Tag Archive: Gold

Rule Britannia

What a glorious day for Britain and anyone among you who continues to believe in the ideas of liberty, freedom, and sovereign democratic rule. Against all expectations, the leave camp somehow managed to push the referendum across the center line, with 51.9% of voters counted electing to leave the European Union.

Read More »

Read More »

Great Graphic: Gold and the Dollar

Many investors still think about gold as if it were money. Economists identify three functions of money: store of value, means of exchange, and a unit of account.

It can be a store of value, but the price fluctuates compared with other form...

Read More »

Read More »

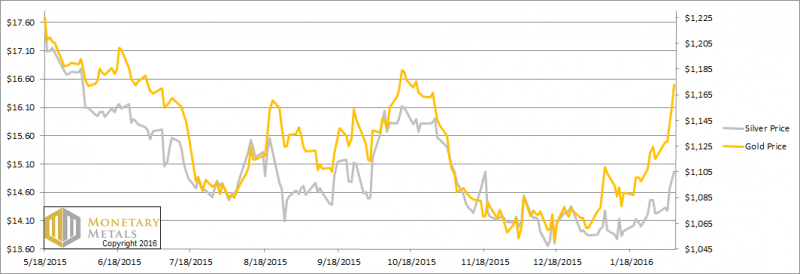

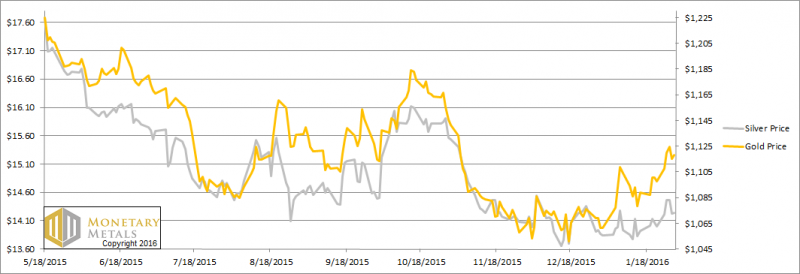

Paper Gold Is Rising

The Metals Take Off The price of gold shot up over $60 this week. The price of silver moved up proportionally, gaining over $0.85. The mood is now palpable. The feeling in the air is that of long suffering suddenly turned to optimism. Big gains, if...

Read More »

Read More »

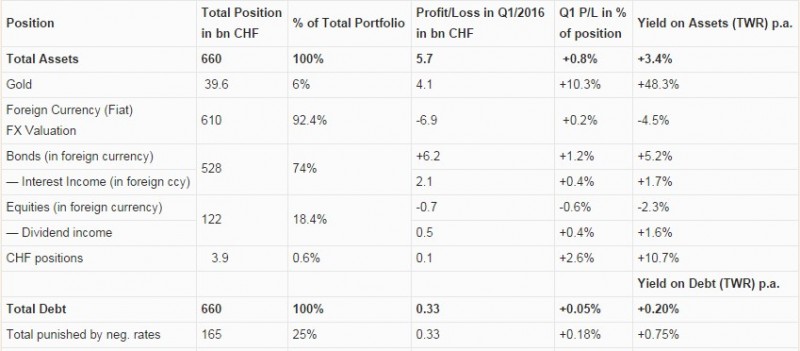

Gold, Bonds and Negative Interest Rates Give SNB a Q1 profit

SNB Results Q1 2016: Two thirds of SNB profit comes from Gold. Deflation helps with higher bonds prices and profit on negative interest rates.

Read More »

Read More »

Great Graphic:Is that a Head and Shoulders Top in Gold?

This Great Graphic, created on Bloomberg shows the price of gold over the last six months. The price peaked a month ago near $1285. It seems a distribution top is being formed.

Specifically, it looks like a potential head and shoulders to...

Read More »

Read More »

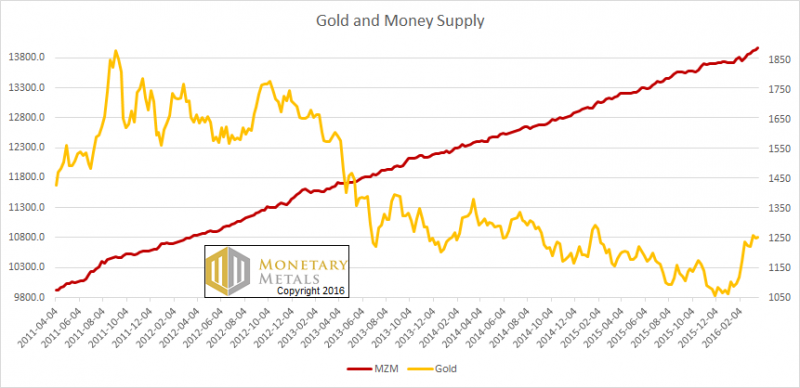

The Gold Money Supply Correlation Report, 3 Apr, 2016

There were some fireworks this week. Gold went up on Tuesday (it was a shortened week due to Easter Monday), from a low of $1,215 to $1,244 over the day, a move of over 2 percent. Silver moved from $15.02 to $15.44, almost 3 percent. What happened on...

