Category Archive: 6a.) Swiss Gold Referendum

Swiss Gold Referendum: Results and Analysis

In a referendum, the Swiss had to decide about:

1) Ecopop, an ecological-political movement that wants to limit immigration to 0.2% of the population.

2) Abolishment of tax advantages for rich foreigners.

3) A gold initiative.

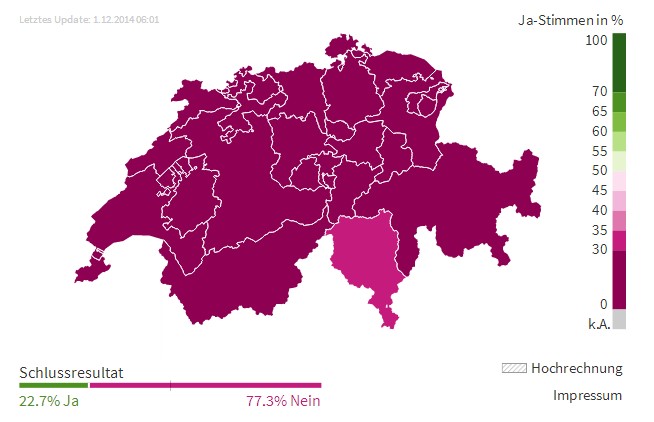

All three initiatives were rejected, the gold initiative by 78%.

George Dorgan summarizes the outcome. He explains what it means for gold, CHF and the SNB. He argues that the next economic cycle will be driven by...

Read More »

Read More »

Taxpayers Association Europe: Die SNB, der Franken, Rotkäppchen und der böse Wolf

Offizielle Stellungnahme des Europäischen Steuerzahlerbunds (TAE) zur Schweizer Volksabstimmung zur Gold-Initiative

Read More »

Read More »

George Dorgan auf Finews: Die vier Fronten bei der Goldinitiative

Der frühere UBS-Banker und Ökonom George Dorgan sieht in der Debatte um die Goldinitiative vier Fronten aufeinander prallen. Dabei wird die Abstimmung über das Schweizer Gold immer mehr zu einem Entscheid über den Fortbestand oder die Abschaffung des Euro-Mindestkurses.

Read More »

Read More »

Vier Meinungsgruppen im Schweizer Goldreferendum, eine Übersicht

Das Thema der "Abstimmungs-Arena" im Schweizer Fernsehen war „Gefährdet die Gold-Initiative die Handlungsfreiheit der SNB“? Dieser Blog versucht zu vermitteln, dass die SNB ihre Handlungsfreiheit im Sinne der Einhaltung der Preisstabilität schon im September 2011 verloren hat, als sie den Euro-Mindestkurs einführte.

Read More »

Read More »

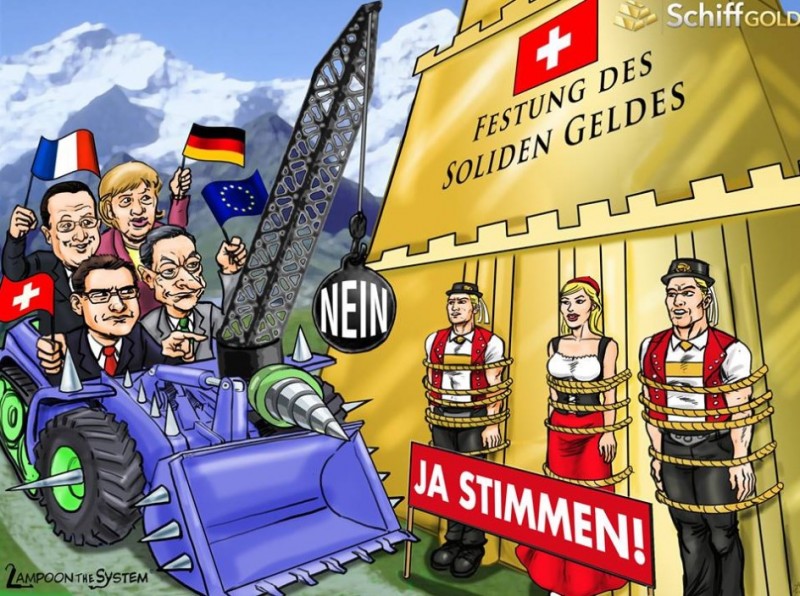

Peter Schiff’s Message to Switzerland: Preserve Your Wealth, Gold is Better than Pegging to the Euro

