Tag Archive: Gold

Why Did Both Silver and Gold Become Money?

Keith Weiner explains why gold and silver, two shiny metals, have become money. They fill different human needs, and evolved through different paths. Money solves a problem called the coincidence of wants. Moreover he looks on the choice between gold and silver.

Read More »

Read More »

The Six Major Fundamental Factors that Determine Gold and Silver Prices

Gold and silver are the most complicated assets to price. Stocks, currencies, commodities mostly depend on their fundamental data, supply and demand. Gold and silver, however, are priced indirectly.

Read More »

Read More »

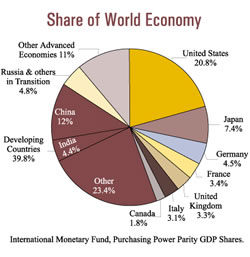

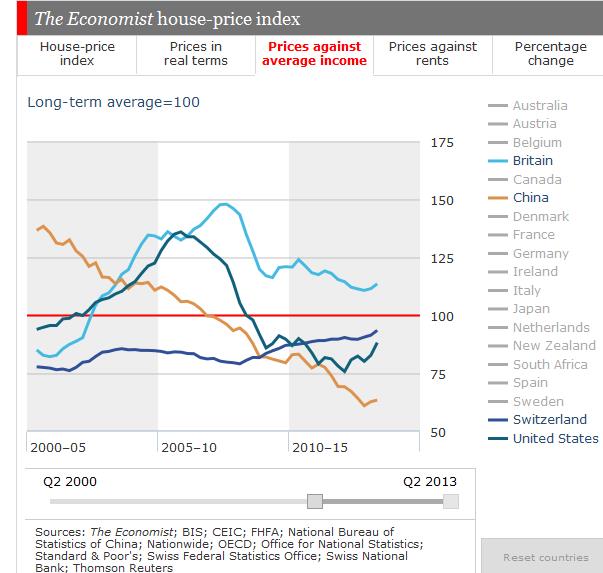

CHF Is No Safe-Haven, but a Safe Proxy for Global Economic Growth

In our view the Swiss franc is not a pure Safe-Haven, but a "Safe Proxy for Global Economic Growth". Global investors want to participate via the purchase of safe Swiss multi-nationals in global growth. This means inflows into Swiss franc denominated assets. Together with the big Swiss trade surplus, this implies a stronger franc. China stands for global economy, its slowing growth has a negative influence on the profits of Swiss multi-nationals...

Read More »

Read More »

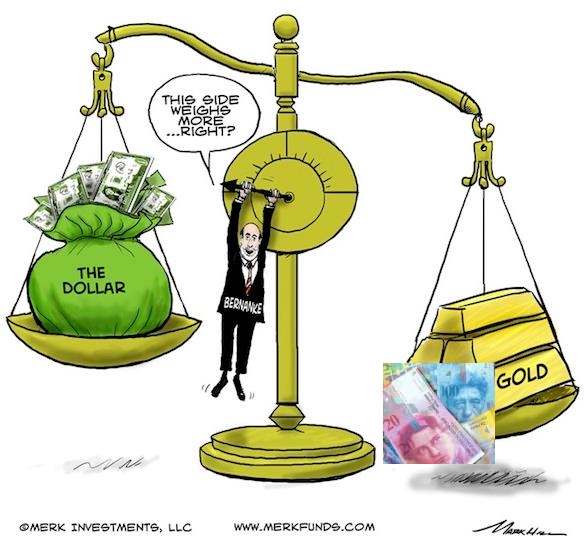

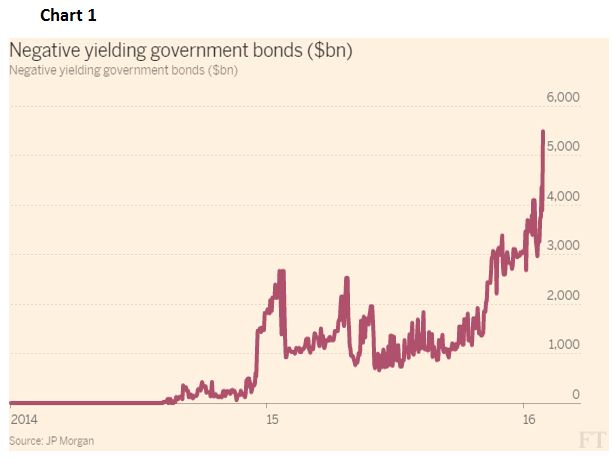

Quantitative Easing, its Indicators and the Swiss Franc

The main drivers of demand for Swiss francs are the euro crisis and, even more, the behavior of American investors, who go out of the dollar in the fear of bad US economic data and/or Quantitative Easing (QE). Risk-friendly investors move into risky assets like stocks or currencies of emerging markets, while risk-averse investors fear inflation and buy inflation-resistant assets like Swiss francs.

