Category Archive: 8a.) Economic Theory

Happy Xmas Lars von Trier

Dear friends and readers, Christmas is family time. But since my blog is contrarian, you read here a contrarian family post by one my idols, Lars von Trier. I just want to thank all my loyal readers and followers for following and commenting on my blog and any discussion on Twitter. Since the blog is driven by … Continue reading »

Read More »

Read More »

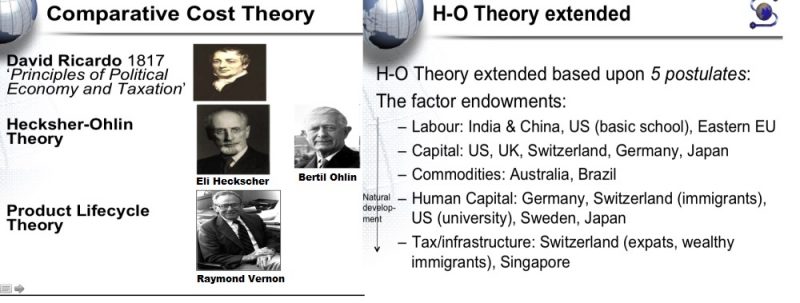

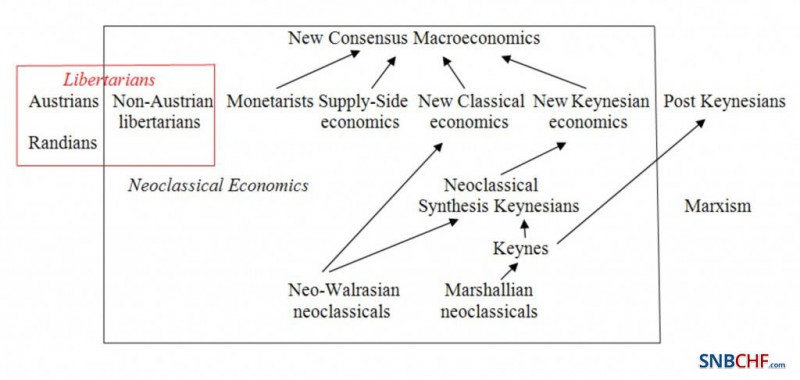

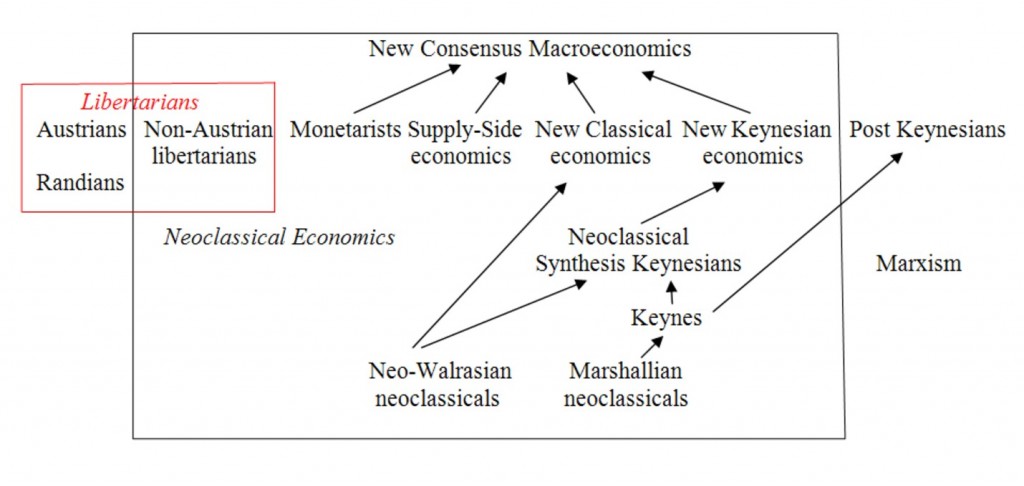

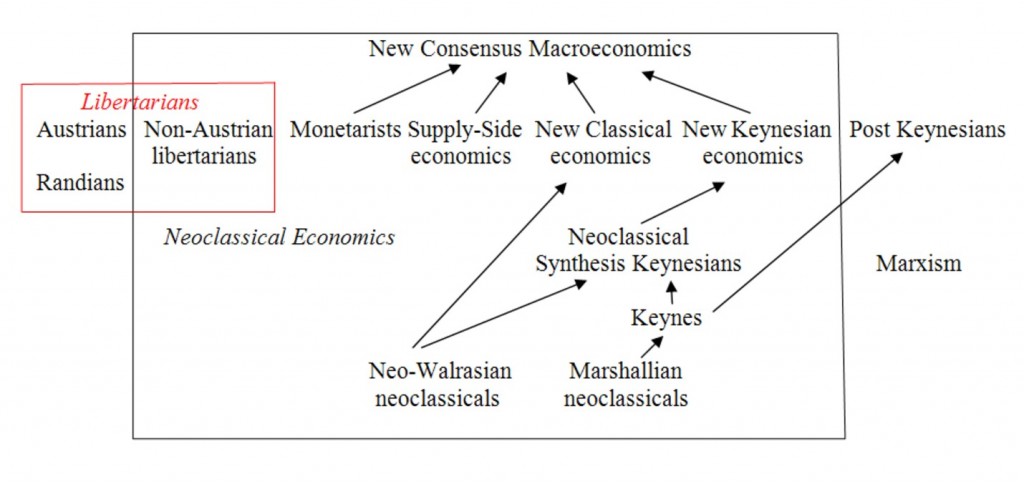

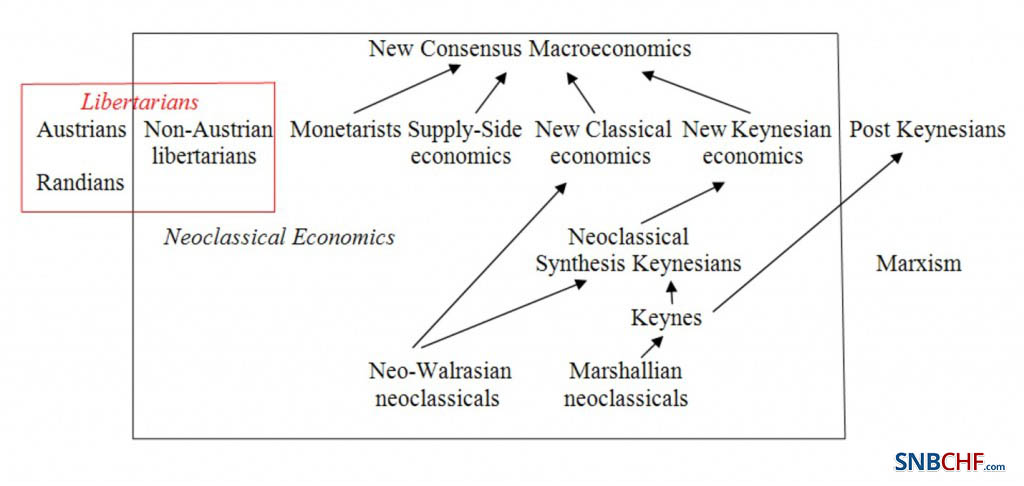

Heterodox Economic Theories and GDP

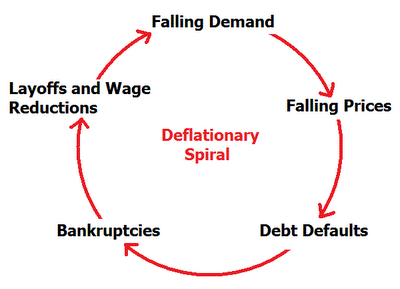

Heterodox economic theories focus on the human desires to spend, to save, to obtain credit in order to anticipate spending and future earnings, to increase or to reduce debt or even to deplete existing savings, on human behaviour. Those theories neither think that humans are rational nor that markets are efficient.

Read More »

Read More »

Volckers Attack on Stagflation

