Category Archive: 2) Swiss and European Macro

Immobilien: Dieser Fehler wird extrem teuer!

► Hier könnt Ihr den YouTube-Kanal „Hell Investiert“ von Sebastian Hell abonnieren → https://www.youtube.com/c/Hellinvestiert?sub_confirmation=1

Nicht erschrecken! Mein Kollege Sebastian Hell vertritt mich heute und spricht über einen Fehler, den Immobilien-Investoren nicht machen sollten. Konkret geht es darum, dass die EU ab 2027 den freien Handel von CO2-Zertifikaten plant und dies zu einer massiven Verteuerung führen wird. Worauf...

Read More »

Read More »

Trump-Sieg! Diese 3 Aktien gewinnen!

► „BuyTheDip“ Podcast-Folge „2 Kauf-Chancen, 1 böses Omen & Blackrocks neuer Billionen-Markt“ – hier direkt hören → https://buythedip.podigee.io/

► Hier kannst Du meinen Kanal abonnieren → https://www.youtube.com/erichsengeld?sub_confirmation=1

► Sichere Dir meinen Report mit Tipps zu Gold, Aktien, ETFs – 100% gratis → https://www.lars-erichsen.de

Donald Trump wird die 60. US-Präsidentschaftswahl gewinnen. Das ist sehr wahrscheinlich und es...

Read More »

Read More »

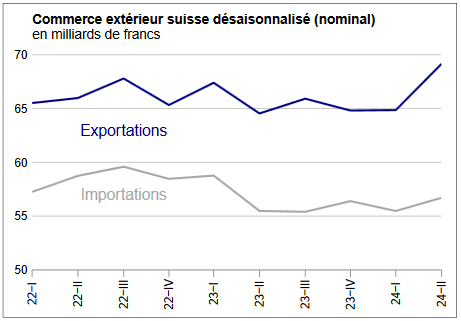

Record exports in the 2nd quarter of 2024

After a tepid first quarter, Swiss foreign trade regained momentum in the second quarter of 2024. In seasonally adjusted terms, exports jumped by 6.6% and reached a record level. Imports increased by 2.2%. The trade balance closes with a historic quarterly surplus of 12.4 billion francs.

Read More »

Read More »

Meine 10.000 Euro Silber-Spekulation!

► Hier kannst Du meinen Kanal abonnieren → https://www.youtube.com/erichsengeld?sub_confirmation=1

► Sichere Dir meinen Report mit Tipps zu Gold, Aktien, ETFs – 100% gratis → https://www.lars-erichsen.de

Auf vielfachen Wunsch, heute ein Update zu meiner 10.000 Euro Silber-Spekulation im Video-Format. Ich werde also über die 3 Silber-Aktien sprechen, in die ich investiert bin. Ich gehe auch auf die wahrscheinlich beliebteste Silber-Aktie der...

Read More »

Read More »

Die Ruhe vor dem Sturm?

Jetzt in der Sommerzeit genießen viele ihren Urlaub, die Ruhe und Entspannung. Und danach? Beginnen dann an den Börsen die Herbststürme? Denn es stehen pikante Ereignisse an. Zunächst die ewige Frage, wann, wie viel und ob die Fed auf den Zinssenkungspfad einschwenkt. Und so mancher sorgenvolle Anlegerblick fällt auf die US-Präsidentenwahl und die schwierigen politischen Verhältnisse in Europa, u.a. in Frankreich. Robert Halver mit seiner...

Read More »

Read More »

Swiss timber harvest lower by 6% in 2023

17.07.2024 - In 2023, 4.9 million cubic metres of timber were harvested in Switzerland, a decrease of almost 6% compared to the previous year. There was a noticeable decline in sawlogs (–12%) and the harvests of industrial roundwood (–1%) and chopped wood (–5%).

Read More »

Read More »

Der wahre Grund für Klaus Schwabs Rücktritt beim WEF – Ernst Wolff im Gespräch mit Dominik Kettner

✅ Jetzt kostenlos zum Live-Workshop anmelden: https://www.kettner-edelmetalle.de/aktionen/webinar-bankenkrise

In diesem Video diskutieren Dominik Kettner und ich über die neusten Entwicklungen des WEF, die jüngsten Vorwürfe gegen Klaus Schwab und den möglichen Machtkampf zwischen BlackRock und Klaus Schwab.

