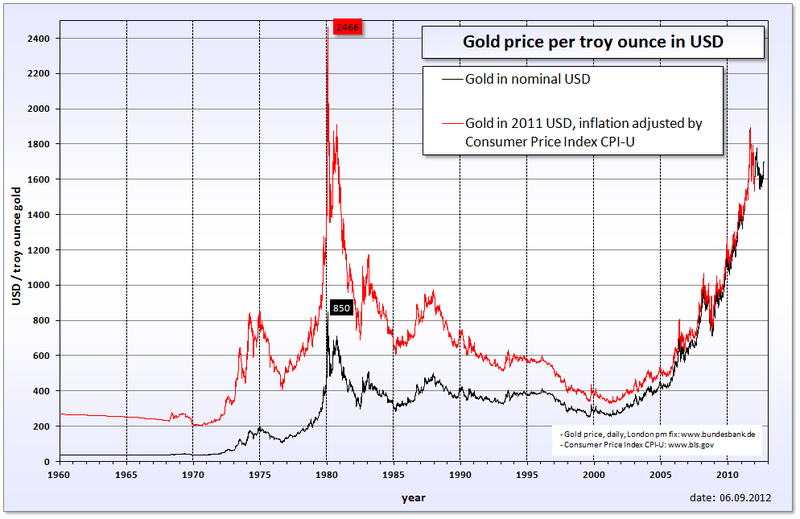

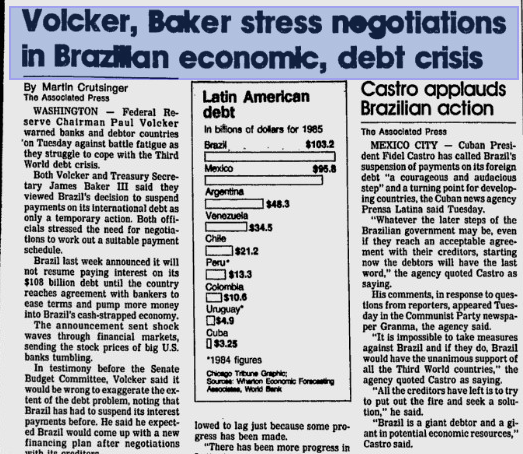

After the Volcker moment or sometimes called “Volcker shock”, commodity prices plunged, the gold price collapsed. Thanks to additional supply, e.g. from Northsea oil, a so-called oil glut appeared. After the increase of debt in the 1970s, some economies in Southern America collapsed. The major reason was Volcker’s tight monetary policy with high interest rates and the dependency on US funds. Global economic growth remained lack-lustre during these years.

