Excessive imbalances in the Bretton Woods system arrived every couple of years. Countries with negative trade balances and fiscal deficits often devalued their currency in order to gain competitiveness. Some of them reduced debt by paying less interest on government bonds than the inflation rate, negative real rates, sometimes called “financial repression“. Examples are the UK and the U.S. that via financial repression and GDP growth managed to reduce the debt obtained in WWII.

Similarly to gold, Switzerland established itself as an anchor of stability. The reasons are:

|

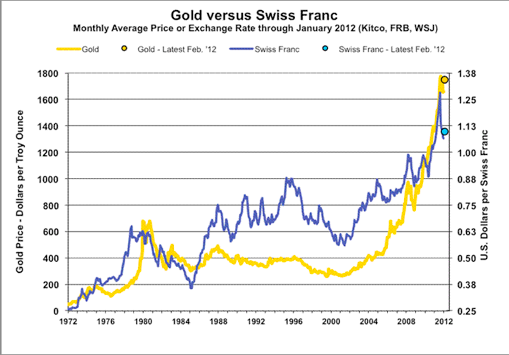

Gold vs. Swiss Franc(see more posts on USD/CHF, ) |

|

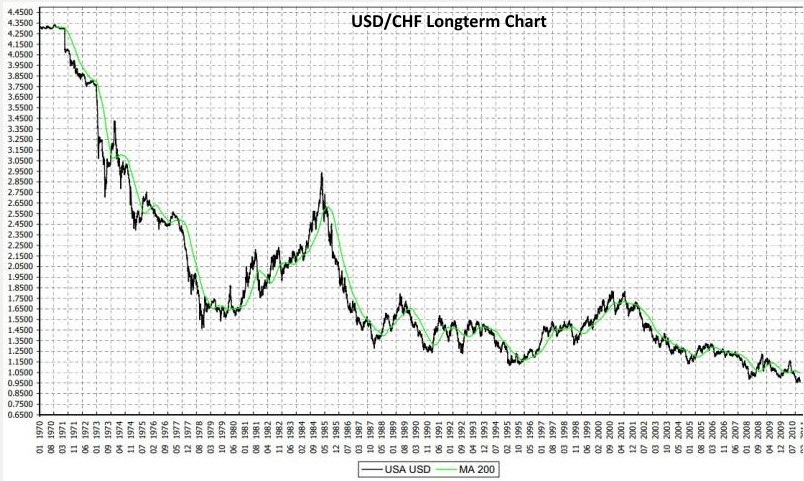

USD/CHF Longtime Chart(see more posts on USD/CHF, )

|

|

Real trade-weighed value of Swiss franc |

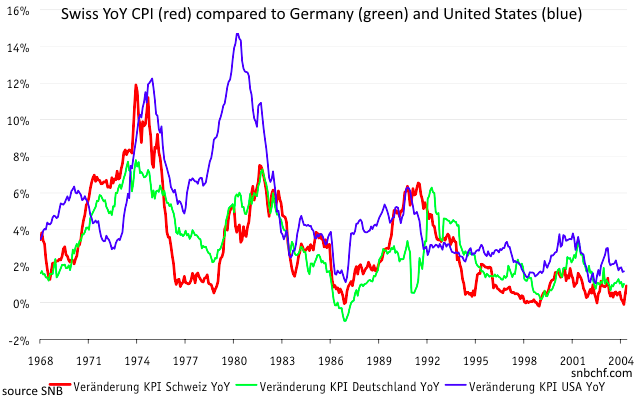

CPI Inflation US (blue), Germany (green), Switzerland (red)Since 1975 the Swiss inflation (red line) was always lower than US inflation (blue line). Only on two occasions, before the oil price crisis of 1973 and during the Swiss real estate bubble in the early 1990s, the Swiss CPI was considerably higher than German one |

Swiss CPI, Germany, US Compared(see more posts on Switzerland Consumer Price Index, ) Swiss CPI vs. Germany, US Source: Hildebrand (2004) - Click to enlarge |

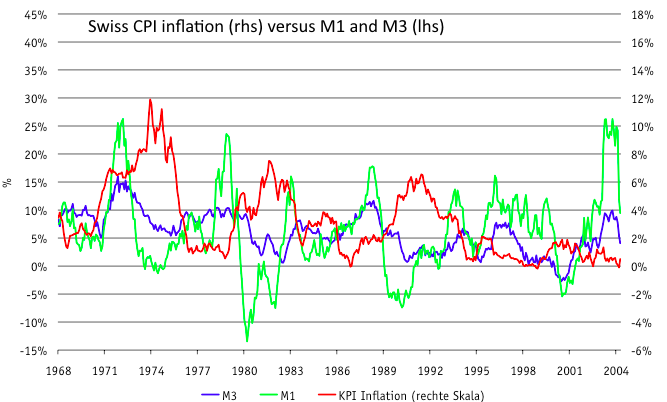

Price inflation follow money inflation

|

Price Inflation Follows Monetary Expansion Price Inflation follows Monetary Expansion ebrand SNB Source: snb.chf - Click to enlarge |

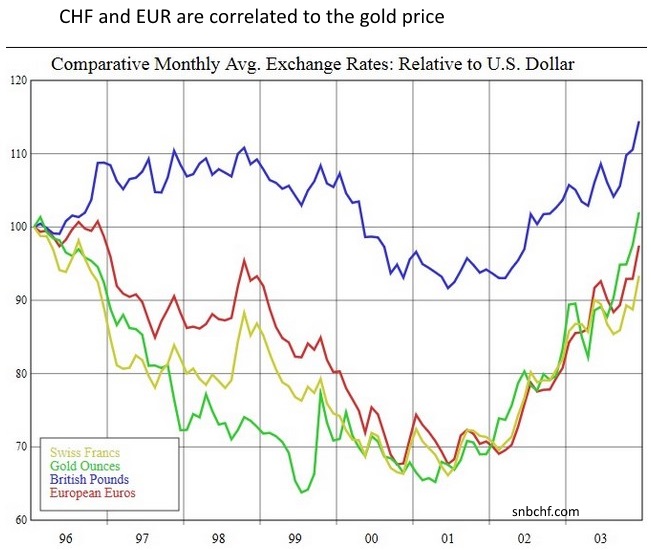

CHF appreciated in crises with high inflation together with gold and depreciated during phases of low inflation

On the other side, the franc was always a volatile currency that appreciated in global crises and periods of high inflation – as safe-haven and/or inflation-hedge similarly to gold. During periods of strong global economic expansions that did not translate into high inflation, the franc depreciated, examples are the early 1980s, the late 1990s or 2005-2008. Hence the CHF was historically correlated to gold not only thanks to the big accumulation of gold reserves achieved from the strong Swiss trade surpluses. But also the slow wage increases and the inflation aversion of its central bank and its people contributed to this correlation. Until the late 1990s, the Swiss constitution even required that currency in circulation was (partially) backed by gold. Consequently the franc often reached overvalued territory more or less at the same time when gold reached its highs. |

Gold EUR CHF Correlation |

1 ping

Tour de Brexit – Britain says See EU Later as May signs Article 50 letter and triggers Brexit – Tour de Travoy

2017-03-30 at 11:47 (UTC 2) Link to this comment

[…] why so many MP’s and some rich British people supported Brexit may be partly explained by the above chart. In 1973, when Britain joined the EU, the US dollar was worth 3.5 Swiss francs. The British pound […]