Category Archive: 5) Global Macro

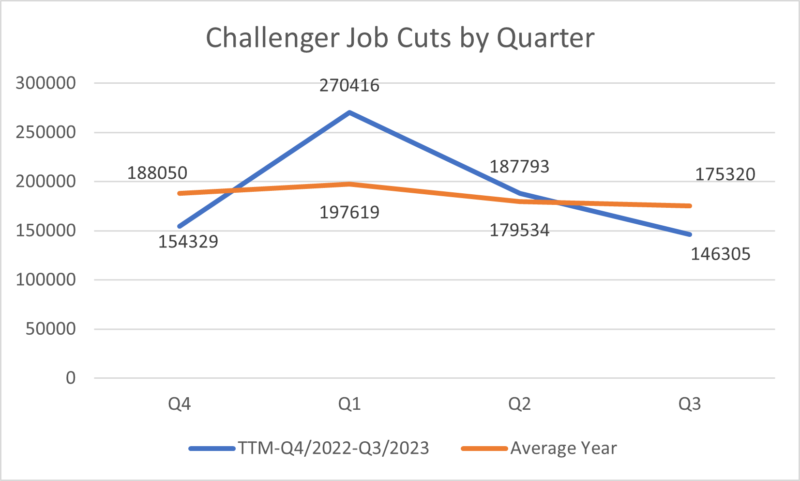

Macro: Challenger Job Cuts — Improvement throughout the year

We had a bad 1st quarter relative to historic averages for job cuts. But the situation has gotten better throughout the year. In the 3rd quarter of 2023 less people are losing their job relative to the average 3rd quarter going back to 1989.

Read More »

Read More »

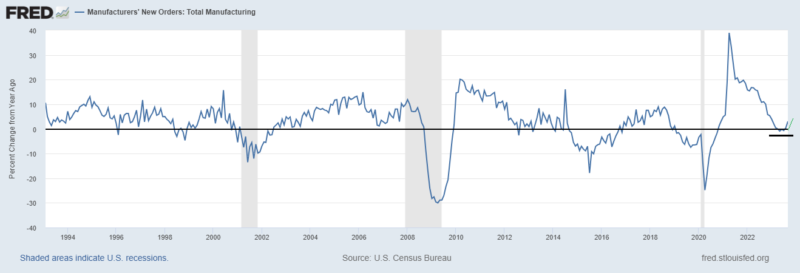

Macro: Factory Orders — revision

This was a slight downward revision. Nothing to cheer and really nothing to write home about.

September Durable Goods were revised down .1% MoM in Sept and .05% MoM in Aug.

Read More »

Read More »

What happens to your brain as you age

As the most complex organ in your body, your brain changes radically throughout your life. Starting from before birth and continuing even after you've died. This is what happens to your brain as you age.

00:00 - What happens to your brain when you age?

00:32 - In the womb

01:03 - Childhood

03:19 - Teenage years

04:48 - Early adulthood

05:27 - Middle age

07:04 - Later life

07:36 - Death

Sign up to The Economist’s daily newsletter:...

Read More »

Read More »

What is Hizbullah?

Hizbullah has been shooting rockets across the Israel-Lebanon border. If it intervenes in the Israel-Hamas conflict, it could lead to serious escalation.

00:00 - The origins of Hizbullah

01:06 - Its political rise

02:00 - How big a threat is it?

Sign up to The Economist’s daily newsletter: https://econ.st/3QAawvI

Why has Israel’s ground invasion been delayed?: https://econ.st/3tFIlFi

The firepower of Iran-backed militias:...

Read More »

Read More »

Is Israel breaking the rules of war?

The Economist’s defence editor Shashank Joshi spoke to legal experts to find out whether Israel’s response to Hamas’s terrorist attack is lawful.

00:00 - Is Israel breaking the rules of war?

00:59 - Blockade

01:32 - Bombardment

Sign up to The Economist’s daily newsletter: https://econ.st/3QAawvI

Is Israel acting within the laws of war?: https://econ.st/3tzVBv7

Joe Biden steers a risky course after a Gaza hospital blast: https://econ.st/3ty6RIl...

Read More »

Read More »

Are artificial wombs the future?

Scientists are hoping to build the world’s first clinically approved artificial womb. The purpose is to save the lives of more premature babies.

00:00 The dangers of premature birth

01:49 How to build an artificial womb

04:17 How does it work?

05:54 When will artificial wombs be rolled out?

Sign up to The Economist’s weekly science newsletter: https://econ.st/46wOpyv

Read our full quarterly report on fertility: https://econ.st/3S1LZnj

Watch...

Read More »

Read More »

Can Netanyahu’s leadership survive the war?

Many Israelis blame Prime Minister Binyamin Netanyahu for failing to stop Hamas’ terrorist attack. Can his leadership survive the war and its fallout?

00:28 - What will the war do to Netanyahu?

00:52 - Government’s absence

01:20 - Protests

01:52 - Positive changes

Sign up to The Economist’s daily newsletters: https://econ.st/3QAawvI

Read about how Hamas’ atrocities and Israel’s retaliation will change both sides forever: https://econ.st/3Qq13tL...

Read More »

Read More »

How powerful is Hamas?

On October 7th Hamas fighters launched a surprise attack on Israel and slaughtered more than 1,300 people, mostly civilians. What is Hamas and how powerful is it?

00:00 - What is Hamas?