|

Gold Price Inflation Adjusted(see more posts on gold price, ) |

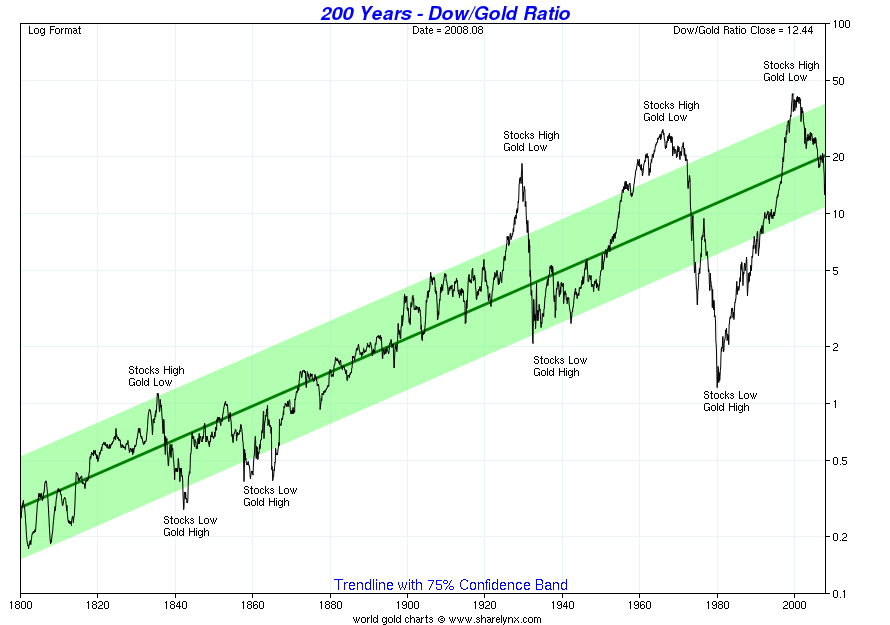

| With the high inflation the Dow-Gold ratio fell from 25.1 to 1.5 in the year 1980. Investors, however, prefer to hold gold, oil or other commodities when global growth demands more of the assets and the US expansion is hampered by the high costs of imported oil.

The maybe most important reason that the US dominance continued in the 1990s, was the US lead in the computer revolution. With the decline of the US from the year 2001, this tendency completely changed again. The Dow-Gold ratio inverted from levels of 1.5 in 1980 with the strong US economy, positive real interest rates and weak emerging markets. |

Dow-Gold Ratio 200 years(see more posts on gold ratio, ) |

| Emerging markets like Mexico and Brazil initiated in the 1970s a growth path via rising oil and commodity prices and the increase of debt – based on the at time very strong Keynesian influences. From 1982 on they did not receive enough income from commodities, the dutch disease of the 1970s became apparent. Growth in emerging markets, especially in Latin America collapsed, it let a lost decade. |

Volcker and the Brazil Debt Crisis |

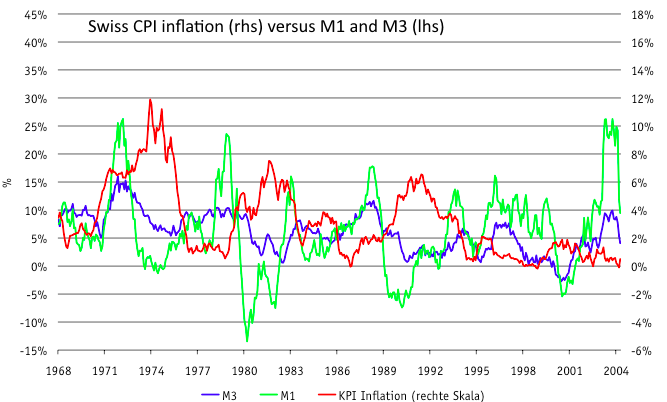

| Oil was cheap. The Swiss safe-haven, that takes profit of short distances in times of high oil prices and that has trade surpluses to emerging markets, was not needed any more.Still in 1976 the Swiss had sent home many foreign workers. The combination of a weaker currency, a lack of labor supply and wage inflation translated into heavy price inflation. Inflation was over 6% in 1981 and 1982. This high inflation was only repeated in 1990/1991 when another oil glut depressed prices. German wage inflation in expectation of the reunification plus the effects of the 1987 monetary expansion in response to the stock market crashed caused inflation to rise over 5% again.

As opposed to 2014, however, the Swiss did not have a far lower current account surplus during earlier oil gluts. Volcker saved the United States and made the emerging markets relatively poor, for nearly two decades. Oil was cheap. |

Price Inflation Follows Monetary Expansion Price Inflation follows Monetary Expansion ebrand SNB Source: snb.chf - Click to enlarge |

Read also:

History: The Lost 1980s Decade in Latin America

Bibliography

Bloomberg News, How Volcker Launched His Attack on Inflation, Online

Bennett T. McCallum, The Concise Encyclopeida of Economics, Monetarism, Online

Kirk Lindstrom, Dow-Gold Ratio Continues Climb As ‘Civilized’ Investors Buy Equities, in Seeking Alpha, Online

See more for