When the Swiss National Bank introduced the 1.20 lower limit, it wanted to eliminate the deflationary risks for Switzerland. For a certain period, namely when a global recession was looming in Autumn 2011, and the Swiss franc was hovering around 1.10, this risk was really present. In this post we would like to know if …

Read More »

Category Archive: 2.) Other safe-havens

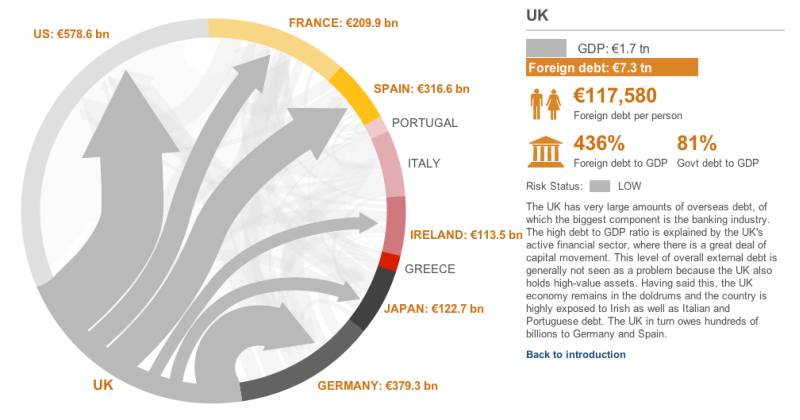

Who’s the Next Downgrade Domino to Fall?…The UK?

Who Downgrades France MUST downgrade the UK, too After Moody’s downgraded France, we are waiting the next major sovereign to suffer the same fate. According to the must-read interactive graph on the BBC, France now has a medium risk of default, but the UK is still in risk status “low”. According to the BBC, each citizen …

Read More »

Read More »

74.8 percent of Norwegians Say No to EU Membership

In the latest poll, 74.8 percent of the Norwegian population says no to EU membership, while 17.2 said they would vote yes in any referendum. 7.9 percent have not decided. Seven out of ten voters of the ruling party do not share the party’s views on the EU and would have voted no in a possible referendum, … Continue reading...

Read More »

Read More »

The new European Save-Havens: Trade SEK/CHF and NOK/CHF

After the announcement of the floor in the EUR/CHF pair, many predicted the Swedish and the Norwegian Krone to take the place of the Swiss Franc as European save-haven against the Euro turmoil (http://on.ft.com/pKSJ1V). Both countries possess a low level of debt, positive trade balance and very competitive economies.

Read More »

Read More »