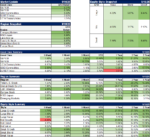

The most anticipated release of the week came in … “Unchanged” or sticky stuck from the August at 3.7% yoy. But it’s worth mentioning as we will discuss below that this is up from June CPI which was 3.09% yoy. Core CPI which excludes food and energy because of their volatility sits at 4.13% yoy down from 4.39% last month.

Let’s look under the hood a bit because headlines will mention “sticky” CPI and there are some reasons that CPI will indeed be stickier for longer than we hope.

Let’s first start with energy which is about 7.5% of the basket. With the exception of the spike in oil coinciding with the Russian invasion of Ukraine, oil peaked in June 22 at around $122/bbl. So for the whole year of June22-June23 oil was helping bring inflation down. In June22 energy inflation was 41.25% yoy

Read More »