Post Keynesians are similarly as Marxists on the left side of the economic spectrum. Essentially they are left-wing economists who want more state intervention because they strongly believe in the power of central banks and the power of money creation.

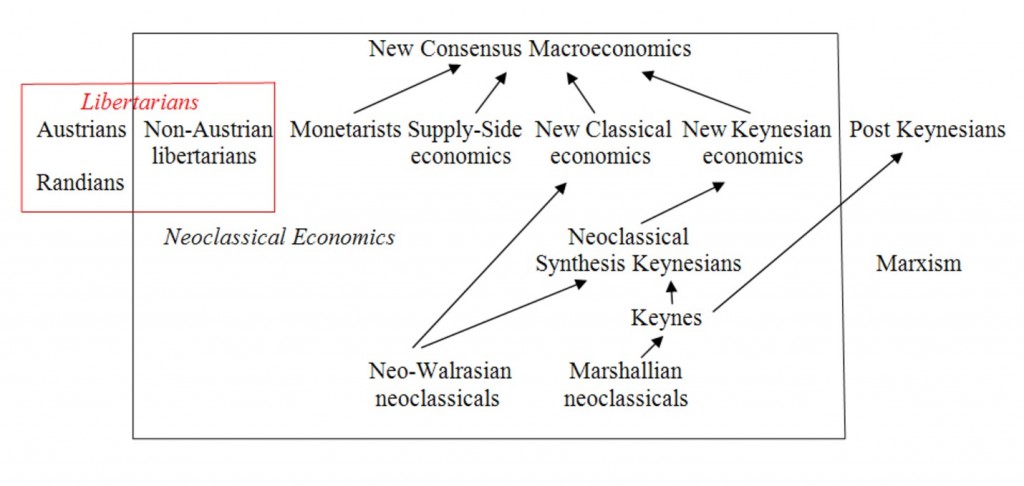

Major economic schools (source) - Click to enlarge

Post Keynesian is a more radical development of Keynesian theory, true to Keynes’ fundamental ideas (if not to all his more conservatively-minded policy recommendations), and has always rejected the foundational neoclassical axioms (namely, the gross substitution axiom, neutrality of money axiom, and the ergodic axiom). Here some details on these three axioms and why Post Keynesians reject them: (source Lars Syll, Real World Economics Review Blog)

John Maynard Keynes’s 1936 book The General Theory of Employment, Interest, and Money attempted to overthrow classical theory and revolutionize how economists think about the economy. Economists who build upon Keynes’s General Theory to analyze the economic problems of the twenty-first-century global economy are called Post Keynesians. Keynes’s “principle of effective demand” (1936, chap. 2) declared that the axioms underlying classical theory were not applicable to a money-using, entrepreneurial economic system. Consequently, the mainstream theory’s “teaching is misleading and disastrous if we attempt to apply it to the facts of experience” (Keynes 1936, p. 3). To develop an economic theory applicable to a monetary economy, Keynes suggested rejecting three basic axioms of classical economics (1936, p. 16).

Some axioms that Keynes suggested for rejection are still part of the foundation of twenty-first-century mainstream economic theory. Post Keynesians have thrown out the three axioms that Keynes suggested rejecting in The General Theory. The rejected axioms are the ergodic axiom, the gross-substitution axiom, and the neutral-money axiom, which are explained below. Only if these axioms are rejected can a model be developed that has the following characteristics:

- Money matters not only on the short run like the common consensus thinks, but also on the long run, that is, changes in the money supply can affect decisions that determine the level of employment and real economic output.

- As the economic system moves from an irrevocable past to an uncertain future, decision makers recognize that they make important, costly decisions in uncertain conditions where reliable, rational calculations regarding the future are impossible.

- People and organizations enter into monetary contracts. These money contracts are a human institution developed to efficiently organize time-consuming production and exchange processes. The money-wage contract is the most ubiquitous of these contracts.

- Unemployment, rather than full employment, is a common laissez-faire situation in a market-oriented, monetary production economy.