Read More »

Read More »

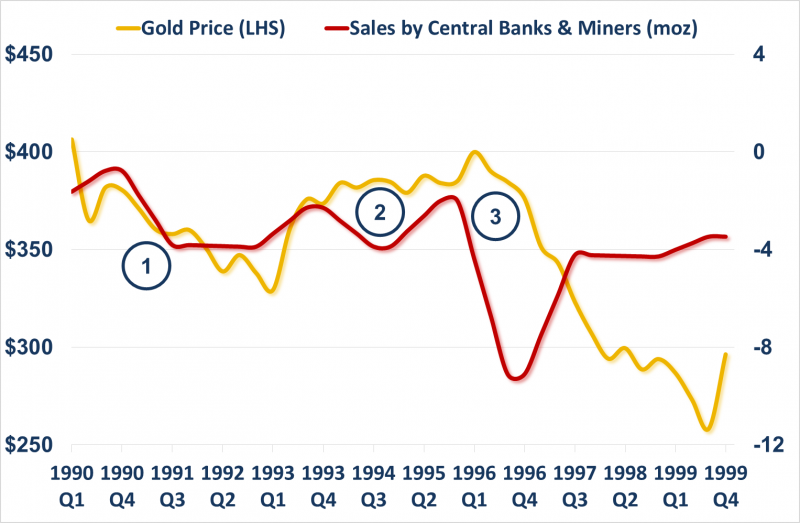

The Voldemort Effect: Gold Price and Gold Sales

Gold market analysts have for many years puzzled over the unusual behaviour of the gold market during the 1990s, specifically the bizarrely flat gold price from 1993 to 1996 in the face of sustained selling pressure from central banks and gold miners...

Read More »

Read More »

Silver Relative Strength Report, 27 Mar, 2016

Gold went down (as the muggles would measure it, in dollars). It dropped almost 40 bucks. Silver fell almost 60 cents. Since silver fell proportionally farther than gold, the gold-silver ratio went up.

Read More »

Read More »

FX Review Week March 21- March 25

The US dollar rose against all the major and most emerging market currencies last week. After selling off following the ECB and FOMC meetings, the dollar found better traction. It was helped by widening interest rate differentials. Regional Fed manufacturing surveys for March suggest the quarter is ending on a firm note. With new orders rising, …

Read More »

Read More »

Silver Gone Wild Report, 20 Mar, 2016

Early on Monday morning (Arizona time), silver began to rise. From its close on Friday of $15.46, it ran up to $15.82. Then it began to slide, eventually dropping to $15.17 by midmorning on Wednesday. Then…

Read More »

Read More »

Supply and Demand Report, 13 Mar, 2016

On the week, the prices of the metals didn’t move all that much. However, the move around 6am (Arizona time) on Thursday is notable. The price of silver spiked up from around $15.12 to $15.64—3.4%—by around 8am. Twelve hours later, the price touched ...

Read More »

Read More »

Gold-Silver Ratio Reversal Report, 6 Mar, 2016

So the price of silver rocketed up 80 cents, while the price of gold jumped $37. Silver is now more expensive than it was two weeks ago; the price decline of last week was more than overcompensated. This pushed the gold-silver ratio down about two wh...

Read More »

Read More »

Gold-Silver Ratio Breakout Report, 28 Feb, 2016

The gold to silver ratio moved up very sharply this week, +4.2%. How did this happen? It was not because of a move in the price of gold, which barely budged this week. It was due entirely to silver being repriced 66 cents lower.

Read More »

Read More »

Gold Costs 80oz of Silver, Report 21 Feb, 2016

The big news is that the gold-silver ratio closed at 80. This is not only a new high for the move. It’s higher than it has been since 2008. It’s also exactly what Monetary Metals has been calling for. Last week, we said the gold fundamental was $1,45...

Read More »

Read More »

The Silver Blaze Report, 14 Feb, 2016

Again, we had another big drop in the dollar this week. No, we don’t mean against the dollar derivatives known as the euro, pound, etc. We mean by the only standard capable of measuring it: gold. The dollar fell 1.4 milligrams, to 25.1mg gold. Or, if...

Read More »

Read More »

Possible Silver U-Turn Report, 7 Feb

Wow, did the dollar move down this week! It dropped more than it has in quite a while. It fell 1.3mg gold, or 0.1g silver. Gold and silver bugs of course are excited, as they look at it as the prices of the metals going up $55 and 72 cents respective...

Read More »

Read More »

Possible Sign of Silver Turn, Report 31 Jan, 2016

The price of the dollar was down 50mg gold, to 27.8mg, or if you prefer 0.04g silver to 2.18g. Why do we measure the volatile dollar in terms of gold and silver? There’s nothing else to measure it, certainly not the dollar-derivatives called euro, po...

Read More »

Read More »

Monetary Metals Brief 2016

We have consistently been making the contrarian call for a falling silver price and a rising gold to silver ratio for years. This ratio has risen a lot during this time. So are we ready to change our call yet?

Read More »

Read More »

Will Gold Outperform Stocks?

Will stocks go up more, or will gold outperform? With the paperocentric theory, this is hard to answer. We have to estimate rates of inflation (meaning increases in the quantity of dollars) and calculate how much inflation (meaning rising prices of all things, consumer and asset) that will cause. Then we have to somehow put a value on gold. It boils down to a guess.

Read More »

Read More »