Tag Archive: Gold

Economic freedom: Politics, of course, by its nature is always the pursuit of the Left

Share this article

Article II of II, by Claudio Grass

Collectivism is extremely versatile and very easy for political animals to “sell” to the public and to weaponize. Politics, of course, by its nature is always the pursuit of the Left, if we are to follow strict definitions. It seeks to influence and coerce others and it abhors individual liberties and self-determination. What we know as far-right is national socialism and the rest is...

Read More »

Read More »

Interview with Executive Global: “The Return of Marxism in the West”

Our special interview on Swiss Wealth Advisor with CLAUDIO GRASS, CEO and Independent Precious Metals Consultant, explores the manner in which astute investors may preserve wealth against the backdrop of debilitating central economic planning and monetary inflation.

Read More »

Read More »

Saving in gold is the only reliable way to save

Share this article

For the longest time, according to conventional and widely embraced wisdom, all responsible and prudent members of society had to have a savings account. All those hardworking taxpayers and all those forward-thinking and sensible individuals that understand the importance of planning ahead, of being prepared for whatever the future holds and of securing a better life for their children, have traditionally been expected to put...

Read More »

Read More »

Weekly Market Pulse: Are Higher Interest Rates Good For The Economy?

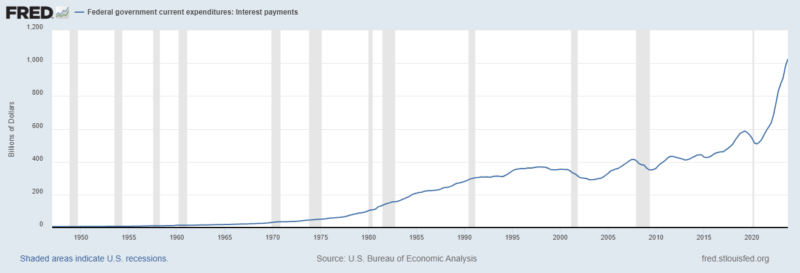

Interest rates surged last week on the back of a hotter-than-expected inflation report that wasn’t actually that bad (see below). Not that my – or your – opinion about these things matters all that much to the market.

Read More »

Read More »

Is gold too expensive to buy right now?

Share this article

This question has been at the center of a great many conversations I’ve been recently having with clients and friends. The way I like to answer it is with another question: Expensive compared to what?

Despite its recent surge to record highs, there are compelling reasons why purchasing gold right now is a prudent decision, with strong indications that its value is poised to climb even higher. Making investment decisions...

Read More »

Read More »

Sound Individualism vs Toxic Collectivism

When it comes to the State, however, and all its ministries, branches and institutions, a very different set of rules seems to apply – a much more lenient, flexible and liberal one.

Read More »

Read More »

Private property rights under siege

People invest in gold for many different reasons. Many do so out of concern over economic, monetary or political uncertainty. Others seek a hedge against inflation, a way to protect and preserve the real purchasing power of their savings.

Read More »

Read More »

Corrupt Money = Corrupt Society

Share this article

Discussion with Sean from SGT Report about the corruption of our money which has led to the corruption of society.

to watch the video click on this link: https://rumble.com/v44t52f-corrupt-money-corrupt-world-claudio-grass.html

Read More »

Read More »

2024 outlook: Gold Shines Bright in the Gathering Storm

The year 2024 is poised to be a critical period for the global economy and it already appears to be fraught with economic and geopolitical challenges, casting a dark shadow over the global landscape. Signs of a looming economic downturn are becoming increasingly evident and the many challenges we faced over the past year will certainly remain with us for many months to come.

Economic and monetary landscape

Central bankers in most advanced...

Read More »

Read More »

2023: A year in review

After the catastrophic covid crisis of 2020 and 2021, the extremely impactful and consequential Russian invasion of Ukraine in 2022, many hoped that 2023 would break this terrible bad spell and finally present us all with some hope, economically, geopolitically, socially, technologically. Unfortunately, it only offered further reasons for serious concerns on all these fronts.

Economically, even though the official inflation rate followed a...

