When you’re dealing with Switzerland, Mr. Allon, is’s best to keep one thing in mind. It’s a business, and it’s run like a business. It’s a business that is constantly in a defensive posture. It’s been that way for seven hundred years.

—- Daniel Silva, The English Assassin

Some proponents of the Swiss gold referendum in November 2014 were claiming that the United States has managed to infiltrate the Swiss National Bank to destroy the Swiss businesses. Let’s take our own look at the history of Swiss gold sales.

Until the end of Bretton Woods, the Swiss managed to accumulate large gold reserves thanks to their Calvinist traditions that favored high savings and desire to do business. These high savings led continuous current account surpluses and big gold holdings owned by Swiss National Bank (SNB), but held physically in the Fed’s vaults or at other central banks like the Bank of England or the Bank of Canada. Thanks to the capital accumulation, insufficient labor supply was often the major concern and the Swiss let (relatively) cheap and preferably well-qualified workers immigrate.

For years the Swiss and the SNB resisted the rather Keynesian mindset of the International Monetary Fund (IMF), and joined this institution only in 1992. The IMF membership implied that the Swiss had to change their constitution: until 1999 the franc was officially bound to gold. The gold reserves of the Swiss National Bank were historically regarded as the “property of the Swiss people” which could not be sold. Still in 1995 Swiss politicians declared that the Swiss gold was unsellable.

In a referendum in 1999, leaders managed to convince voters to remove the relevant constitutional article from 1971 that required the Swiss franc to be backed by 40% gold.1

In the 1990s the IMF intensified the “demonetization of gold” campaign and enforced the Washington agreement on gold in September 1999, a “gentlemen’s agreement among central banks of developed nations”: During a period of weak inflation and strong U.S. growth, Central Bankers were of the strong belief that the strength of the anchor currencies of the global monetary system, the US dollar and the newly created euro, would be able to defeat any future supply-side and inflation issues. The central bankers reckoned that gold was a “barbarous relic” to hold gold. Even if officially independent of governments, central bankers suggested that government bonds were the better deal, because “bonds generate income“. In 2002, the gold and monetary expert Walter Hirt objected against the gold sales. He emphasized that gold helps to hedge against debt and inflationary crises; in this crisis case gold prices would strongly improve.

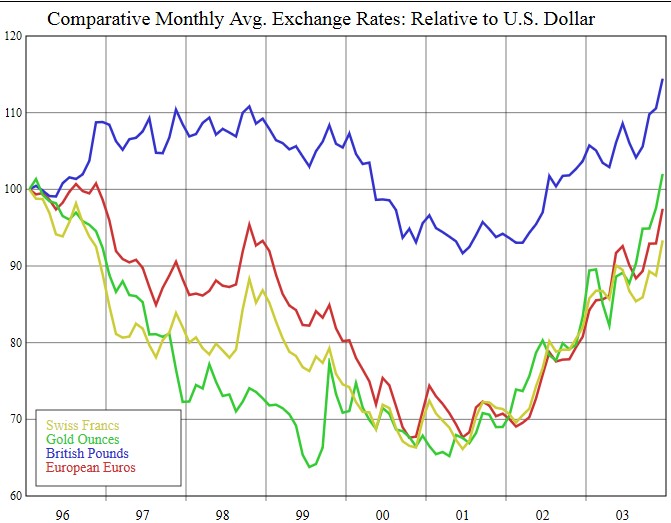

| The Bank of England quickly sold a big part of its gold before 2002, at the lowest prices under 400$ per ounce and invested a big part of the proceeds into the euro-denominated government bonds. As visible in the graph, gold prices were and are strill strongly related to the euro and so they are today. We explain this relationship with the German and European exposure to growth in Emerging Markets, the main counter element to the dollar in global macro. Moreover, we judge that the Bank of England aimed to prop up the value of the euro; similarly as the ECB did interventions in the year 2000.

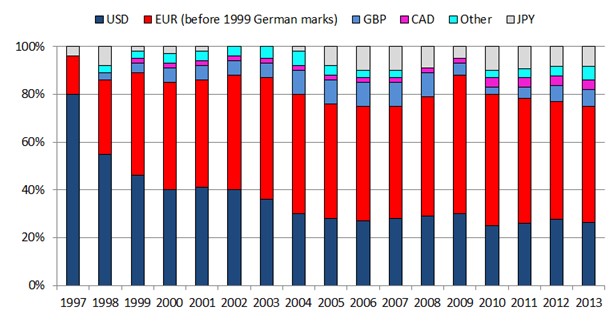

The Swiss National Bank faced more political discussions, decided to distribute the gold sales over several years and sold gold under 500$ per ounce. Similar to the UK, the Swiss replaced gold primarily with such “income-generating” bonds denominated in the euro. Until 1997, however, the dollar served primarily to balance the SNB portfolio against its high gold holdings. The official results show that the SNB gain. The euro countries, Germany, France and Italy, instead, decided to keep their big gold reserves, possibly to give the euro better credibility. |

