Tag Archive: USD/CHF

FX Daily, July 8: Abe’s Assassination Shocks the World

News that former Prime Minister Abe was assassinated while campaigning in Japan ahead of the weekend election shocked the nation and world. The immediate market impact looks minimal. Asia Pacific equities mostly advanced.

Read More »

Read More »

FX Daily, July 16: BOJ Tweaks Forecasts

The markets head into the weekend with little fanfare. Most large equity markets in the Asia Pacific region slipped earlier today. Hong Kong, which will be exempt from the need to secure mainland's cybersecurity approval for foreign IPOs, and Australia were notable exceptions. European bourses are edging higher, while US futures are oscillating around unchanged levels.

Read More »

Read More »

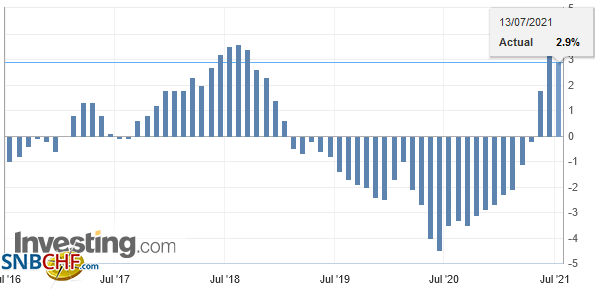

Swiss Producer and Import Price Index in June 2021: +2.9 percent YoY, +0.3 percent MoM

The Producer and Import Price Index rose in June 2021 by 0.3% compared with the previous month, reaching 102.7 points (December 2020 = 100). In particular, basic metals and semi-finished metal products, scrap and petroleum products saw higher prices.

Read More »

Read More »

FX Daily, July 12: Markets Adrift ahead of Key Events

The new week has begun quietly. The dollar is drifting a little higher against most major currencies, with the Scandis and dollar-bloc currencies the heaviest. The yen and Swiss franc's resilience seen last week is carrying over.

Read More »

Read More »

FX Daily, July 09: PBOC Cuts Reserve Requirements after Inflation Measures Ease

The capital markets are winding down what has been a challenging week that has seen equity markets slide and the dollar and bonds rally. The MSCI Asia Pacific fell for the fourth consecutive session, but the more interesting story may be the intrasession recovery that could set the stage for a better performance next week.

Read More »

Read More »

FX Daily, July 08: Capital Markets Remain Unhinged

The dramatic move in the capital markets continues. The US dollar is soaring as yields and equities slide. The US 10-year yield has fallen below 1.30 to 1.26% European benchmark yields are 1-4 bp lower, while Australia and New Zealand have seen a 7-9 bp drop today.

Read More »

Read More »

FX Daily, July 07: Dollar Stabilizes at Elevated Levels After Surging Yesterday

The dollar has steadied after surging yesterday and has so far retained the lion's share of its gains, though it remains lower against most major currencies today. The dollar-bloc and Norwegian krone are the best performers while the yen is underperforming.

Read More »

Read More »

FX Daily, July 06: Greenback Shows Some Resilency after Follow-Through Selling Dried up

Follow-through dollar selling stalled as key levels were approached, including $1.19 in the euro, $1.3900 in sterling, $0.7600 in the Australian dollar, and CAD1.2300. Sentiment is mixed after the greenback sold-off before last weekend despite the fastest jobs growth in 10-months.

Read More »

Read More »

FX Daily, July 02: US Jobs and OPEC+ Day

The US jobs report and OPEC+ decision are awaited. The dollar remains bid. Only the yen and Canadian dollar are showing a hint of resilience, though, on the week, the Scandis and dollar-bloc currencies are off between around 1-2%. The greenback is also firmer against the emerging market currency complex, and the JP Morgan index is off for the sixth consecutive session.

