Category Archive: 5) Global Macro

How AI is generating a revolution in entertainment

A new wave of artificial intelligence is starting to transform the way the entertainment industry operates. Who will be the winners and losers?

01:07 AI is changing the music business

04:09 How big data revolutionised entertainment industries

05:20 Can AI predict a film’s success?

09:26 How generative AI is creating new opportunities

12:36 What are the risks of generative AI?

Sign up to The Economist’s daily newsletter: https://econ.st/45PGz1H...

Read More »

Read More »

President Zelensky’s goals for 2024

As 2024 begins President Volodymyr Zelensky speaks to The Economist’s Editor-in-chief, Zanny Minton Beddoes, about his political and military goals for the coming year and why he won’t compromise with Vladimir Putin.

00:00 - 2024 military goals

01:35 - Why he won’t negotiate

A New Year’s interview with Volodymyr Zelensky: https://econ.st/48A4Nim

Read our coverage from the war in Ukraine: https://econ.st/41MgGjc

Sign up to The Economist’s...

Read More »

Read More »

The most important elections to watch in 2024

More than half the people on the planet live in countries that will hold nationwide elections in 2024. In theory it should be a triumphant year for democracy. In practice it will be the opposite

Read More »

Read More »

The World Ahead 2024: five stories to watch out for

What are the stories set to shape 2024? From the biggest election year in history, to how to control AI and even taxis that fly, The Economist offers its annual look at the world ahead.

00:00 - The World Ahead 2024

00:33 - Vital votes

03:34 - Taxis take off

07:10 - AI rules

10:19 - Industry cleans up?

13:48 - BRICS build

Read more on The World Ahead 2024: https://www.economist.com/the-world-ahead-2024

Read Tom Standage’s editor’s note on The...

Read More »

Read More »

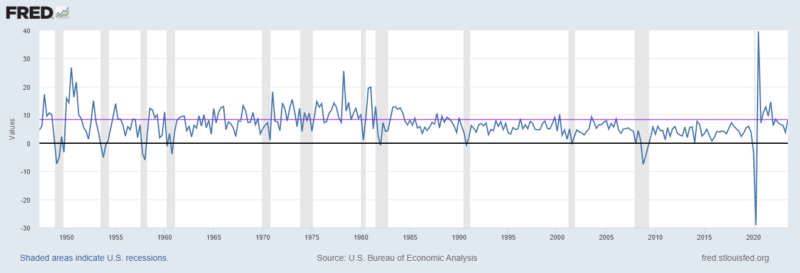

Macro: GDP Q3 — Inflationary BOOM!

Outside of the pandemic defined as 2020 and 2021, this past quarter was the 5th best quarter for nominal GDP in the last 25 years.

Read More »

Read More »

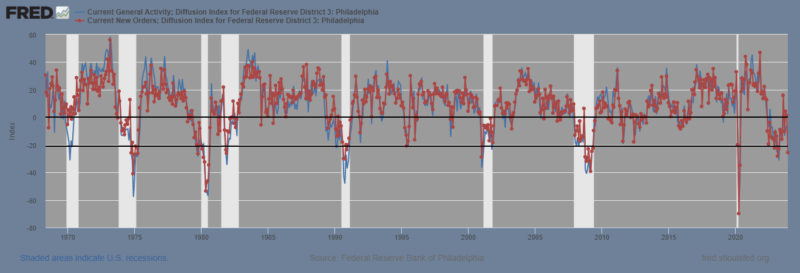

Macro: Philly Fed Mfg Survey — Umm

Tis was a poor number. The headline dropped from -5.9 to -10.5. The more eye popping number was the Index for New Orders which dropped from 1.3 to -25.6.

Read More »

Read More »

Which countries get the best night’s sleep?

Sleep patterns differ across the world. From early-to-bed South Africans to Russians who hit the sack around midnight, we reveal the cultural nuances that shape global sleep schedules. Watch the film to find out where your country ranks in the lie-in-dex, and why it matters.

Read more about which countries get the best night's sleep: https://econ.st/3GTRxt8

Find out why chinstrap penguins sleep thousands of times a day: https://econ.st/48pow45...

Read More »

Read More »

Is nuclear fusion the future of clean energy?

Fusion is a kind of nuclear power, which could revolutionise how clean energy is produced. As a new wave of experiments heats up, can fusion live up to the hype?

