Category Archive: 5) Global Macro

Weekly Market Pulse (VIDEO)

Alhambra CEO Joe Calhoun responds to questions about a slowing economy, long-term economic impacts of COVID, stock prices and the business cycle.

Read More »

Read More »

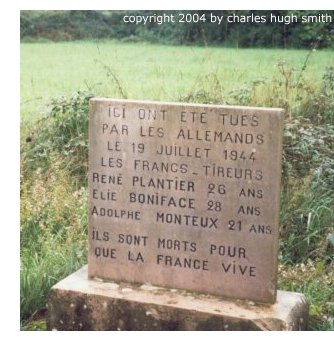

The Banality of (Financial) Evil

The financialized American economy and State are now totally dependent on a steady flow of lies and propaganda for their very survival. Were the truth told, the status quo would collapse in a putrid heap.

Read More »

Read More »

Please Don’t Pop Our Precious Bubble!

It's a peculiarity of the human psyche that it's remarkably easy to be swept up in bubble mania and remarkably difficult to be swept up in the same way by the bubble's inevitable collapse.

Read More »

Read More »

Weekly Market Pulse (VIDEO)

Alhambra CEO Joe Calhoun talks about last week’s surprising market reaction to the unemployment numbers and why it’s important to study the bond market.

Read More »

Read More »

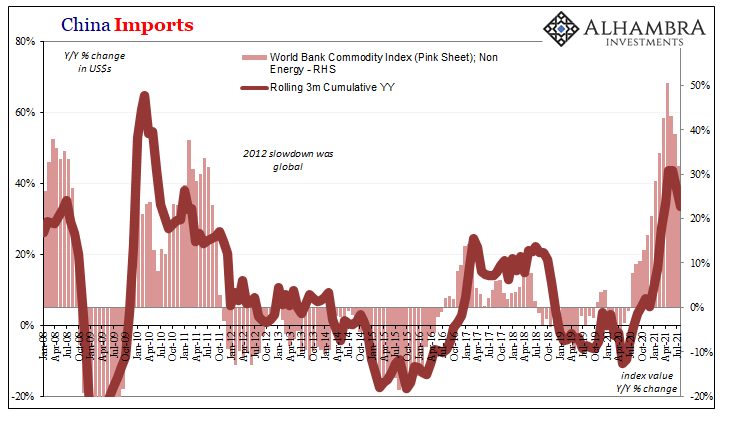

What’s Real Behind Commodities

Inflation is sustained monetary debasement – money printing, if you prefer – that wrecks consumer prices. It is the other of the evil monetary diseases, the one which is far more visible therefore visceral to the consumers pounded by spiraling costs of bare living. Yet, it is the lesser evil by comparison to deflation which insidiously destroys the labor market from the inside out.

Read More »

Read More »

The Upside of a Stock Market Crash

A drought-stricken forest choked with dry brush and deadfall is an apt analogy. While a stock market crash that stairsteps lower for months or years is generally about as welcome as a trip to the guillotine in Revolutionary France, there is some major upside to a crash.

Read More »

Read More »

The Smart Money Has Already Sold

Generations of punters have learned the hard way that their unwary greed is the tool the 'Smart Money' uses to separate them from their cash and capital.

Read More »

Read More »

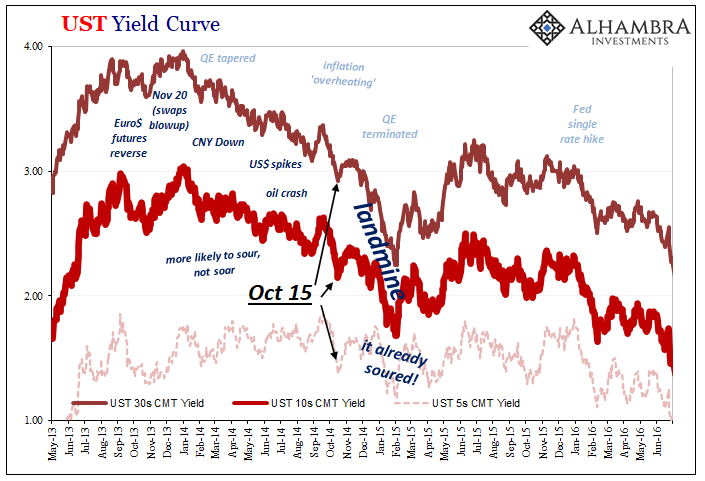

Taper *Without* Tantrum

Whomever actually coined the term “taper”, using it in the context of Federal Reserve QE for the first time, it wasn’t actually Ben Bernanke. On May 22, 2013, the central bank’s Chairman sat in front of Congressman Kevin Brady and used the phrase “step down in our pace of purchases.” No good, at least from the perspective of a media-driven need for a snappy one-word summary.

