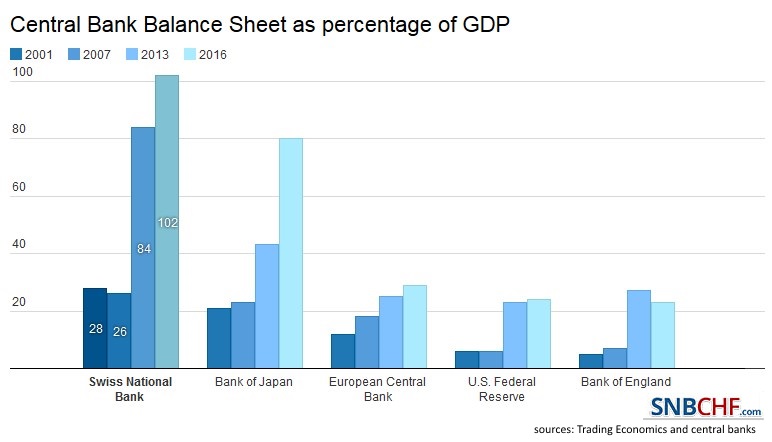

Since 2008 the balance sheet of the Swiss National Bank has risen from 28% to 102% of Swiss GDP. Balance sheets of other central banks have strongly risen, too. But there is one big difference: The risk for the SNB is far higher, the SNB nearly exclusively possesses assets denominated in volatile foreign currency.

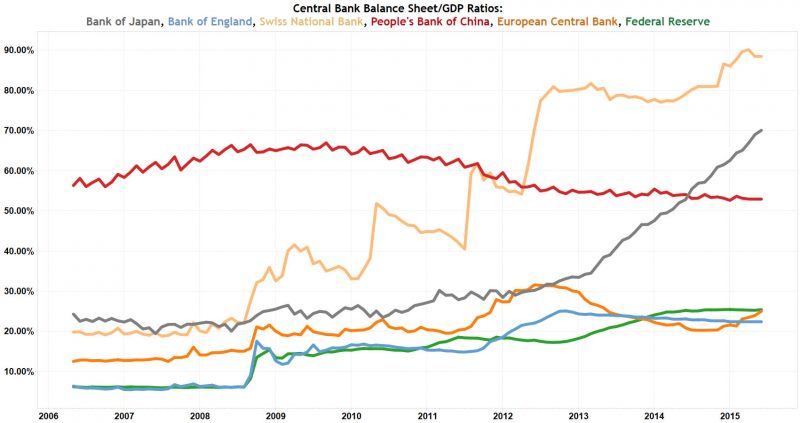

SNB balance sheet now over 100% of GDPIt should be remarked that the SNB assets are volatile FX investments. FX investments are less than 3% of the BoJ, ECB, Fed and BoE balance sheet. Central banks from Emerging Markets typically buy foreign bonds. But these countries have far higher inflation and therefore – over time – a weaker local currency. But the Swiss Franc is a currency that by tendency appreciates. |

|

SNB runs a massive currency riskSNB: From 40% in 2012 to 102% of GDP. Nearly all volatile assets in foreign currency. Bank of Japan: Still increasing asset purchases. Only 2% of assets in foreign currency. The Japanese private sector owns foreign currency bonds, but not the central bank. ECB: Since Mid 2014, rising asset purchases. Has few foreign assets. Fed: Stopped asset purchases in 2015. Bank of England: % of GDP remained flat since 2013. The BoE no assets in foreign currency. People’s Bank of China Stopped strong asset purchases in 2011. Has a high currency risk because the assets are mostly in US Dollar and some Euro. However China is a country in development, with typically higher inflation rates. This reduces the currency risk.

|

Central Bank Balance Sheet as percentage GDP

|

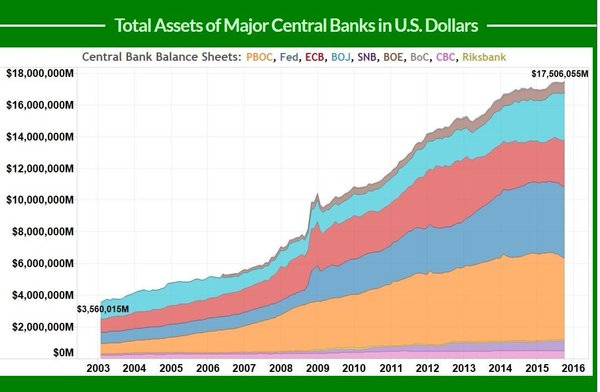

Total Assets of Major Central BanksThe Fed, ECB, BoJ and BoE bought assets in their own currency, while the PBoC bought mostly dollars in order to prevent a stronger appreciation of the yuan.

|

|

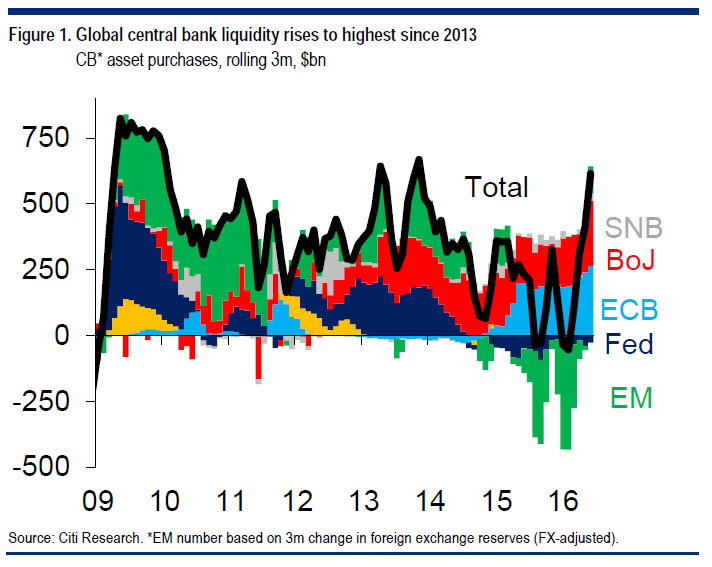

Western Central Banks Still Increasing Liquidity“But, for now, a rash of global Central Banks continue to support asset prices by increasing accommodative policies either through additional reductions in interest rates or direct injections of liquidity. As Matt King from Citi recently noted: ‘It has been a surge in net global central bank asset purchases to their highest level since 2013.’ |

The SNB buy foreign assets

|

SNB vs. BoJ Balance Sheet |

See more for

1 comment

Stefan Wiesendanger

2016-10-05 at 00:44 (UTC 2) Link to this comment

The warning should not be about the composition of SNB reserves because they are foreign-denominated by design. And the risk management on them with 20% global shares and for the rest a sizable chunk of German Bunds appears to me to be robust under many scenarios, including Euro-breakup and no Euro-breakup. Of course there will be losses if there is turmoil, but losses that can be met.

The real warning should be about the rate of growth of reserves. The implicit crawling peg should be doing more crawling and less pegging. The problem is that the department Schneider-Ammann (and behind the scenes Swissmem) has hijacked the discourse in the current Bundesrat and created an atmosphere of panic. Just look at the CVs of the current office-holders. Other than Schneider-Ammann, there are a pianist, two lawyers, a politician and two farmers. None of them have the slightest clue about monetary matters, and other than Schneider-Ammann, none of them have ever been exposed to the private economy. None of them can hold their ground let alone imagine a way forward.