00:33 The future of green energy

02:00 What is nuclear fusion and how does it work?

03:17 Is it achievable?

Sign up to The Economist’s daily newsletter: https://econ.st/3s9WjPB

Energy security gives climate-friendly nuclear-power plants a new appeal: https://econ.st/3QHgdd1

Listen...

Read More »

Read More »

How the Amazon became a Wild West of land-grabbing

To save the Amazon rainforest, Brazil’s President Lula must work out who owns it. But with 22 different agencies registering land claims–and many of them overlapping–it’s not an easy task.

00:00 - How is Amazonian land distributed?

00:27 - How do land claims conflict?

01:15 - How is Lula helping?

Sign up to The Economist’s daily newsletter: https://econ.st/3QAawvI

Read our coverage on the Brazilian Amazon: https://econ.st/3NnFA2l

Why the...

Read More »

Read More »

Who made millions from the attack on Israel?

In the days before the October 7th attack short selling of Israeli stocks spiked in New York, making someone a lot of money. How likely is it that a Hamas insider was behind it?

00:00 - Pre-war stock market changes

00:33 - What happened to the stocks?

01:03 - Who was behind it?

Sign up to The Economist’s daily newsletter: https://econ.st/3QAawvI

Read our coverage on Israel and Hamas: https://econ.st/46Ka8Cy

Did Hamas make millions trading the...

Read More »

Read More »

The race to improve weather forecasting

As global warming makes weather more extreme and deadly, accurate and accessible weather forecasting has never been more needed.

00:00 - Hurricane Otis

00:40 - Extreme weather

01:33 - Democratic Republic of Congo

02:38 - Problems with forecasting

04:25 - Innovative solutions

05:41 - Arrival of AI

07:30 - Smallholder farmers

09:30 - Early warning systems

Read about the high-tech race to improve weather forecasting: https://econ.st/4a1pqpo

Listen...

Read More »

Read More »

How green is the energy revolution really?

We hear a lot about the need to get off fossil fuels. How is the energy transition really going and how fast is the world moving towards a green future?

00:51 How did the war in Ukraine impact the green revolution?

05:50 Why is green energy booming in unlikely places?

08:31 Rewiring the world for net zero

11:40 Is nuclear energy making a comeback?

14:20 Texas: the anti-green future of clean energy

18:09 Do environmentalists need to change?...

Read More »

Read More »

What’s wrong with lockdown drills for school shootings?

To teach students how to protect themselves from an active shooter most American schools run lockdown drills – but could they do more harm than good?

00:00 - What are lockdown drills?

00:43 - When did lockdowns become widespread?

01:25 - What are the national guidelines?

01:47 - The impact on children

Sign up to The Economist’s daily newsletter: https://econ.st/3QAawvI

Read our full investigation: https://econ.st/477yzLd

Inside America’s hoax...

Read More »

Read More »

Why some teachers in America are learning how to fire guns

Gun crime in American schools is increasing–but does training teachers how to shoot make classrooms any safer?

00:00 - Is arming teachers the solution?

00:50 - Meet the teachers learning to shoot

01:55 - Why they want to learn

03:17 - How effective is the training?

Sign up to The Economist’s daily newsletter: https://econ.st/3QAawvI

Read our full investigation: https://econ.st/477yzLd

Inside America’s hoax school shootings epidemic:...

Read More »

Read More »

Hoax school shootings: inside America’s epidemic

In America the fear of gun crime in schools is being weaponised. More and more SWAT teams are having to respond to hoax calls about school shootings.

00:00 - America’s hoax school shooting crisis

01:07 - Hoax calls are becoming more commonplace

02:00 - Aspen Elementary School

03:29 - What happened on February 22nd 2023?

05:10 - Who was behind it?

07:35 - The fight against SWAT hoax calls

Sign up to The Economist’s daily newsletter:...

Read More »

Read More »

The Invisible Court’s Verdict: You Are Hereby Exiled to Digital Siberia

As in the Gulag it replicates, the innocent are swept up with the guilty in a disconcertingly unjust ratio.

Read More »

Read More »

Trump’s trials: How much jeopardy is he really in?

Accusations of election manipulation and the mishandling of classified documents are just a few of the criminal charges former President Donald Trump faces across four criminal trials as the race for the White House gets underway. But is he really in jeopardy or will he succeed in turning his legal woes to his political advantage?

00:00 - How much jeopardy is Trump really in?