Read More »

Read More »

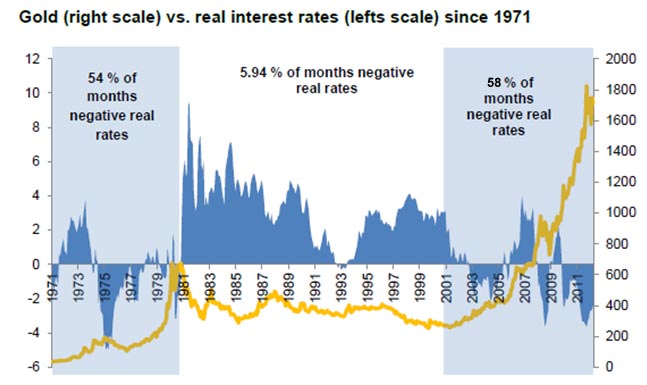

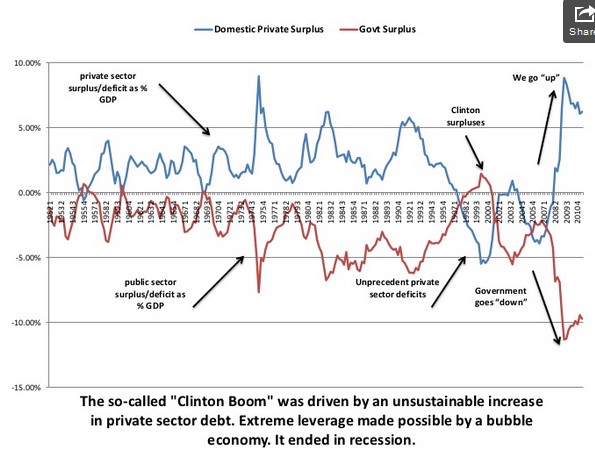

Why was the gold price so low in 1999/2000?

To find further explanations as to why the gold price was weak in the late 1990s we analyze sector balances. Effectively private spending and private debt went in two different directions: a heavy increase in private spending and debt in the US against less growth in private spending and less debt in the rest of world. This combination fostered GDP growth in the US and weakened it in other countries. Real interest rates were positive. Markets...

Read More »

Read More »

Weltwoche nimmt Blogbeitrag zu Gold von unbequemefragen.ch auf

Da habe ich nicht schlecht gestaunt, als sich Markus Schär von der Weltwoche vorgestern Abend bei mir über Twitter gemeldet und verkündet hat, dass er bei seinem Artikel über die Goldverkäufe der SNB sehr prominent meinen Blogbeitag zitiert. Nochmals...

Read More »

Read More »

Bewiesen: Die SNB verkaufte Gold, welches bei der Fed gelagert war

Endlich kommt der Beweis für meine Vermutung! Die SNB hat heute – parallel zur Propaganda des Bundesrats – ein Dokument “Goldinitiative – häufig gestellte Fragen” (PDF) ins Netz gestellt und dabei sogar interessante Fakten preisgegeben. Konkret geht ...

Read More »

Read More »

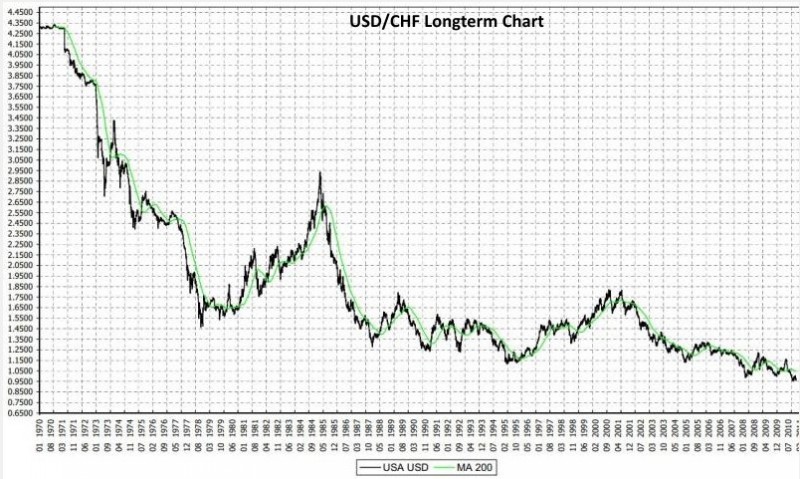

Swiss Franc History: The long-term view and the comparison with gold

We establish a long-term view and history of the Swiss franc. We compare the franc with gold.

