Category Archive: 5) Global Macro

Plainly reigns but on a plane to Spain: Venezuela’s leader

Nicolás Maduro has stolen an election, again—but this time the rightful winner felt so threatened that he has fled to Spain (https://www.economist.com/the-americas/2024/08/29/nicolas-maduro-digs-in-with-the-help-of-a-pliant-supreme-court?utm_campaign=a.io&utm_medium=audio.podcast.np&utm_source=theintelligence&utm_content=discovery.content.anonymous.tr_shownotes_na-na_article&utm_term=sa.listeners). We ask what happens next. A...

Read More »

Read More »

Grand Barnier: France’s new prime minister

Two months ago, French politics was thrown into crisis after a snap election left no party with a clear majority. Michel Barnier (https://www.economist.com/europe/2024/09/05/turmoil-awaits-michel-barnier-frances-new-prime-minister?utm_campaign=a.io&utm_medium=audio.podcast.np&utm_source=theintelligence&utm_content=discovery.content.anonymous.tr_shownotes_na-na_article&utm_term=sa.listeners), the new prime minister, has a huge task...

Read More »

Read More »

What happens to your brain when you burn out?

What happens to your brain when you burn out? This is the science behind thinking too hard.

00:00 - Does thinking make you tired?

00:21 - What biochemical changes take place?

00:51 - What is glutamate?

01:13 - How to stop burnout?

How thinking hard makes the brain tired: https://econ.st/3TfP0A5

Pity the modern manager—burnt-out, distracted and overloaded: https://econ.st/3B0VVGR

How to keep the brain healthy: https://econ.st/4cU1YdP

Sign up...

Read More »

Read More »

Current affairs: how batteries will green the grid

Though we use more renewable energy than ever before, electricity grids need ways to cope with intermittent wind or solar power. Innovations that make batteries to store that energy bigger, cheaper...

Read More »

Read More »

Beyond the bullets: we go to Ukraine

We take a look at the grim conditions in and prospects for the frontlines in the country’s east and north. But not all of the fighting is military in nature. We examine a far wider cultural revival going on (10:59), in music and fashion and long-forgotten ingredients and methods of Ukrainian cuisine (19:13). “Oh, the Red Viburnum in the Meadow” sung by Andriy Khlyvnyuk

Get a world of insights by subscribing to Economist Podcasts+...

Read More »

Read More »

The sound of fury: pressure builds within Israel

The recovery of six hostages from Gaza has provoked mass demonstrations on the streets of Israel and a general strike. But Israel’s government (https://www.economist.com/middle-east-and-africa/2024/08/29/have-israels-far-right-religious-nationalists-peaked?utm_campaign=a.io&utm_medium=audio.podcast.np&utm_source=theintelligence&utm_content=discovery.content.anonymous.tr_shownotes_na-na_article&utm_term=sa.listeners) refuses to bow...

Read More »

Read More »

Our Espresso app is now free for students worldwide

Espresso, our short-form, daily news app, is now free for high school and university students worldwide. Search for “Economist Espresso student” to sign up

Read More »

Read More »

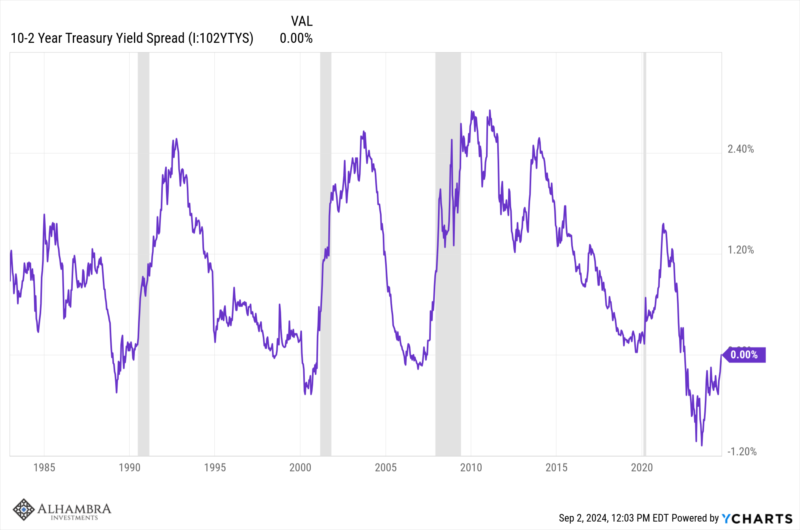

Weekly Market Pulse: It’s An Uncertain World

You’re going to hear a lot of talk about the yield curve soon and what it means for “the” yield curve to uninvert (which isn’t a real word but will get used a lot). The difference between the 10-year Treasury note yield and the 2-year Treasury note yield is about to turn positive, the 2-year note yield recently falling a bit more rapidly than the 10-year.

Read More »

Read More »

What If All the Conventional Models Fail to Predict What Happens Next?

The 'novel, apocalyptic situation which has now arisen' goes largely unrecognized. A truly staggering quantity of content is aimed at predicting what happens next, a.k.a. the future, and justifies their prediction by referencing models that are presented as rock-solid predictive tools.

