Tag Archive: Gold

EUR/CHF: One Year of Free Market (07/2010-07/2011): January 2011

ForexLive Asian Market Open: Risk Aversion To The Fore Fears of an escalation of the troubles in Egypt and a possible spread throughout the region have led to some risk aversion in early interbank trade. EUR/JPY is trading at 111.40 after closing at 111.75 on Friday night, USD/JPY is trading just below 82.00, and EUR/CHF … Continue reading »

Read More »

Read More »

EUR/CHF: One Year of Free Market (07/2010-07/2011): December 2010

Hildebrand Unable To Unload ‘Burden’ Of Record Franc As GDP Seen Slowing Bloomberg article. EUR/CHF down at 1.2595 from early 1.2635. Just reading UBS forex strategists say they are bearish the cross, focusing on 1.2439 ahead of 1.2283. They see resistance at 1.2714. They also forecast a fall in USD/CHF. See break through support at … Continue reading...

Read More »

Read More »

EUR/CHF: One Year of Free Market (07/2010-07/2011): November 2010

EUR/CHF Continues Lower Presently down at 1.3055 from early 1.3090, having been as low as 1.3037 so far. Earlier I was reading comments made by UBS economist Huenerwadel, who said “At least from a fundamental point of view and aware of the increased long CHF positioning, very little speaks in favour of a materially higher EUR/CHF … Continue reading...

Read More »

Read More »

EUR/CHF: One Year of Free Market (07/2010-07/2011): October 2010

EUR/CHF Up On Day; Talk Of 1.3700 Option Interest EUR/CHF up at 1.3680 from early 1.3635. Talk of 1.3700 option interest. Guess we should expect some defensive selling to kick in then. By Gerry Davies || October 27, 2010 at 09:11 GMT Cititechs Cut Long EUR/GBP Position As I wrote yesterday, I thought this was a bad … Continue reading »

Read More »

Read More »

EUR/CHF, a Year of Free Market (07/2010-07/2011): September 2010

Cable Showing Signs Of Tiredness Cable rallied above 1.5900 in the early European rush to sell EUR/GBP but the sharp fall since doesn’t bode well for the short term bulls. I personally have exited most of my long position and will look to reinstate towards 1.5500. GBP/CHF once again halted at the major 1.5360 low … Continue reading »

Read More »

Read More »

EUR/CHF, a Year of Free Market (07/2010-07/2011): July 2010

EUR/CHF Hit Again EUR/CHF has been hit again, down at 1.3535 from early 1.3580. Recently there has been talk of the Swiss National Bank selling the cross, something I for one certainly can’t substantiate. Also yesterday there were rumours of a September rate hike in Switzerland. All very murky. The EUR/CHF cross selling has helped pressure EUR/USD, which is … Continue reading »

Read More »

Read More »

EUR/CHF A history of interventions: November 2009

November 2009 Asian FX Market Open: Price Action Suggests That There’s More To Come As I wrote yesterday, the market moves reminded me of 12 months ago when risk aversion was in full flow and this has continued throughout the European session. As Lilac mentioned after the FTSE fell by over 3%, we could be … Continue reading »

Read More »

Read More »

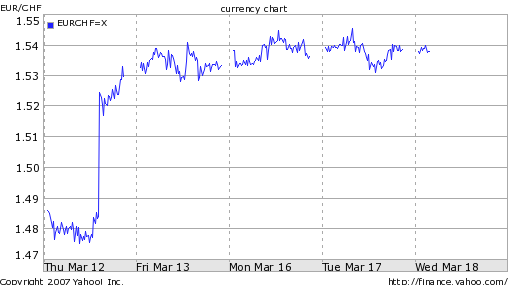

SNB Fulfills Promise of Forex Intervention, Franc Collapses (March 2009)

Extracts from the history of the Swiss franc (March 2009). Mar. 17th 2009 Last week, the Forex Blog concluded a post on the Swiss Franc by suggesting that the Swiss National Bank (SNB) could artificially depress the value of its currency, which had “not just posted strong gains against the eurosince late August …

Read More »

Read More »

Swiss Franc Rises on a Trade-weighted Basis, but Down against the Dollar (March 2009)

Mar. 11th 2009 Extracts from the history of the Swiss franc (March 2009). Most of the “safe haven” talk in forex circles has focused on Japan and the US. Switzerland, meanwhile, has also attracted is fair share of risk-averse investors, who are piling into Franc-denominated assets, despite the deteriorating Swiss economic situation. In fact, …

Read More »

Read More »

Recent History of the Swiss franc: January to February 2009

Swissy Sees Some Slight Improvement Swissy is seeing some slight improvement in afternoon trade, the EUR/CHF cross presently down at 1.4900 from the 1.4990 session high posted earlier. The general flight to perceived safety, with gold fast approaching $1,000, will be playing a part with swissy’s safe haven premium coming into play. However how …

Read More »

Read More »