Category Archive: 5) Global Macro

Putin, Erdogan discuss deal to resume Ukrainian grain exports | Latest English News

Russian President Vladimir Putin met his Turkish counterpart Recep Tayyip Erdogan and thanked him for mediation to help “move forward” a deal on Ukrainian grain exports.

Read More »

Read More »

EU dependent on Nord Stream 1 for gas, ‘Gazprom will fulfill obligations,’ says Putin | World News

Russia is expected to restart the gas supplies via the North Stream One pipeline on time. This, as per the EU was preparing for Russia to delay the gas supplies after the North Stream One pipeline was shut down for its annual maintenance on July 11.

Read More »

Read More »

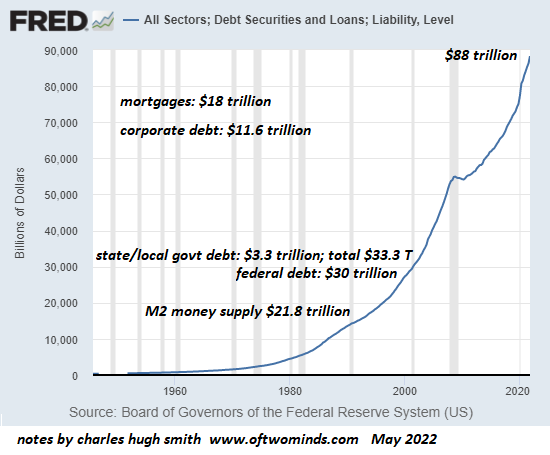

The Real Policy Error Is Expanding Debt and Calling It "Growth"

Waste is not growth, and neither are the unlimited expansion of debt and speculative bubbles. The financial punditry is whipping itself into a frenzy about a Federal Reserve "policy error," which is code for "if the music finally stops, we're doomed!"

Read More »

Read More »

Ask Bob: Is Maxing Out Your 401k A Good Investment Decision?

Since the beginning of 401(k) plans in 1978, people have considered it to be the quintessential retirement plan—you get to save money before taxes and in most cases, the company puts money into your account, too. What could be better than that? But now, 44 years later, it’s time to take a broader look at 401(k)s that considers taxes on 401(k) distributions.

Read More »

Read More »

Yield Curve Inversion ‘Infection’ Spreading [Ep. 263, Eurodollar University]

The US Treasury yield curve continues to spread and has reached the 52-week bill. The Fed is being told by the market it will be CUTTING rates, soon.

Read More »

Read More »

The global food crisis, explained

The war in Ukraine threatens the world with unprecedented hunger. Even with a deal in place to get Ukraine's food exports moving, serious weaknesses in the global food system would remain. Can anything be done to prevent future crises?

Read More »

Read More »

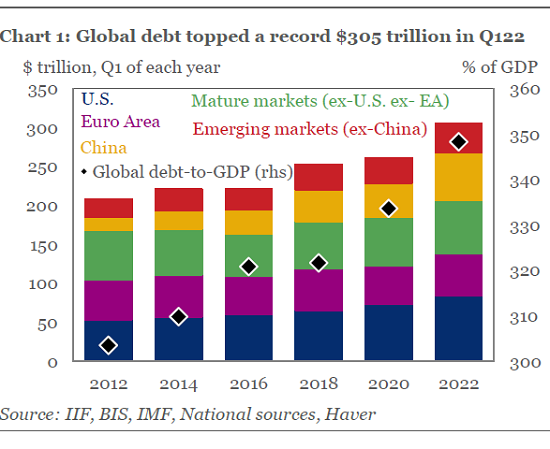

The Only Real Solution Is Default

The destruction of 'phantom wealth' via default has always been the only way to clear the financial system of unpayable debt burdens and extremes of rentier / wealth dominance. The notion that the world could always borrow more money as long as interest rates were near-zero was never sustainable.

