Category Archive: 5) Global Macro

WION Fineprint | Russian Space Agency: Soyuz MS-22 radiator hit by micro meteoroid

Russia's Soyuz spacecraft MS-22 suffered a three hour long coolant leakage episode on Wednesday night. The untimely leakage forced the Russian space agency to call off its planned six hour long spacewalk of its two astronauts.

Read More »

Read More »

Ukraine-Russia War: Ukraine works to restore power after Russian missiles batter grid | Latest |WION

We are close to the end of the year but it has been 10 long months since Russia invaded Ukraine. Even after witnessing defeat in three Ukrainian cities, Russian President Vladimir Putin is not ready to back down.

Read More »

Read More »

Are brain implants the future of computing?

Imagine brain implants that let you control devices by thought alone—or let computers read your

mind. It’s early days, but research into this technology is well under way.

Film supported by @mishcondereya

00:00 - Are brain implants the future of computing?

00:58 - Headsets are changing how brains interact with the virtual world

02:24 - What is a brain computer interface?

03:24 - What’s holding this technology back?

04:00 - How wearable BCIs can...

Read More »

Read More »

Monopolies and Cartels Are "Communism for the Rich"

What's unfettered in America is "Communism for the Rich" and the normalization of corruption that results from the auctioning of political power to protect monopolies and cartels. The irony of constantly being accused of being a communist is rather rich.

Read More »

Read More »

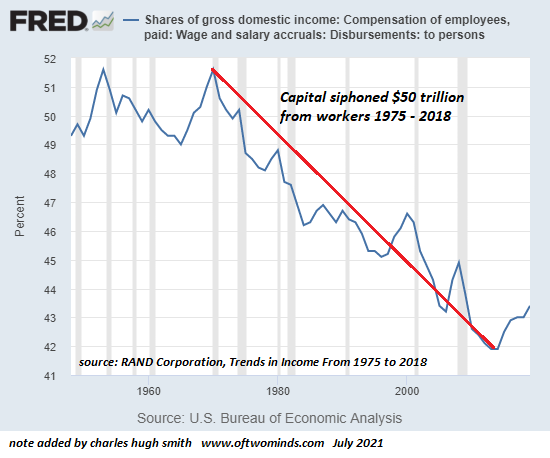

The Blowback from Stripmining Labor for 45 Years Is Just Beginning

The clueless technocrats are about to discover that unfairness and exploitation can't be measured like revenues and profits, but that doesn't mean they're not real. Economists and financial pundits tend to make a catastrophically flawed assumption.

Read More »

Read More »

Weekly Market Pulse: Envy

Legendary investor and Berkshire Hathaway vice-chair Charles Munger recently stated: “The world is not driven by greed.

Read More »

Read More »

How Things Fall Apart

That's how things fall apart: insiders know but keep their mouths shut, outsiders are clueless, and the decay that started slowly gathers momentum as the last of the experienced and competent workforce burns out, quits or retires. Outsiders are shocked when things fall apart. Insiders are amazed the duct-tape held this long.

Read More »

Read More »

Why the counterfeit business is booming

The quantity and quality of counterfeit sneakers has never been greater. As online sales boom, many buyers are deliberately choosing the steal over the real.

00:00 - The counterfeit epidemic

00:57 - How does eBay authenticate goods?

03:34 - What is driving the counterfeit boom?

05:24 - How is the sneaker resale market affecting counterfeits?

07:11 - What is the role of influencers?

08:56 - China: the world's counterfeit capital

10:45 - Is...

Read More »

Read More »

The Monopoly – Labor "Let It Rot" Death Spiral

The only rational response to this reality is to opt out, lay flat and let it rot. In my previous post, The Bubble Economy's Credit-Asset Death Spiral, I described the self-reinforcing feedback of expanding credit and soaring asset valuations and how the only possible result of this financial perpetual motion machine was a death spiral of collapsing debt service, collateral and credit impulse.

Read More »

Read More »

There is no mistaking these signals; that’s the bad news.

You really, *really* need to understand what market curves are telling you - and why. To get the best sense, let's go through the fundamentals, make what might seem a startling comparison, and then see if all that matches what we're just now seeing come up in the data.

