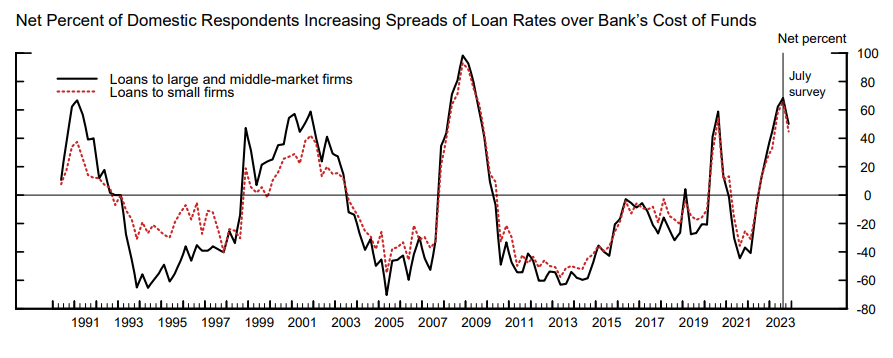

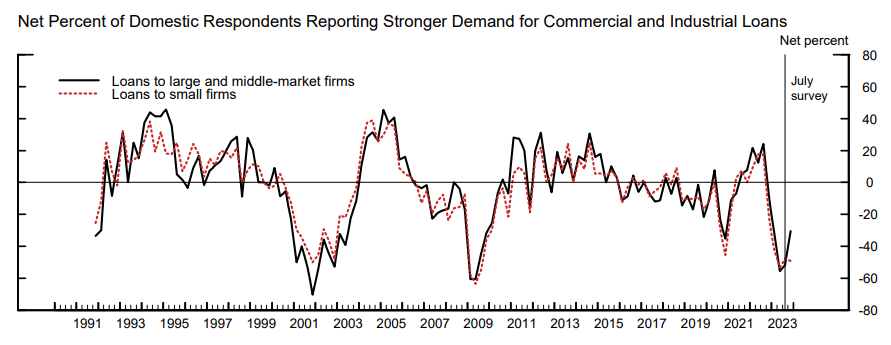

Banks continue to tighten lending standards across all sectors. This has eased a bit from the July survey. Banks continue to widen spreads across all sectors. The percentage of banks widening spreads has also eased a tad. Banks are not seeing increasing demand for loans. I’m just posting survey results for C&I loans, the graph is very similar for commercial real estate, residential real estate and consumer loans.

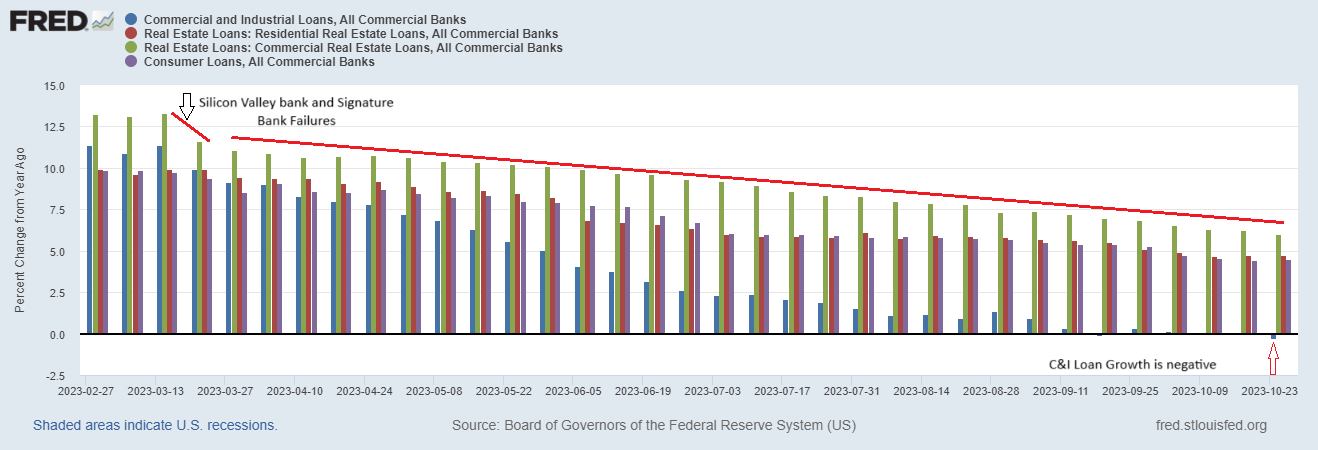

Commercial and Industrial loan growth has turned negative. Loan growth in other sectors (consumer and real estate) is not at unhealthy levels, but does continue to slow.

Disclaimer: This information is presented for informational purposes only and does not constitute an offer to sell, or the solicitation of an offer to buy any investment products. None of the information herein constitutes an investment recommendation, investment advice or an investment outlook. The opinions and conclusions contained in this report are those of the individual expressing those opinions. This information is non-tailored, non-specific information presented without regard for individual investment preferences or risk parameters. Some investments are not suitable for all investors, all investments entail risk and there can be no assurance that any investment strategy will be successful. This information is based on sources believed to be reliable and Alhambra is not responsible for errors, inaccuracies, or omissions of information. For more information contact Alhambra Investment Partners at 1-888-777-0970 or email us at [email protected].

Full story here Are you the author? Previous post See more for Next postTags: economy,Featured,lending,newsletter