Read More »

Read More »

Why the Global Economy Is Unraveling

Global supply chain logjams and global credit/financial crises aren't bugs, they're intrinsic features of Neoliberalism's fully financialized global economy. To understand why the global economy is unraveling, we have to look past the headlines to

the primary dynamic of globalization: Neoliberalism, the ideological orthodoxy which holds that introducing market dynamics to sectors that were closed to global markets generates prosperity for all.

Read More »

Read More »

Weekly Market Pulse: Happy Anniversary!

Today is the 50th anniversary of the “Nixon shock”, the day President Richard Nixon closed the gold window and ended the post-WWII Bretton Woods currency agreement. That agreement, largely a product of John Maynard Keynes, pegged the dollar to gold and most other currencies to the dollar.

Read More »

Read More »

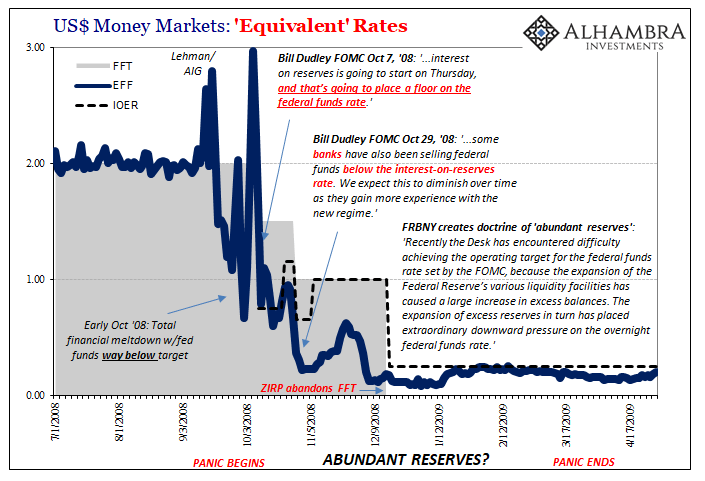

CPI’s At Fives Yet Treasury Auctions

A momentous day, for sure, but one lost in what would turn out to be a seemingly endless sea of them. October 8, 2008, right in the thick of the world’s first global financial crisis (how could it have been global, surely not subprime mortgages?) the Federal Reserve took center stage; or tried to.

Read More »

Read More »

Dear Fed: Are You Insane?

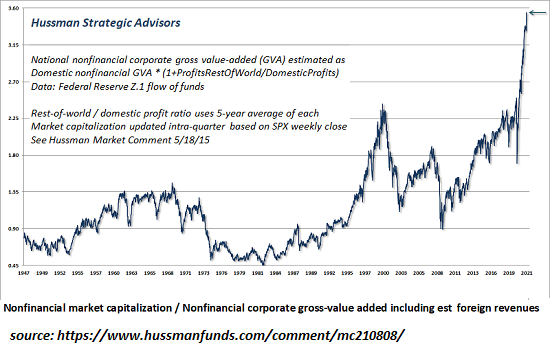

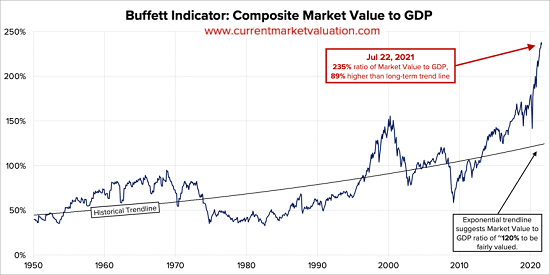

So sorry, America, but your central bank is certifiably insane, and it's not going to magically work out. History definitively shows that speculative bubbles always pop--always. Every speculative

bubble mania, regardless of its supposed uniqueness--"it's different this time"--pops.

Read More »

Read More »

A Real Example Of Price Imbalance

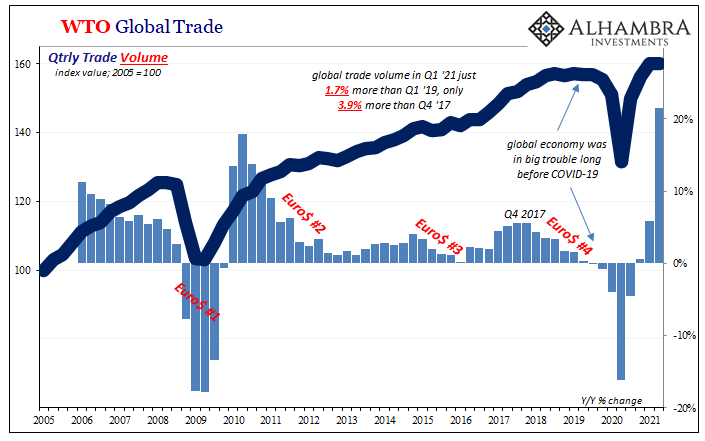

It’s not just the trade data from individual countries. Take the WTO’s estimates which are derived from exports and imports going into or out of nearly all of them. These figures show that for all that recovery glory being printed up out of Uncle Sam’s checkbook, the American West Coast might be the only place where we can find anything resembling Warren Buffett’s red-hot claim.