Read More »

Read More »

SNB verlängert Goldabkommen, aber wozu?

Die SNB schreibt heute in einer Medienmitteilung: Um ihre Absichten in Bezug auf ihre Bestände an Gold darzulegen, geben die Beteiligten am Goldabkommen folgende Erklärung ab: Gold bleibt ein wichtiges Element der globalen Währungsreserven.

Read More »

Read More »

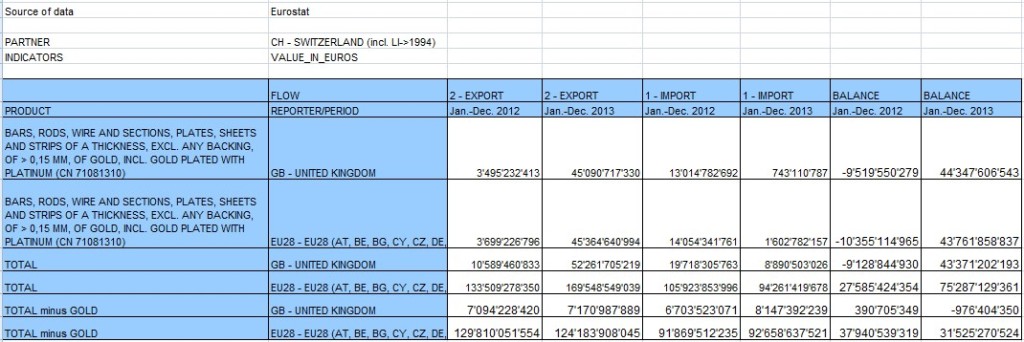

Official Eurostat Trade Balance Massively Distorted by UK Sales Of 1464 Tonnes of Gold To Switzerland

In 2013, private investors from the UK sold net (!) 1464 tons of physical gold (and similar) for a value 44.3 billion EUR. This was 1 464 000 kilograms each at the current price of 30254€ per kilo

Read More »

Read More »

SNB Q1/2014 Results: 1.7% annualized Yield on Seigniorage, 2% annualized Loss on FX Rate Change

The main task of a central bank occupied with QEE (quantitative easing or exchange intervention) is to obtain higher gains on seigniorage than it loses with its "ever appreciating" currency. Otherwise its equity capital would be absorbed.

Read More »

Read More »

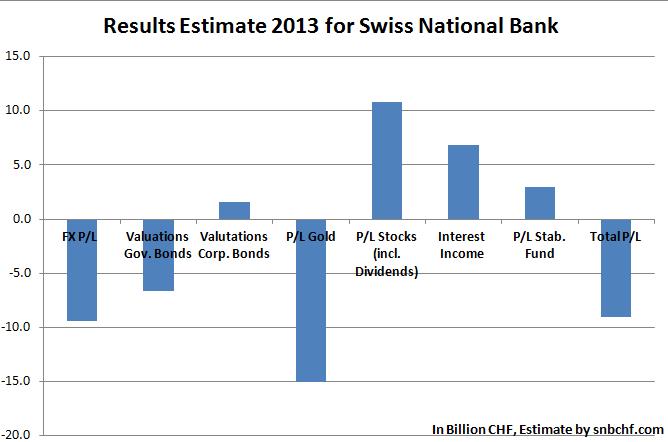

15 Billion SNB Losses on Gold in 2013, But 40 Billion SNB Profit on Gold between 2000 and 2012

For anybody complaining about gold that caused the big loss of the Swiss National Bank. Since 2000, the total SNB profit was 32.1 bln. CHF, of which 24.6 billion came from gold.

Read More »

Read More »

The Fed Will Remain Gold’s Strongest Supporter For Years

In the early 1980s the Fed stopped the wage-price spiral and destroyed the gold price. Today main-stream economists have discovered that rising company profits compared to stagnating wages could an issue for the U.S. economy. For us this implies that the ultimate Fed goal will be to increase wages and inflation. Consequently the Fed has become the biggest supporter of gold and silver prices.

