Category Archive: 5) Global Macro

Q3 Cyclical Outlook

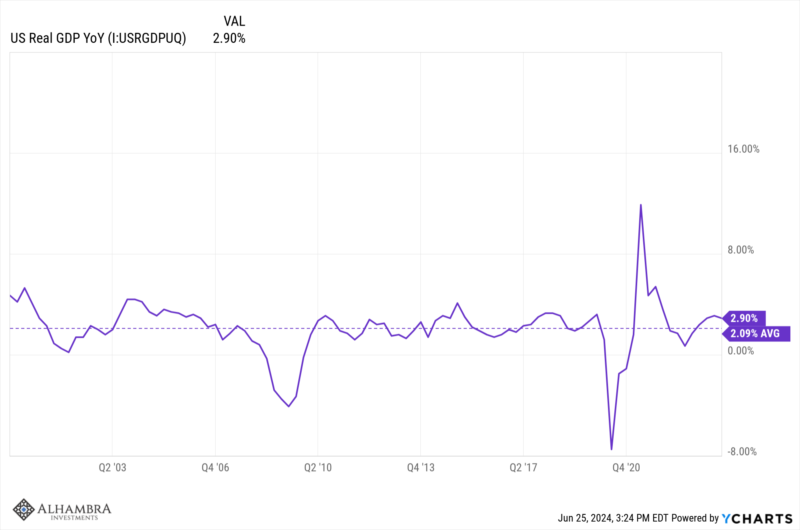

Growth peaked on a quarter over quarter seasonally adjusted annual rate in Q3 last year at 4.9%. The preferred reading is on an annual basis where growth peaked in Q4 of last year at 3.13%. Growth in Q1 was 2.88% and growth in Q2 has risen some and is trending at right about 3%.

Read More »

Read More »

"Why Are You So Negative?" Good Question. Here’s the Answer: Real Life

I think it's more productive to go with Plan B: set aside our emotions and reluctance and start doing the hard work of dealing with polycrisis.

Read More »

Read More »

Weekly Market Pulse: The Sober Spending Of Drunken Sailors

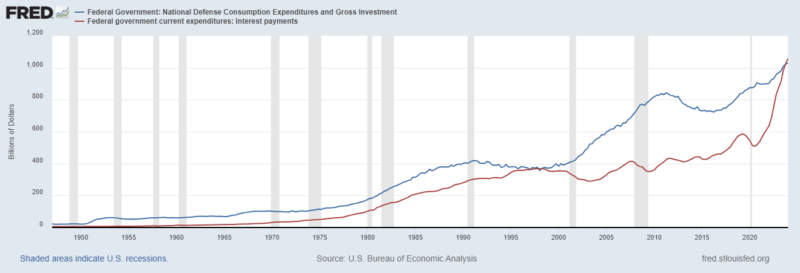

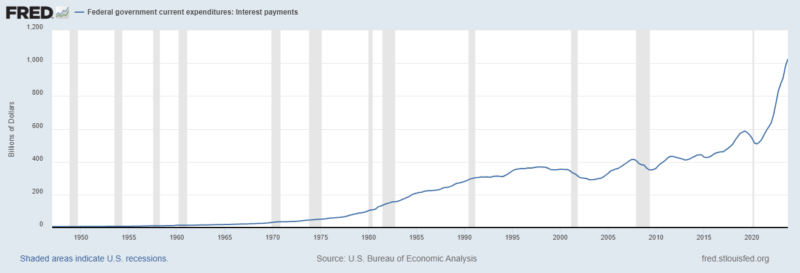

Any great power that spends more on debt service (interest payments on the national debt) than on defense will not stay great for very long. True of Habsburg Spain, true of ancien régime France, true of the Ottoman Empire, true of the British Empire, this law is about to be put to the test by the U.S. beginning this very year.

Read More »

Read More »

