Category Archive: 9a.) Real Investment Advice

How Inflation Impacts Demand for Loans and Interest Rates

Understanding the correlation between inflation, loan demand, and interest rates is key. Learn more about longer duration bonds and their impact! 🔍💰 #Finance101 #InterestRates #Bonds

Want to learn more? Subscribe to our YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

7-25-24 How Your Confidence Can Boost or Break the Economy

The S&P Global Services Index is "great," in contradiction to other eocnomic metrics; the first estimate of Q2 GDP is released today (up 2.8%); this will be revised. Important to note the behavior of GDP prior to past recessions, which are always back-dated. 350-days without a 2% correction, until Wednesday. Bill Dudley is calling for lower interest rates now; Lance Roberts & Michael Lebowitz explain the crucial link between...

Read More »

Read More »

Inflation and Retirement: Adjusting Your Spending Plan

Retirees must adjust their budgets and spending to compensate for inflationary forces. #FinancialPlanning #Budgeting

Want to learn more? Subscribe to our YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

7-24-24 How to Invest, or not, in a Presidential Election

Trump Hasn’t Won the Election Yet. The Stock Market Is Acting Like He Already Has. Lance Roberts & Danny Ratliff discuss what-if's and which sectors to watch...either way. Plus, which strategy wins the Retirement Spending smack-down, and why you need to plan to spend-down your retirement nest egg.

Hosted by RIA Advisors Chief Investment Strategist Lance Roberts, CIO, w Senior Financial Planner, Danny Ratliff, CFP

Produced by Brent Clanton,...

Read More »

Read More »

Why Wall Street’s Earnings Predictions Often Miss the Mark

Wall Street's expectations for earnings growth are historically overly optimistic. With the economy slowing down, companies making money now may not make sense. #WallStreet #EarningsGrowth

Want to learn more? Subscribe to our YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

7-23-24 Is the Bull Market Just Getting Started?

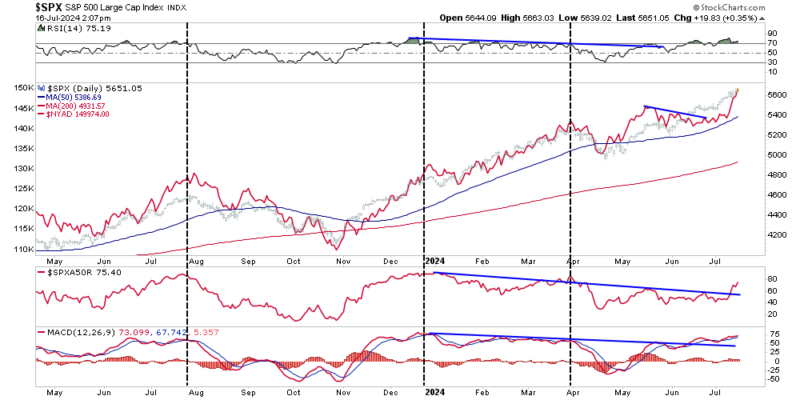

Since the beginning of this year, the “bad breadth” issue has been a concern for the current bull market rally. Historically speaking, periods of narrow market advances typically precede short-term corrections and bear markets. However, as the Federal Reserve prepares to cut rates for the first time since 2020, there seems to be a change afoot.

Hosted by RIA Advisors Chief Investment Strategist Lance Roberts, CIO, w Senior Financial Advisot,...

Read More »

Read More »

The Bull Market – Could It Just Be Getting Started?

We noted last Friday that over the previous few years, a handful of “Mega-Capitalization” (mega-market capitalization) stocks have dominated market returns and driven the bull market. In that article, we questioned whether the dominance of just a handful of stocks can continue to drive the bull market. Furthermore, the breadth of the bull market rally has remained a vital concern of the bulls.

Read More »

Read More »

7-22-24 Analyzing the Potential Impact of a Kamala Harris Presidency

Lance discusses the markets' potential reaction to Biden's exit from Presidential race, and whether markets' rotation out of mega-cap stocks is sustainable; a rewind to February market conditions compared to now: A correction is expected before the election. Commentary on keeping market corrections into context; the mega-cap rotation and fewer medium- and small-cap companies from which to choose: 40% of these are unprofitable companies. As...