Read More »

Read More »

FX Daily, June 30: The Greenback is Firm into Quarter-End

The dollar is finishing the quarter on firm footing, gaining against most of the major currencies today. The euro is straddling the $1.1900 area, having begun the month above $1.22. Sterling has tested the $1.38 area. It had traded at a three-year high near $1.4250 at the start of the month.

Read More »

Read More »

FX Daily, June 29: Fear that the Mutating Virus Could Slow Recoveries Takes a Toll on Risk Appetites Ahead of Quarter-End

Fear that the new mutation of the covid virus will slow the global recovery has sent ripples across the global capital markets. The foreign exchange market has the clearest reaction, and the dollar is bid.

Read More »

Read More »

FX Daily, June 28: European Political Drama Kicks off Big Economic Week

The global capital markets are off to a quiet start of what promises to be a busy week. Quarter and month-end adjustments, Japan's Tankan survey, the eurozone's preliminary June CPI, the US employment report, and an OPEC+ meeting are featured.

Read More »

Read More »

FX Daily, June 25: Tokyo Escapes Deflation, Leaving the Greenback Trapped between Two Expiring Options against the Yen

New record highs in the S&P 500 and NASDAQ yesterday helped lift most Asia Pacific markets today. China and Hong Kong led the regional gains and were sufficient to lift the MSCI regional benchmark to halt a two-week drop.

Read More »

Read More »

FX Daily, June 24: Did the PBOC Signal it is Content with the Yuan’s Pullback?

The US dollar is trading slightly lower against most of the major and emerging market currencies. The Scandis are leading the major currencies, while the Russian ruble leads the central and eastern European currencies higher. Emerging market currencies mostly firmer, though the Turkish lira and South African rand are notable exceptions.

Read More »

Read More »

FX Daily, June 23: Japan Retains Distinction of being the only G7 Country with Sub-50 PMI Composite

Federal Reserve officials, lead by Chair Powell, pushed gently against the more hawkish interpretations of last week's FOMC meeting. Tapering not a rate hike was the focus of discussions. Powell reiterated that price pressures would prove transitory and would ease after the re-opening disruptions settled down.

Read More »

Read More »

FX Daily, June 22: Turn Around Tuesday or Dollar Rally Resumes?

Firming long-term US yields have lent the dollar support after trading heavily yesterday. The greenback is around 0.15%-0.50% higher against the major currencies. The Japanese yen and Canadian dollar are among the more resilient, and the Australian dollar and sterling among the heaviest.

Read More »

Read More »

FX Daily, June 21: Dollar Surge Stalls

Pressure on equities seen last week carried over into Asia and Europe today. The MSCI Asia Pacific Index fell for the fourth consecutive session, led by more than a 3% decline in the Nikkei. Australia, Taiwan, and Hong Kong bourses fell by more than 1%. European equities opened lower, but have turned higher.

Read More »

Read More »

FX Daily, June 16: Will the Fed Talk the Talk?

With the outcome of the FOMC meeting awaited, the dollar is narrowly mixed in quiet turnover. The Scandis are the weakest (~-0.3%) among the majors, while the Antipodeans are the strongest (~+0.25%). JP Morgan's Emerging Market Currency Index is snapping a three-day decline

Read More »

Read More »

FX Daily, June 15: Commodities Ease though Oil remains Firm

The new record high in the S&P 500 and the NASDAQ's sixth gain in seven sessions may have helped lift Asia Pacific markets today. Only China and Hong Kong did not participate. MSCI's regional index rose for its fourth consecutive session. Europe's Dow Jones Stoxx 600 is moving higher for the eighth session in a row.

Read More »

Read More »

FX Daily, June 14: Dollar Becalmed as Markets Wait for US Leadership

The short squeeze that lifted the US dollar ahead of the weekend has seen limited follow-through buying, and instead a consolidative tone emerged. Europe is searching for direction and perhaps waiting for US leadership after a quiet Asia Pacific session, with several centers closed for holiday today (China, Hong Kong, Taiwan, and Australia).

Read More »

Read More »