Category Archive: 2) Swiss and European Macro

Geheime Dokumente – Ernst Wolff im Gespräch mit Krissy Rieger

Nächste Woche beginnt das große Treffen in Davos.

Hier wurden wieder eigene Rekorde gebrochen und die Inhalte aufgelistet.

Was hat es mit den geheimen Dokumenten auf sich?

Kristina Rieger: Das System: https://bit.ly/3D6sodG

Ernst Wolff: World Economic Forum: https://bit.ly/3zuC9jz

Das neue Buch "World Economic Forum: Die Weltmacht im Hintergrund" ist hier erhältlich:

►► https://bit.ly/3zuC9jz (Die ersten 2000 signierten Exemplare...

Read More »

Read More »

Amazon – Google (verkaufen?) – Apple – Microsoft (kaufen?)

► Meinen Podcast findest Du hier: https://lars-erichsen.de/podcasts.html

Wir schauen heute gemeinsam auf die Aktien von Amazon, Google, Apple und Microsoft. Und ich stelle die provokante Frage, ob sich jetzt, also genau in dieser Zeit, vielleicht alles ändert? Und das ist in zwei Richtungen gedacht, zum einen habe ich gerade ein sehr interessantes Gespräch geführt, mit einem KI-Insider. Also einem echten Branchen-Experten, wenn es um das Thema...

Read More »

Read More »

Geldpolitik 2023: Hart reden, um weniger hart handeln zu müssen

Die Sprache der Notenbanker weltweit ist hart. Auch die EZB-Präsidentin hat von taubenhaften Schalmeienklängen auf falkenhafte Marschmusik geschaltet. Aktuell sagt sie sogar, dass die Zinsen noch deutlich und stetig steigen müssen, um der Inflation den Garaus zu machen. Gut gebrüllt Ihr Notenbank-Löwen. Aber wie viel Beißkraft haben Eure Zins-Zähne wirklich? Robert Halver über Inflationsbekämpfung und Inflationstoleranz

Read More »

Read More »

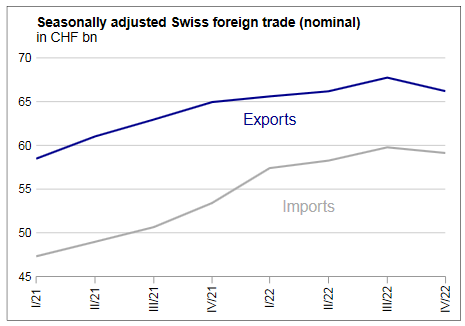

2022: Price-driven increase in foreign trade

Driven by rising prices, Swiss foreign trade increased significantly in nominal terms in 2022. Although exports rose by 7.2%, they stagnated in price-adjusted terms. Meanwhile, imports grew by 16.8% in nominal terms and edged up slightly in real terms. Trade declined in both directions in the fourth quarter. The year ended with a trade surplus of CHF 43.5 billion.

Read More »

Read More »

Davos: Das sind die Pläne der Supermächte!

► Meinen Podcast findest Du hier: https://lars-erichsen.de/podcasts.html

Die Supermächtigen haben sich, mal wieder, in Davos getroffen um die Agenda für die nächsten Jahre festzulegen. Wie sieh aussieht und was das aus meiner Sicht, für Folgen und Konsequenzen hat. Das möchte ich gern in diesem Video besprechen.

► Link zum Global Risks Report 2023: https://www.weforum.org/reports/global-risks-report-2023/digest

► Sichere Dir meinen Report, mit...

Read More »

Read More »

Heiner Flassbeck: Deutschland muss seinen Leistungsüberschuss reduzieren! #rezession

#shorts

▶️YouTube-Channel "Finanzwissen - biallo"

https://www.youtube.com/channel/UC6H1dV9ue8BqLFihyqp9OGg

Unsere Seiten:

Homepage: https://www.biallo.de/

Impressum: https://www.biallo.de/impressum/

Twitter: https://twitter.com/biallo_de

Instagram: https://www.instagram.com/biallo.de/

Facebook: https://www.facebook.com/biallo.de/

*Die/der mit Sternchen (*) gekennzeichnete(n) Links sind sogenannte Affiliate-Links. Wenn du auf so einen...