Read More »

Read More »

Analyzing the Potential Impact of a Kamala Harris Presidency

What does the market anticipate with a potential Kamala Harris presidency? 📈💼 #Election2024 #KamalaHarris #MarketTrends

Want to learn more? Subscribe to our YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

Raising the Inflation Baseline in a Rapidly Changing World

Increasing inflation baseline from 2.5 to 3? Ready to adapt as the world changes. #EconomicInsights #Adaptability

Want to learn more? Subscribe to our YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

Temp Work Reduction: A Key Indicator of Economic Recession

📉 Keeping an eye on temp hiring! 💼 When companies cut down on temp work, it might be a sign of an approaching recession. #economy #finance #tips

Want to learn more? Subscribe to our YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

Why Falling Yields Are Bad News for Small Cap Stocks

Interesting findings on small caps and yields! When yields fall, it's not good for small and mid cap stocks due to their dependency on economic growth. 📉💼 #StockMarket #InvestingTips

Want to learn more? Subscribe to our YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

7-19-24 Have Economic Concerns Put Your Retirement Plans on Hold?

A recent survey reveals 50+ aged Americans are either delaying their retirement or considering re-entering the workforce. Generation X stands out as particularly anxious about retirement. Concerns about not having enough money (49%), inflation (47%), and the desire for more financial options (42%) were among the top reasons cited for delaying retirement.

Hosted by RIA Advisors Director of Financial Planning, Richard Rosso, CFP, w Senior Financial...

Read More »

Read More »

Why You Need a Financial Advisor

RIA Advisors' Chief Investment Strategist recounts how you can tell you need a financial advisor, and why the group of advisors at RIA can best fill your needs.

➢ Listen daily on Apple Podcasts:

https://podcasts.apple.com/us/podcast/the-real-investment-show-podcast/id1271435757

➢ Watch Live Mon-Fri, 6a-7a Central on our Youtube Channel:

www.youtube.com/c/TheRealInvestmentShow

➢ Upcoming personal finance free online events:...

Read More »

Read More »

Relationship Between Fed Rate Cuts and Treasury Yields Explained

During a rate cutting environment, treasury bonds tend to do well. Fed funds cuts lead to falling ten year treasury yields due to Fed control over the short end of the curve. #investing #economy

Want to learn more? Subscribe to our YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

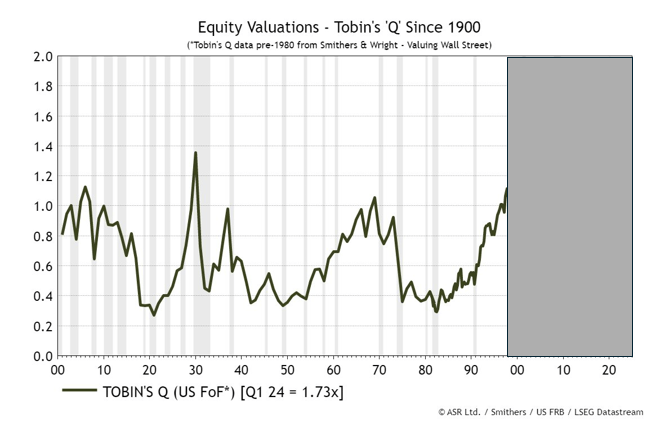

7-18-24 Irrational Exuberance Then And Now

Walking the tightrope between irrational exuberance and reality is complex. Therefore, appreciate the market for what it is. This bull market has no known expiration date. Active management, using technical and fundamental analysis along with macroeconomic forecasting, is crucial to managing the potential risks and rewards that lie ahead. What if we are experiencing rational exuberance and AI is an economic game changer? What if current valuations...

Read More »

Read More »

Mastering Hurdle Rates: How to Achieve Financial Success

Ever wonder about hurdle rates in your financial plan? It's the key return needed for success. Patience is key in investing. No shortcuts! 💰 #FinanceTips

Want to learn more? Subscribe to our YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

7-17-24 Avoiding the Sexy Stock Plays

With a slowing economy, what's the best play for investors? The market has been sustained essentially by seven large-cap stocks, but that dynamic appears to be shifting, and the appeal of making big money quickly may blind you to the realities in the market.

Hosted by RIA Advisors Chief Investment Strategist Lance Roberts, CIO, w Senior Financial Advisor, Danny Ratliff, CFP

Produced by Brent Clanton, Executive Producer

-------

Articles mentioned...

Read More »

Read More »

Irrational Exuberance Then And Now

On December 5, 1996, Chairman of the Fed Alan Greenspan offered that stock prices may be too high, thus risking a correction that could result in an economic fallout. He wondered out loud if the market had reached a state of “irrational exuberance.”

Read More »

Read More »

Knowing When to Get Out: Mastering Market Timing

Want to make your cash work for you? Buy back shares at a better price! But the real challenge is knowing when to get out and when to buy the dip. #InvestingTips 💸📈

Want to learn more? Subscribe to our YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »