This page is published in the context of the real mean reversion, namely that currencies with high savings and trade surpluses must appreciate with time. One example is the Swiss franc.

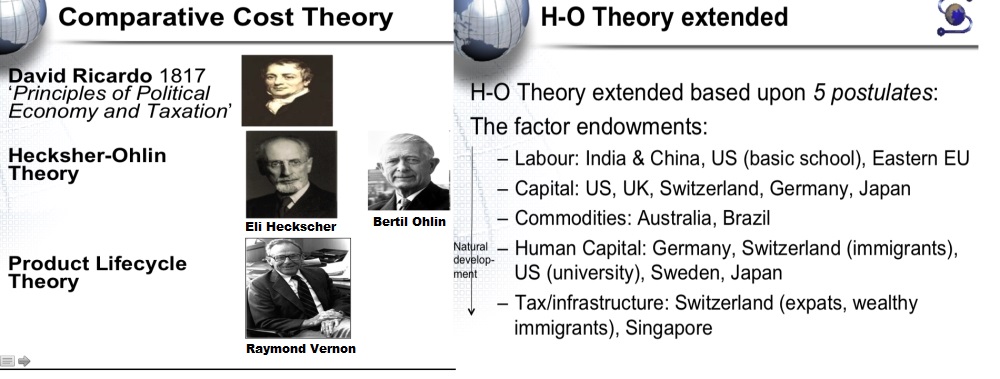

Comparative Cost Theory

Comparative Cost Theory is based on Ricardo‘s work “On the Principles of Political Economy and Taxation” that recited earlier work of the entomologist William Spence. The idea was that each country should concentrate on what they can do best, on its comparative advantage. The Heckscher-Ohlin theorem refines the comparative cost theory. Vermont’s product life cycle theory defended comparative cost theory against critiques from Leontief, against the so-called “Leontief paradox“.

The Heckscher-Ohlin model is based on four critical theorems, with the Heckscher-Ohlin theorem being one. This states that a country will export goods based on its abundant factors and import goods based on factors it lacks. For a two factor case it states: “A capital-abundant country will export the capital-intensive good, while the labor-abundant country will export the labor-intensive good.”

The critical assumption is that the countries involved are identical, apart from for the specific resources. A capital rich country will produce goods that are capital-intensive more cheaply than they would be produced in the labor-abundant country.

At the start when the counties are not trading:

- Capital-intensive goods in the capital-abundant country will be priced lower than in the other country.

- Labor-intensive goods in the labor-abundant country will be priced lower than in the other country.

The after trade is allowed, products will be moved to markets that have a temporally higher price. Resulting in:

- Capital-intensive goods being exported by the capital-abundant country.

- Labor-intensive goods being exported by the labor-abundant country.

Heckscher-Ohlin extended

We have extended the Heckscher-Ohlin theorem by some more factors that can constitute a comparative advantage versus other countries:

- Cheap labor is available e.g. in India, China, or Eastern Europe. Due to problems in the US educational system many US workers are able to deliver labor rather than other production factors. US workers without high school have a 45.1% labor participation rate (down from 46.9% one year ago), but university graduates 75.9% (down from 76.4%). The stronger fall since last year implies that certain easy US work is still outsourced to other countries.

- Capital is available in countries like the US, UK, Switzerland, Germany, or Japan. It allows them to build new technology easily.

- For us commodities have become somehow a production factor: Australia, Russia, and Brazil are three countries that focus on commodities. This is their comparative advantage, but often connected to the Dutch decease problem.

The following production factors are summarized in the term “productivity” or sometimes total factor productivity.

- Countries with an elevated level of human capital are Germany, the Scandinavian countries, Japan, and Switzerland, with the most recent wave of highly qualified people, since the Swiss-EU bilateral contracts. In the US human capital is an important factor; university level education in the US is one of the best in the world.

- Cheap tax and efficient infrastructure already represents a competitive advantage. It will become more important when more and more states start to tax the wealthy. Rich people, global companies (like Glencore), companies from the European periphery (latest example Coca-Cola Hellenic Bottling), well-educated immigrants will flee into low-tax countries, such as Switzerland and Singapore. An efficient infrastructure for doing business is also closely connected to this.

- Political freedom leads to more economic freedom and, in most cases, to less corruption. Similarly as China got economic freedom in 1978, recently Myanmar got economic freedom.

- Last but not least, mentality or geographic factors may influence productivity. This is, however, under dispute.

We have ordered the production factors by the period when they became important.

- Labor: From the beginning of humanity till 1800 it was the most important factor.

- Capital/technology: Capital has been always important, technology more from the industrial revolution.

