In this post we will show the history of the Swiss Franc until 1971, a monetary era driven by the gold standard and the Bretton Woods period, both periods with nearly fixed exchange rates.

The following graph shows again the very long-term relation between the dollar and the Swiss franc and on the other side the living costs in the U.S as expressed by the CPI.

Period of multiple currencies in one country

Between 1820 and 1850 Switzerland had a period of competing currencies issued by different banks. From 1850 to 1881 a phase of free banking arrived, multiple banks issued one single currency, the Swiss franc. From 1881 to 1905 currency was partially regulated and from 1905 the Swiss National Bank (SNB) obtained the monopoly to issue the Swiss currency.

The gold standardUntil 1936, the Swiss franc and its predecessors were driven by a gold-silver standard, a so-called bimetallic standard and later by the gold standard. The gold standard relates money supply to gold automatically without the need of regulation or a central bank. If a country supplies to much money, then the country loses gold reserves, it sees “gold drains”. Since credit and spending is closely related to money supply, the gold standard prevents global imbalances and ensures stable current account or trade balances. Therefore Austrian economists are pretty sure that a gold standard would have prevented the financial crisis of 2008, a crisis caused by global imbalances. In an international gold standard system, exchange rates and the gold price are typically fixed. A trade surplus results in an oversupply of foreign currencies. The currency-issuing banks (or later central banks) had to be make sure that the surplus will need to be invested in monetary metal (aka gold in the gold standard) or they had to react with lower interest rates until the market accept the fixed exchange rate again. For the country with a deficit the contrary – sales of gold holdings or higher interest rates – applied. In an international gold standard an independent monetary is impossible: Unilateral monetary expansion would lead to higher wages and inflation, less competitiveness and a trade deficit and therefore a loss of monetary metal.1: Just to give an indication about exchange rates: we show how the Swiss franc developed against the US Dollar as anchor of stability against inflation. In 1907 one needed to pay still 25.22 francs for one British pound. In the 19th century, however, the franc had the tendency to weaken against its pears. By 1849 the dollar got revalued from 3.75 to 5 CHF. To this level it returned after the U.S. civil war. |

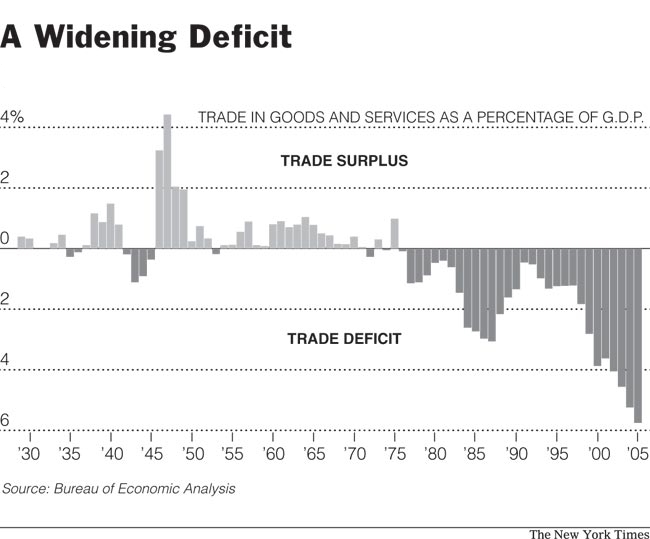

US Trade Deficit 1947-2006 |

The Swiss Franc in the Bretton Woods system (1945-1970)The main elements of the 1944 Bretton Woods agreement were2:

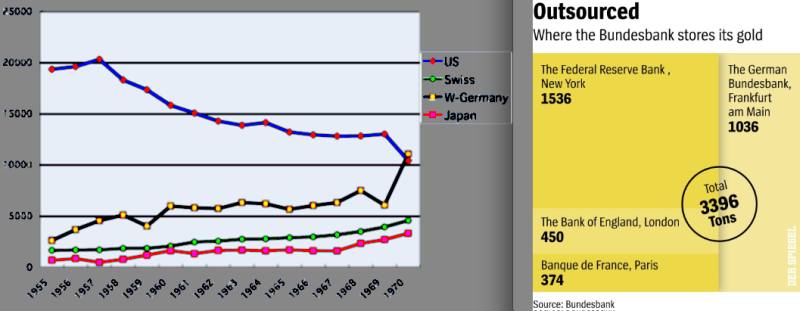

click to expandAs a general rule of the Bretton Woods system, a current account deficit resulted in a transfer of dollar or gold reserves from the deficit country to the ones with a trade surplus. The system became unstable when with the Vietnam war the dollar stopped being an anchor of price stability. High inflation drove the U.S. towards twin deficits – fiscal and trade deficits. Economies like Japan, Germany, France and Italy managed to reduce the delay in their economic development caused by WWII. In the 1960s, Germany was one of the first among them to achieve continuous trade surpluses and changed parts of the surplus into gold. Since it did not make sense to transport the gold from the U.S. to Germany or Switzerland, the gold reserves remained in the country with the trade deficit (see below). Already since WWI, Switzerland managed to achieve surpluses, hence it accumulate gold and FX reserves. |

Gold and FX Reserves |

| As opposed to the gold standard, even a trade deficit country was able to acquire more gold reserves, what high-inflation countries like Italy and India actually did to stabilize their currencies.3 |

The following presentation gives an overview from the “gold perspective”. |

- Baltensberger Ernst, Der Schweizer Franken, 2013, Neue Zürcher Zeitung Verlag, page 111 and 268ff. [↩]

- ibid, page 194 [↩]

- Remember that a positive capital account and capital inflows could make up for a negative current account and enable gold purchases, more in the balance of payments [↩]