Differences

1) “The future is uncertain”: rejection of the ergodic axiom

The ergodic axiom postulates that all future events are actuarially certain, that is, that the future can be accurately forecasted from an analysis of existing market data. Consequently, this axiom implies that income earned at any employment level is entirely spent either on produced goods for today’s consumption or on buying investment goods that will be used to produce goods for the (known) future consumption of today’s savers. In other words, orthodox theory assumes that all income is always immediately spent on producibles, so there is never a lack of effective demand for things that industry can produce at full employment. The proportion of income that households save does not affect total (aggregate) demand for producibles; it affects only the composition of demand (and production) between consumption and investment goods. Thus, saving creates jobs in the capital-goods-producing industries just as much as consumption spending creates jobs in the consumer-goods-producing industries. Post Keynesian theory rejects the ergodic axiom.In Post Keynesian theory, however, people recognize that the future is uncertain (nonergodic) and cannot be reliably predicted. Consequently, people decide on how much of current income is spent on consumer goods and how much is not spent on consumption goods but is instead saved by purchasing various liquid assets.

Liquid assets are time-machine vehicles that savers use to store and transport savings to an indefinite future date or dates. Unlike savers in the classical system who can reliably predict their economic future, real-world savers do not know exactly what they will buy, and what contractual obligations they will incur, at any specific future date. As long as money discharges all contractual obligations and monetary contracts are used to organize production and exchange activities, the possession of money (and liquid assets that have small carrying costs and can be easily resold for money) means that holding one savings in the form of liquid assets gives savers the ability to demand products whenever they desire in the uncertain future and/or to meet a future unforeseen contractual commitment. Liquid assets are savers’ security blankets, protecting them from possible hard times. As Nobel Price winner John Hicks has stated, income recipients know that they “do not know just what will happen in the future” (1977, p. vii).

2) “Saving is lacking demand”: rejection of gross-substitution axiom

Keynes (1936, chap. 17) argued that money (and all liquid assets) have two essential properties. First, money does not grow on trees, and hence labor cannot be hired to harvest money trees when income earners reduce consumption to save more in the form of money or liquid assets. Accordingly, the decision to consume rather than to save is a choice between an employment-inducing demand and a non-employment-inducing demand. When savings increase at the expense of the demand for producibles, sales and employment decline. Second, liquid asset prices will increase as new savings increase the demand for such assets. Because of high carrying and high resale costs, producible durables are not gross substitutes for liquid assets, contrary to the classical gross-substitution axiom where the latter assumes anything is a good substitute for anything else. Post Keynesians reject the gross substitution axiom as applicable to assets that savers use to store their savings. Consequently, higher liquid asset prices do not divert this savings demand for liquid assets to a demand for producibles whose relative price has declined.

3) “More money means more employment”: rejection of neutrality of money

For Post Keynesians, investment spending on producible durables is constrained solely by entrepreneurs’ expectations of profits. If the future is uncertain, these expectations depend on “animal spirits” rather than on a reliable calculation of future profit income (Keynes 1936, p. 161). In an economy where money is created by banks, if entrepreneurs borrow from banks to finance the production of working capital goods, the resulting increases in the quantity of money will be associated with increasing employment and output. In contrast, the classical neutral-money axiom implies that, for example, if the money supply increases as people borrow more from banks, this change in the money quantity cannot affect the level of employment or output. Post Keynesians reject the classical neutral-money axiom when they argue that changes in the money supply due to borrowing from banks to finance the production of investment goods affect the level of employment and output in both the short run and the long run.

Consequently, Post Keynesians reject the IS-LM model of Hicks, the Phillips curve, and the empirically unsupported notion of the liquidity trap (Davidson 2002: 95).

BIBLIOGRAPHY

Davidson, Paul. 1994. Post Keynesian Macroeconomic Theory: A Foundation for Successful Economic Policies for the Twenty-First Century. Cheltenham, U.K.: Elgar Publishing.

Davidson, P. 2002. Financial Markets, Money, and the Real World, Edward Elgar, Cheltenham.

Hicks, John R. 1977. Economic Perspectives. Oxford: Clarendon Press.

Keynes, John Maynard. 1936. The General Theory of Employment, Interest, and Money. New York: Harcourt, Brace.

See more for