- Commodities: are important in the current commodity super-cycle that started in the year 1998. They are overpriced from a long-term perspective thanks to cheap central bank money and an over-estimation of emerging markets’ capabilities and an under-estimation of what human capital and technology can achieve. The falling price of natural gas, thanks to shale gas, is an example of the commodities super-cycle that will end one day. The rise of commodities, for example copper, is strongly connected with the real-estate bubbles in many countries.

- Human Capital: This is currently, and since the IT revolution, the most important production factor. Apart from aging, the lack of human capital is a major factor that might cause China, but even more other emerging markets like Brazil to struggle to deliver the largest share of global growth in the future. For more details why Chinese growth rates will go down due to a lack of human capital. See UBS senior advisor George Magnus great paper “Asia: Is the Miracle Over?” (also as “The Great Recoupling” on Zerohedge)

- Tax and efficient infrastructure: have become an important production factor in recent years and will become more important. Companies and workers decide where they should work based on these factors. In international trade, tax questions decide where the sales department is situated, because profits are made in this country

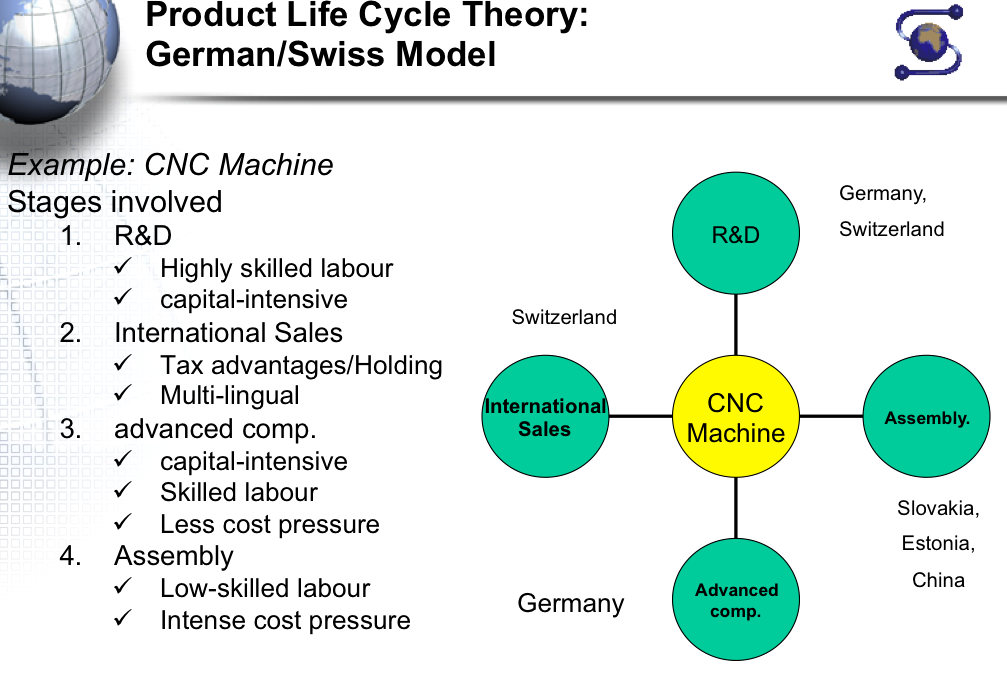

Product Life Cycle Theory

This graph depicts an application of Vernon’s product life cycle theory for the global export model of a Swiss or German company. Most labor-intensive work is done in cheap countries like China, Slovakia, or Estonia. Research is done in Switzerland or Germany. Advanced components are produced in Germany. Swiss employees execute global sales. Since a considerable part of the work force is situated in Switzerland the firm can charger a lower transfer price and can move a bigger part of the profit taking into Switzerland and benefit from lower taxes. A similar model is the “double Irish sandwich“.

My presentation on Dukascopy TV summarizes some of these points related to the Swiss franc.

Further Bibliography

Bela Balassa, An Empirical Demonstration of Classical Comparative Cost Theory, Vol. 45, No. 3 (Aug., 1963), pp. 231-238, Published by: The MIT Press

George Magnus, UBS Senior Economic Advisor: “Asia – Is the Miracle Over”, Online

Murray N. Rothbard, Classical Economics (LvMI) (An Austrian Perspective on the History of Economic Thought), April 13, 2010, Ludwig von Mises Institute, ASIN: B003H4R8N8, Extracts on Ricardo online

Daron Acemoglu, James Robinson: Why Nations Fail: The Origins of Power, Prosperity, and Poverty, Crown Publishing, 2012, 0307719219

See more for

1 comment

Mary Spaeth

2017-02-02 at 02:28 (UTC 2) Link to this comment

Hi. It seems that you have some awareness of these economic principles, but the faulty spelling of individuals you describe is mildly embarrassing. Please do edit your pages! Raymond Vernon, for example. Eli, not Eki. Etc.