Category Archive: 5) Global Macro

Charles Hugh Smith: Resisting Inflation Is Futile

In this fascinating video, Charles Hugh Smith joins us to discuss the inevitability of inflation. He discusses why fighting it is a losing battle, and how it can be used as an economic tool. Discover what he has to say about the long-term effects of inflation and learn strategies for protecting your finances in an inflating world. Don't miss out on Charles' valuable insights - watch now!

Read More »

Read More »

Entering an Era of Scarcity | Charles Hugh Smith

The world is entering a new era of scarcity, which is different from the previous 75 years of abundance. This scarcity is not only limited to resources but also affordability, as costs are rising for various reasons. This will impact the global economy, and the model of growth at any cost will no longer be sustainable.

Watch more of this short video from Turmoil Ahead As We Enter The New Era Of 'Scarcity' | Charles Hugh Smith

#shortvideo...

Read More »

Read More »

Charles Hugh Smith: Sailing the Uneasy Economic Waters.

Ride It Out.

Navigating the recent economic storm has been a challenge for many. In this video, Charles Hugh Smith offers expert insight and advice on how to weather the downturn. Learn his strategies for sustaining your finances and investments during these difficult times. Hear his tips on how to make sound decisions in turbulent markets and prepare yourself for whatever comes next. Don't miss out - watch this must-see video now to get valuable...

Read More »

Read More »

Putin’s hidden war: the Russians fighting back

The invasion of Ukraine left Russians with a stark choice: carry on as normal or make a stand against the war. But speaking out in Russia carries huge risks. How is the opposition managing to resist the regime – and at what personal cost?

00:00 - One year on

01:37 - The first wave of protests

05:43 - Crackdown on dissent

10:04 - Individual acts of rebellion

13:51 - Partial mobilisation

16:20 - Russia’s mass exodus

23:06 - The future of Russian...

Read More »

Read More »

If We No Longer Pay Attention to Things We Don’t Control, What’s Left For Us to Focus On?

Our time is better invested in actually learning about trends that impact us directly. Imagine making this simple change in your life: whatever you don't control, you stop paying attention to it.

Read More »

Read More »

Turmoil Ahead As We Enter The New Era Of ‘Scarcity’ | Charles Hugh Smith

WORRIED ABOUT THE MARKETS? SCHEDULE YOUR FREE PORTFOLIO REVIEW with Wealthion's endorsed financial advisors at https://www.wealthion.com

As the old saying goes: "It ain’t what you don’t know that gets you into trouble. It’s what you know for sure that just ain’t so."

It's easy for investors to fall into the traps laid by their belief systems. Whether to the bullish or bearish side, we all have our own biases that can warp the way we...

Read More »

Read More »

Ferocious battle of disinformation in Ukraine War, Russia blaming Ukraine for Bucha | Latest | WION

Ukraine is fighting away from the battlefield and that's a ferocious battle of disinformation. The Pro-Russian agitators are seeking to shift blame for many war crimes on Ukraine.

Read More »

Read More »

Why Nigeria is crucial to democracy in Africa

Nigeria's youth are fighting for a better, cleaner government. What can this political awakening tell us about the state of democracy across Africa?

00:00 - Why Nigeria matters

01:06 - Nigeria’s security crisis

03:42 - How corruption threatens Nigeria’s democracy

05:26 - How young Nigerians are driving change

11:31 - Youth protests across Africa

Sign up to The Economist’s daily newsletter: https://econ.st/3QAawvI

Read more of our Africa...

Read More »

Read More »

Russia Ukraine War: Russia fires missiles across Ukraine | World News | WION

Ukraine war nears one year anniversary, now Russia is reportedly gaining in the Luhansk region. While, western allies pledge more weapons to Ukraine, in the latest, Russia launched missile strikes across Ukraine.

Read More »

Read More »

WION Speed News | Paris Olympics 2024: Zelensky attends meet to ban Russian and Belarusian athletes

WION examines global issues with in-depth analysis and brings you a quick round-up of all the top headlines and breakings from all across the world.

Read More »

Read More »

War in Ukraine: NATO looks at new start of offence in Bakhmut | Latest News | English News | WION

Russia has begun a new offense in the Eastern Ukrainian city of Bakhmut. Ukrainian military are now bracing for new ground attacks. As the anniversary of invasion of Ukraine nears, Russian forces pounded the city of Bakhmut on Monday.