Zum @KettnerEdelmetalle Kanal.

____________________

📅 Alle Termine und die Links zu meiner Vortragsreihe finden Sie hier:

👉...

Read More »

Read More »

Alarm-Signal: Bullenmarkt zu Ende?

► Hier geht’s zu meinem Podcast → https://erichsen.podigee.io/

► Hier kannst Du meinen Kanal abonnieren → https://www.youtube.com/erichsengeld?sub_confirmation=1

► Sichere Dir meinen Report mit Tipps zu Gold, Aktien, ETFs – 100% gratis → https://www.lars-erichsen.de

Eine Crash-Bewegung trifft den Markt völlig überraschend. Zumindest mal in der Regel ist ja ein Black Swan, also ein Ereignis welches wir eben nicht vorhergesehen haben, dafür...

Read More »

Read More »

Orban´s Absichten & Erschreckende Wahlergebnisse – Ernst Wolff im Gespräch mit Krissy Rieger

Raus aus dem System? Aber wie? Trage dich zu unserem kostenlosen Report ein: https://www.rieger-consulting.com/riegersreport

Mehr zu Krissy Rieger:

Finanzkanal ►► / @chrisrieger91

Zweitkanal ►► / @krissy.rieger2

Instagram ►► https://www.instagram.com/krissy.rieg...

Twitter ►► https://twitter.com/krissyrieger?lang=de

Telegram ►► https://t.me/KrissyRieger

____________________

📅 Alle Termine und die Links zu meiner Vortragsreihe finden Sie...

Read More »

Read More »

22% Dividende! Hier gibt es die höchste Rendite!

► Hier geht’s zu meinem Podcast → https://erichsen.podigee.io/

► Sichere Dir meinen Report mit Tipps zu Gold, Aktien, ETFs – 100% gratis → https://www.lars-erichsen.de

► Hier kannst Du meinen Kanal abonnieren → https://www.youtube.com/erichsengeld?sub_confirmation=1

In diesem Video werde ich Euch mehrere Aktien ganz konkret vorstellen, die allesamt eine attraktive Dividendenrendite ausweisen. Eine dieser Aktien nämlich die erstgenannte, wurde...

Read More »

Read More »

Bonjour Tristesse?

Rechtspopulisten werden im neuen französischen Parlament nicht regieren. Uff! Doch die Bildung einer neuen Regierung könnte lange dauern. Selbst wenn, wie stabil kann eine Koalition sein, die für französische Verhältnisse ungewohnt und kunterbunt ist? Könnte der Preis für einen Pariser Polit-Frieden sogar noch mehr Staatswirtschaft und Verschuldung sein, was Nachahmer in der Gesamt-EU auf den Plan ruft? Wie schauen eigentlich die europäischen...

Read More »

Read More »

2 Top-Aktien – jetzt kaufen?

► Hier kannst Du meinen Kanal abonnieren → https://www.youtube.com/erichsengeld?sub_confirmation=1

► Sichere Dir meinen Report mit Tipps zu Gold, Aktien, ETFs – 100% gratis → https://www.lars-erichsen.de

Während der Recherche zu einem Video in der letzten Woche, in welchem ich über die LVMH und die Swatch Group gesprochen habe, sind mir zwei Aktien aufgefallen, die ich, ich sag's ganz offen schon früher hätte analysieren sollen. Jetzt hab ich das...

Read More »

Read More »

Larry Fink vs. Klaus Schwab | Ernst Wolff Aktuell

Innerhalb des World Economic Forum ist offenbar ein Machtkampf entbrannt

____________________

📅 Alle Termine und die Links zu meiner Vortragsreihe finden Sie hier:

👉 https://ernstwolff.com/#termine

Auf dem offiziellen YouTube-Kanal vom Wirtschaftsexperten Ernst Wolff, finden Sie verschiedene Formate wie das "Lexikon der Finanzwelt", das dem Zuschauer als umfassendes, audiovisuelles Finanzlexikon dienen soll. Komplexe Begriffe und...

Read More »

Read More »

Die nächste große Gefahr, AfD, Nordkorea & Orban – Ernst Wolff im Gespräch mit Krissy Rieger

Raus aus dem System? Aber wie? Trage dich zu unserem kostenlosen Report ein: https://www.rieger-consulting.com/riegersreport

Mehr zu Krissy Rieger:

Finanzkanal ►► / @chrisrieger91

Zweitkanal ►► / @krissy.rieger2

Instagram ►► https://www.instagram.com/krissy.rieg...