Read More »

Read More »

Die “Titanic”-Analogie, die Sie noch nicht gehört haben | Von Charles Hugh Smith

Den vollständigen Tagesdosis-Text (inkl. ggf. Quellenhinweisen und Links) finden Sie hier: https://apolut.net/die-titanic-analogie-die-sie-noch-nicht-gehoert-haben-von-charles-hugh-smith

Read More »

Read More »

Die “Titanic”-Analogie, die Sie noch nicht gehört haben | Von Charles Hugh Smith

Den vollständigen Tagesdosis-Text (inkl. ggf. Quellenhinweisen und Links) finden Sie hier: https://apolut.net/die-titanic-analogie-die-sie-noch-nicht-gehoert-haben-von-charles-hugh-smith

Ein Kommentar von Charles Hugh Smith.

Passive Akzeptanz des Verleugnens

Ob wir uns dessen bewusst sind oder nicht, wir reagieren mit passiver Akzeptanz des Verleugnens.

Sie haben zweifellos gehört, dass die Neuanordnung der Liegestühle auf der Titanic eine...

Read More »

Read More »

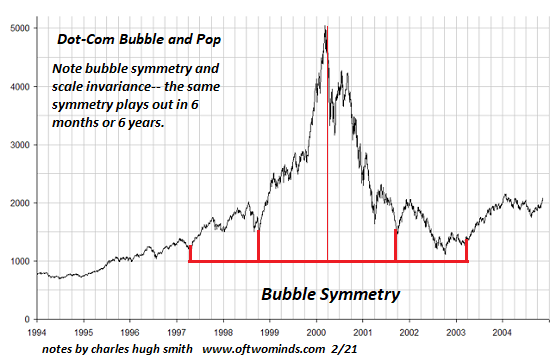

The Bubble Economy’s Credit-Asset Death Spiral

Who believed that central banks' financial perpetual motion machine was anything more than trickery designed to generate phantom wealth? Central banks seem to have perfected the ideal financial perpetual motion machine: as credit expands, money pours into risk assets, which shoot higher under the pressure of expanding demand for assets that yield either hefty returns (junk bonds) or hefty capital gains as the soaring assets suck in more capital...

Read More »

Read More »

SMART BOURSE – Marchés à thème(s) : Thomas Costerg (Pictet WM)

Lundi 5 décembre 2022, SMART BOURSE reçoit Thomas Costerg (Économiste senior US, Pictet WM)

Read More »

Read More »

SMART BOURSE – L’invité de la mi-journée : Thomas Costerg (Pictet WM)

Lundi 5 décembre 2022, SMART BOURSE reçoit Thomas Costerg (Économiste senior US, Pictet WM)

Read More »

Read More »

What should Xi do next?

China has been rocked by protests at the country’s zero-covid policy, and Xi Jinping now faces a dilemma: should he relax restrictions and risk hundreds of thousands of deaths, or continue lockdowns at the expense of the economy and, potentially, further social unrest?

00:00 - Protests spread in China

01:13 - What is the zero-covid policy?

01:30 - What is Xi’s dilemma?

02:32 - What should Xi do next?

Sign up to The Economist’s daily newsletter:...

Read More »

Read More »

The cost of health care: how to make it affordable

The cost of health care is unaffordable for many in the developing world. But while universal health care may sound like an impossible dream, it’s more achievable than you might think.

Film supported by @bainandcompanyinsights

00:00 – The argument for universal health coverage is clear

00:57 – Thailand’s path to universal health coverage

03:31 – Universal health care around the world

04:48 – How to finance universal health coverage?

05:30 –...

Read More »

Read More »

This Is of Course Insane

Greed is a powerful motivation to be an ardent believer in the central banking cult. The ideal cult convinces its followers that it isn't a cult, it's simply the natural order of things.In current terms, this normalizes insane behaviors and beliefs. Sacrificing youth to appease the gods isn't a cult; it's simply the natural order of things.

Read More »

Read More »

The "Oil Curse" and Splashy PR Announcements of Oil Production Cuts

It's not just the price of oil that matters: how much disposable income consumers have left to buy more goods and services matters, too. The Oil Curse (a.k.a. The Resource Curse) refers to the compelling ease of those blessed with an abundance of oil/resources to depend on that gift for the majority of state/national revenues.

Read More »

Read More »