Read More »

Read More »

WION live: U.S. shoots down 4th aerial object in 2 weeks | Russia-Ukraine war update | English News

U.S. military shot down a mysterious object to have appeared in the skies of Lake Huron close to the Canadian border. This is the fourth flying object that has been taken down over North America in two weeks. Watch this livestream for more updates.

Read More »

Read More »

Moldova President warns of Russian agent infiltration | Latest News | International News | WION

Moldovan President Maia Sandu has accused Russia of planning to overthrow her country's government by using foreign saboteurs disguised as anti-government protesters.

Read More »

Read More »

We really can’t afford for this to fail.

China reopening, media rather than money blitz. Bank lending has been hyped though as usual the rest of the story - the important parts - get left out for the narrative. The reopening impulse just isn't there, and we can verify that it isn't just by doing the full money math.

Read More »

Read More »

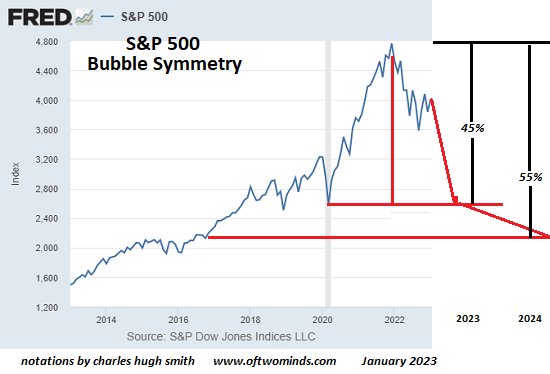

The New Normal: Death Spirals and Speculative Frenzies

There is an element of inevitability in play, but it isn't about central bank bailouts, it's about Death Spirals and the collapse of unsustainable systems. The vapid discussions about "soft" or "hard" landings for the economy are akin to asking if the Titanic'sencounter with the iceberg was "soft" or "hard:" either way, the ship was doomed, just as the global economy is doomed by The New Normal of Death Spirals and Speculative Frenzies.

Read More »

Read More »

Weekly Market Pulse: Look Up In The Sky! It’s A UFO! Or Not!

As I sit here writing this Sunday afternoon, the US has just shot down a third UFO in the last 3 days in addition to the Chinese “weather” balloon last week. I have no insight into what these things might be but I do wonder if we haven’t declared war on the National Weather Service. The federal government has become so sprawling that it could easily be the case that NORAD has no idea what the NWS has up in the air.

Read More »

Read More »

Climate-change migrants: what can be done?

Climate change could force hundreds of millions to flee their homes in the coming years. What can countries do to prepare for this mass migration?

Film supported by @mishcondereya

00:00 - Climate migration is on the rise

01:06 - How Louisiana is relocating its flood-victims

03:55 - How ‘managed retreat’ can resolve climate impacts

05:15 - Global warming spells trouble for the developing world

06:30 - How should governments handle mass climate...

Read More »

Read More »

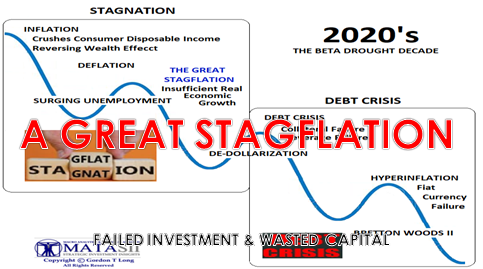

Prepare to Be Bled Dry by a Decade of Stagflation

Our reliance on the endless expansion of credit, leverage and credit-asset bubbles will have its own high cost. The Great Moderation of low inflation and soaring assets has ended. Welcome to the death by a thousand cuts of stagflation.

Read More »

Read More »

Weekly Market Pulse: Happy Days Are Here Again!

Your cares and troubles are gone

There’ll be no more from now on!

Happy days are here again!

The skies above are clear again

Let us sing a song of cheer again

Happy days are here again!

Lyrics: Jack Yellen, Music: Milton Ager

That’s certainly how it’s felt since the turn of the new year with the NASDAQ up nearly 15%, European stocks continuing to recover, emerging markets anticipating a Chinese recovery and a solid January for the S&P...

Read More »

Read More »

Seven Points on Investing in Treacherous Waters

What's truly valuable has no price and cannot be bought. If all investments are being cast into Treacherous Waters, our investment strategy must adapt accordingly. Once we set aside denial and magical thinking as strategies and accept that we're in treacherous waters, a prudent starting point is to discern the most consequential contexts of all decisions about where and how we invest our time, energy and capital.

Read More »

Read More »