Category Archive: 5) Global Macro

Weekly Market Pulse: Happy Days Are Here Again!

Your cares and troubles are gone

There’ll be no more from now on!

Happy days are here again!

The skies above are clear again

Let us sing a song of cheer again

Happy days are here again!

Lyrics: Jack Yellen, Music: Milton Ager

That’s certainly how it’s felt since the turn of the new year with the NASDAQ up nearly 15%, European stocks continuing to recover, emerging markets anticipating a Chinese recovery and a solid January for the S&P...

Read More »

Read More »

Seven Points on Investing in Treacherous Waters

What's truly valuable has no price and cannot be bought. If all investments are being cast into Treacherous Waters, our investment strategy must adapt accordingly. Once we set aside denial and magical thinking as strategies and accept that we're in treacherous waters, a prudent starting point is to discern the most consequential contexts of all decisions about where and how we invest our time, energy and capital.

Read More »

Read More »

Russian President vows victory in Ukraine | World News | English News | Latest News | WON

Russian president drew parallels between the Soviet Union's fight in World War II and the ongoing Russia-Ukraine conflict. He compared the fighting to Nazi Germany's invasion and hinted that Moscow could use nuclear weapons.

Read More »

Read More »

Russian President draws parallel between WWII, Ukraine War | World News | English News | WION

Russian president drew parallels between the Soviet Union's fight in World War II and the ongoing Russia-Ukraine conflict. He compared the fighting to Nazi Germany's invasion and hinted that Moscow could use nuclear weapons.

Read More »

Read More »

Gravitas: Is Russia planning a new offensive?

Is Russia planning a new offensive? Ukraine's Defence Minister says Putin could launch a new offensive on February 24. Is there any credit to his claims? Molly Gambhir reports.

Read More »

Read More »

Climate change: what is ocean acidification?

As carbon emissions change the chemistry of the seas, ocean acidification threatens marine life and human livelihoods. How worried should you be about climate change’s so-called “evil twin”?

Film supported by @NipponFoundationPR

00:00 The other carbon problem

00:50 How does the ocean’s deepest point reveal its past?

02:55 Why are baby oysters dying?

04:08 Is the ocean acidic?

05:21 What is causing ocean acidification?

06:01 Why are corals...

Read More »

Read More »

This wasn’t just expected, it has been practically inevitable.

What *was* behind the Fed's aggressive hawkishness from just a couple weeks ago? A whole lot of bad assumptions. What *is* behind the Fed's sudden conversion?

Read More »

Read More »

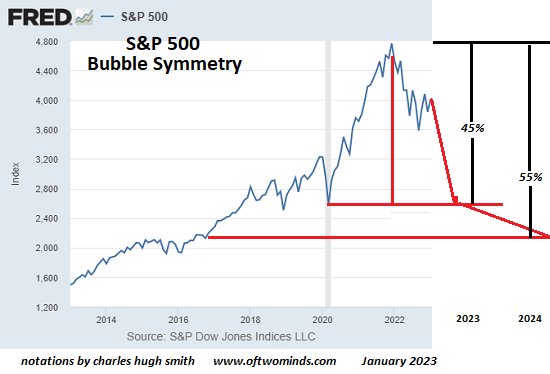

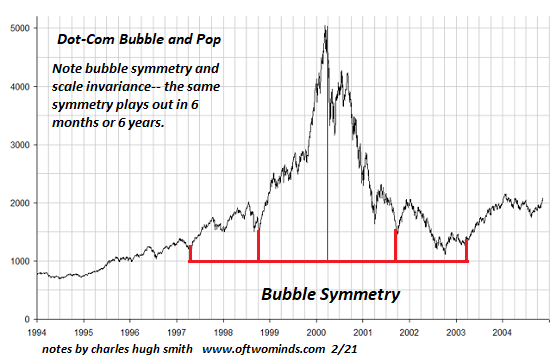

What Goes Up Also Comes Down: The Heavy Hand of Bubble Symmetry

Should bubble symmetry play out in the S&P 500, we can anticipate a steep 45% drop to pre-bubble levels, followed by another leg down as the speculative frenzy is slowly extinguished. Bubble symmetry is, well, interesting. The dot-com stock market bubble circa 1995-2003 offers a classic example of bubble symmetry, though there are many others as well.

Read More »

Read More »

They jumped the gun on the soft landing, just as markets predicted.

Soft landing fever has spread around the world. There are three major reasons why, from US labor stats to China reopening then the idea Europe survived a major scare. On that last one, did it? Latest data from there has gotten as ugly as market curves when predicting that very ugliness.

