Tag Archive: Featured

Canada’s “Worst Decline in 40 Years”

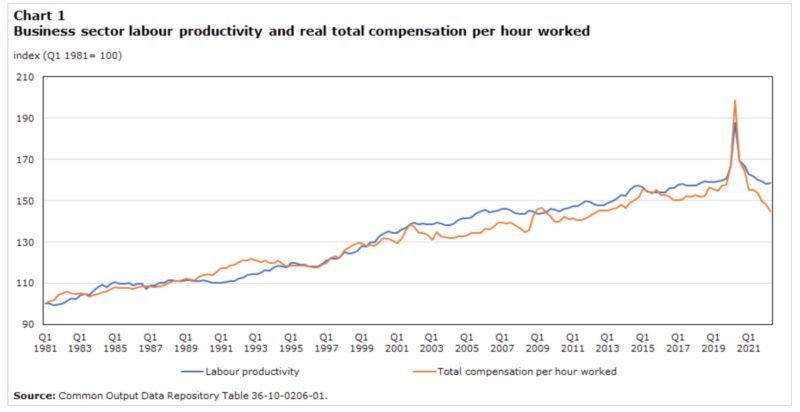

Canada’s standard of living is on track for its worst decline in 40 years, according to a new study by Canada’s Fraser Institute.The study compared the three worst periods of decline in Canada in the last 40 years — the 1989 recession, the 2008 global financial crisis, and this post-pandemic era.They found that unlike the previous recessions, Canada is not recovering this time. Something broke.In fact, according to the Financial Post, since 2019,...

Read More »

Read More »

No exceptions, please!

The American Constitution is far from perfect, but one good feature is that it lacks a provision found in some European constitutions. This provision allows the president to suspend the Constitution if there is a national emergency.As the theologian David Bentley Hart observes,“I am not a devout admirer of the United States constitution, but I do find many of its essential principles admirable — chief among them, the refusal to acknowledge the...

Read More »

Read More »

#517 Wie viel ist dein Immobilienfonds noch wert? #fonds

#517 Wie viel ist dein Immobilienfonds noch wert? 📉 #fonds

Immobilienfonds waren in letzter Zeit in den Schlagzeilen und werden oft als sicherer Baustein im Portfolio angesehen. Wie aber 17% Wertverlust plötzlich bei dieser vermeintlich sicheren Anlage entstehen können, klären wir in dieser Folge. Markus und Max sprechen darüber, was Immobilienfonds sind, warum sie doch riskanter sein können als gedacht, wie man sie verkaufen kann und welche...

Read More »

Read More »

Roboter – KI und Verdrängung des Menschen

✘ Werung:

Mein Buch Katastrophenzyklen ► https://amazon.de/dp/B0C2SG8JGH/

Kunden weren Tesla-Kunden ► http://ts.la/theresia5687

Mein Buch Allgemeinildung ► https://amazon.de/dp/B09RFZH4W1/

-

#Humanoide (menschenähnliche) #Rooter kommen und machen in den kommenden Jahren dem Menschen mehr und mehr #Konkurrenz. Bei schweren, gefährlichen und wiederkehrenden Areiten haen Industrierooter ereits den Menschen aus den Farikhallen verdrängt. Mit der...

Read More »

Read More »

El Legado de Biden es PEOR de lo que Parece…

Link del programa completo - &t=1433s

Te animo a suscribirte a mi canal y te invito a seguirme en mis redes sociales:

☑ Twitter - https://twitter.com/dlacalle

☑ Instagram - https://www.instagram.com/lacalledanie

☑ Facebook - https://www.facebook.com/dlacalle

☑ Página web - https://www.dlacalle.com

☑ Mis libros en Amazon - https://www.amazon.es/Daniel-Lacalle/e/B00P2I78OG

¡Un saludo!

#biden #bidenvstrump #eleccionesusa #trump

Read More »

Read More »

Kamala’s Palace Coup

What is the Mises Institute?

The Mises Institute is a non-profit organization that exists to promote teaching and research in the Austrian School of economics, individual freedom, honest history, and international peace, in the tradition of Ludwig von Mises and Murray N. Rothbard. Non-political, non-partisan, and non-PC, we advocate a radical shift in the intellectual climate, away from statism and toward a private property...

Read More »

Read More »

How to Invest in High Safety Corporate Bonds

Understanding the importance of safety when investing in corporate bonds. Choose wisely to avoid defaults. #InvestingTips #CorporateBonds

Want to learn more? Subscribe to our YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

7-26-24 Should You Tap Your Home Equity for Retirement Income?

Rich & Danny recap Danny's recent accident; Rich's market summary includes a preview of today's PCE release. Markets are awaiting confirmation of a trend. Dealing with the election fallout on your money; markets have already priced-in everything you know. PCE will move markets today; there is still $500-billion in unspent government funds from the Inflation Reduction Act. Dealing with data breaches. Retirees' biggest worry is about income: What...

Read More »

Read More »

Lanz: Das Allein “beseitigt” keine AfD Wähler!

Lanz Eklat!

Ich setze auf dieses Depot:

https://link.aktienmitkopf.de/Depot *

Auf der Freedom 24-Plattform findest Du:

- Langfristige Sparpläne mit Zinssätzen bis zu 8,76 %!

- Rendite von 3,86 % in Euro und 5,31 % in Dollar bei täglicher Gutschrift der Zinsen!

- Bis zu 1.000.000 Aktien, ETFs, Aktienoptionen und andere Finanzinstrumente!

Bildrechte: By Steffen Prößdorf, CC BY-SA 4.0, https://commons.wikimedia.org/w/index.php?curid=149484259

📊...

