When you’re dealing with Switzerland, Mr. Allon, is’s best to keep one thing in mind. It’s a business, and it’s run like a business. It’s a business that is constantly in a defensive posture. It’s been that way for seven hundred years.

—- Daniel Silva, The English Assassin

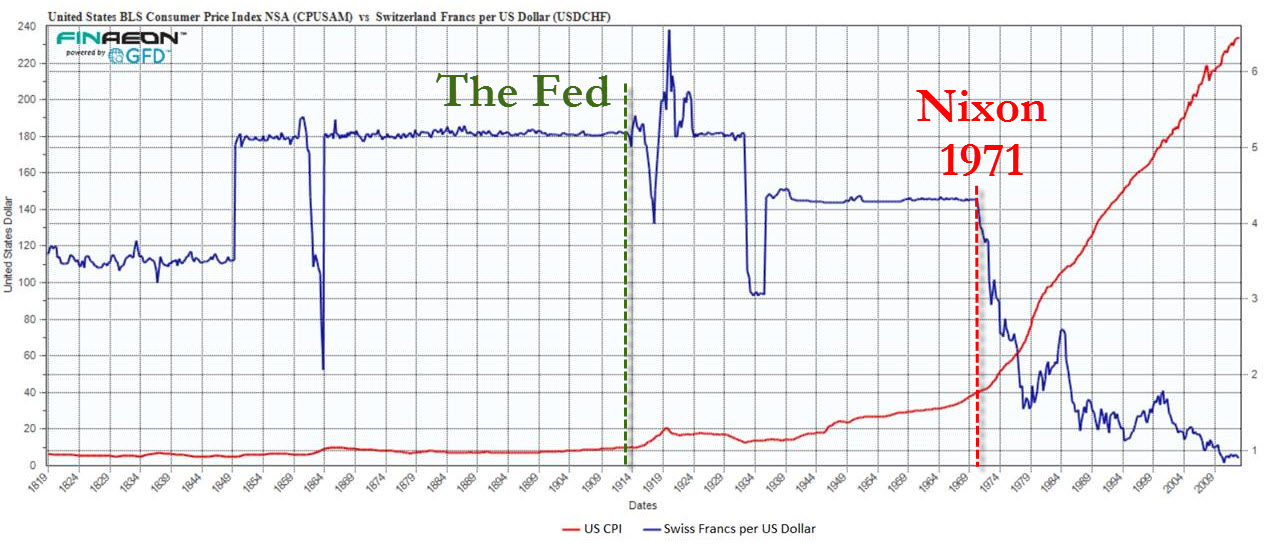

The following graph shows the very long-term FX rate between the dollar and the Swiss franc (blue line) and on the other side the living costs in the U.S as expressed by the CPI (red line). Obviously the value of the dollar started its descent at the moment then the Fed was created. The Swiss Franc, however, showed a stability that is only comparable to gold.

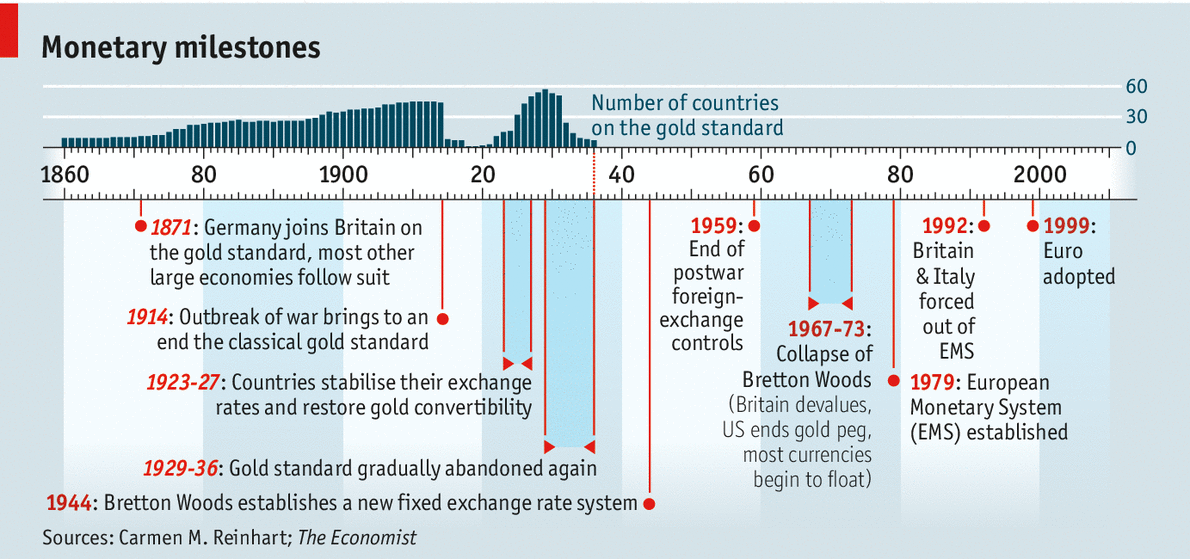

The following overview indicates the most important monetary events.

source The Economist

Click for the following chapters:

1860-1971: The Swiss Franc during the Gold Standard and Bretton Woods

Since the 1950s: The long-term view on the Swiss franc and the correlation to gold

1971-1996 History wrap-up: From the end of Bretton Woods until the Swiss real estate crisis

1970s: Due to US Stagflation CHF Strengthens Massively

1978-1979: Volcker’s Attack on Stagflation

1978: The Volcker Moment and the First Cap on CHF

1978-1983: Volcker’s defeat of inflation strengthens dollar, weakens Swiss franc and gold

1980s: The Volcker Shock, the oil glut and the breakdown of gold and Emerging Markets

1986-1996: Swiss real estate Boom and Bust

1996-2004: Weak German and Swiss growth

2000-2007: The sale of Swiss gold reserves

2004 to 2009: Global Carry Trade and the undervalued franc

2008-2011: The Financial Crisis and the SNB Interventions

2012:The Swiss Franc becomes a “safe” Risk-On currency

The following two chapters give more background about the 1970s:

1970s: “Cost-Push Inflation” Myth and the 1970s Stagflation

See more for

3 comments

teberin

2014-08-12 at 16:25 (UTC 2) Link to this comment

im about to cause the Swiss Banking establishment some serious heart burn if they dont “fix” this problem.

My daughter took a 1000 SW note to a large London Bank to get it converted to British Pounds. This 1000 SW note has been in her father’s bank deposit box since 1978 when it was given to him AT A SWISS BANK in exchange for US Dollars at the time.

She was informed at the London bank that the note is “out of date” and won’t be honored.

the 1976-issued notes are supposed to be honored until 2020.

what’s going on ?

thank you for any information you may have to share

George Dorgan

2014-08-13 at 05:31 (UTC 2) Link to this comment

Maybe you got to change it directly at the SNB, not every bank in the world will do that.

http://www.snb.ch/en/mmr/reference/instr_recalled_notes/source/instr_recalled_notes.en.pdf

gerwaz

2015-02-09 at 18:47 (UTC 2) Link to this comment

hi, does anybody know where to find CHF/USD chart from 1920 to 1950 years?