Read More »

Read More »

Weekly Market Pulse: First, Kill All The Speculators

The Fed meets this week and is widely expected to raise the Fed Funds rate by 0.25% to a range of 4.5% – 4.75%. The market has factored in a small probability that they do nothing and leave rates alone, but they’ll probably do what’s expected because they’ve spent the last couple of months preparing the markets for exactly this outcome.

Read More »

Read More »

You won’t believe what is really behind the Fed’s rate hikes & inflation rhetoric.

The FOMC meets again tomorrow and Wednesday to discuss policymakers' views of economic conditions and risks. And they are all based on garbage. This garbage.

Read More »

Read More »

“The Fed lied. Now they’re doing it again,” Jeff Snider

Jeff Snider is Chief Strategist for Atlas Financial and co-host of the popular Eurodollar University podcast.

Read More »

Read More »

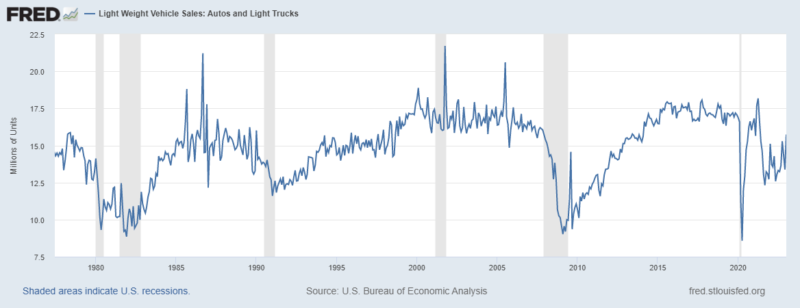

Proofs Of Recession Are Already Here! – JEFFREY SNIDER

Educate my audience about free market economics and the principles and benefits of individual liberty, limited government and sound money. These are America's founding principles, guaranteed by the U.S.

Read More »

Read More »

WION Fineprint: Germany rules out fighter jets demand of Ukraine | World News | English News | WION

Germany has announced it is ready to send 14 of its own tanks and to allow others to do so, in an U-turn from its previous position. The decision comes after weeks of pressure on Berlin from Western allies.

#Germany #Ukraine #LeopardTanks

Read More »

Read More »

Russia-Ukraine war: 3 killed, 14 injured in Russian strike on residential complex in East Ukraine

Three people have been killed and 14 others have been injured in a Russian strike in Eastern Ukraine city. Kiev said that Moscow targeted residential buildings as garages and civilian cars were damaged earlier in an alleged strike in a Ukrainian hospital.

Read More »

Read More »

Self-Reliance in the 21st Century By Charles Hugh Smith, Chapter by Chapter Preview

Hear it Here - https://adbl.co/3iJOonl

Just as no one was left unaffected by the rise of globalization, no one will be unaffected by its demise. The only response that reduces our vulnerability is self-reliance.

When Ralph Waldo Emerson wrote his famous essay Self-Reliance in 1841, the economy was localized and households supplied many of their own essentials. In our hyper-globalized economy, we’re dependent on distant sources for our...

Read More »

Read More »

Ep. 293: The State Episode with Doug Casey and Charles Hugh Smith with Michael Covel

My guests today are Doug Casey and Charles Hugh Smith.

Casey is the founder and chairman of Casey Research, a provider of paid subscription newsletter services espousing libertarian viewpoints as the justification for the purchase of highly speculative microcap stocks, precious metals, and other investments.

Smith is an American writer and blogger. He is the chief writer for the site “Of Two Minds”. Started in 2005, this site has been listed No....

Read More »

Read More »

It’s a really bad sign for everyone. Just don’t call it unexpected.

Intel's earnings and guidance were truly epic, for all the wrong reasons. Heed these big name warnings, which are only too consistent with market positions and increasingly economic data. They are all pointing us toward a near-term future which is likely to produce a lot of tears before it's over.

Read More »

Read More »

Of Two Minds with Charles Hugh Smith, Ep #23

Today’s guest is Charles Hughes Smith, who’s been writing about socioeconomic and technology trends since 2005 on his blog, “Of Two Minds.” His blog hosts over 4,000 pieces of original content. His work is also on Patreon and ZeroHedge.

Charles seeks to understand why our sociopolitical and economic systems are failing and lays out alternative ways to find a sustainable way of living. His work doesn’t fit into an ideological box and he believes...

Read More »

Read More »

This is what always happens before falling through the floor.

US GDP data was solidly - recessionary. There's no soft landing here; on the contrary it is following the established pattern. The economy isn't rebounding, it is highly unstable in the same way as what happened just prior to previous recessions. Looking into the report's details confirms the interpretation.

Read More »

Read More »