Read More »

Read More »

War is the health of the State

Part I of II by Claudio Grass

For any reasonably well read adult, any amateur student of history or any responsible citizen for that matter, the idea that ”war is the health of the State” should be adjacent to a truism. After all, literally nobody benefits from violence and bloodshed apart from those at the heart of any State that is directly or indirectly involved and their cronies. In fact, the more horrific the violence and the more...

Read More »

Read More »

“Sound money must be anchored to and backed by real, tangible assets”

Dani Stüssi interview with Claudio Grass

Over the last few years, the financial woes and daily pressures that have been unleashed upon the average citizen, saver and taxpayer have put the spotlight on money itself. Countless ordinary people who have otherwise never seriously pondered these questions, began to question basic principles like: what makes their paycheck shrink from month to month, what or who actually responsible of it and what,...

Read More »

Read More »

Weekly Market Pulse: Monetary Policy Is Hard

So, is that it? Have rates peaked? Is the long bear market finally over?

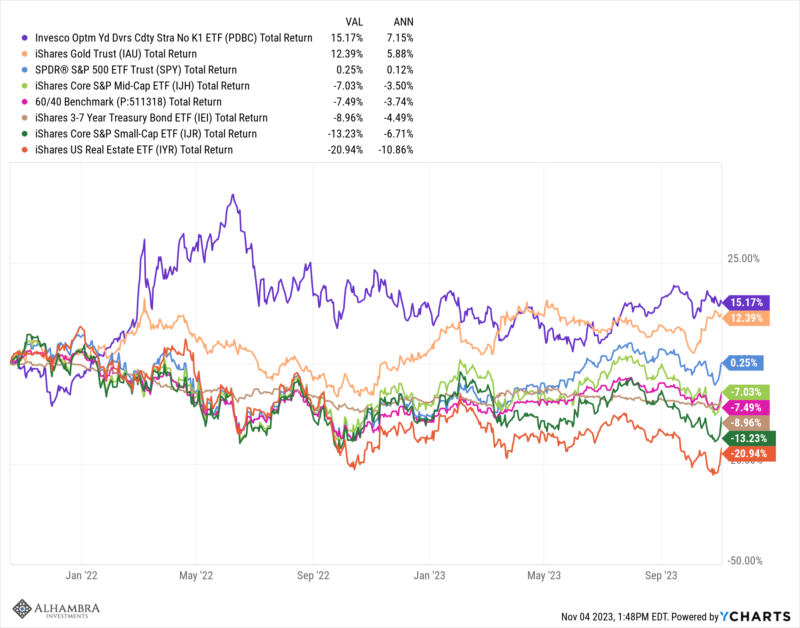

The market decided last week that interest rates have peaked for this cycle. And if rates have peaked then all the assets that have been pressured over the last two years can finally come up for air. Since October 18, 2021, over two years ago, investors have had few places to hide. Of the major asset classes we follow closely, only two – gold and commodities – were higher by...

Read More »

Read More »

Rethinking “safe” investments

Part II of II by Claudio Grass, Hünenberg See, Switzerland. For those of us who have studied history, these Ingenuous beliefs and expectations likely bring a smirk to our face. However, these are entirely reasonable assumptions for most citizens, as the majority of the population is blissfully unaware of the numerous real-life examples that clearly demonstrate just how capable and how eager the government is to do these things – to fail, or to lie,...

Read More »

Read More »

Rethinking “safe” investments

Part I of II by Claudio Grass, Hünenberg See, Switzerland

To most observant citizens and diligent investors it is surely quite obvious that the current monetary, fiscal and banking system is inherently flawed, hopelessly unjust, corrupt, unsustainable and simply destined to collapse sooner or later. With every (predictable) recession and every (foreseeable) crisis, this structure gets weaker; its very own architects increasingly second-guess...

Read More »

Read More »

Gold for the people

At the end of September, a very interesting story made the rounds in the media and caught my attention. Apparently, the US big box giant Costco added one rather surprising product to its range and it proved immensely popular. Next to humongous multipacks of cereal, buckets of peanut butter, mattresses and air fryers, customers were offered the opportunity to throw a gold bar in their carts as well.

Selling like hotcakes

According to a...

Read More »

Read More »

Gold Hits New All Time Highs

2023-11-02

by Dave Russell

2023-11-02

Read More »