Category Archive: 6b) Austrian Economics

Time to reject ‘social justice’ and replace it with real justice

One of the most familiar terms heard or read today is “social justice.” Ironically, “social justice” is anything but justice. It basically represents double standards, inequality, partiality, prejudice, racism, selectivity, and subjectivity. It has to be one of modernity’s cleverest and most subtle paradoxes.Perhaps the best way to expose it as a paradox is by revealing what genuine and true justice demands when applied evenly and honestly to all...

Read More »

Read More »

Wall Street’s latest poison: Leveraged EFTs

The market always seems to teach retail investors a lesson. Bloomberg reported leveraged EFTs such as The Direxion Daily Semiconductors Bull 3x Shares (ticker SOXL), which delivers triple the daily move of the NYSE Semiconductor Index, took in a record 1.5 billion last week, only to drop “15% Wednesday to extend a 37% loss in the past 14 days.”“The $23 billion ProShares UltraPro QQQ (TQQQ) and the $4 billion ProShares UltraPro S&P 500 (UPRO)...

Read More »

Read More »

A ‘smart city’ is a city plagued by high taxes and central planning

The term “smart city” conjures images of futuristic utopias where technology seamlessly enhances our daily lives. Traffic flows like a symphony, garbage trucks only show up when needed, and potholes fill themselves while apologizing for the inconvenience. But peel back the glossy veneer, and you’ll find that these so-called smart initiatives are often just a new way to nickel-and-dime residents. Let’s take a tour through the cityscape of this...

Read More »

Read More »

Reich vs Reality: Free Markets Work Best

Robert Reich recently asserted that “free markets” aren’t neutral or free, are actually shaped by those who wield power. Reich believes that government powers have been subverted by private interests- this part of his analysis is actually true in many cases. Reich hopes for some sort of miracle whereby countervailing government powers will work in the public interest to suppress greedy monopolists- this part of his analysis is delusional and...

Read More »

Read More »

Biden’s parting deluge of deceit deserves damning

In a mere 11 minutes on Wednesday night, President Biden settled any doubts about whether he was fit for another four years of the presidency. Uncle Joe wrestled with the teleprompter like a slacker high school boy blindsided by trigonometry questions on the math SAT test. By the end of the Bidens brief spiel, most judges declared that the teleprompter had won by technical knockout.A few weeks ago, Biden declared that it would take “the Lord...

Read More »

Read More »

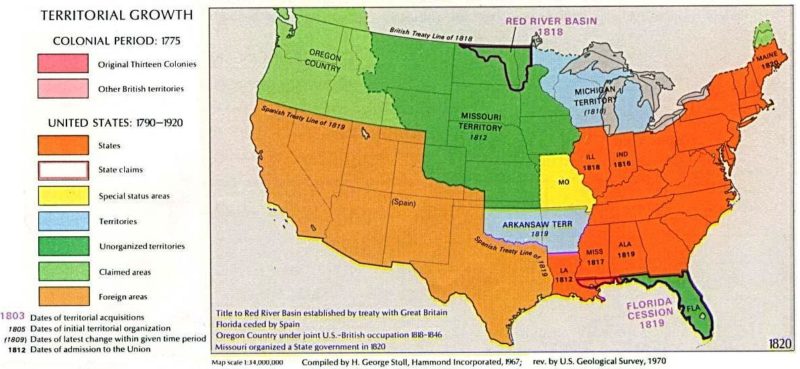

How westward expansion sowed the seeds of the Civil War

[Editor’s note: The article below is adapted from a lengthy 1954 memo by Rothbard which is written largely as a review of George B. DeHuszar and Thomas Hulbert Stevenson’s A History of the American Republic. The memo was republished in 2010 by the Mises Institute as part of Strictly Confidential: The Private Volker Fund Memos of Murray N. Rothbard, edited by David Gordon. Rothbard here provides a concise and razor-sharp analysis of how the...

Read More »

Read More »

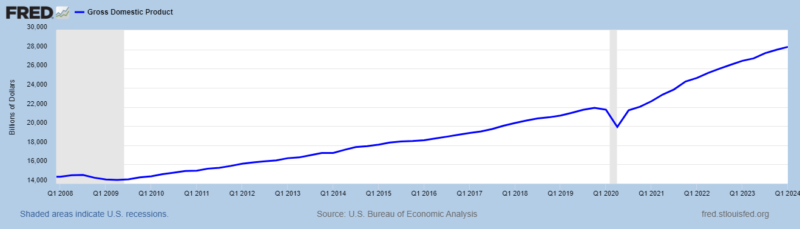

Have we been living in an MMT world since 2008?

I recently viewed Finding the Money, a video aimed at persuading a popular audience of the putative merits of Modern Monetary Theory (MMT). The video debuted this past May on several streaming platforms and theaters throughout the U.S. Whether it succeeded or not in its purpose, I will leave it for others to judge. What I found most noteworthy in the 95-minute video was a brief clip of an interview with George Selgin, an economist of some...

Read More »

Read More »

United in economic stagnation and false fears

The U.K. election is over. While it was in full swing, I happened to find myself watching an interview of party leaders from the 1959 election, and it put so much of the current political landscape into perspective. The video, which you can watch here, takes you back to a time, post war, where there was something Brits called “the post-war consensus.” After the Second World War ended, both major parties came to a philosophical harmony where certain...