Read More »

Read More »

Pictet — Multi Generational Wealth, Nassau (Abridged version)

Pictet’s first ever Family Forum took place at the Rosewood Hotel in Nassau, the capital of the Bahamas, from the 14th to the 16th November 2022. The event saw wealthy families and business owners from across Latin America and beyond gather in the luxurious retreat for three days of networking, discussion and debate. Under the overarching theme of “Building Bridges in a Fragmented World”, Pictet organised a range of different sessions led by...

Read More »

Read More »

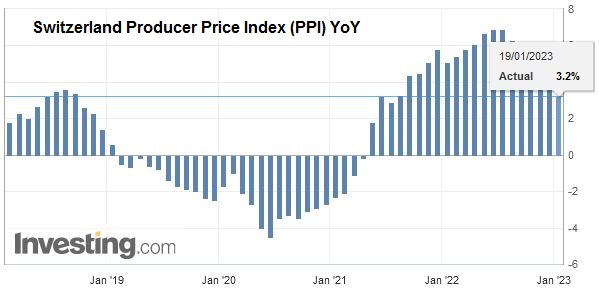

Swiss Producer and Import Price Index in December 2022: +3.2 percent YoY, -0.7 percent MoM

The Producer and Import Price Index fell in December 2022 by 0.7% compared with the previous month, reaching 108.5 points (December 2020 = 100). Compared with December 2021, the price level of the whole range of domestic and imported products rose by 3.2%. Average annual inflation in 2022 reached +5.6%.

Read More »

Read More »

“Es besteht die Gefahr einer tiefen Rezession!” – Heiner Flassbeck im Interview

Das Rezessionsgespenst ist zurück an den Aktienmärkten! Auslöser für den aktuellen Verkaufsdruck an der Börse ist das vielbeachtete "Beige Book" – der Konjunkturbericht der US-Notenbank Federal Reserve. Demnach sind die Industrieproduktion und Einzelhandelsumsätze in den USA im Dezember stärker zurückgegangen, als Analysten erwartet hatten.

Auf der anderen Seite besteht Hoffnung, dass die #Inflation ihren Zenit mittlerweile...

Read More »

Read More »

WEF-Agenda: „Das digitale Zentralbankgeld kommt!“ – Ernst Wolff im Gespräch mit AUF1

Bernhard Riegler hat sich mit Ernst Wolff über die Pläne der Globalisten und des aktuellen Weltwirtschaftsforums unterhalten. Der Wirtschaftsfachmann und Bestsellerautor befasst sich intensiv mit den globalen Hintergrundmächten. So publizierte er zu den verschiedenen Instrumenten und Netzwerken der selbsternannten Weltherrscher und der Hochfinanz. In Davos gibt dieser derzeit Befehle an Politiker aus aller Welt aus.

____________________

Auf dem...

Read More »

Read More »

Die Erfolgsformel der Super-Investoren!

► Sichere Dir meinen Report, mit Tipps zu Gold, Aktien, ETFs - 100% gratis: http://lars-erichsen.de/

► NEU: Gewinne von bis zu +170%… Mein exklusives Lars-Erichsen-Depot: https://www.rendite-spezialisten.de/video/depot/

Sieben Jahre hat die Studie gedauert. 45 der besten Fondmanager auf diesem Planeten wurde genaustens auf die Hände geschaut, analysiert wurden über 30 000 Depotaktien, um sie heraus zu bekommen. Die Superformel der Top-Investoren...

Read More »

Read More »

Hat Aktien-Europa 2023 gegenüber den USA die Nase vorn?

Als Anleger reibt man sich erstaunt die Augen. Nach langer Lethargie überrascht Europa im Vergleich zu den USA immer mehr. Und nicht nur das: Ebenso zeigt sich an den Aktienmärkten eine spürbare Outperformance Europas zur amerikanischen Konkurrenz. Was sind die Gründe dafür? Ist das nur ein Nachholeffekt, nur ein Strohfeuer? Vor allem aber, wie nachhaltig ist der Vorsprung des alten Kontinents? Robert Halver mit seiner Analyse

Read More »

Read More »

Pictet – Multi Generational Wealth, Nassau

Pictet’s first ever Family Forum took place at the Rosewood Hotel in Nassau, the capital of the Bahamas, from the 14th to the 16th November 2022. The event saw wealthy families and business owners from across Latin America and beyond gather in the luxurious retreat for three days of networking, discussion and debate. Under the overarching theme of “Building Bridges in a Fragmented World”, Pictet organised a range of different sessions led by...