Gold Sales and Currencies |

|

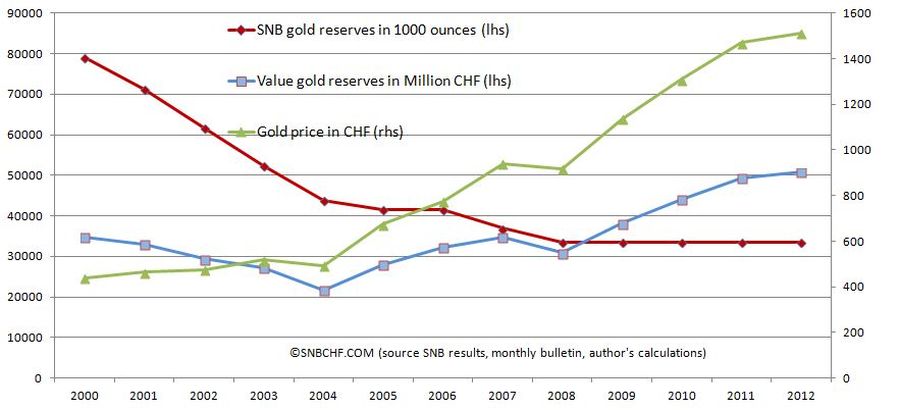

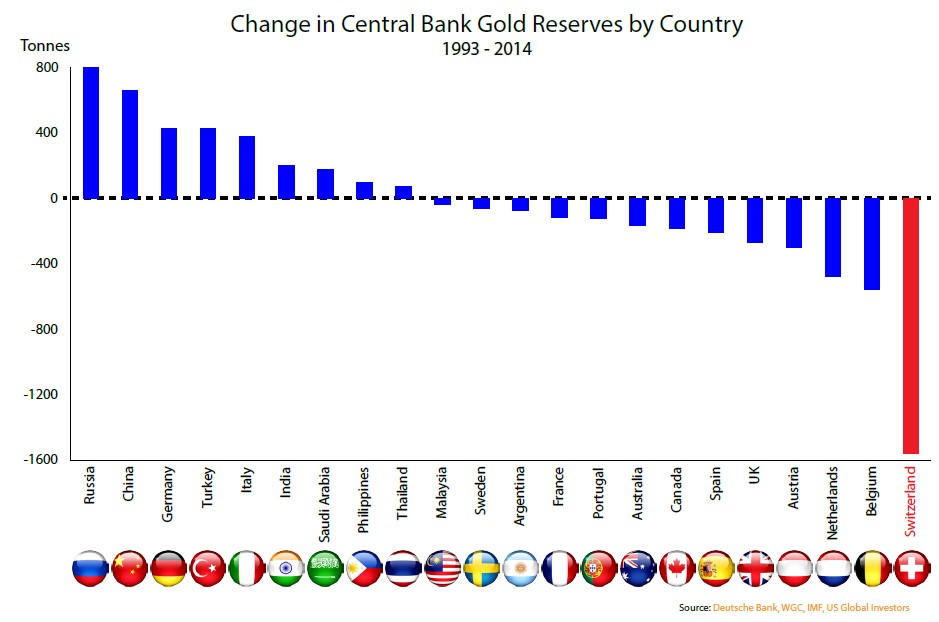

Since the last gold sales in 2007, the Swiss have maintained the same quantity of gold. Despite the strong rise of gold prices between 2008 and 2012, the SNB never bought more gold. But people and central banks in China, Russia, India and other emerging markets purchased more. For more than one decade, the gold price improved with higher oil prices and rising incomes in those “barbarous” countries. The gold price improved with higher oil prices and rising incomes and demand in those “barbarous” countries. Many central banks had capital gains on gold thanks to those rising incomes of people in “barbarous countries”.. |

CHF and EUR correlation to Gold(see more posts on EUR/CHF, Gold, ) SNB Distribution of Currencies Source: SNB - Click to enlarge |

Gold sales at cheap prices propped up finances of Swiss cantonsBetween 2001 and 2007, the SNB made the Swiss cantons happy and delivered some billions of francs to prop up their finances. The gains were unfortunately not caused by strong asset management capabilities, but mostly due to gold price improvements and gold sales at quite cheap prices.

|

Gold Price vs. SNB Gold Reserves(see more posts on gold price, ) |

| The official end of the initially agreed gold sales was in 2005. But in 2007 the gold price had risen even more and the Swiss decided to make some more “fiat money” out of it. They sold another 250 tonnes (source SNB).