Read More »

Read More »

Kamala Harris is awful

President Joe Biden announced over the weekend that he is withdrawing from the 2024 presidential election. The announcement follows almost a month of pressure on Biden to drop out after his abysmal debate performance in late June made it impossible to keep hiding the fact that the president is cognitively impaired.The soon-to-be former president and most major players in Democratic politics quickly threw their support behind Vice President Kamala...

Read More »

Read More »

Group interests and the ‘good of the whole’

What is the Mises Institute?

The Mises Institute is a non-profit organization that exists to promote teaching and research in the Austrian School of economics, individual freedom, honest history, and international peace, in the tradition of Ludwig von Mises and Murray N. Rothbard. Non-political, non-partisan, and non-PC, we advocate a radical shift in the intellectual climate, away from statism and toward a private property...

Read More »

Read More »

Though popular, nationalizations ruin economies

What is the Mises Institute?

The Mises Institute is a non-profit organization that exists to promote teaching and research in the Austrian School of economics, individual freedom, honest history, and international peace, in the tradition of Ludwig von Mises and Murray N. Rothbard. Non-political, non-partisan, and non-PC, we advocate a radical shift in the intellectual climate, away from statism and toward a private property...

Read More »

Read More »

Woodrow Wilson and Freedom

What is the Mises Institute?

The Mises Institute is a non-profit organization that exists to promote teaching and research in the Austrian School of economics, individual freedom, honest history, and international peace, in the tradition of Ludwig von Mises and Murray N. Rothbard. Non-political, non-partisan, and non-PC, we advocate a radical shift in the intellectual climate, away from statism and toward a private property...

Read More »

Read More »

Anarchy in the UK

What is the Mises Institute?

The Mises Institute is a non-profit organization that exists to promote teaching and research in the Austrian School of economics, individual freedom, honest history, and international peace, in the tradition of Ludwig von Mises and Murray N. Rothbard. Non-political, non-partisan, and non-PC, we advocate a radical shift in the intellectual climate, away from statism and toward a private property...

Read More »

Read More »

Biden’s student loan gift SAVE is simply a wealth transfer

What is the Mises Institute?

The Mises Institute is a non-profit organization that exists to promote teaching and research in the Austrian School of economics, individual freedom, honest history, and international peace, in the tradition of Ludwig von Mises and Murray N. Rothbard. Non-political, non-partisan, and non-PC, we advocate a radical shift in the intellectual climate, away from statism and toward a private property...

Read More »

Read More »

Praxeology and Animals

What is the Mises Institute?

The Mises Institute is a non-profit organization that exists to promote teaching and research in the Austrian School of economics, individual freedom, honest history, and international peace, in the tradition of Ludwig von Mises and Murray N. Rothbard. Non-political, non-partisan, and non-PC, we advocate a radical shift in the intellectual climate, away from statism and toward a private property...

Read More »

Read More »

The Reality of Human Action

What is the Mises Institute?

The Mises Institute is a non-profit organization that exists to promote teaching and research in the Austrian School of economics, individual freedom, honest history, and international peace, in the tradition of Ludwig von Mises and Murray N. Rothbard. Non-political, non-partisan, and non-PC, we advocate a radical shift in the intellectual climate, away from statism and toward a private property...

Read More »

Read More »

Biden is not running the government. So, who is?

What is the Mises Institute?

The Mises Institute is a non-profit organization that exists to promote teaching and research in the Austrian School of economics, individual freedom, honest history, and international peace, in the tradition of Ludwig von Mises and Murray N. Rothbard. Non-political, non-partisan, and non-PC, we advocate a radical shift in the intellectual climate, away from statism and toward a private property...

Read More »

Read More »

ASÍ NOS EMPOBRECEN

Te animo a suscribirte a mi canal y te invito a seguirme en mis redes sociales:

☑ Twitter - https://twitter.com/dlacalle

☑ Instagram - https://www.instagram.com/lacalledanie

☑ Facebook - https://www.facebook.com/dlacalle

☑ Página web - https://www.dlacalle.com

☑ Mis libros en Amazon - https://www.amazon.es/Daniel-Lacalle/e/B00P2I78OG

¡Un saludo!

Read More »

Read More »

Unelected technocrats are now the nation’s chief executives

President Biden has not been seen in public since announcing he would not seek re-election on Sunday. Biden’s “resignation” was nothing more than a text-only post on Twitter/X—and we know that the president does not manage his own social media accounts. There has been no video of the president making an announcement, and the White House is apparently planning no press conference or official act of any kind. Biden has not been seen by anyone except...

Read More »

Read More »

Trump and Biden can’t wait to send more assistance to Ukraine

Trump and Biden cannot wait to send more assistance to UkraineThe most recent presidential debate allowed American voters to compare the policies and rhetoric of President Joe Biden and former President Donald Trump. There was a lot of posturing and insulting, but below it all were comments on foreign policy which must be addressed. With roughly two and a half years of large-scale fighting between Russia and Ukraine, increasing tension between...

Read More »

Read More »