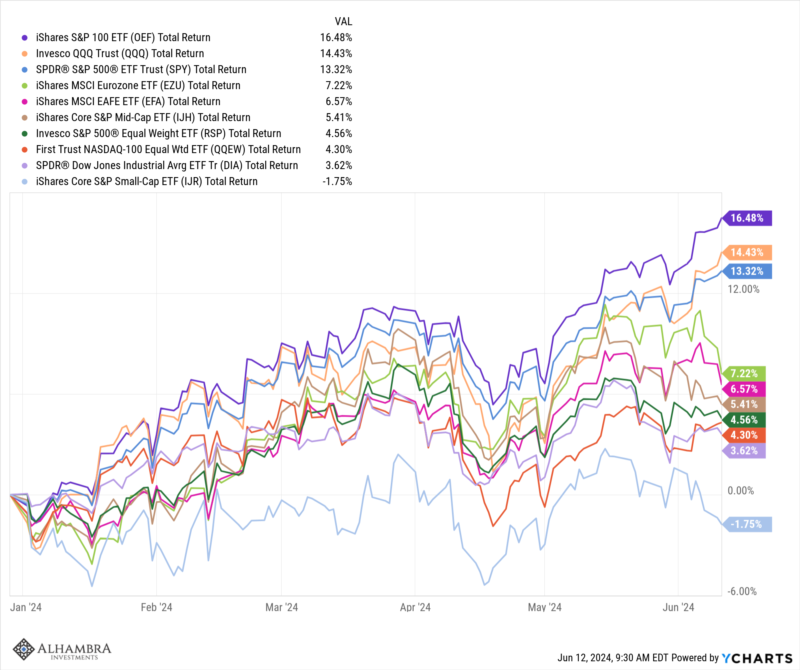

Market Morsel: How “The Market” Is Really Doing

When people talk about “the market” they are usually referring the big indexes – the S&P 500 or the NASDAQ. For more casual observers, “the market” is the Dow which is a lousy index for a lot of reasons but has the advantage of history. But are any those really representative of how “the market” is doing? Not really.

Read More »

Read More »

If AI Is So Great, Prove It: Eliminate All Surveillance, Spam and Robocalling

AI is for the peons, access to humans is reserved for the wealthy. Judging by the near-infinite hype spewed about AI, its power is practically limitless: it's going to do all our work better and cheaper than we can do, replacing us at work, to name one example making the rounds.

Read More »

Read More »

Financial Forecast 2025-2032: Please Don’t Be Naive

Rather than attempt to evade Caesar's reach, a better strategy might be to 'go gray': blend in, appear average. Let's start by stipulating that I don't "like" this forecast. I'm not "talking my book" (for example, promoting nuclear power because I own shares in a uranium mine) or issuing this forecast because I favor it.

Read More »

Read More »

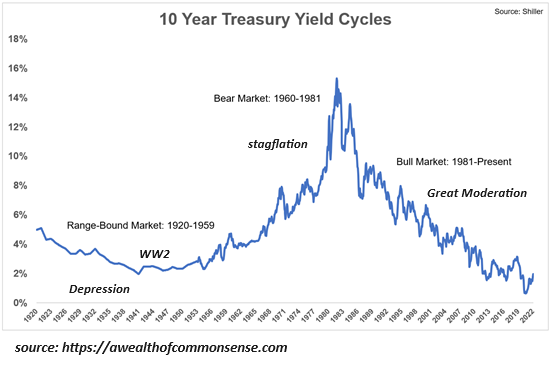

Weekly Market Pulse: Are Higher Interest Rates Good For The Economy?

Interest rates surged last week on the back of a hotter-than-expected inflation report that wasn’t actually that bad (see below). Not that my – or your – opinion about these things matters all that much to the market.

Read More »

Read More »

Global Recession’s Winners and Losers

The few winners of global recession will use the decline as a means to break the chokehold of unproductive BAU elites.

Read More »

Read More »

Rates, Risk and Debt: The Unavoidable Reckoning Ahead

Policy errors have consequences, and we're only in the first inning of those consequences.

Read More »

Read More »

How the Economy Changed: There’s No Bargains Left Anywhere

What changed in the economy is now nobody can afford to get by on working-class wages because there's no longer any bargains.

Read More »

Read More »

Digital Service Dumpster Fires and Shadow Work

One wonders what we're paying for via taxes, products and services, when we end up having to do so much of the work ourselves for nothing.

Read More »

Read More »

Market Morsels: ISM and Recession

The ISM manufacturing survey has been below 50 for 15 months in a row and sits today at 49.1. This survey, along with a lot of other manufacturing data and anecdotes, has been cited repeatedly by the economic bears as evidence we are heading for recession. That, of course, hasn’t happened and that is consistent with this indicator.

Read More »

Read More »

Irony Alert: "Outlawing" Recession Has Made a Monster Recession Inevitable

Those who came of age after 1982 have never experienced a real recession, and so they're unprepared for anything other than guarantees of rescue and permanent expansion.

Read More »

Read More »

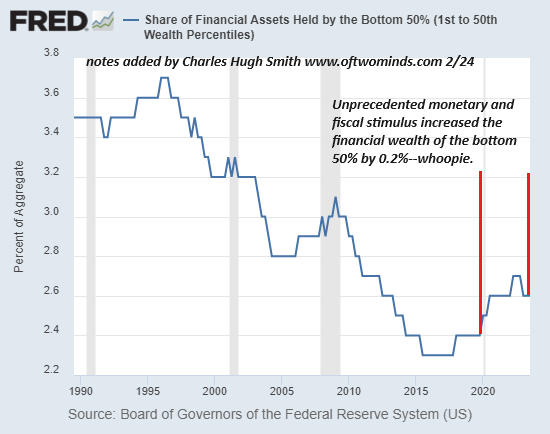

What the Fed Accomplished: Distorted the Economy, Enriched the Rich and Crushed the Middle Class

The mainstream holds the Fed is busy planning a return to the glory days of zero interest rates, but ZIRP is on the downside of the S-Curve; it's done, gone, history.