In this chapter we describe how Volcker managed to defeat stagflation; he applied the monetarist models that had been applied successfully in Switzerland and Germany. Thanks to this effort, the dollar stopped its secular decline.

Read More »

Read More »

Hans Werner Sinn’s Piketty Critique: r ≠ i > g

Hans Werner Sinn has formulated his critique with Piketty. Sinn says that r ≠ i > g. Interest rate are usually higher than economic growth, but not necessarily increases of wealth.

Read More »

Read More »

Hans Werner Sinn’s Piketty Critique: “r ≠ i > g”

Hans Werner Sinn has formulated his critique with Piketty. Sinn says that:

r ≠ i > g, hence Interest rates i are usually higher than economic growth g, but r is not the same as i. Hence r can be higher or lower than g.

Read More »

Read More »

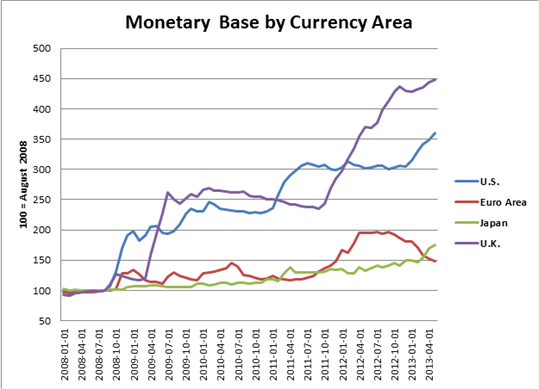

Traditional Monetarist vs. Market Monetarists

Along the double mandate of the federal reserve, monetarists can be divided into. - traditional monetarists that focus on a slow increase of money supply in order to avoid price inflation. - Market monetarists that want to target growth and income instead of inflation.

Read More »

Read More »