another Media Conspiracy Theory?

On Sunday night, the CBS show 60 Minutes ran a segment about the series of mysterious medical episodes suffered by United States intelligence officers and government officials that has been given the nickname “Havana Syndrome.” For almost a decade, officials and their families have reported hearing sudden ringing sounds in their ears and experiencing headaches, dizziness, and other symptoms, usually while stationed abroad.Many journalists,...

Read More »

Read More »

The US Vetoes International Action on Gaza

In the world of patronage, it doesn’t get much worse. The United States is at Israel’s elbow—it is a cobelligerent: In actively sustaining Israel’s armed forces, and running diplomatic interference for its politicians; America is acting as Israel’s “principal sponsor,” complicit in war crimes, signaling to the Jewish State that it will let it continue to its evil endgame.As I ventured in January, the issuance of the equivalent of a legal...

Read More »

Read More »

Rate Adjustment Underpins Greenback

Overview: The adjustment to US interest rates

continues and this helps underpin the US dollar. The 10-year yield rose to

4.40% yesterday, the highest it has been since last November. It is trading

4.34%-4.38% today. The two-year yield is firm though holding below the Q1 high

set last month near 4.75%. This week, for the first time since last October,

the Fed funds futures do not have at least a quarter point cut discounted for

July. As recently as...

Read More »

Read More »

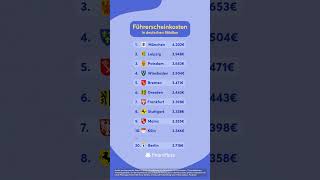

Führerscheinkosten in deutschen Städten #führerschein

Führerscheinkosten in deutschen Städten 🚗 #führerschein

📝 Quelle: paulcamper.de, Stand 01/2022, (Grundbetrag der Fahrschule, 25 Fahrstunden, 12 Sonderfahrten, Anmeldegebühren für die theoretische und praktische Prüfung durch die Fahrschule, amtliche Gebühren für beide Prüfungen, Erste-Hilfe-Kurs, Sehtest, Antrag auf Ersterteilung einer Fahrerlaubnis, Passbild)

🎯 2015 haben wir es uns zur Mission gemacht, Menschen zu ermutigen, ihre Finanzen in...

Read More »

Read More »

Moskau: DAS steckt wirklich hinter dem Attentat

Kostenfreies Video-Training (Durch Trading in 2024 absichern) 👉 https://oliverklemmtrading.com/casestudy-1?utm_source=youtube&utm_medium=social&utm_campaign=tradingcoacholi&utm_term=morning-news&utm_content=1

Klicke hier, um dich direkt gemeinsam mit Oli unabhängig zu machen 👉...

Read More »

Read More »

“Conspiracy” Is Not a Real Crime, and Trump Isn’t Guilty of It

Last month, former president Donald Trump succeeded in indefinitely delaying his trial on federal charges related to the January 6 riot at the US Capitol building. It is now unclear if or when he will stand trial for the federal crimes with which he was charged in August of last year.The charges are primarily conspiracy charges. Specifically, Trump has been charged in federal court with one count of conspiracy to defraud the United States, one...

Read More »

Read More »

RKI Skandal: Katrin Göring Eckardt

Ich kaufe Katrin Göring Eckardt nicht einen einzigen Meter die Bemühung um eine ehrliche und echte Aufarbeitung ab!

Depotempfehlung 3,9 % Tagesgeld-Zinsen und 5,3% für Einlagen in USD

https://link.aktienmitkopf.de/Depot*

BIldrechte: By Kasa Fue - Own work, CC BY-SA 4.0, https://commons.wikimedia.org/w/index.php?curid=135664251

📊 Tracke deine Dividenden mit dieser App http://myfinances24.de/mydividends24

📒 Mein Buch! Der Rationale Kapitalist...

Read More »

Read More »

EURUSD Technical Analysis – The bearish bias remains intact

#eurusd #forex #technicalanalysis

In this video you will learn about the latest fundamental developments for the EURUSD pair. You will also find technical analysis across different timeframes for a better overall outlook on the market.

----------------------------------------------------------------------

Topics covered in the video:

0:00 Fundamental Outlook.

1:27 Technical Analysis with Optimal Entries.

3:01 Upcoming Economic Data....

Read More »

Read More »

Wichtige Morning News mit Oliver Klemm #276

Kostenfreies Video-Training (Durch Trading in 2024 absichern) 👉 https://oliverklemmtrading.com/casestudy-1?utm_source=youtube&utm_medium=social&utm_campaign=tradingcoacholi&utm_term=morning-news&utm_content=1

Klicke hier, um dich direkt gemeinsam mit Oli unabhängig zu machen 👉...

Read More »

Read More »

NZDUSD support and resistance has been set against technical levels.What are they and why?

