On this page we explain one type of rational expectations that lead to financial or credit cycles. The expectation in the 1970s was that wages must rise more quickly than prices (positive real wages) or for employers that sales prices must increase more quickly than wages. This leads to a price-wage spiral and finally it destroys the effectiveness of monetary policy (so called Lucas Critique). We explain useful concepts behind, like NAIRU and the expectations-augment Philips curve.

NAIRU

At the height of the Phillips curve’s popularity as a guide to policy, Edmund Phelps and Milton Friedman independently challenged its theoretical underpinnings. They argued that well-informed, rational employers and workers would pay attention only to real wages—the inflation-adjusted purchasing power of money wages. In their view, real wages would adjust to make the supply of labor equal to the demand for labor, and the unemployment rate would then stand at a level uniquely associated with that real wage—the “natural rate” of unemployment.Both Friedman and Phelps argued that the government could not permanently trade higher inflation for lower unemployment. Imagine that unemployment is at the natural rate. The real wage is constant: workers who expect a given rate of price inflation insist that their wages increase at the same rate to prevent the erosion of their purchasing power. Now, imagine that the government uses expansionary monetary or fiscal policy in an attempt to lower unemployment below its natural rate. The resulting increase in demand encourages firms to raise their prices faster than workers had anticipated. With higher revenues, firms are willing to employ more workers at the old wage rates and even to raise those rates somewhat. For a short time, workers suffer from what economists call money illusion: they see that their money wages have risen and willingly supply more labor. Thus, the unemployment rate falls. They do not realize right away that their purchasing power has fallen because prices have risen more rapidly than they expected. But, over time, as workers come to anticipate higher rates of price inflation, they supply less labor and insist on increases in wages that keep up with inflation. The real wage is restored to its old level, and the unemployment rate returns to the natural rate. But the price inflation and wage inflation brought on by expansionary policies continue at the new, higher rates.

Friedman’s and Phelps’s analyses provide a distinction between the “short-run” and “long-run” Phillips curves. So long as the average rate of inflation remains fairly constant, as it did in the 1960s, inflation and unemployment will be inversely related. But if the average rate of inflation changes, as it will when policymakers persistently try to push unemployment below the natural rate, after a period of adjustment, unemployment will return to the natural rate. That is, once workers’ expectations of price inflation have had time to adjust, the natural rate of unemployment is compatible with any rate of inflation. The long-run Phillips curve could be shown here as a vertical line above the natural rate.

The Lucas Critique and the policy-ineffectiveness proposition

The policy-ineffectiveness proposition (PIP) is a new classical theory proposed in 1976 by Thomas J. Sargent and Neil Wallace based upon the theory of rational expectations. It posited that monetary policy could not systematically manage the levels of output and employment in the economy. (source Wiki)

The original Phillips curve, that maintains that inflation and unemployment are in a linear (inverse) relationship, was not valid any more. Robert Lucas of the University of Chicago opened a big discussion.

The ‘Lucas critique’ is a criticism of econometric policy evaluation procedures that fail to recognize that optimal decision rules of economic agents vary systematically with changes in policy. In particular, it criticizes using estimated statistical relationships from past data to forecast the effects of adopting a new policy, because the estimated regression coefficients are not invariant but will change along with agents’ decision rules in response to a new policy. A classic example of this fallacy was the erroneous inference that a regression of inflation on unemployment (the Phillips curve) represented a structural trade-off for policy to exploit.

The Expectations-Augmented Phillips Curve

The original curve would then apply only to brief, transitional periods and would shift with any persistent change in the average rate of inflation. These long-run and short-run relations can be combined in a single “expectations-augmented” Phillips curve. The more quickly workers’ expectations of price inflation adapt to changes in the actual rate of inflation, the more quickly unemployment will return to the natural rate, and the less successful the government will be in reducing unemployment through monetary and fiscal policies.

The 1970s provided striking confirmation of Friedman’s and Phelps’s fundamental point. Contrary to the original Phillips curve, when the average inflation rate rose from about 2.5 percent in the 1960s to about 7 percent in the 1970s, the unemployment rate not only did not fall, it actually rose from about 4 percent to above 6 percent.

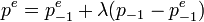

Augmented expectations for inflation had the following formula:

Most economists now accept a central tenet of both Friedman’s and Phelps’s analyses: there is some rate of unemployment that, if maintained, would be compatible with a stable rate of inflation. Many, however, call this the “nonaccelerating inflation rate of unemployment” (NAIRU) because, unlike the term “natural rate,” NAIRU does not suggest that an unemployment rate is socially optimal, unchanging, or impervious to policy.

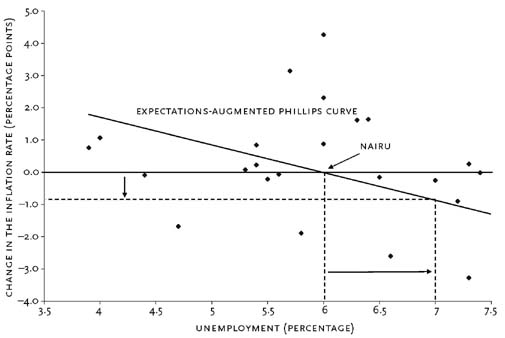

A policymaker might wish to place a value on NAIRU. To obtain a simple estimate, Figure 2 plots changes in the rate of inflation (i.e., the acceleration of prices) against the unemployment rate from 1976 to 2002. The expectations-augmented Phillips curve is the straight line that best fits the points on the graph (the regression line). It summarizes the rough inverse relationship. According to the regression line, NAIRU (i.e., the rate of unemployment for which the change in the rate of inflation is zero) is about 6 percent. The slope of the Phillips curve indicates the speed of price adjustment. Imagine that the economy is at NAIRU with an inflation rate of 3 percent and that the government would like to reduce the inflation rate to zero. Figure 2 suggests that contractionary monetary and fiscal policies that drove the average rate of unemployment up to about 7 percent (i.e., one point above NAIRU) would be associated with a reduction in inflation of about one percentage point per year. Thus, if the government’s policies caused the unemployment rate to stay at about 7 percent, the 3 percent inflation rate would, on average, be reduced one point each year—falling to zero in about three years.

Using similar, but more refined, methods, the Congressional Budget Office estimated (Figure 3) that NAIRU was about 5.3 percent in 1950, that it rose steadily until peaking in 1978 at about 6.3 percent, and that it then fell steadily to about 5.2 by the end of the century. Clearly, NAIRU is not constant. It varies with changes in so-called real factors affecting the supply of and demand for labor such as demographics, technology, union power, the structure of taxation, and relative prices (e.g., oil prices). NAIRU should not vary with monetary and fiscal policies, which affect aggregate demand without altering these real factors.

Further reading

[3] The real-world economic blog: The ergodic axiom: Davidson versus Stiglitz and Lucas

[4] Henry George’s two great purposes in Progress and Poverty: Land speculation and the boom-bust cycle.