Read More »

Read More »

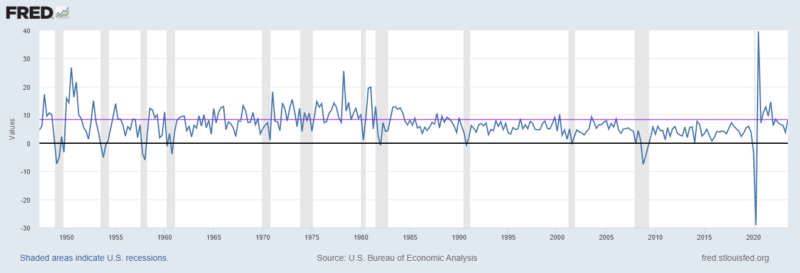

Macro: GDP Q3 — Inflationary BOOM!

Outside of the pandemic defined as 2020 and 2021, this past quarter was the 5th best quarter for nominal GDP in the last 25 years.

Read More »

Read More »

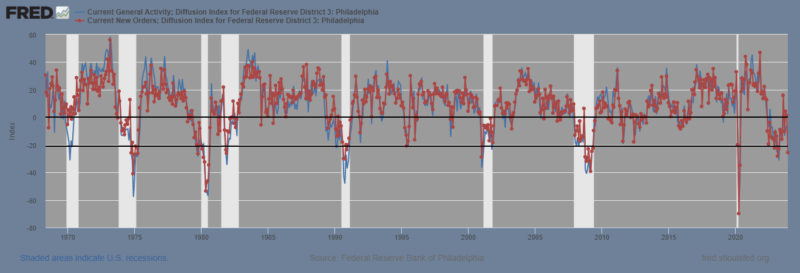

Macro: Philly Fed Mfg Survey — Umm

Tis was a poor number. The headline dropped from -5.9 to -10.5. The more eye popping number was the Index for New Orders which dropped from 1.3 to -25.6.

Read More »

Read More »

The Invisible Court’s Verdict: You Are Hereby Exiled to Digital Siberia

As in the Gulag it replicates, the innocent are swept up with the guilty in a disconcertingly unjust ratio.

Read More »

Read More »

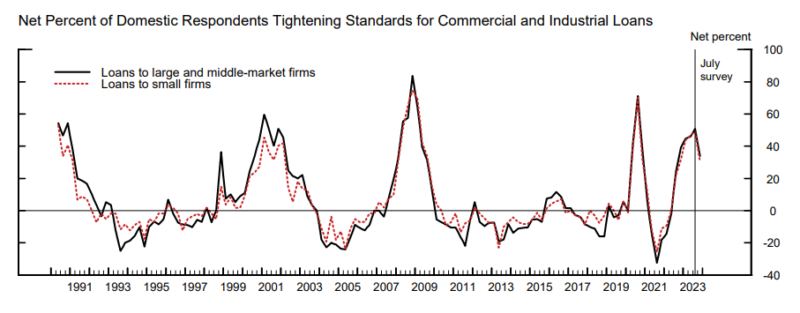

Macro: Banking: Senior Loan Officer’s Survey and Lending

Banks continue to tighten lending standards across all sectors. This has eased a bit from the July survey. Banks continue to widen spreads across all sectors. The percentage of banks widening spreads has also eased a tad.

Read More »

Read More »

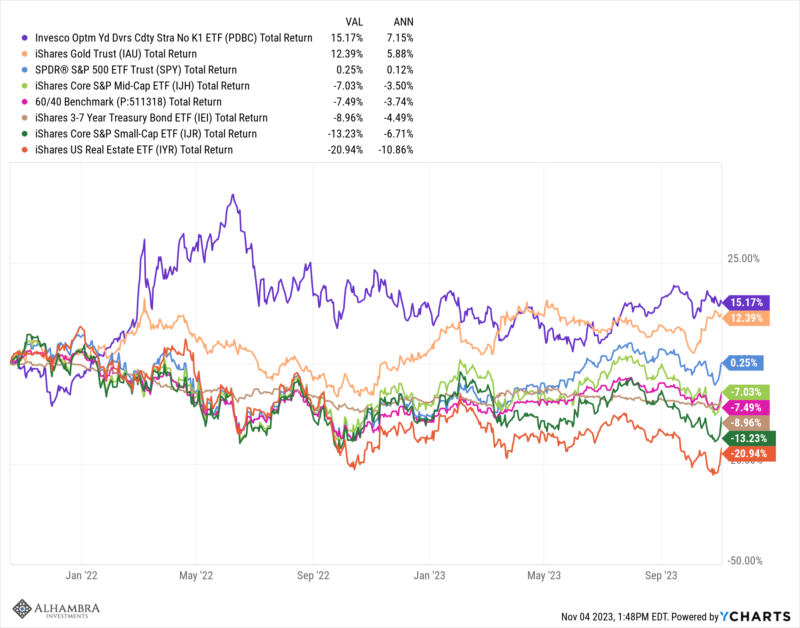

Weekly Market Pulse: Monetary Policy Is Hard

So, is that it? Have rates peaked? Is the long bear market finally over?

The market decided last week that interest rates have peaked for this cycle. And if rates have peaked then all the assets that have been pressured over the last two years can finally come up for air. Since October 18, 2021, over two years ago, investors have had few places to hide. Of the major asset classes we follow closely, only two – gold and commodities – were higher by...

Read More »

Read More »