Read More »

Read More »

What Project 2025 says about the Fed

Mandate for Leadership 2025 is an unofficial blueprint for a potential conservative administration, published by the Heritage Foundation’s Project 2025. Donald Trump has distanced himself from the project, even though many people associated with his first term as president contributed to the document.It’s billed as “The comprehensive policy guide for a new conservative president, offering specific reforms and proposals for Cabinet departments and...

Read More »

Read More »

Student loans are the ‘fudge factor’ that allows institutional profiteering

Imagine an American college or university president making the following public statement:“I regret that my institution, along with many others, has contributed to burdensome federal student loan debt and to rising college tuition levels, allowing our institutions to profit from the existence of student loan monies. At the same time, we have failed to offer our students adequate skills and knowledge required to compete in today’s world.”If...

Read More »

Read More »

Socialism, Israeli-style

In his treatise A Theory of Socialism and Capitalism, Hans-Hermann Hoppe lays the theoretical foundations for understanding and identifying the phenomenon of socialism, not as a mere invention of the Marxists of the nineteenth century, but as a much older idea of the institutionalized interference with or aggression against private property and private property claims. Then, Hoppe holds the institution of the State “as the very incorporation of...

Read More »

Read More »

Field of streams: sports viewing changes

As the Olympics begin, more people than ever will be watching via streaming services. We examine the changing viewing habits transforming (https://www.economist.com/briefing/2024/07/25/a-shift-in-the-media-business-is-changing-what-it-is-to-be-a-sports-fan?utm_campaign=a.io&utm_medium=audio.podcast.np&utm_source=theintelligence&utm_content=discovery.content.anonymous.tr_shownotes_na-na_article&utm_term=sa.listeners) sport’s role in...

Read More »

Read More »

Is the Dramatic Yen Short Squeeze Over?

Overview: The powerful yen short squeeze that has roiled the capital market this week has stalled today. It is the first day this week that the dollar has not fallen below the previous day's low and has risen, though slightly, above previous session's high. The Antipodeans and Scandis are trading with a firmer bias. The yen and Swiss franc are the only two G10 currencies that are not stronger today. The stability of the yen appears to have removed...

Read More »

Read More »

Bringen die neuen Ethereum-ETFs den Ether-Kurs zum Explodieren? #etherum

Bringen die neuen Ethereum-ETFs den Ether-Kurs zum Explodieren? #etherum

🎯 2015 haben wir es uns zur Mission gemacht, Menschen zu ermutigen, ihre Finanzen in die eigenen Hände zu nehmen. Angefangen als YouTube-Kanal mit Erklärvideos, haben wir uns innerhalb weniger Jahre zur größten Community für finanzielle Selbstentscheider im deutschsprachigen Raum entwickelt.

🔔 Möchtest du deine persönlichen Finanzen in den Griff bekommen? Wir wollen dir...

Read More »

Read More »

Buffett CRASH-Indikator am Anschlag!

Der Buffett Indikator schlägt maximal aus!

Ich setze auf dieses Depot:

https://link.aktienmitkopf.de/Depot *

Auf der Freedom 24-Plattform findest Du:

- Langfristige Sparpläne mit Zinssätzen bis zu 8,76 %!

- Rendite von 3,86 % in Euro und 5,31 % in Dollar bei täglicher Gutschrift der Zinsen!

- Bis zu 1.000.000 Aktien, ETFs, Aktienoptionen und andere Finanzinstrumente!

Bildrechte: By Steffen Prößdorf, CC BY-SA 4.0,...

Read More »

Read More »

Deine BU muss mitwachsen #shorts

Die BU ist eine der wichtigsten Grundlagen Deiner Finanzen. Aber auch wenn Du bereits eine BU abgeschlossen hast, solltest Du Deine BU im Auge behalten, damit Du auch im Alter bestens abgesichert bist. Saidi erklärt Dir in diesem Video warum und wie oft Du Deine BU anpassen solltest.

#Finanztip

Read More »

Read More »

Silver Prices Have Pulled Back Sharply! #shorts

🔔 SUBSCRIBE TO MONEY METALS EXCHANGE ON YOUTUBE

➤ http://bit.ly/mmx-youtube

📉 Silver Alert: Prices have dropped over $3 in the past week, with another dollar decline today, now below $28 per ounce. Gold is also seeing a reduction. Lower premiums and precious metals prices are creating a prime entry point for investors. 💼

▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬

★★FOLLOW MONEY METALS EXCHANGE ★★

FACEBOOK ➤ https://www.facebook.com/MoneyMetals

TWITTER...

Read More »

Read More »

RKI Files: Jetzt läuft es komplett aus dem Ruder!

Lauterbach redet sich um Kopf und Krafen!

Meine Depot-Empfehlung:

https://link.aktienmitkopf.de/Depot *

Auf der Freedom 24-Plattform findest Du:

- Langfristige Sparpläne mit Zinssätzen bis zu 8,76 %!

- Rendite von 3,86 % in Euro und 5,31 % in Dollar bei täglicher Gutschrift der Zinsen!

- Bis zu 1.000.000 Aktien, ETFs, Aktienoptionen und andere Finanzinstrumente!

Bildrechte: By Steffen Prößdorf, CC BY-SA 4.0,...

Read More »

Read More »

How The Economic Machine Works: Part 2

This simple animated video series answers the question, "How does the #economy really work?" Based on my practical template for understanding the economy.

This series breaks down economic concepts like #credit, #deficits and #interest rates, allowing viewers to learn the basic driving forces behind the economy, how economic policies work and why economic cycles occur.

This is Part 2, I hope you find these helpful.

If you enjoy this,...

Read More »

Read More »