Category Archive: 5) Global Macro

The history of Taiwan’s relationship with China

The Chinese Communist Party’s obsession with the island of Taiwan is about more than just territory. A journey through 500 years of history reveals why.

Sign up to our China newsletter: https://econ.st/4f6z0IW

A short history of Taiwan and China in maps: https://econ.st/3UcyBgp

Why investors should still avoid Chinese stocks: https://econ.st/408Ewqq

Read More »

Read More »

Spies isn’t everything: Putin’s global-chaos machine

Aggression, election-meddling, “psychological destabilisation”: Russia’s leader is sowing chaos like never before (https://www.economist.com/international/2024/10/13/vladimir-putins-spies-are-plotting-global-chaos?utm_campaign=a.io&utm_medium=audio.podcast.np&utm_source=theintelligence&utm_content=discovery.content.anonymous.tr_shownotes_na-na_article&utm_term=sa.listeners). We ask what power the West has left to curtail it. As...

Read More »

Read More »

Which language takes the longest to learn?

Why do some languages take longer to learn than others? Lane Greene, our language columnist explains.

Sign up to our weekly newsletter: https://econ.st/4eAhtZp

Which languages take the longest to learn?: https://econ.st/3NtqdFf

Why some languages pay closer attention to family ties than others: https://econ.st/4f69weP

Read More »

Read More »

Leaderless: the death of Yahya Sinwar

Yahya Sinwar, the mastermind of the October 7th attacks, is dead (https://www.economist.com/middle-east-and-africa/2024/10/17/how-yahya-sinwars-death-will-change-the-middle-east?utm_campaign=a.io&utm_medium=audio.podcast.np&utm_source=theintelligence&utm_content=discovery.content.anonymous.tr_shownotes_na-na_article&utm_term=sa.listeners). What does that mean for Hamas, for a ceasefire in Gaza and for regional stability more widely?...

Read More »

Read More »

Will young people let democracy die?

Younger generations are less satisfied with democracy than generations before them were at the same age. Our deputy editor, Robert Guest, asks what this means for the future of democracy.

Film supported by @mishcon_de_reya

00:00 - Is democracy dead?

01:57 - Are young people to blame?

02:24 - Spain: from dictator to democracy

04:10 - Why are millennials disillusioned with democracy?

05:10 - What is the satisfaction gap?

06:30 - How media is...

Read More »

Read More »

Shoal searching: the South China sea simmers

A constellation of islands, reefs and rock-piles has been the source of disputes for decades. As a new phase in the conflict (https://www.economist.com/leaders/2024/09/12/more-storms-are-brewing-in-the-south-china-sea?utm_campaign=a.io&utm_medium=audio.podcast.np&utm_source=theintelligence&utm_content=discovery.content.anonymous.tr_shownotes_na-na_article&utm_term=sa.listeners) begins, how to calm things down? In the first of a...

Read More »

Read More »

Ukraine’s drone army is transforming war

By reshaping the balance between humans and technology on the battlefield, cheap drones are transforming warfare in Ukraine. Shashank Joshi, our defence editor, explains how.

Sign up to our defence newsletter: https://econ.st/4dgzw67

How cheap drones are transforming warfare in Ukraine: https://econ.st/4eR1Ayr

What are FPV drones?: https://econ.st/4hbUHcL

Read More »

Read More »

Your money for a run? Campaign finance in America

Kamala Harris has proven to be an enormous draw for campaign donors. But the size of a candidate’s war chest influences the outcome much less (https://www.economist.com/united-states/2024/09/26/kamala-harris-is-outspending-donald-trump-will-it-matter?utm_campaign=a.io&utm_medium=audio.podcast.np&utm_source=theintelligence&utm_content=discovery.content.anonymous.tr_shownotes_na-na_article&utm_term=sa.listeners) than it once did. Our...

Read More »

Read More »

Mapping Putin’s covert war in Europe

Arson, cyber attacks and assassination attempts. There’s been a sudden increase in suspicious incidents across Europe—all linked to Russia. We’ve mapped these events and found a pattern in Vladimir Putin's new tactics.

Read More »

Read More »

Keir eye for the FDI: an interview with Britain’s PM

Our correspondent sits down with Keir Starmer on the sidelines of a conference dedicated to drawing much-needed investment. We examine the prime minister’s pitch to investors (https://www.economist.com/britain/2024/10/14/sir-keir-starmers-elevator-pitch-for-investment?utm_campaign=a.io&utm_medium=audio.podcast.np&utm_source=theintelligence&utm_content=discovery.content.anonymous.tr_shownotes_na-na_article&utm_term=sa.listeners). All...