Read More »

Read More »

Bitcoin: Startschuss zur neuen Rallye?

► Sichere Dir meinen Report, mit Tipps zu Gold, Aktien, ETFs - 100% gratis: http://lars-erichsen.de/

► NEU: Gewinne von bis zu +170%… Mein exklusives Lars-Erichsen-Depot: https://www.rendite-spezialisten.de/video/depot/

Innerhalb weniger Tage steigt Bitcoin um mehr als 20% gradezu katapultartig und lässt wahrscheinlich bei vielen Marktteilnehmern die Frage aufkommen: "War es das vielleicht schon, hab ich vielleicht schon den besten...

Read More »

Read More »

Heiner Flassbeck über Bürgergeld, Einkommen & den sozialen Zusammenhalt in Deutschland. #shorts

Ausschnitt von Heiner Flassbeck im Gespräch mit Markus J. Karsten über den neuen »Atlas der Weltwirtschaft 2022/23«.

Hier der Link:

"Markus J. Karsten spricht mit Heiner Flassbeck über die Themen des aktuellen »Atlas der Weltwirtschaft 2022/23«, darunter; Die wirtschaftlichen Folgen der Lockdownpolitik, die vorherrschende Wirtschaftsweise der Europäischen Union und deren Opfer, sowie der Zusammenhang von einem großen Niedriglohnsektor und...

Read More »

Read More »

Kapitalmarkt 2023: Neues Spiel, neues Glück!

2022 war das Glück den Kapitalmärkten wenig hold. Inflation, Zinsen, Konjunktur, China und Ukraine-Krieg bescherten eine lange Verlustserie. 2023 werden diese Einflussfaktoren erneut an den Börsen gespielt. Mit positiven Entwicklungen wird in diesem Jahr jedoch die Pechsträhne enden. Robert Halver mit seiner Börseneinschätzung

Read More »

Read More »

“Es wird schlimmer als die Finanzkrise”

► Sichere Dir meinen Report, mit Tipps zu Gold, Aktien, ETFs - 100% gratis: http://lars-erichsen.de/

► NEU: Gewinne von bis zu +170%… Mein exklusives Lars-Erichsen-Depot: https://www.rendite-spezialisten.de/video/depot/

Der Chef-Analyst von Morgan Stanley Micheal Wilson ist sehr pessimistisch hinsichtlich der Entwicklungen der Unternehmensgewinne im Jahr 2023. Er sieht sie gar einbrechen und zwar stärker, als in mitten der Finanzkrise 2008. Der in...

Read More »

Read More »

Ex Ifo-Chef: Düstere Prognosen zur Inflation, Armut und Energiekrise in Deutschland

In diesem Video sprechen wir über die Aussagen des ehemaligen Präsidenten des Ifo-Instituts, Hans-Werner Sinn, bei seiner Weihnachtsvorlesung 2022, in der er die Lage Deutschlands in Bezug auf die Corona-Krise und den Ukraine-Krieg analysiert und einige Reformen vorschlägt, um das Vertrauen der Menschen in die Zukunft wiederherzustellen.

Read More »

Read More »

Prof. Hans-Werner Sinn deckt Schlimmes auf – Der große Knall steht kurz bevor!

Videoinhalte: Banken Deutschland, Sparkassen Deutschland, Wirtschaft Deutschland, Finanzen Deutschland , Geld Deutschland , Kapital Deutschland, Aktien Deutschland , Börse Deutschland , Immobilien Deutschland , Politik Deutschland , Medien Deutschland , Gold, Goldmünzen, Silber, Edelmetalle, Bitcoin, Kryptowährung, Währungskrise, Währungsreform,

Read More »

Read More »