Read More »

Read More »

The Two Big Anniversaries of August: The Lost Decade (plus) Of The ‘Fiat’ Half Century

As my esteemed podcast co-host Emil Kalinowski has already mentioned (recurrently), we have, this year, two major anniversaries during these dog days of summer circled on our calendar. Today is, obviously, August 9 and for anyone the slightest familiar with the eurodollar story, that date is seared into their consciousness for as long as it will take to rebuild from the ashes created by the monetary fire lit that day. It has been, sadly, fourteen...

Read More »

Read More »

The End of Global Tourism?

Viewed as a complex non-linear system, the pandemic varinants can only be controlled by drastically pruning the physical connections between disparate global groups, which means effectively ending the unrestricted flow of individuals around the planet.

Read More »

Read More »

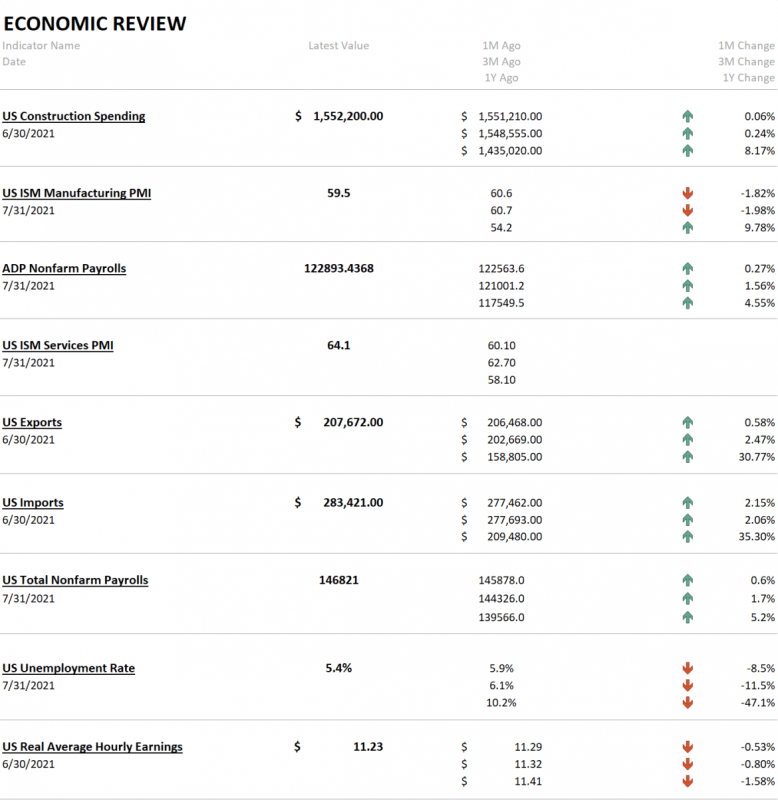

Weekly Market Pulse: What Is Today’s New Normal?

Remember “The New Normal”? Back in 2009, Bill Gross, the old bond king before Gundlach came along, penned a market commentary called “On the Course to a New Normal” which he said would be:

“a period of time in which economies grow very slowly as opposed to growing like weeds, the way children do; in which profits are relatively static; in which the government plays a significant role in terms of deficits and reregulation and control of the...

Read More »

Read More »

While the Herd Slumbers, Risk Is Rocketing Higher

This wholesale transfer of risk from elites to the workers is finally becoming consequential as wealth / income / security inequality is reaching extremes that are destabilizing society and the economy.

Read More »

Read More »

Sophistry Dressed (as) Reallocation

Stop me if you’ve heard this before: About US$275 billion (about SDR 193 billion) of the new allocation will go to emerging markets and developing countries, including low-income countries.

Read More »

Read More »

The Moment Wall Street Has Been Waiting For: Retail Is All In

The ideal bagholder is one who

adds more on every downturn (buy the dip) and who refuses to sell (diamond hands), holding

on for the inevitable Fed-fueled rally to new highs.

Old hands on Wall Street have been wary of being bearish for one reason, and no, it's not

the Federal Reserve: the old hands have been waiting for retail--the individual investor--

to go all-in stocks. After 13 long years, this moment has finally arrived:

retail is...

Read More »

Read More »

Golden Collateral Checking

Searching for clues or even small collateral indications, you can’t leave out the gold market. We’ve been on the lookout for scarcity primarily via the T-bill market, and that’s a good place to start, yet looking back to last March the relationship between bills and bullion was uniquely strong. It’s therefore a persuasive pattern if or when it turns up again.

Read More »

Read More »