Read More »

Read More »

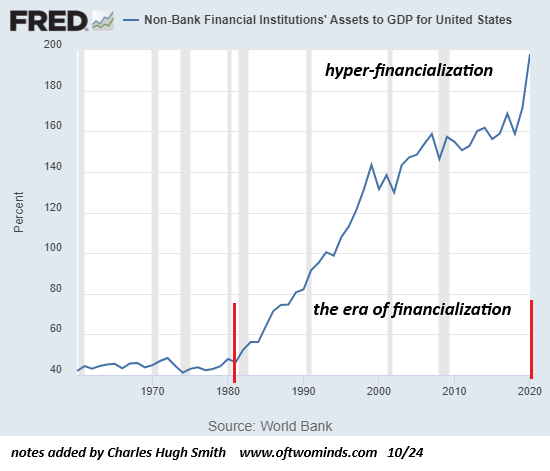

Can We Rein In the Excesses of Financialization Without Crashing the Economy?

Or we can let the bubble implode under its own weight and have a plan ready to clean house when the dust settles.

Read More »

Read More »

Will both the House and Senate flip?

Never before in a US election have chambers of Congress, split between the two parties, both flipped. But according to our US election forecast model, there’s a very good chance it could happen this November. Idrees Kahloon, our Washington bureau chief, explains why the race for Capitol Hill should be attracting more attention.

Our US election forecast model: https://econ.st/3NqyTwf

Who will control the next Congress?: https://econ.st/3BSP3M9...

Read More »

Read More »

One giant, cheap for mankind: SpaceX’s Starship

The fifth test flight of the absolutely enormous Starship went entirely to plan (https://www.economist.com/science-and-technology/2024/10/13/elon-musks-spacex-has-achieved-something-extraordinary?utm_campaign=a.io&utm_medium=audio.podcast.np&utm_source=theintelligence&utm_content=discovery.content.anonymous.tr_shownotes_na-na_article&utm_term=sa.listeners), returning everything to Earth for reuse and heralding a new era of big space...

Read More »

Read More »

Weekly Market Pulse: Questions

As we enter the final quarter of 2024, there are a lot of questions facing investors. There are, of course, always a lot of questions because investors are always dealing with the future, but today’s environment does seems to have more than usual.

Read More »

Read More »

Labour’s love lost: Keir Starmer’s first 100 days

Britain’s Labour Party came to power promising to restore order and stability. Our correspondent explains whether its rocky start (https://www.economist.com/britain/2024/10/07/the-sue-gray-saga-casts-doubt-on-keir-starmers-managerial-chops?utm_campaign=a.io&utm_medium=audio.podcast.np&utm_source=theintelligence&utm_content=discovery.content.anonymous.tr_shownotes_na-na_article&utm_term=sa.listeners) exposes a bigger political...

Read More »

Read More »

Did Olena Zelenska really go on a $1m shopping spree in New York?

In 2023, a story about Olena Zelenska’s spending habits spread on social media. It was a lie. But how did it circulate so quickly—and what does it reveal about Russia’s disinformation war against the West?

Read More »

Read More »

Paradise lost: Hurricane Milton bashes Florida

Global warming is increasing the intensity of storms like the one that just hit Florida (https://www.economist.com/leaders/2024/10/09/how-florida-should-respond-to-hurricane-milton?utm_campaign=a.io&utm_medium=audio.podcast.np&utm_source=theintelligence&utm_content=discovery.content.anonymous.tr_shownotes_na-na_article&utm_term=sa.listeners). Our correspondent explains the science. In a week of reflection on the anniversary of the...

Read More »

Read More »

Google’s lurch: how to fix its monopoly

This summer, an American judge ruled that Google’s search dominance (https://www.economist.com/leaders/2024/10/03/dismantling-google-is-a-terrible-idea?utm_campaign=a.io&utm_medium=audio.podcast.np&utm_source=theintelligence&utm_content=discovery.content.anonymous.tr_shownotes_na-na_article&utm_term=sa.listeners) was illegal. Now the Department of Justice has revealed possible solutions. How robots could help mend leaking water...

Read More »

Read More »

What will Trump do if he loses the US election?

Donald Trump’s machine is already gearing up to fight a loss in America’s presidential election. If Kamala Harris wins he won't give up without a fight. Just how messy could things get?

Sign up to our US politics newsletter: https://econ.st/3BC94Xb

See Harris and Trump’s latest polling numbers: https://econ.st/4dtMpK7

What will happen if America’s election result is contested?: https://econ.st/3BwJPWA

Read More »

Read More »

General rule: how to reinvent America’s army

Twenty years ago America was fighting insurgents in Afghanistan and Iran. As state-on-state clashes become more likely, Randy George (https://www.economist.com/united-states/2024/09/29/the-us-armys-chief-of-staff-has-ideas-on-the-force-of-the-future?utm_campaign=a.io&utm_medium=audio.podcast.np&utm_source=theintelligence&utm_content=discovery.content.anonymous.tr_shownotes_na-na_article&utm_term=sa.listeners) is the person in charge...

Read More »

Read More »