Read More »

Read More »

Extremes come true: Germany’s far-right triumph

The hard right has taken Germany into uncharted territory (https://www.economist.com/europe/2024/09/01/the-hard-right-takes-germany-into-uncharted-territory?utm_campaign=a.io&utm_medium=audio.podcast.np&utm_source=theintelligence&utm_content=discovery.content.anonymous.tr_shownotes_na-na_article&utm_term=sa.listeners), winning one state election and racking up a large share in another. The far left is on the march too. Is Germany...

Read More »

Read More »

For whom the well tolls: Why we must price water

Water scarcity is growing even in parts of the world that used to be drought-free. Since most countries waste (https://www.economist.com/international/2024/08/26/the-poisonous-global-politics-of-water?utm_campaign=a.io&utm_medium=audio.podcast.np&utm_source=theintelligence&utm_content=discovery.content.anonymous.tr_shownotes_na-na_article&utm_term=sa.listeners) vast quantities of water, charging for it would help. Our correspondent...

Read More »

Read More »

Nvincible? What could curb Nvidia’s supremacy

The American chip designer has become one of the world’s most valuable companies on the back of the AI revolution. But there are some contradictions in Nvidia’s plans for the future (https://www.economist.com/business/2024/08/26/what-could-stop-the-nvidia-frenzy?utm_campaign=a.io&utm_medium=audio.podcast.np&utm_source=theintelligence&utm_content=discovery.content.anonymous.tr_shownotes_na-na_article&utm_term=sa.listeners)....

Read More »

Read More »

Cryptic message: why arrest Telegram’s founder?

As Pavel Durov (https://www.economist.com/business/2024/08/27/the-arrest-of-telegrams-founder-rattles-social-media?utm_campaign=a.io&utm_medium=audio.podcast.np&utm_source=theintelligence&utm_content=discovery.content.anonymous.tr_shownotes_na-na_article&utm_term=sa.listeners) sits in a French cell waiting to find out if he will be charged, our correspondent probes the links between Telegram and Russia. What central bankers and...

Read More »

Read More »

Block busters: how Russia flouts sanctions

Since the invasion of Ukraine, the West has deployed massive economic restrictions (https://www.economist.com/europe/2024/08/19/the-mysterious-middlemen-helping-russias-war-machine?utm_campaign=a.io&utm_medium=audio.podcast.np&utm_source=theintelligence&utm_content=discovery.content.anonymous.tr_shownotes_na-na_article&utm_term=sa.listeners) on Russian trade. So why is Russia’s economy growing? A survivor’s story from the forgotten...

Read More »

Read More »

The chips are down: will diet drugs devour junk food?

Snack-food companies have long shown their adaptability to changing diets (https://www.economist.com/business/2024/08/18/can-big-food-adapt-to-healthier-diets?utm_campaign=a.io&utm_medium=audio.podcast.np&utm_source=theintelligence&utm_content=discovery.content.anonymous.tr_shownotes_na-na_article&utm_term=sa.listeners). How could the rise of appetite-suppressing drugs and fears about ultra-processed foods change the food we...

Read More »

Read More »

KamaChameleon: What does Harris stand for?

After an electric week at the Democratic National Convention in Chicago, Kamala Harris now faces the real test (https://www.economist.com/leaders/2024/08/22/kamala-harris-can-beat-donald-trump-but-how-would-she-govern?utm_campaign=a.io&utm_medium=audio.podcast.np&utm_source=theintelligence&utm_content=discovery.content.anonymous.tr_shownotes_na-na_article&utm_term=sa.listeners) in her bid to be president. Can she convince American...

Read More »

Read More »

Electric eye: AI is helping fight terrorists

Predicting political violence is a painstaking job. Now AI is helping analysts (https://www.economist.com/science-and-technology/2024/07/31/how-america-built-an-ai-tool-to-predict-taliban-attacks?utm_campaign=a.io&utm_medium=audio.podcast.np&utm_source=theintelligence&utm_content=discovery.content.anonymous.tr_shownotes_na-na_article&utm_term=sa.listeners) look for clues and throwing up fascinating insights into the shifts that may...

Read More »

Read More »

The human strain: can mpox be contained?

Mpox is spreading fast across Africa, yet public information campaigns are scant and vaccines in short supply. Is a new pandemic in the offing? Strategists are pondering a new potential threat from Russia: the possibility that it could detonate a nuclear weapon in space...

Read More »

Read More »

Byte by byte: Iran and Israel’s escalating cyberwar

While many people fear the risk of a wider war breaking out in the Middle East, a parallel battle (https://www.economist.com/middle-east-and-africa/2024/08/15/irans-electronic-confrontation-with-israel?utm_campaign=a.io&utm_medium=audio.podcast.np&utm_source=theintelligence&utm_content=discovery.content.anonymous.tr_shownotes_na-na_article&utm_term=sa.listeners) is already ongoing – in the digital sphere. Can China challenge a...

Read More »

Read More »

Hail Harris: the Democratic convention begins

As Democrats convene in Chicago, polls suggest Kamala Harris (https://www.economist.com/leaders/2024/08/15/our-forecast-puts-kamala-harris-and-donald-trump-neck-and-neck?utm_campaign=a.io&utm_medium=audio.podcast.np&utm_source=theintelligence&utm_content=discovery.content.anonymous.tr_shownotes_na-na_article&utm_term=sa.listeners) is ahead by a whisker in the US presidential race. Can the party sustain the momentum? In hospital,...

Read More »

Read More »