The NZDUSD found support defined by a technical target and has retraced to a technical level. Want to know what they are and why?

Read More »

Read More »

TOP 10 Aristas MÁS Influyentes de SHERPA

Te animo a suscribirte a mi canal y te invito a seguirme en mis redes sociales:

☑ Twitter - https://twitter.com/dlacalle

☑ Instagram - https://www.instagram.com/lacalledanie

☑ Facebook - https://www.facebook.com/dlacalle

☑ Página web - https://www.dlacalle.com

☑ Mis libros en Amazon - https://www.amazon.es/Daniel-Lacalle/e/B00P2I78OG

¡Un saludo!

Read More »

Read More »

Achtung: Neue CO2 Zentralbank geplant!

Noch mehr supranationale Bürokratie gefällig?! Warum auch nicht, gibt ja noch nicht genug in der EU!

Depotempfehlung 3,9 % Tagesgeld-Zinsen und 5,3% für Einlagen in USD

https://link.aktienmitkopf.de/Depot*

BIldrechte: By Gam9bit - Own work, CC BY-SA 4.0, https://commons.wikimedia.org/w/index.php?curid=134944868

📊 Tracke deine Dividenden mit dieser App http://myfinances24.de/mydividends24

📒 Mein Buch! Der Rationale Kapitalist...

Read More »

Read More »

AUDUSD rebounds higher today after fall yesterday, but stalls at target resistance level.

The AUDUSD fell yesterday but is taking back the declines today. However, resistance at 0.6523 stalls the rally

Read More »

Read More »

Aufbruch oder Untergang – Teil 1 – Ernst Wolff im Gespräch mit Investor Talk

Ernst Wolff zu den Themen Überschuldung, Crash, digitalen Zentralbankenwährungen, Krieg und möglicher Weltkrieg, Bürgerrechte, Vorsorge, u.a. mit Edelmetallen und Chancen für einen anderen "Reset".

#crash #cbdc #krieg #silber

Teil 2 des Interviews finden Sie hier:

____________________

📅 Alle Termine und die Links zu meiner Vortragsreihe finden Sie hier:

👉 https://ernstwolff.com/#termine

Auf dem offiziellen YouTube-Kanal vom...

Read More »

Read More »

Why Argentina Needs a 100%-Reserves Banking System

There have been criticisms against Javier Milei´s plan to install a 100% reserve banking system in Argentina. One of the fears is that in a 100% reserve banking system there would be price deflation which would be detrimental to the economy. I have written about the myth that falling prices are to be fought against with inflation of the money supply in my book “In Defense of Deflation” which has recently been recommended by Javier Milei on X.Now...

Read More »

Read More »

America’s Fiscal Collapse Accelerates

In case you thought anybody in Washington was driving this thing, they are not. It’s official: the Department of Treasury is now issuing debt at pandemic levels. It’s worth noting the pandemic record was double the previous record, which had stood for 231 years.In raw numbers, the latest numbers for Q4 2023 show Treasury issued $7 trillion in new debt. For the entire year, it came to $23 trillion.This has bloated the Treasury market to $27 trillion...

Read More »

Read More »

Kabelgebühren ab Juli 2024: Wie teuer werden Internet & Fernsehen? (So sparst Du)

Kabel & DSL Vergleich: So findest Du den besten Internettarif

Check24* ► https://www.finanztip.de/link/check24-internet-yt/yt_Lv_sW9_uHI0

Verivox* ► https://www.finanztip.de/link/verivox-internet-yt/yt_Lv_sW9_uHI0

🧡 Jetzt Finanztip Unterstützer werden: https://www.finanztip.de/unterstuetzer-youtube/?utm_source=youtube&utm_medium=videobeschreibung&utm_campaign=Lv_sW9_uHI0&utm_content=content_unterstuetzer

Ihr habt Fernsehen oder...

Read More »

Read More »

S&P index gaps lower today and below a trend line and moving average.Sellers make a play.

The sellers have moved the S&P below a upward sloping trend line and the 100 hour MA at 5198.39. Stay below is a tilt to the downside technically.

Read More »

Read More »

Hat der Bitcoin einen Usecase? #bitcoin

Hat der Bitcoin einen Usecase? 🔨 #bitcoin

📝 Im Netz sorgt diese Frage immer wieder für Zoff. Es scheint nur zwei Lager zu geben: Krypto-Maximalisten und Bitcoin-Totalverweigerer und die reden auch noch oft aneinander vorbei.

🎯 2015 haben wir es uns zur Mission gemacht, Menschen zu ermutigen, ihre Finanzen in die eigenen Hände zu nehmen. Angefangen als YouTube-Kanal mit Erklärvideos, haben wir uns innerhalb weniger Jahre zur größten Community...

Read More »

Read More »