Read More »

Read More »

Own These Assets To Survive The Bear Market

Hot inflation is crashing corporate profits, as consumer spending falls and the Fed's rate hikes make the cost of capital more expensive. As a result, stocks remain under pressure and bond default risks grow.

Read More »

Read More »

Why Are Foreigners Happy with Bond ‘Losses’? [Ep. 262, Eurodollar University]

Foreign institutions have been merrily losing money on US Treasury holdings for years, buying high and selling low - are they insane? No, their investment behavior reveals that these bonds are used for managing risk, global systemic risk.

Read More »

Read More »

Weekly Market Pulse: There Is No Certainty In Investing

Investors crave certainty. They want to know that there are definitive signals for them to follow as they adjust their investments to fit the current market and economy. They want to know that A leads to B leads to C. Tea leaf readers are always in high demand on Wall Street and they continue to find employment despite their almost universally dismal track record.

Read More »

Read More »

Solar tech company aims to cut Germany’s reliance on Russian gas amid Ukraine war | Tech In Trend

Europe is facing a major energy crisis amid the ongoing Russia-Ukraine war. However, there is a Solar tech company named WeDoSolar that aims to cut Germany's reliance on Russian gas.

Read More »

Read More »

Fossil fuels will have to end. Are batteries the new ‘oil’?

There is an urgent need to cut greenhouse gas emissions in order to avoid global warming and create a society without fossil fuels. The solution is emission-free electrification 3 scientists received the 2019 Nobel Prize for their work on lithium-ion batteries.

Read More »

Read More »

US Security Advisor: Iran will supply combat drones to Russia | Latest English News

Jake Sullivan, the White House national security advisor said that Iran is planning to supply hundreds of drones with combat weapon capabilities to Russia for use in Ukraine.

Read More »

Read More »

4 Social Security Changes to Expect in 2023

Looking into a crystal ball and prognosticating the future is always a risky endeavor, but when it comes to Social Security and the year 2023 there are 4 things that have a high probability of happening.

Read More »

Read More »

Russian rockets hit central Ukraine, Zelensky call it ‘an act of terrorism’ | World News | WION

Russian missiles struck a city in central Ukraine. The strike killed 21 people and wounded about 90 more. Ukrainian president Zelensky called it 'an act of terrorism'.

Read More »

Read More »

US Dollar Strength: “Unintended Consequences” Or “The Empire Strikes Back”?

How unintended can these consequences be? My guess: not very. A great many people got the U.S. dollar trade wrong. The conventional view held that "printing money", i.e. expanding the supply of money, would automatically devalue the currency. It isn't quite so simple, it seems.

Read More »

Read More »

Gravitas: Ukraine war: Putin renews old friendships

Europe is on the edge after the Russian Nord Stream gas link was shutdown. President Vladmir Putin is making fresh moves. He will travel to Iran next week. Palki Sharma tells you what to expect.

#Gravitas #Ukraine #VladimirPutin

Read More »

Read More »

The Economist Reviews Pandemic Goods Boom 2020-22 [Eurodollar University, Ep. 261]

The Economist recounts how the pandemic led to a goods-consumption-boom and whether post-pandemic economics means normalization, or a services boom or a recession.

Read More »

Read More »

Calm Before the Tempest?

Is it beyond conception that the core actually strengthens for a length of time before the unraveling reaches it?Let's start by stipulating the obvious: no one knows the future, and most of the guesses--oops, I mean forecasts--will be wrong. Arguing about the forecasts now won't make any difference as to which ones are correct and which ones are wrong.

Read More »

Read More »

The Economist Notes UK’s Economy was Maimed 15 Years Ago [Eurodollar University, Ep. 260]

The Economist admits to, warns of and draws attention to Britain's 15-year economic depression, labeling it a "slow-burning crisis", "long-standing", "stagnation nation" and "a chronic disease". There are many devastating socioeconomic, geopolitical consequences. It's not just Britain, it's the world.

Read More »

Read More »