Twitter ►► https://twitter.com/krissyrieger?lang=de

Telegram ►► https://t.me/KrissyRieger

____________________

📅 Alle Termine und die Links zu meiner Vortragsreihe finden Sie...

Read More »

Read More »

Übernahme? Jetzt diese Aktien kaufen?

► Sichere Dir meinen Report mit Tipps zu Gold, Aktien, ETFs – 100% gratis → https://www.lars-erichsen.de

► Hier kannst Du meinen Kanal abonnieren → https://www.youtube.com/erichsengeld?sub_confirmation=1

Es gibt kaum einen Bereich an der Börse, in dem es derart viele Übernahmen gegeben hat in den letzten 10 Jahren, wie im Luxus-Segment. Und heute möchte ich über ein Unternehmen sprechen, welches in den Fokus von Übernahme-Gerüchten geraten...

Read More »

Read More »

Gold: Droht ein Kurseinbruch?

► Sichere Dir meinen Report mit Tipps zu Gold, Aktien, ETFs – 100% gratis → https://www.lars-erichsen.de

► Hier kannst Du meinen Kanal abonnieren → https://www.youtube.com/erichsengeld?sub_confirmation=1

Wenn Du bereits in Gold investiert bist, oder Du überlegst Gold zu kaufen und dieses nicht langfristig zu halten, sondern vielleicht in 6, 12, 18 oder 24 Monaten mit einem schönen Profit wieder zu verkaufen, dann läufst du bestenfalls nicht durch...

Read More »

Read More »

„AUF ein Wort zum Sonntag“ – Ernst Wolff im Gespräch mit Vivien Vogt

Im Gespräch mit Vivien Vogt zeigt sich der Bestseller-Autor von einer ganz persönlichen Seite und spricht über seine Vorbilder, Enttäuschungen und Hoffnungen für die Zukunft. Was er etwa am WikiLeaks-Gründer Julian Assange bewundert, was er kürzlich von seinem Enkel gelernt hat und warum er die 1960er Jahre für eine besonders lebenswerte Epoche hält, erfahren Sie exklusiv in der aktuellen Ausgabe von „AUF ein Wort zum Sonntag“....

Read More »

Read More »

Quo vadis, Kapitalmärkte im 2. Halbjahr 2024?

Geldpolitik bleibt der neuralgische Punkt der Märkte. Vorerst sind nur schleichende Inflationsrückgänge der Nährboden für trotzige Notenbankrhetorik. Dennoch kommt es von Fed und EZB zu Zinssenkungen, um die Konjunktur zu düngen und Strukturrisiken wie Überschuldung entgegenzuwirken. Weltwirtschaftlich ist mit einer zunächst noch anfälligen Stabilisierung zu rechnen. Über die Sommermonate sind zunächst seitwärts gerichtete Schaukelbörsen zu...

Read More »

Read More »

Vorsicht: Crash-Indikator ist weiter aktiv!

► Sichere Dir meinen Report mit Tipps zu Gold, Aktien, ETFs – 100% gratis → https://www.lars-erichsen.de

► Hier kannst Du meinen Kanal abonnieren → https://www.youtube.com/erichsengeld?sub_confirmation=1

Es gibt an der Börse nur wirklich wenige zuverlässige Rezessions- Indikatoren. Das Problem an der Sache, der beste von allen, in den letzten 60 Jahren, hat er bis auf eine Ausnahme immer funktioniert. Der ist ausgerechnet jetzt noch aktiv. Der...

Read More »

Read More »

Diese Dividenden-Aktien sind unterbewertet!

► Hier geht’s zu meinem Podcast → https://erichsen.podigee.io/

►► NEU → https://www.lars-erichsen.de/investup (kostenlos)

► Sichere Dir meinen Report mit Tipps zu Gold, Aktien, ETFs – 100% gratis → https://www.lars-erichsen.de

► Hier kannst Du meinen Kanal abonnieren → https://www.youtube.com/erichsengeld?sub_confirmation=1

Achtung! Wer sich durch hochprozentiges in irgendeiner Art und Weise getriggert fühlt, der sollte sich dieses Video nicht...

Read More »

Read More »