An extract from history:

Jimmy Carter beat the incumbent Gerald Ford in the presidential election of November 1976, an election dominated by concerns about high unemployment and high inflation. The country had gone through a sharp recession the previous year and the unemployment rate still averaged almost 8 percent. Although inflation had declined to 5 percent in 1976, less than half its 1974 level, it was almost the same as was considered embarrassing in 1969.

Stagflation — the lethal combination of high unemployment and high inflation — reflected a change in consumers’ behavior. The “buy now, pay later” philosophy adopted by those with jobs overwhelmed the spending restraint of the unemployed, resulting in higher prices. Economists had to rework their thinking to take account of Milton Friedman’s warning that gains in employment would disappear once inflationary expectations caught up with reality.

Volcker understood the power of expectations. At his very first FOMC meeting on Aug. 19, 1975, he had warned the optimists on the committee not to be encouraged by the projections “for reduced inflation emanating from some econometric models,” which he said “did not take adequate account of the important factor of expectations.”

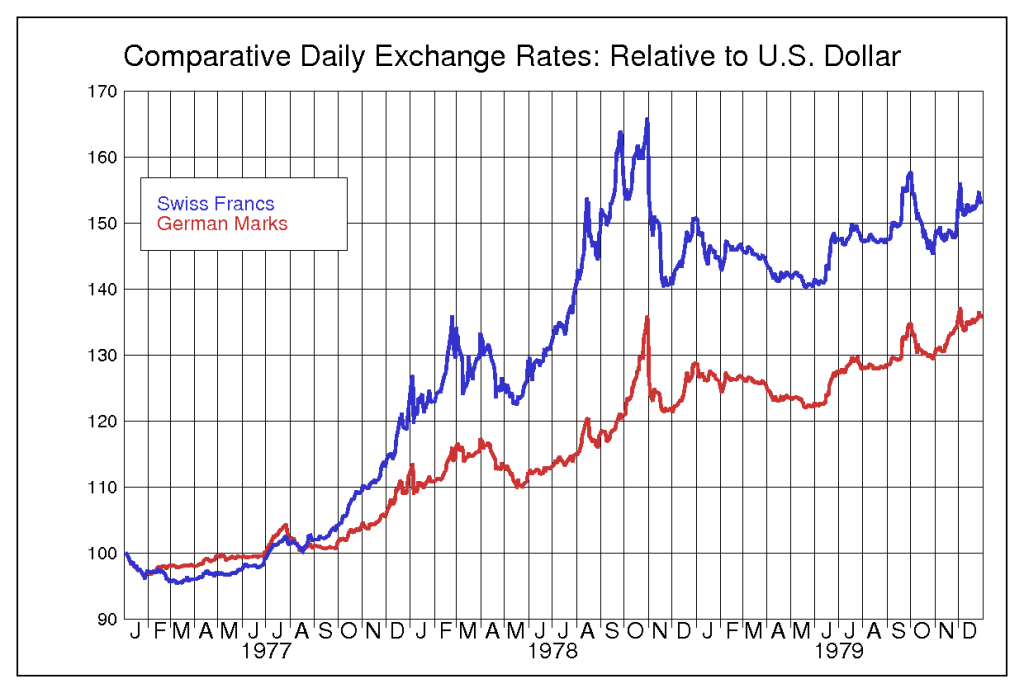

The need to consider the inflationary consequences of monetary policy even with unemployed resources wasn’t yet the conventional economic wisdom. Keynesian economic models ignored inflationary expectations, but the market for gold bullion did not. By 1978, gold signaled renewed concerns with inflation and on July 28 the price passed its previous peak of $197.50, and would trade as high as $243.65 later in the year. The foreign-exchange market noticed. (source Bloomberg)

On the other side of Atlantic, there were two countries that had different views:

In August 1978, the US currency fell to new lows against the German mark and even further down against the Swiss franc, “a fresh vote of no confidence in America”. “On Oct. 30, 1978, one dollar purchased 1.72 German marks, an all-time low, representing a decline of more than 20 percent in a year. “ |

Comparative Daily Exchange Rates: Relative to US Dollar(see more posts on US dollar, ) |

See more for