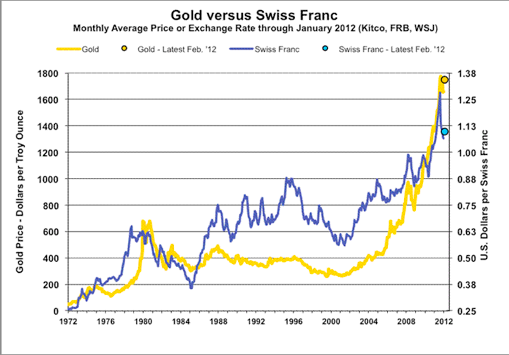

Peter Schiff, an Austrian economist who predicted the financial crisis urges the Swiss to preserve their wealth. Therefore, they should vote yes in the gold referendum. He thinks that buying gold is better than pegging to the euro. The Swiss will be better off if they possess a strong currency. Pegging to the euro implies that the Swiss Franc will become a new Italian Lira, Peseta or French Franc.

Read More »

Read More »

Swiss Gold Referendum and SNB’s Opinion: An Exchange of Arguments

Already in 2013, the Swiss National Bank (SNB) spoke out against the gold initiative and revealed that the Swiss gold is stored mostly in Switzerland and 20% in the UK and 10% in Canada. There is no Swiss gold in the United States according to SNB chairman Jordan. In this post we provide an exchange of Jordan's arguments against the ones of the gold initiative. We also state our view that is not as strict as the one of the referendum proponents.

Read More »

Read More »

Gold Referendum, Parliamentary Speech Lukas Reimann

Swiss parliament member Lukas Reimann outlines the importance gold. In a future inflationary environment, prices of SNB holdings, the ones of German Bunds and US Treasuries will drop, while gold will appreciate.

Read More »

Read More »

“SNB Concerned”: Does a Yes to the Swiss Gold Referendum Imply an End of the CHF Cap?

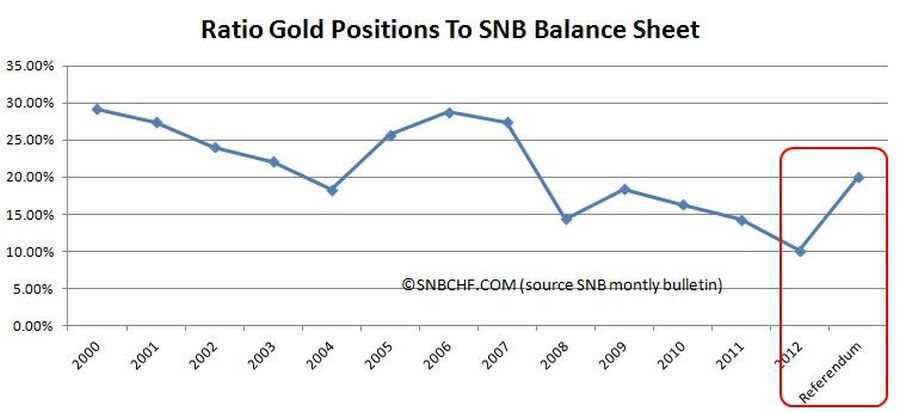

If the upcoming referendum "Save our Swiss gold" wins, the SNB must increase gold holdings from 10% to 20% of its balance sheet. Gold purchases and/or sales of fiat money implies an end of CHF cap.

Read More »

Read More »