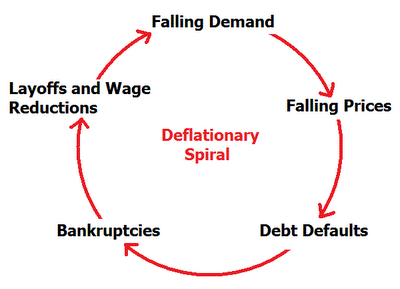

Fisher’s classic Deflationary Spiral, where falling prices, defaults, bankruptcies, and falling wages reinforce each other in a continuous cycle.

(Update after end of EUR/CHF peg. On several occasions, we explained that a deflationary spiral will not happen in Switzerland,

Thomas Jordan confirmed that view when he announced the peg exit).

The deflationary spiral in 2008/2009 vs. the 1930s

Initially deflation may appear to be a beneficial thing, as in, “Shouldn’t falling prices be great for consumers?” or “Hey, what’s wrong with lower prices?”

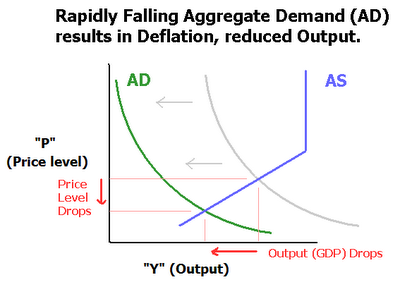

The truth is that deflation, while initially and outwardly attractive, is really symptomatic of a serious collapse in across-the-board aggregate demand. It is equivalent to the falling body temperature of a patient that is hanging on to life.

Deflation has game-theoretic implications: sellers are reluctant to sell at the current low prices and buyers refuse to buy at the prevalent prices, in the expectation that prices will drop even further. For example, housing markets from the US to China have seized up as both parties refuse to approach the table. (Credit concerns factor-in too, but lets just focus on the deflation here).

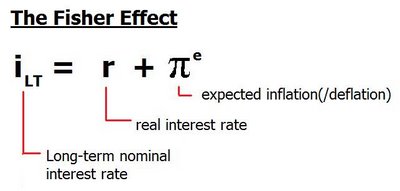

This update focuses on a feature of deflation that is not included in most of the prevailing deflation literature—the role of the Fisher Effect and of real interest rates in a deflationary environment.

The Fisher Effect is: (Nominal Long-term Interest Rates = [ Real Interest Rates ] + [ Expected Inflation (Deflation) ]

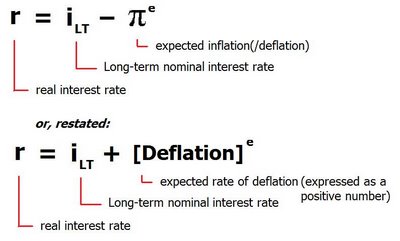

Rewriting, we have: Real Interest Rates = [ Nominal Rates ] – [Expected Inflation (Deflation) ]

The real rates are simply the real interest earned by savers (in terms of actual purchasing power) and simultaneously, the real interest “lost” by borrowers.

If we have deflation in the future, at say -2.5%, and if Fed Chairman Bernanke has interest rates down to 0.1% (for example) then we get real rates as:

r = 0.1% – (-2.5%),

or,

r = 0.1% + 2.5% = 2.6% !

In other words, despite near-zero nominal interest rates, we have positive real rates. This encourages savings, and strongly discourages borrowing. It simply makes sense to save. Even if CDs pay low rates (the nominal rates) the accompanying deflation results in a high effective real rate! It “makes sense” to park your money, and not to borrow.

The Fisher Effect also illustrates how the real cost of any and all debts grow as a result of Deflation.

By way of example, say that with real-estate significantly off from its recent highs, you decide that your dream-house is finally within reach.

Being a responsible borrower with good credit, you put 25% down today and qualify for a 30-year $200,000 mortgage at 6%.

After a year of making timely payments at $1200/month, in December 2009 your principal amount is down to $197,544. So far, so good.

However: if the rate of Deflation is 2.5%, the real value of this debt in today’s dollars is $202,482. Despite doing everything right, your debt has grown and you owe more in real dollars than you did when you started!

Knowing this, private and business borrowers everywhere focus their energies on saving and paying down debt wherever possible, rather than consuming or expanding, which exacerbates the drop in Demand, further accelerating the rate of Deflation. Bankruptcies follow for individuals and businesses who cannot pay the ever-increasing real value of their debts, and prices continue to fall.

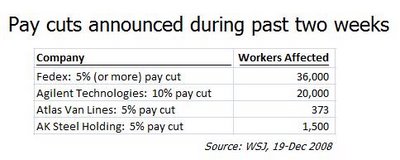

To this potent mix must be added declining wages, evidence of which is growing.

Aside from outright pay cuts, many companies have announced massive layoffs, unpaid leave, and wage & benefit freezes.

The downward movement of wages and employment adds yet more pressure on the already falling Aggregate Demand. All of these factors can potentially add up to the classic Deflationary Spiral, where falling prices, defaults, bankruptcies, and falling wages reinforce each other in a continuous cycle.

Getting out of a Deflationary Spiral is notoriously difficult (as Japan has learned over the past decade and a half).

The severe depression following the Panic of 1873 subsided only after exhausting itself through massive liquidation, but is considered by many to be simply the start of the Long Depression, which lasted for more than twenty years, until the late 1890’s.

Fisher’s times: The Great Depression

The economy did not fully recover from the Great Depression, and ensuing downturn, until America’s entry into World War II.

These are the two major severe Deflationary episodes in the US over the past 150 years. Unfortunately, other than liquidation, and war, policy prescriptions to escape a Deflationary Depression are purely theoretical.

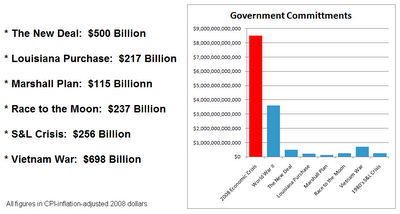

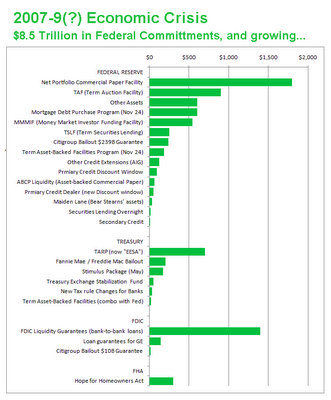

Our economic policymakers are well aware of this, which is why everything including the kitchen sink is being thrown at the growing crisis:

source Ritholtz

By comparison with past crises, the level of Federal Commitment is staggering. Here is how the present $8.5 Trillion commitment (so far) compares with other historical Government commitments, in constant 2008 dollars:

The incoming administration promises an additional $775 Billion (or more) in additional stimulus aimed at spurring economic recovery. All of this firepower being brought to bear on the crisis is sure to have significant effects, some positive, hopefully fewer negative, and, certainly, many unintended.

Sources for the articles are Macrobuddies and The Economist

See more for

1 comment

Anonymous

2018-04-30 at 13:28 (UTC 2) Link to this comment

Very well explained! Thanks a ton!