00:31 - The cases

03:05 - The risks

04:02 - Trump’s campaign

Sign up to...

Read More »

Read More »

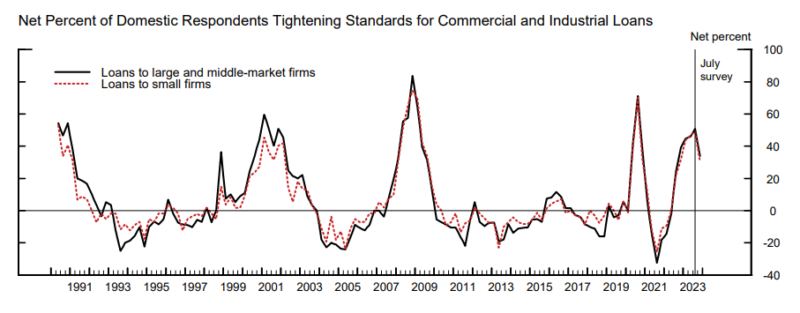

Macro: Banking: Senior Loan Officer’s Survey and Lending

Banks continue to tighten lending standards across all sectors. This has eased a bit from the July survey. Banks continue to widen spreads across all sectors. The percentage of banks widening spreads has also eased a tad.

Read More »

Read More »

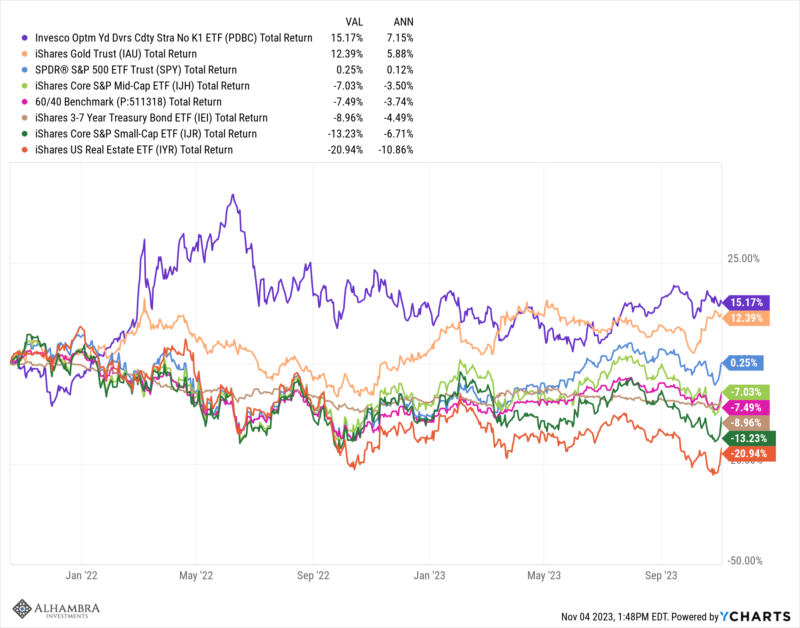

Weekly Market Pulse: Monetary Policy Is Hard

So, is that it? Have rates peaked? Is the long bear market finally over?

The market decided last week that interest rates have peaked for this cycle. And if rates have peaked then all the assets that have been pressured over the last two years can finally come up for air. Since October 18, 2021, over two years ago, investors have had few places to hide. Of the major asset classes we follow closely, only two – gold and commodities – were higher by...

Read More »

Read More »

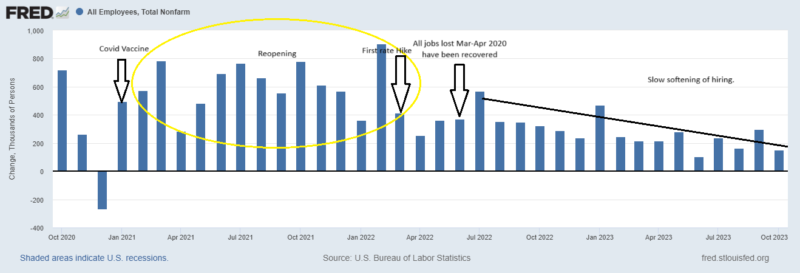

Macro: Employment Report

Wall street cheered the fact that we added fewer jobs (150,000) than expected (179,000) in October. This was a welcome relief after the hot September number that was revised down from 336,000 to 279,000.

Read More »

Read More »