00:55 - Hamas’s control of Gaza

01:18 - Growth of Hamas military capacity

01:32 - The latest attack on Israel

Sign up to The Economist’s daily newsletter: https://econ.st/3QAawvI

Hamas’s attack was the bloodiest in Israel’s history: https://econ.st/3ts3qD3

A...

Read More »

Read More »

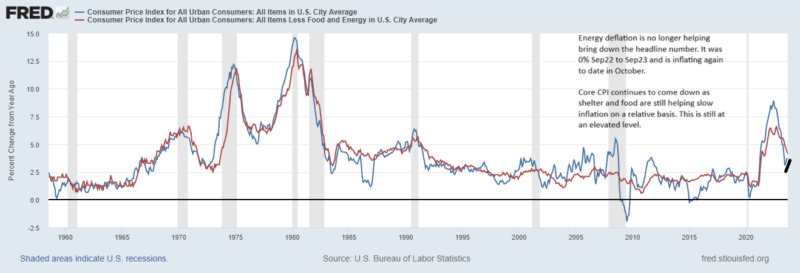

Macro: Sep CPI stuck at 3.7% YOY

The most anticipated release of the week came in … “Unchanged” or sticky stuck from the August at 3.7% yoy. But it’s worth mentioning as we will discuss below that this is up from June CPI which was 3.09% yoy. Core CPI which excludes food and energy because of their volatility sits at 4.13% yoy down from 4.39% last month.

Let’s look under the hood a bit because headlines will mention “sticky” CPI and there are some reasons that CPI will indeed...

Read More »

Read More »

Who is polluting the ocean with plastic?

Plastic pollution is destroying ocean life and coastal livelihoods. With small island states suffering most, what do they reveal about how to solve this global problem?

00:00 The plastic problem

00:43 What challenges do small islands face?

02:48 Where is the plastic coming from?

07:47 How are small islands combating plastic pollution?

11:13 How is plastic waste managed? / Where does plastic end up?

12:30 Future solutions

14:31 The global plastic...

Read More »

Read More »

Israel and the Palestinians: a century of conflict

A brutal attack on Israel by Hamas has spectacularly reignited the long-running conflict between Israel and the Palestinians. We look back over a century of hostilities.

00:00 - Israel is at war

00:19 - What was the Balfour Declaration?

00:36 - The British Mandate

01:12 - Establishment of the State of Israel

02:04 - West Bank and Gaza since 1967

Sign up to The Economist’s daily newsletter: https://econ.st/3QAawvI

After its brutal attack, Hamas...

Read More »

Read More »

How different languages are accommodating non-binary people

In a world where over a third of all languages use gender-specific grammar, non-binary people are looking for innovative solutions.

00:09 - Being gender-neutral in English

00:17 - The problem posed by grammatical gender

00:43 - Innovative solutions

Read Johnson, The Economist’s language column: https://econ.st/3rwxcpF

Find out why you have an accent in a foreign language: https://econ.st/48skXLr

Watch our film on how to sound like a local when...

Read More »

Read More »

Longevity: can ageing be reversed?

Ageing has always been inevitable but fasting, epigenetic reprogramming and parabiosis are just some of the scientific techniques that seem to help people stay young. Might the Peter Pan dream become real?

00:00 - Can science turn back the clock?

01:01 - Centenarians

02:51 - What is ageing?

04:51 - Dietary restriction

06:00 - Roundworms

07:55 - Epigenetics

09:43 - Blood and guts

11:40 - Senolytics

12:38 - Metformin

13:51 - Anti-ageing treatments...

Read More »

Read More »

Inside Ukraine’s DIY drone revolution

In garages, bedrooms and workshops across Ukraine a small army of amateur enthusiasts has emerged to build and adapt drones capable of taking the fight to the Russians. We explain how the war created this cottage industry, and what motivates the people behind it.

00:00 - Ukraine’s drone war

00:47 - The army of volunteers

03:03 - Ukrainian drone success

Sign up to The Economist’s daily newsletter: https://econ.st/3QAawvI

An interview with the...

Read More »

Read More »

Why the baby business is booming

The business of surrogacy is growing fast, as fertility rates fall and demand from gay parents rises. This global trade has a dark underbelly, and needs policing.

00:51 America: putting a price on family

05:32 What’s driving demand?

07:52 How did surrogacy become a global trade?

11:30 Surrogacy’s dark underbelly

16:49 How can surrogacy be better regulated?

21:10 What’s in the child’s best interest?

Sign up to The Economist’s daily newsletter:...

Read More »

Read More »

Kenneth Cukier explains why your data is “meaningless” on its own #Data #AI #podcast

We are launching a new subscription for podcasts. To hear more from “Money Talks” and access the whole range of our podcasts, including exclusive episodes and series, become a subscriber to Economist Podcasts+

Read More »

Read More »

Winning the long war in Ukraine

Ukraine is bracing for a long war. Can the country ensure that Western aid keeps flowing as the fight extends into 2024—and possibly beyond?

00:00 - How should Ukraine prepare for a future at war?

00:29 - A long war

01:46 - Drones open a front in Russia

03:53 - Attrition

Sign up to The Economist’s daily newsletter: https://econ.st/3QAawvI

Why is Vladimir Putin looking to North Korea for arms?: https://econ.st/3rkFeBN

How the Pentagon assesses...

Read More »

Read More »