Mainstream Economic Theory: The Short Run

The aim of this page is to provide economic theory and criteria for the short run and to compare Switzerland to other countries based on these criteria. In this chapter we concentrate on mainstream economics or “New Consus Macroeconomics” as defined here. The “mainstream economic theory” is best described in the completely new edition of the following book.

Check here to see more details.

The IS-LM model

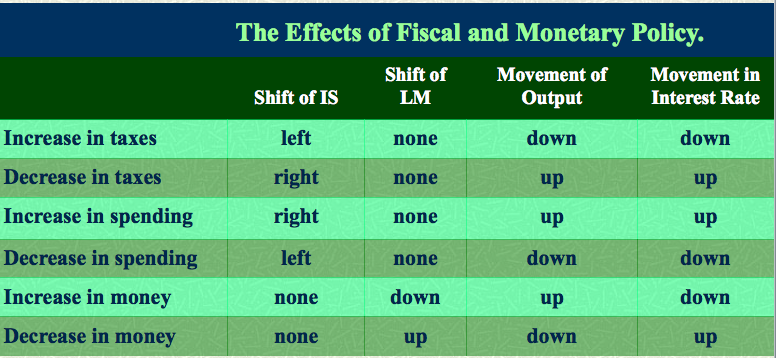

The most common model for the short run is the IS-LM model of Harrod, Hicks and Meade, a way of formalizing parts of Keynes’ “General Theory of Employment, Interest and Money”. It examines the influences of taxes, government spending and money supply increases on the IS curve, the LM curve, output growth and interest rates. In the IS curve, interest rates i are a function of output Y: interest rates rise with higher output. In the LM curve, interest rates i are a function of money M/P: With rising money interest rates increase.

The IS-LM Model (source)

Other Factors that can affect growth in the short term

Commodity Prices. A rise in commodity prices such as a rise in oil prices can cause a shock to growth. It causes SRAS to shift to the left leading to higher inflation and lower growth. A slowing of commodity prices often helps the United States to come out of a trough (like in the oil glut in the 1980s, cheap oil prices in 2009 or in the autumn/winter 2011). Estimates say that half the current US trade deficit results from imported oil.

Political Instability. Political instability can provide a negative shock to growth.

Weather. The exceptionally cold December in UK 2010, led to a shock fall in GDP. Similarly the unusually warm winter in the US in 2012 saw the GDP rising.

Bibliography:

Hicks, J. R. (1937), “Mr. Keynes and the Classics – A Suggested Interpretation”, Econometrica, v. 5 (April): 147-159.

Keynes, John Maynard. 1936. The General Theory of Employment, Interest, and Money. New York: Harcourt, Brace.

See more for