Read More »

Read More »

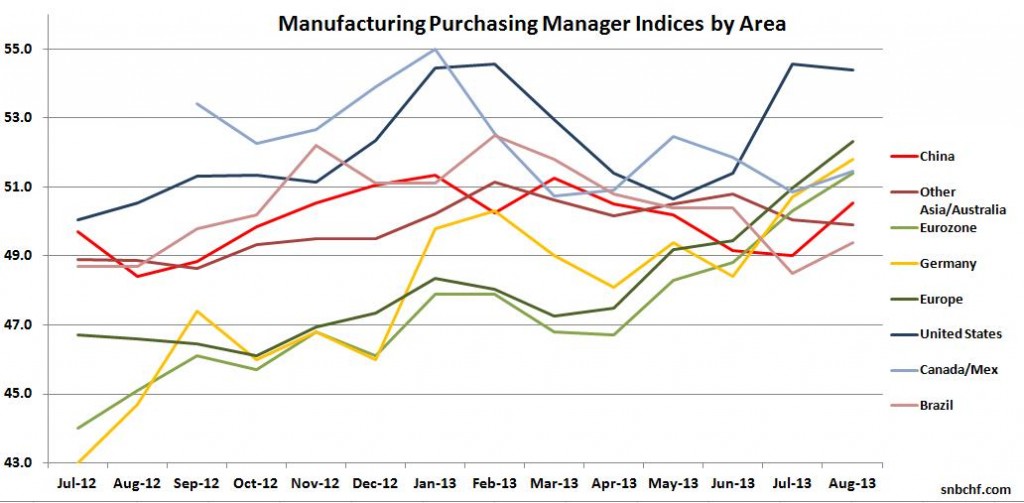

Fundamentals,FX,Gold and CHF:Week November 18 to November 22

Fundamentals with highest importance: The HSBC Flash Purchasing Manager Index (PMI) for China weakened from 50.8 to 50.4. In particular, new export orders, output prices and employment started to decrease again, while output increased. The preliminary Markit manufacturing PMI for the United States edged up to 54.3 (vs. 52.3 expected), a 9-month high after the …

Read More »

Read More »

Fundamentals,FX,Gold and CHF:Week November 11 to November 15

Fundamentals with highest importance: In Janet Yellen’s hearing at the Senate Banking Commission, the future Fed chair emphasized the need to provide support to the economic recovery and to overcome low inflation. Her speech supported equities, gold and US Treasuries. GDP in the Euro zone rose by 0.1% QoQ in line with expectations, but less …

Read More »

Read More »

Fundamentals,FX,Gold and CHF: Week November 4 to November 8

Fundamentals with highest importance: The U.S. GDP release for Q3, showed that despite the recent U.S. critique with Germany, the Americans are trying to follow the successful Germans: for the first time since Q1/2012 and Q2/2011 exports rose more than imports. GDP was up 2.8%, but not driven by consumption, it was mostly helped by …

Read More »

Read More »

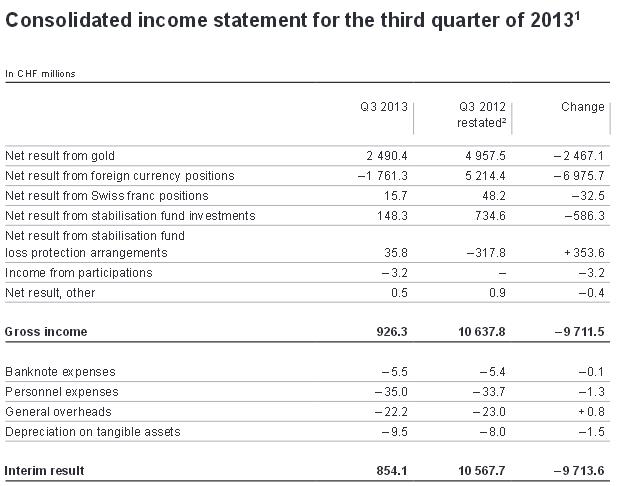

In Which Positions Does the SNB Win and Where Does it Lose Money: Details on the Q3 Results

UPDATE October 31, The official press release focused on the results for Q1 to Q3. The loss was 6.4 billion after a 7.3 bln. CHF loss in the first two quarters. Over all three quarters especially gold and the yen weakened the central bank’s positions. For the third quarter, it means that income was positive … Continue reading »

Read More »

Read More »

Fundamentals, FX, Gold and CHF: Week October 21 to 25

Major Fundamental Events The week contained a lot of important fundamental events, in particular Non-Farm Payrolls and preliminary “flash” PMI readings. Highest importance for FX rates Non-Farm Payrolls (NFPs) weakened to 148K, private NFPs to 126K, both against 180K expected. Especially the private NFPs were disappointing. The decrease in the unemployment rate from 7.3% …

Read More »

Read More »