Swiss FrancThe Euro has fallen by 0.04% to 1.0899 |

EUR/CHF and USD/CHF, June 15(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesOverview: The new record high in the S&P 500 and the NASDAQ’s sixth gain in seven sessions may have helped lift Asia Pacific markets today. Only China and Hong Kong did not participate. MSCI’s regional index rose for its fourth consecutive session. Europe’s Dow Jones Stoxx 600 is moving higher for the eighth session in a row. Since May 19, it has only fallen twice. US future indices are firm. Benchmark 10-year yields are soft. The US yield briefly rose above 1.50% yesterday, but it was not sustained, and it is holding just below there now. The US dollar is narrowly mixed against the majors. The dollar-bloc is nursing small losses, while most European currencies are posting small gains in quiet turnover. Among emerging market currencies, Asian currencies are underperforming a little, while European currencies, the Mexican peso, and South African rand have a firmer bias. The Turkish lira is off the most today, easing around 1% after falling almost 0.9% yesterday, despite a smaller than expected current account deficit. Unable to resolve the dispute at NATO, Erdogan seemed defiant. The JP Morgan Emerging Market Currency Index is lower for a third session. If sustained, it would match the longest decline in three months. Commodities are drawing attention. Despite July WTI hovering around $71 a barrel, other commodities are weaker. Copper is off around 3.6%, which could be the biggest decline since March. Lumber fell almost 6% yesterday after falling 5.6% before the weekend. It was the eighth consecutive decline. In fact, lumber prices have risen once since May 21. Corn and wheat are trading lower. After paring losses yesterday, gold trading softly around $1864. |

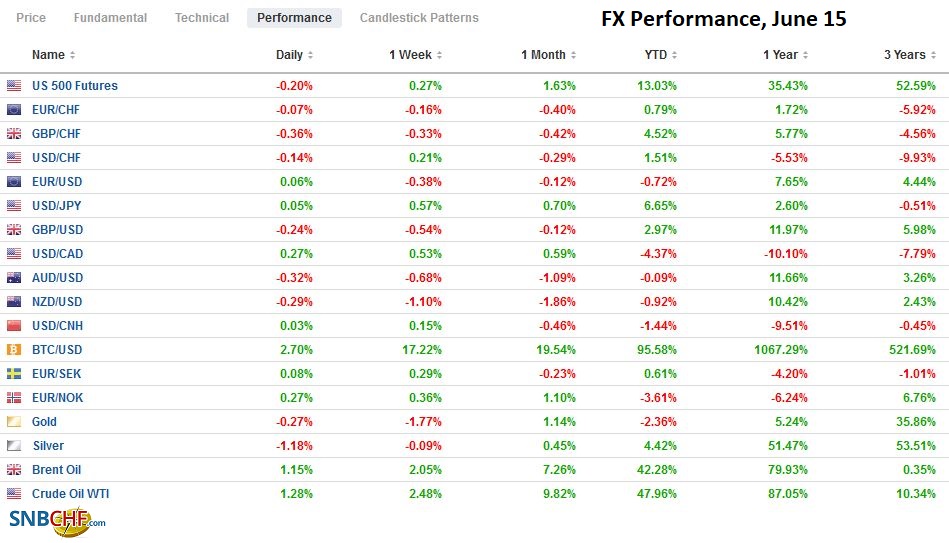

FX Performance, June 15 |

Asia Pacific

Japan’s vaccination program is accelerating, and the formal state of emergencies covering Tokyo and several other prefectures is due to be lifted on June 20. However, there is talk of retaining some social restrictions ahead of the Olympics (July 23 Open Ceremonies). Japan’s economy remains weak, and this is reflected in today’s April report of the tertiary sector, which contracted by 0.7%, a little more than expected. Tomorrow Japan reports May’s trade balance. Seasonally, it is a weak month. Japan’s trade balance has deteriorated in May – 18 of the past 20 years. On the other hand, the balance improves in June -19 of the past 20 years. The BOJ meets later in the week, and besides updated its economic projections, is not expected to do anything.

CNN reported that the US is assessing a reported problem at a nuclear plant in Guangdong. It is co-managed by a subsidiary of France’s EDF and China General Nuclear Power Group. While reports suggest that the plant is operating within safety parameters, there has been an increased concentration of noble gases in one of its reactors. The lack of transparency is problematic. According to reports, there is concern that Chinese authorities will raise the acceptable limits for radiation outside of the facility to avoid shutting it down. As news of this was reported yesterday, uranium stocks in the US traded lower.

The dollar remains firm against the yen but in a very narrow trading range (~15 pips) after pushing above JPY110 yesterday. It has held mostly above there today, where a $1.2 bln option is set to expire. The high recorded earlier this month was a little above JPY110.30. Last month’s high was slightly lower (~JPY110.20). The high for the year, so far, was set at the end of March, just shy of JPY111.00.

The Australian dollar posted an outside down day ahead of the weekend but did not see follow-through selling yesterday. It is come back offered today and has flirted with the pre-weekend low, a little below $0.7690. The low from earlier this month is in the $0.7645-$0.7650 area. There is an option for A$490 mln at $0.7700 that expires today and about A$1.1 bln in the $0.7725-$0.7730 area.