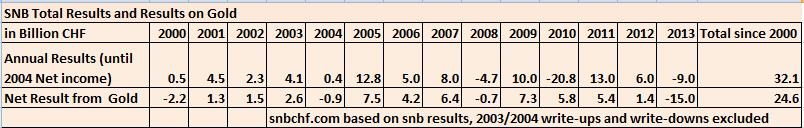

As the year 2010 SNB results show, the remaining Swiss gold holdings prevented higher losses. Unfortunately, the quantity of gold was less than half that in the year 2000; otherwise, gains on the gold price would have nearly neutralized losses on fiat currencies. Since the SNB decided to value gold at market prices in 1999, the total SNB profit over the years has been 32.1 bln. CHF. Gold contributed 24.6 billion and income on foreign currency investments only 7 bln CHF. Between 2000 and 2012 the profit on gold had been 40 billion francs. |

SNB Total Results and Results on Gold 2000 - 2013 |

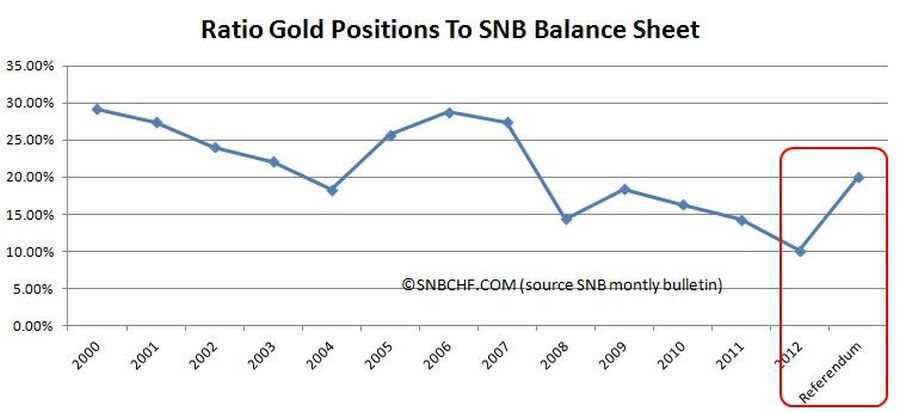

Percentage of SNB gold holdings has fallen from 30% to 8%For the proponents of the gold referendum held in November 2014, the SNB gold sales were the destruction of what their parents and grandparents achieved during the Bretton Woods period. The percentage of gold holdings to total SNB balance sheet has fallen from 30% in the year 2000 to 10% in 2012 and 8% in 2014. The referendum initiative might oblige the SNB to increase the gold holdings to 20% again. |

Ratio Gold to Balance Sheet SNB(see more posts on gold ratio, ) |

| Due to the fact that the gold price fell in the late 1990s, the gold part was even higher some years before.

The following presents the view of the Swiss National Bank, Philip Hildebrand, vice chairman of the SNB in 2005. At that moment most parts of the gold sales had happened. |

Change in Gold Holdings |

SNB Gold Sales – Lessons and Experiences

The SNB published an article about the gold sales when most parts finished. The central bank seems to suggest in this presentation that Switzerland only import gold and do not export it again. We know that Switzerland is an export-hub for gold to Asia.

Here direct access to the file, if the viewer should not work.

Further references

Already in the year 2000 Swiss television SRF anticipated the high gold demand by Chinese and Indians but it also claimed that gold is no longer need for central banks. Video in German.

Luzi Stamm, Postulat: Swiss parliamentary commission to investigate in the gold sales, German: Hintergründe des Goldverkaufs der Schweizerischen Nationalbank, source

<– Back to Swiss franc history overview

- Already the replacement of paper money by electronic sight deposits might have reduced legal binding to this constitution article. The SNB claims that the 40% gold backing only concerns SNB debt in the form of paper money but not sight deposits. The article was mostly reflected in a fixed gold price in the SNB balance sheet and in the obligation not to sell gold. Swiss National Bank History from 1957 to 1982, old constitution article of 1970 on page 413, comment page 123 [↩]

1 comment

veraciti

2014-11-25 at 11:52 (UTC 2) Link to this comment

Here is the real story of the Swiss Gold and the machinations of the Banksters:

http://bit.ly/1y55ppR

The significance of this vote can’t be overestimated, but judge for yourself.

A strong currency has never bankrupted a country, but the reckless printing of Fiat Currency as the SNB is currently engaged in has!

Why to Banksters and Politicians hate gold so much, it prevents their criminal activities and the printing of fiat currency with abandon and then charge interest on this confetti paper; usury!

@ Geroge Dorgan

Regards

Veraciti