Returning from yesterday’s holiday, the Chinese yuan is softer for the third consecutive session and the fifth in the past six. Since mid-April, the dollar has held below the 20-day moving average against the yuan and is now above it (~CNY6.4005). The high from earlier this month was around CNY6.4120. The PBOC set the dollar’s reference rate at CNY6.4070, which was close to the CNY6.4074 anticipated in the Bloomberg survey.

Europe

While the American press seems to highlight that China dominated the NATO agenda, it seems there may not have been as much of a united front as it appears. First, it appears that the statement was a function of a compromise between the US, which is pushing hard to contain China, and Europe that remains more concerned about Russia. One report noted that Russia was cited 62 times while China was mentioned less than a dozen times. Second, Europeans appeared to have tempered the rhetoric and referred to China as a challenge, not a threat, Third, the Secretary-General of NATO underscored Beijing’s military encroachment and cyber-activities. He was explicit that NATO was “not entering a Cold War with China, and China is not our adversary, our enemy. On a separate but related note, Europe’s four G7 countries, the UK, Germany, France, and Italy, are members of the Asian Infrastructure Investment Bank (AIIB), which funds China’s Belt Road Initiative.

China inadvertently helped the US and Europe resolve the protracted Airbus-Boeing dispute and the associated punitive tariffs. Reports suggest that both sides recognize that their duopoly will be threatened over the next few years by the rise of the Commercial Aircraft Corporation of China (Comac). The steel and aluminum tariffs the US continues to impose on Europe on national security grounds may be lifted by the end of the year.

There were two economic reports from Europe today to note. First, the UK’s labor market is strengthening. The jobless claims fell by a whopping 92.6k in May. The April series was revised to show a nearly 56k decline rather than 15k. The number of employees on payrolls rose by almost 200k in May. The unemployment rate to 4.7% in the three months through April and wage growth was stronger than expected. Second, the euro area trade balance in April was smaller than expected at 9.4 bln euros. The disappointment was mitigated by the sharp upward revision in the March series to 18.3 bln euros from 13.0 bln.

The euro traded below $1.21 before the weekend and yesterday, but it has held above it today. Still, the upside momentum remains constrained, perhaps ahead of the conclusion of the FOMC meeting tomorrow. Initial resistance has been approached near $1.2150 in Europe, but it remains quiet, content, apparently to consolidate.

Sterling is trading with a heavier bias, near its recent lows around $1.4070. A break would signal losses toward $1.4035. It has not traded below $1.40 since May 10. A move above $1.4100 would help stabilize the tone.

America

The US economic diary is full today. The highlights include May retail sales, industrial production, and producer prices. We already know that auto sales were disappointing than this weigh on headline retail sales. Excluding auto, retail sales may have risen by around 0.4%, according to the median forecast in Bloomberg’s survey. The core retail sales, which exclude autos, gasoline, building materials, and food services, may have fallen for the second consecutive month and the third time in four months. Industrial production is expected to have matched April’s 0.7% rise while manufacturing output is forecast to rise by 0.8% after April’s 0.4% gain. Headline and core producer prices may have risen by 0.5% in May, which would leave the headline pace little changed at 6.2% year-over-year. The core pace may quicken to 4.8% from 4.4%. Outside of some headline risks, the data are unlikely to spark a significant reaction ahead of tomorrow’s FOMC statement, new forecasts, and Chair Powell’s press conference.

There is more talk that the Fed may bring its first hike into 2023, but don’t let the market’s shorthand confuse. As officials point out, there is no Fed forecast. There are individual forecasts. In March, 7 of 17 officials saw a hike in 2023 would be appropriate. The median still favored a later date. Also, note that not all dots are equal in the sense that not all Fed officials vote. Moreover, the Board of Governors seems to be more patient than several of the regional presidents. Lastly, we note that the December 2022 Eurodollar futures appear to have a hike largely discounted. Meanwhile, the use of the Fed’s reverse repo facility reached a new record yesterday (~$583 bln). Today is a quarterly tax date and settlement day for the recent coupon sales. This could ease some demand for the reverse repos, but they are expected to climb again into the quarter-end.

Canada reports May housing starts and new home sales. These are not typically market-moving reports. Tomorrow Canada reports May CPI figures. After rallying before the weekend, the US dollar paused yesterday but is pushing higher today. Near CAD1.2185, the US dollar is at its best level in nearly a month. The next immediate target is CAD1.2200 and then around CAD1.2250. Support is now seen around CAD1.2130-CAD1.2145.

For the third consecutive session, the dollar is pushing against MXN19.97-MXN20.00. The high from earlier this month was in the MXN20.1750-MXN20.21 band. A break of MXN19.85 would suggest a dollar high is in place.

Graphs and additional information on Swiss Franc by the snbchf team.

Full story here Are you the author? Previous post See more for Next postTags: #USD,China,commodities,Currency Movement,EUR/CHF,Featured,FOMC,newsletter,USD/CHF